Teradyne said on January 25, 2023 that its board of directors declared a regular quarterly dividend of $0.11 per share ($0.44 annualized). Shareholders of record as of February 16, 2023 will receive the payment on March 17, 2023. Previously, the company paid $0.11 per share.

At the most recent share price of $103.44 / share, the stock’s dividend yield was 0.43%. Additionally, the company’s dividend payout ratio is 0.10, indicating it is retaining a low percentage of its earnings to reinvest in growth opportunities.

The company’s 3-Year dividend growth rate is 0.10%, demonstrating that it has increased its dividend over time.

Analyst Price Forecast Suggests 2.40% Upside

As of January 27, 2023, the average one-year price target for Teradyne is $105.92. The forecasts range from a low of $84.84 to a high of $133.35. The average price target represents an increase of 2.40% from its latest reported closing price of $103.44.

The projected annual revenue for Teradyne is $3,127MM, a decrease of 0.89%. The projected annual EPS is $4.00, a decrease of 11.51%.

Fund Sentiment

There are 1450 funds or institutions reporting positions in Teradyne. This is a decrease of 19 owner(s) or 1.29%.

Average portfolio weight of all funds dedicated to US:TER is 0.2488%, a decrease of 13.3713%. Total shares owned by institutions decreased in the last three months by 1.14% to 183,944K shares.

What are large shareholders doing?

Jpmorgan Chase & holds 9,637,955 shares representing 6.19% ownership of the company. In it’s prior filing, the firm reported owning 8,807,605 shares, representing an increase of 8.62%. The firm decreased its portfolio allocation in TER by 5.34% over the last quarter.

Ameriprise Financial holds 6,114,910 shares representing 3.93% ownership of the company. In it’s prior filing, the firm reported owning 7,010,712 shares, representing a decrease of 14.65%. The firm decreased its portfolio allocation in TER by 85.78% over the last quarter.

Baillie Gifford & holds 5,335,783 shares representing 3.43% ownership of the company. In it’s prior filing, the firm reported owning 5,660,898 shares, representing a decrease of 6.09%. The firm decreased its portfolio allocation in TER by 58.84% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 4,670,705 shares representing 3.00% ownership of the company. In it’s prior filing, the firm reported owning 4,720,779 shares, representing a decrease of 1.07%. The firm decreased its portfolio allocation in TER by 13.45% over the last quarter.

Kayne Anderson Rudnick Investment Management holds 4,293,451 shares representing 2.76% ownership of the company. In it’s prior filing, the firm reported owning 4,322,557 shares, representing a decrease of 0.68%. The firm decreased its portfolio allocation in TER by 12.42% over the last quarter.

Teradyne Background Information

(This description is provided by the company.)

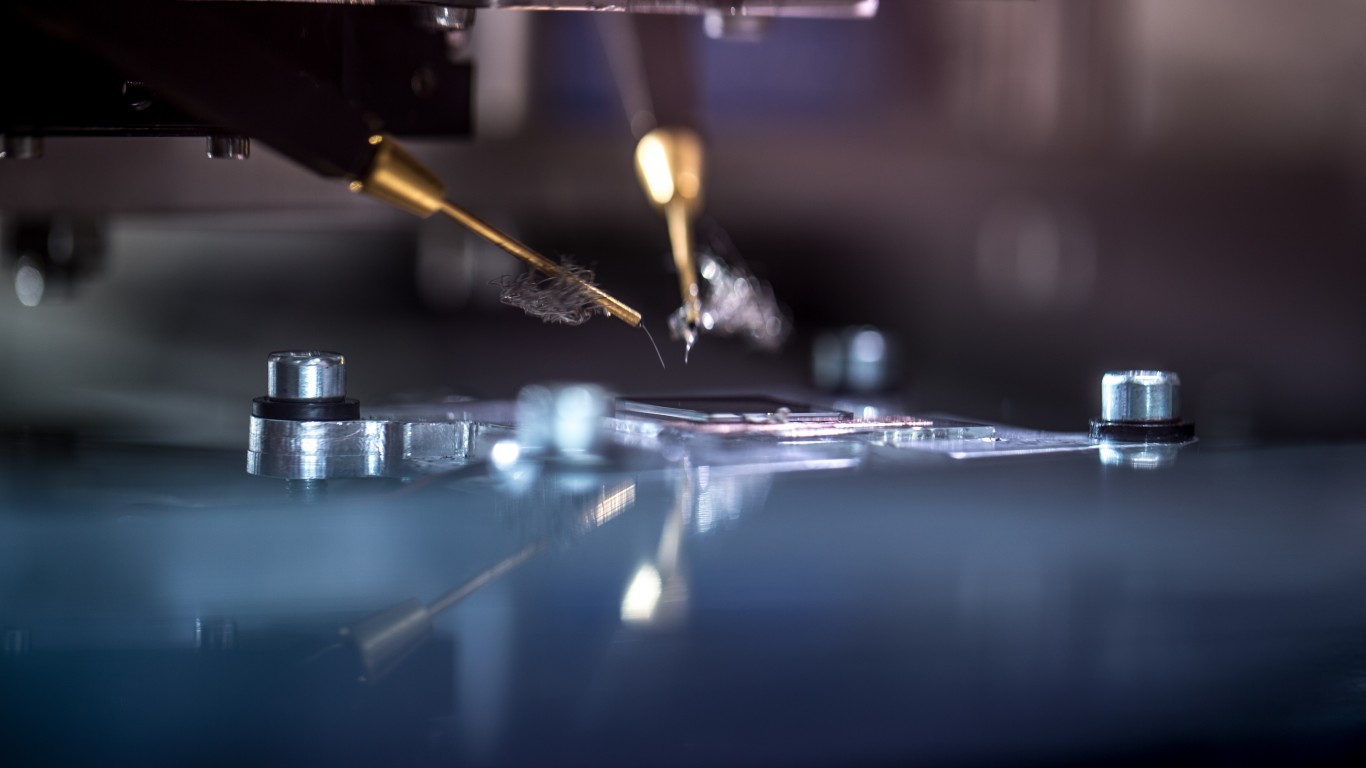

Teradyne brings high-quality innovations such as smart devices, life-saving medical equipment and data storage systems to market, faster. Its advanced test solutions for semiconductors, electronic systems, wireless devices and more ensure that products perform as they were designed. Its Industrial Automation offerings include collaborative and mobile robots that help manufacturers of all sizes improve productivity and lower costs. In 2019, Teradyne had revenue of $2.3 billion and today employs 5,500 people worldwide.

This article originally appeared on Fintel

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.