Premarket action on Thursday had the three major U.S. indexes trading higher. The Dow Jones industrials were up 0.28%, the S&P 500 up 0.48% and the Nasdaq 0.87% higher.

Nine of 11 market sectors closed lower Wednesday, although the damage was relatively contained. Real estate (−1.02%) and energy (−0.77%) dropped the most. Materials (0.67%) and consumer cyclicals (0.52%) posted the only gains. The Dow closed down 0.26%, the S&P 500 down 0.16% and the Nasdaq up 0.13%.

Two-year Treasuries closed down one basis point at 4.66% on Tuesday, and 10-year notes retreated two basis points to close at 3.93%. In Thursday’s premarket, two-year notes were trading at around 4.71% and 10-year notes near 3.95%.

Oil traded down about 2.8% Wednesday, and it traded up by 0.68% early Thursday morning at $74.42.

Wednesday’s trading volume was right around the five-day average. New York stock Exchange winners outpaced losers by 1,673 to 1,374, while Nasdaq decliners led advancers by about 11 to 10.

The minutes of the January Federal Open Market Committee meeting were released on Wednesday, sending equities briefly higher in the afternoon before they sank to intra-day lows.

Thursday, the weekly petroleum and natural gas inventory reports will be released, along with the weekly report on new claims for unemployment benefits. The American Petroleum Institute reported an inventory build of nearly 10 million barrels. Economists expect new claims for jobless benefits to rise by 6,000 week over week. The second estimate of fourth-quarter gross domestic product growth is projected to be unchanged at 2.9%, and the GDP deflator is also expected to remain at 3.5%.

Among S&P 500 stocks, Caesar’s Entertainment Inc. (NASDAQ: CZR) added 5.41% after reporting a loss and inline revenue after markets closed Tuesday. Shares bounced higher on CEO Tom Reeg’s comment that demand remains strong and that the company is “optimistic for the year ahead.”

Design and test solutions company Keysight Technologies Inc. (NASDAQ: KEYS) dropped 12.71% after reporting earnings late Tuesday that beat estimates. The damage was caused by executives’ comments on weak current demand that was especially notable among the company’s consumer electronics and computing segments.

Thanks to the cacophony surrounding the release of ChatGPT and its many rivals, mentioning your company’s path to AI riches 18 times during the conference call is sure to get your message across. Despite a 48% drop in gaming revenue, Nvidia Corp. (NASDAQ: NVDA) managed to beat consensus estimates on both the top and bottom lines. The first words from CEO Jensen Huang in the company’s press release were, “AI is at an inflection point.” He went on to say that Nvidia’s AI supercomputer is now in full production and that the company will partner with leading cloud services providers to offer AI-as-a-service. The stock was up about 8% in Thursday’s premarket.

Electric vehicle (EV) maker Lucid Group Inc. (NASDAQ: LCID) traded down about 10% Thursday morning after missing analysts’ consensus revenue estimate. The company’s estimate of 2023 production fell short of expectations as well. Lucid is controlled by Saudi Arabia’s Public Investment Fund (PIF), owner of about 62% of the EV maker. The company did not mention the PIF but did say that it has enough cash to fund its operations through the first quarter of 2024. Is that a signal that the Saudis are not going to scoop up the 38% of Lucid they do not own? That would be worse for the stock than the earnings report.

