Investing

FormFactor Set to Rise on Bullish Q1 Outlook Commentary and Analysts Think This Could Be the Bottom

Published:

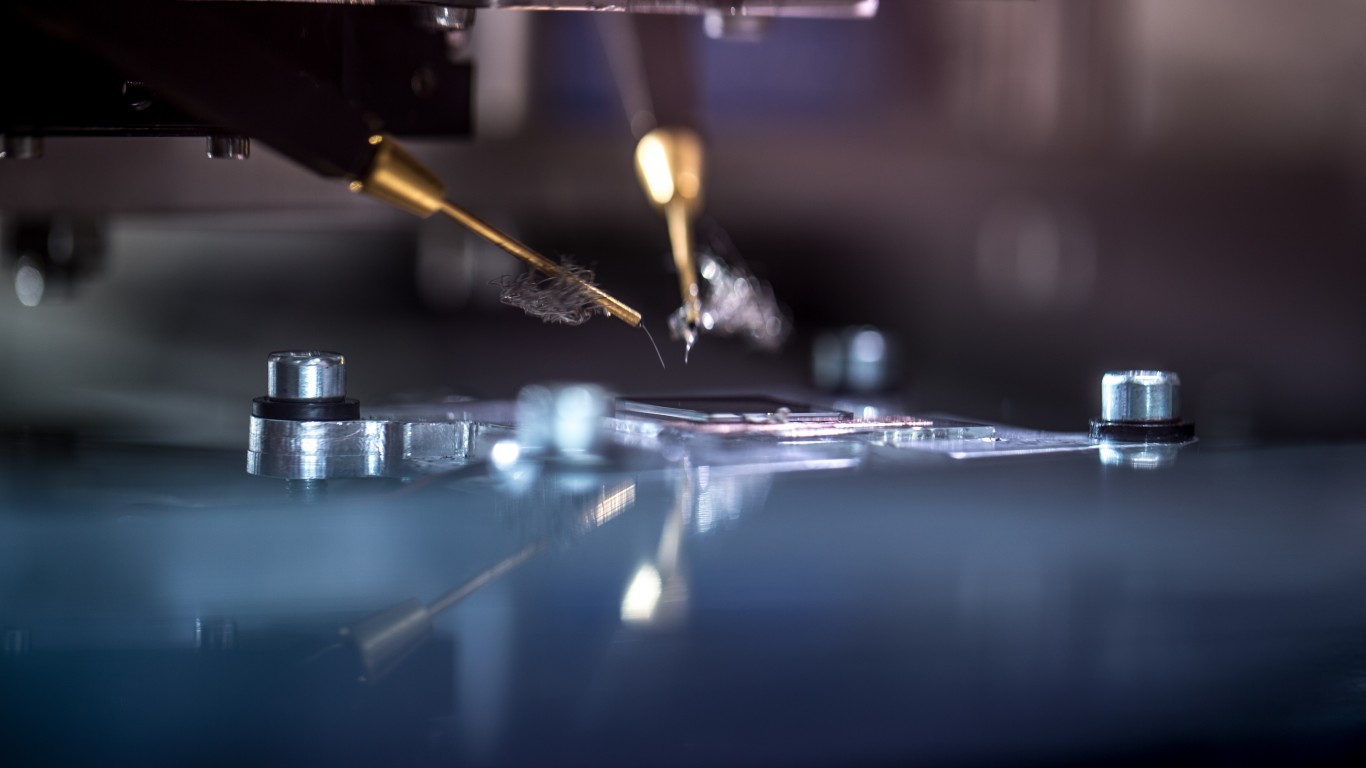

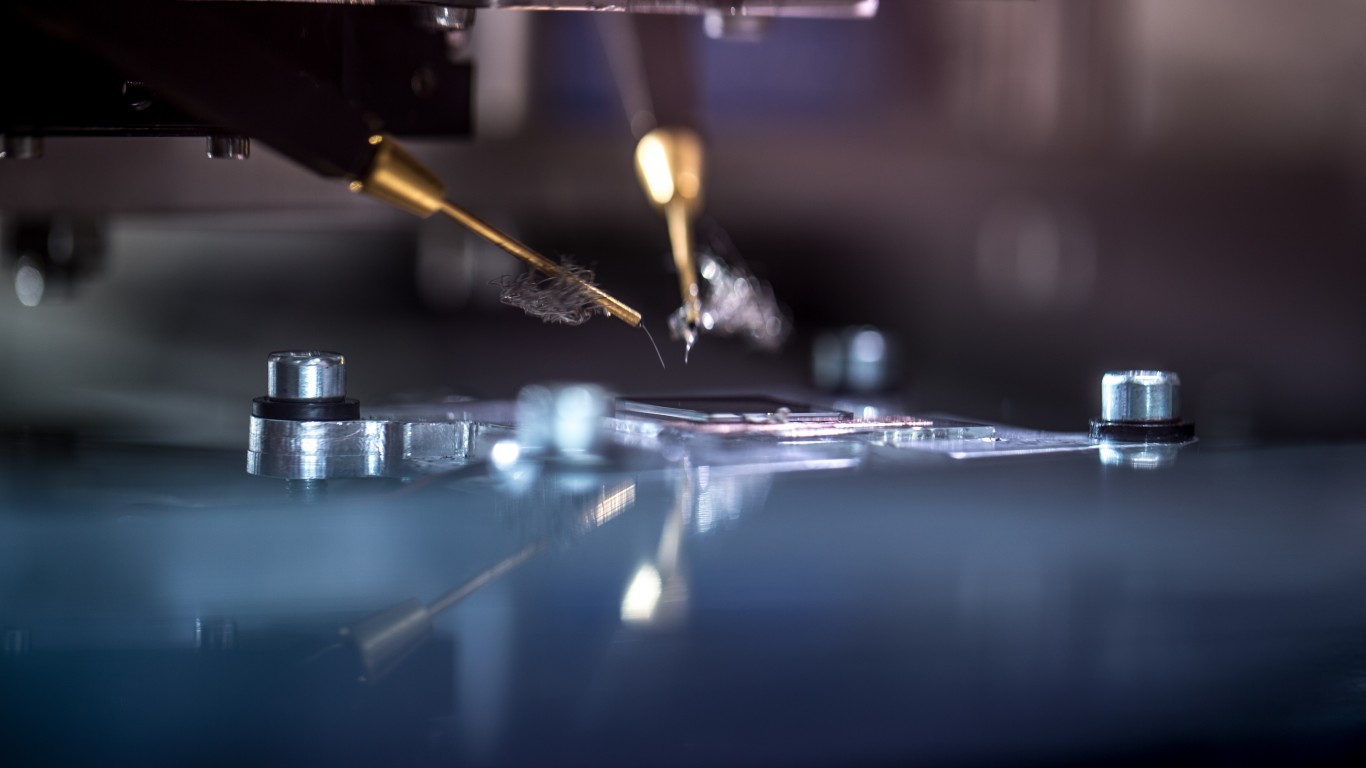

Essential testing and measurement solutions company for the semiconductor industry, FormFactor (US:FORM) reported fourth quarter results after market closure on Wednesday which proved conditions were not as bad as the market originally feared.

Although the results showed a decline in sales and profits, management guided to a rebound in margins over the first quarter. FORM shares declined -1.7% in trading on Tuesday leading into the result but jumped 8.5% in extended trading post market.

FORM reported a gross margin of 31.7% for the quarter which was at the bottom end of management’s guidance.

The fourth quarter of 2022, sales declined by 8.2% to $166.0 million from $180.9 million in Q4 of 2021. Even with the weaker performance, the sales figure beat previous guidance by management of $150 to $160 million and analyst forecasts around the middle of that range.

Net income on an underlying non-GAAP basis contracted from $18.3 million in 2021 to $4.1 million during the quarter, equating to earnings per share of 5 cents. The EPS result was at the top end of the guidance range and topped analyst forecasts of 3 cents per share.

Management highlighted that during the quarter, they completed company restructuring which is expected to improve operational effectiveness and profitability.

FormFactor’s CEO Mike Slessor commented on the outlook for the company stating “We expect significant gross margin improvement in the first quarter, driven by two factors: the full-quarter benefit of our October restructuring and a return to typical excess and obsolete inventory costs.”

