Investing

Before the Bell: Investors Plow Cash Into Bonds; Tesla May Plow Cash Into Lithium Mining

Published:

Premarket action on Tuesday had the three major U.S. indexes trading lower. The Dow Jones industrials were down 0.69%, the S&P 500 down 0.66% and the Nasdaq 0.84% lower.

Six of 11 market sectors closed higher Friday, but two of the three major indexes closed lower. Energy (−3.65%) and technology (−1.19%) gave up the most. Consumer staples (1.29%) and utilities (1.00%) posted the best gains. The Dow closed up 0.39%, while the S&P 500 ended down 0.28% and the Nasdaq down 0.58%.

Two-year Treasuries closed down two basis points at 4.6% on Friday, and 10-year notes slipped by four basis points to close at 3.82%. In Tuesday’s premarket, two-year notes were trading at around 4.66% and 10-year notes at around 3.88%. With guaranteed short-term returns of nearly 5%, it is no surprise that bonds are flying high and equities have begun to struggle after a blistering January.

Oil traded down about 2.2% Friday and traded up by 0.93% early Tuesday morning at $77.05.

Friday’s trading volume was slightly above the five-day average. New York Stock Exchange losers outpaced winners by 1,713 to 1,309, while Nasdaq advancers led decliners by about 11 to 10.

After markets open on Tuesday, the Census Bureau will release its report for existing home sales in January. The consensus estimate calls for 4.12 million, up from 4.02 million in December.

On Wednesday, the Federal Reserve releases the minutes of last month’s Federal Open Market Committee meeting and the Energy Information Administration releases its weekly report on petroleum inventories. The weekly report on new claims for unemployment benefits comes out Thursday, and the monthly report on personal consumption expenses is on tap for Friday morning.

Among S&P 500 stocks, Deere & Co. (NYSE: DE) jumped 7.53% on Friday, following a better-than-expected quarterly earnings report.