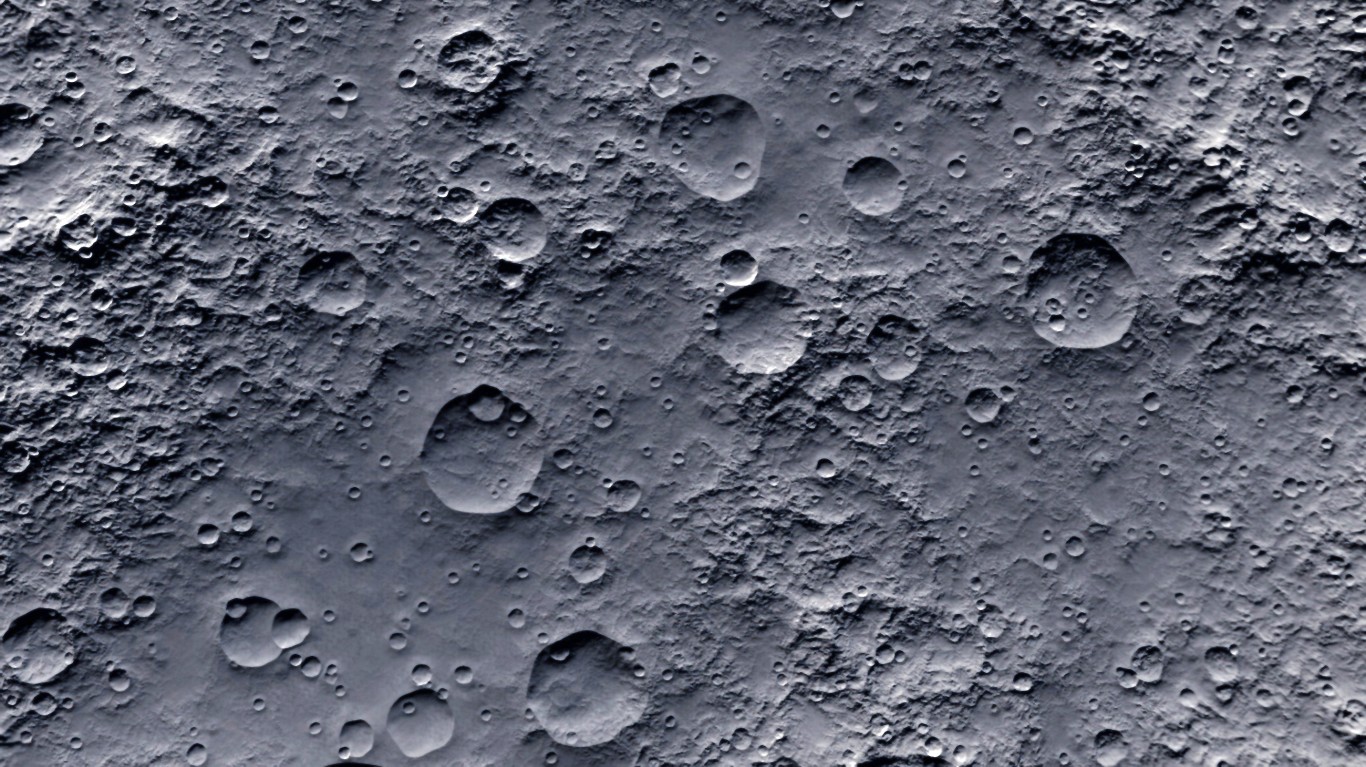

Last week, lunar landing company Intuitive Machines Inc. (NASDAQ: LUNR) completed a SPAC merger that generated far less cash than Inflection Point Acquisition and Intuitive expected. Investor redemptions wiped nearly $280 million from the $301 million the merger anticipated raising. The stock is a different story. Since beginning to trade on February 14 at $10 a share, the stock closed at $81.99 on Wednesday and traded at around $105 in Thursday’s premarket. Exactly why the shares have soared is unclear. What should be absolutely clear is that Inflection Point investors who demanded, and got, their money back are really sorry.

Finally, AMC Entertainment Holdings Inc. (NYSE: AMC) has added about $1.00 to its share price (20%) in just three two trading days this week. Meanwhile, holders of AMC’s preferred shares (NYSE: APE) have seen the value of their shares drop about 6.3%. The only news out of the company is its coming meeting at which the shareholders are expected to increase the number of authorized shares the company may issue. That may sound like dilution and not a reason to invest in AMC. Maybe another short squeeze? Fintel data shows about 23% of shares are currently sold short.

Are You Ahead, or Behind on Retirement? (sponsor)

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.