On April 12, 2023 at 09:48:25 ET an unusually large $1,230.00K block of Call contracts in Enovix (ENVX) was bought, with a strike price of $17.50 / share, expiring in 646 days (on January 17, 2025). Fintel tracks all large options trades, and the premium spent on this trade was 3.93 sigmas above the mean, placing it in the 100.00 percentile of all recent large trades made in ENVX options.

This trade was first picked up on Fintel’s real time Unusual Option Trades tool, where unusual option trades are highlighted.

Analyst Price Forecast Suggests 118.42% Upside

As of April 6, 2023, the average one-year price target for Enovix is $30.23. The forecasts range from a low of $15.15 to a high of $105.00. The average price target represents an increase of 118.42% from its latest reported closing price of $13.84.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Enovix is $8MM, an increase of 33.10%. The projected annual non-GAAP EPS is -$0.74.

What is the Fund Sentiment?

There are 390 funds or institutions reporting positions in Enovix. This is an increase of 13 owner(s) or 3.45% in the last quarter. Average portfolio weight of all funds dedicated to ENVX is 0.42%, a decrease of 19.69%. Total shares owned by institutions decreased in the last three months by 2.65% to 88,735K shares. The put/call ratio of ENVX is 0.44, indicating a bullish outlook.

What are Large Shareholders Doing?

Park West Asset Management holds 8,646K shares representing 5.48% ownership of the company. In it’s prior filing, the firm reported owning 9,096K shares, representing a decrease of 5.20%. The firm decreased its portfolio allocation in ENVX by 10.90% over the last quarter.

Eclipse Ventures holds 7,583K shares representing 4.81% ownership of the company. In it’s prior filing, the firm reported owning 12,583K shares, representing a decrease of 65.93%. The firm decreased its portfolio allocation in ENVX by 1.32% over the last quarter.

Electron Capital Partners holds 5,036K shares representing 3.19% ownership of the company. In it’s prior filing, the firm reported owning 5,911K shares, representing a decrease of 17.38%. The firm decreased its portfolio allocation in ENVX by 46.24% over the last quarter.

Point72 Asset Management holds 3,697K shares representing 2.34% ownership of the company. In it’s prior filing, the firm reported owning 1,471K shares, representing an increase of 60.22%. The firm increased its portfolio allocation in ENVX by 45.15% over the last quarter.

Encompass Capital Advisors holds 3,461K shares representing 2.19% ownership of the company. In it’s prior filing, the firm reported owning 2,729K shares, representing an increase of 21.16%. The firm decreased its portfolio allocation in ENVX by 33.76% over the last quarter.

Enovix Background Information

(This description is provided by the company.)

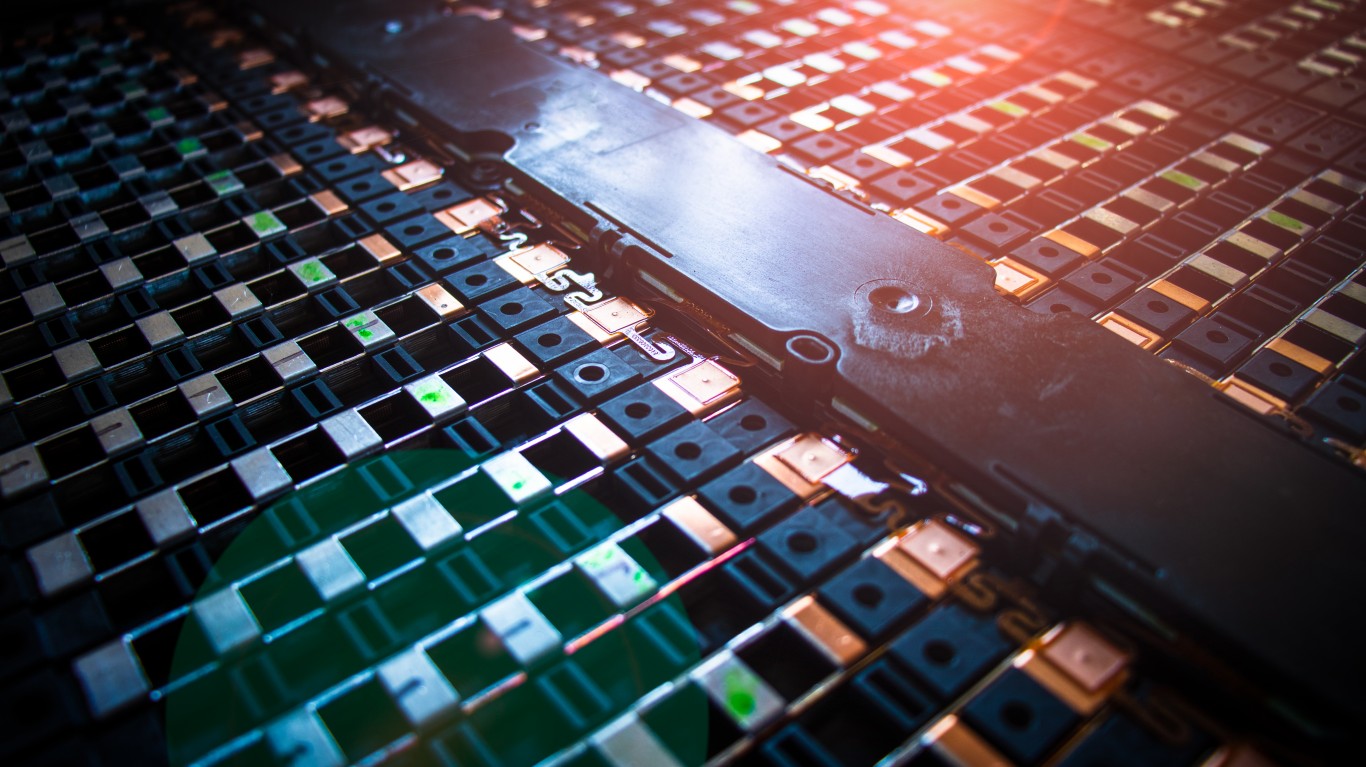

Enovix is the leader in advanced silicon-anode lithium-ion battery development and production. The company’s proprietary 3D cell architecture increases energy density and maintains high cycle life. Enovix is building an advanced silicon-anode lithium-ion battery production facility in the U.S. for volume production. The company’s initial goal is to provide designers of category-leading mobile devices with a high-energy battery so they can create more innovative and effective portable products. Enovix is also developing its 3D cell technology and production process for the electric vehicle and energy storage markets to help enable widespread utilization of renewable energy.

This article originally appeared on Fintel

The #1 Thing to Do Before You Claim Social Security (Sponsor)

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.