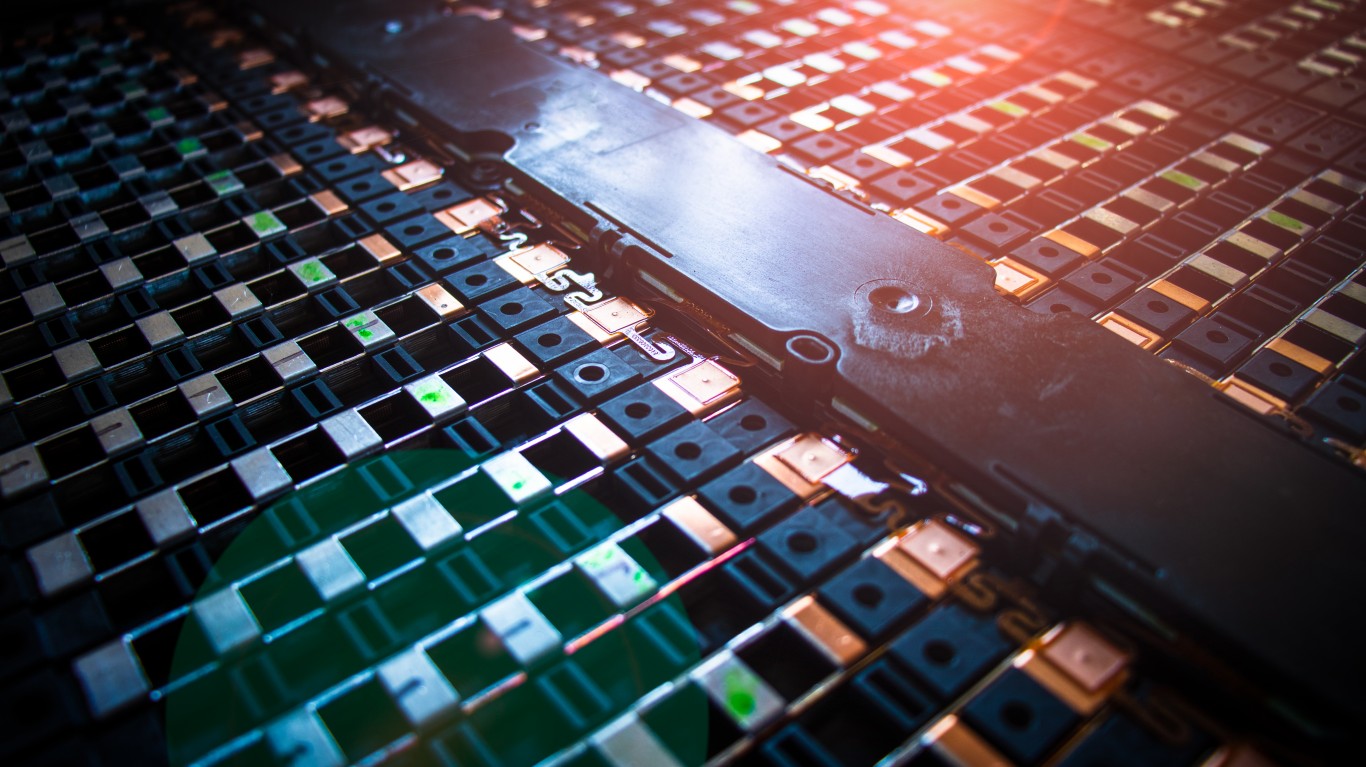

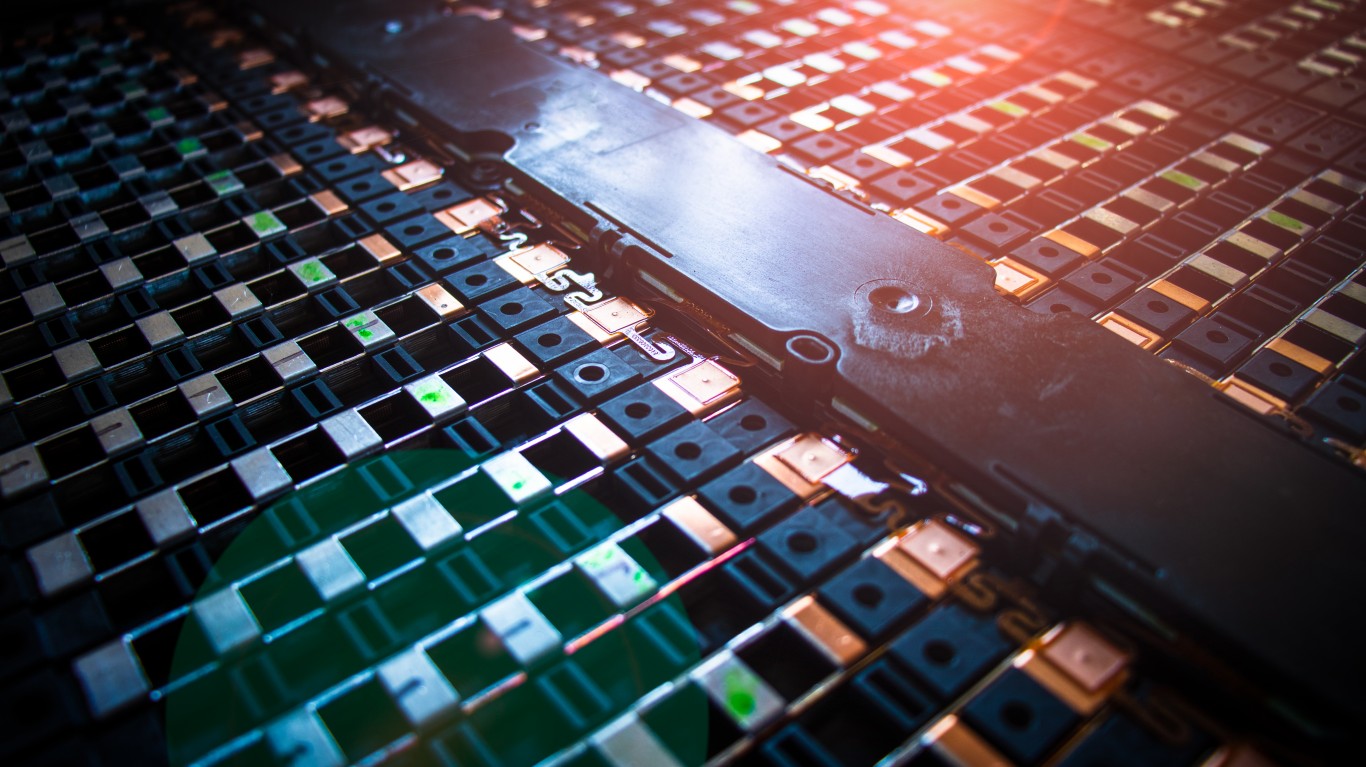

Lithium miner Albemarle Corp. (NYSE: ALB) dropped 9.67%, one day after gaining 4.7% following an earnings report that blew past expectations. On Friday, China’s (and the world’s) largest EV battery maker, CATL, reportedly announced a new lithium carbonate price of around CNY200,000 (about $30,000) per metric ton beginning the third calendar quarter of this year. Other customers will pay the spot price, currently around CNY470,000 (about $64,000) per tonne. The privileged buyers include Chinese EV makers Li Auto, Nio, Huawei and Zeekr. According to a report in DigiTimes, these four EV makers must purchase 80% of their lithium supply from CATL.

Two obvious exclusions: Tesla Inc. (NASDAQ: TSLA) and China’s BYD (BYDDY), which is Berkshire Hathaway’s favorite auto stock. CATL’s EV battery market share is around 37%, nearly three times higher than either Tesla or BYD, each of which has a share of around 13.6%. Tesla contributed 12.42% of CATL’s revenue in the first half of last year according to DigiTimes.

Tesla has been reported to be considering acquiring Brazilian lithium miner Sigma Lithium Corp. (NASDAQ: SGML). Sigma shares traded up nearly 25% in Tuesday’s premarket session following the report. Tesla CEO Elon Musk last year teased the idea that Tesla would get into the lithium mining business. The company already holds claims on 10,000 acres of potential mining acreage in Nevada.

In its most recent quarterly report, Tesla claimed $22.2 billion in cash and short-term investments, more than enough to buy Sigma, which had a market cap of around $3 billion at Friday’s close. But other miners, including Rio Tinto, are reportedly interested in acquiring a lithium property.

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.