For the first quarter of 2023, the company has provided sales guidance in the range of $157 to $167 million with adjusted EPS in the range of 9 to 17 cents per share.

Gross margins for Q1 will be in the range of 35.5% to 38.5% as the company bounces bank from a mild Q4 result.can

B Riley Securities analyst Craig Ellis upgraded his ‘buy’ rating target price on the stock from $30 to $40. Ellis thinks estimates have now bottomed out with catalysts coming in the second half that should gain momentum over 2024.

B Riley expects the product cycle and technology transition model to show resilience in the down cycle with some of the performance visible in the improving Foundry/Logic activity.

Fintel’s consensus target price of $30.91 suggests the stock could see an additional 6.8% capital upside over 2023. This target price could drift higher in the coming days as analysts revise forward forecasts with the new Q1 guidance.

Research from the Fintel platform confirmed a change in investor sentiment for FORM shares observed in the options market from October to December. This was explained by a sharp decline in the Fintel quant put/call ratio from 1.8x down to 0.2x in a period of two months.

Fintel’s put/call ratio is a sentiment indicator for investors that measures the total put and call option demand in the market and how it is changing over time. A high ratio above 1 indicates strong bearish sentiment (from more put option demand) and a ratio below 1 and towards 0 indicates bullish sentiment.

Fintel also recorded a spike in net long premium with $2.52 million in net long value bought on Wednesday as some investors had a good feeling about the result.

This article originally appeared on Fintel

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.