Investing

Unusual Call Option Trade in Riot Blockchain Worth $472.26K

Published:

Last Updated:

On April 14, 2023 at 11:09:57 ET an unusually large $472.26K block of Call contracts in Riot Blockchain (RIOT) was bought, with a strike price of $25.00 / share, expiring in 280 day(s) (on January 19, 2024). Fintel tracks all large options trades, and the premium spent on this trade was 7.21 sigmas above the mean, placing it in the 100.00th percentile of all recent large trades made in RIOT options.

This trade was first picked up on Fintel’s real time Unusual Option Trades tool, where unusual option trades are highlighted.

What is the Fund Sentiment?

There are 398 funds or institutions reporting positions in Riot Blockchain. This is an increase of 12 owner(s) or 3.11% in the last quarter. Average portfolio weight of all funds dedicated to RIOT is 0.26%, an increase of 6.20%. Total shares owned by institutions increased in the last three months by 4.77% to 67,855K shares. The put/call ratio of RIOT is 0.72, indicating a bullish outlook.

Analyst Price Forecast Suggests 28.51% Downside

As of April 6, 2023, the average one-year price target for Riot Blockchain is $9.65. The forecasts range from a low of $5.05 to a high of $12.60. The average price target represents a decrease of 28.51% from its latest reported closing price of $13.50.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Riot Blockchain is $424MM, an increase of 63.58%. The projected annual non-GAAP EPS is -$0.08.

What are Other Shareholders Doing?

EQ ADVISORS TRUST – 1290 VT Small Cap Value Portfolio Class IB holds 27K shares representing 0.02% ownership of the company. In it’s prior filing, the firm reported owning 22K shares, representing an increase of 19.74%. The firm decreased its portfolio allocation in RIOT by 46.00% over the last quarter.

Brighthouse Funds Trust I – JPMorgan Small Cap Value Portfolio holds 99K shares representing 0.06% ownership of the company. In it’s prior filing, the firm reported owning 101K shares, representing a decrease of 2.43%. The firm decreased its portfolio allocation in RIOT by 54.53% over the last quarter.

HDG – ProShares Hedge Replication ETF holds 0K shares representing 0.00% ownership of the company. In it’s prior filing, the firm reported owning 0K shares, representing an increase of 19.54%. The firm decreased its portfolio allocation in RIOT by 22.40% over the last quarter.

Ronald Blue Trust holds 1K shares representing 0.00% ownership of the company. In it’s prior filing, the firm reported owning 0K shares, representing an increase of 80.00%.

NSIDX – Northern Small Cap Index Fund holds 79K shares representing 0.05% ownership of the company. In it’s prior filing, the firm reported owning 71K shares, representing an increase of 9.62%. The firm decreased its portfolio allocation in RIOT by 46.11% over the last quarter.

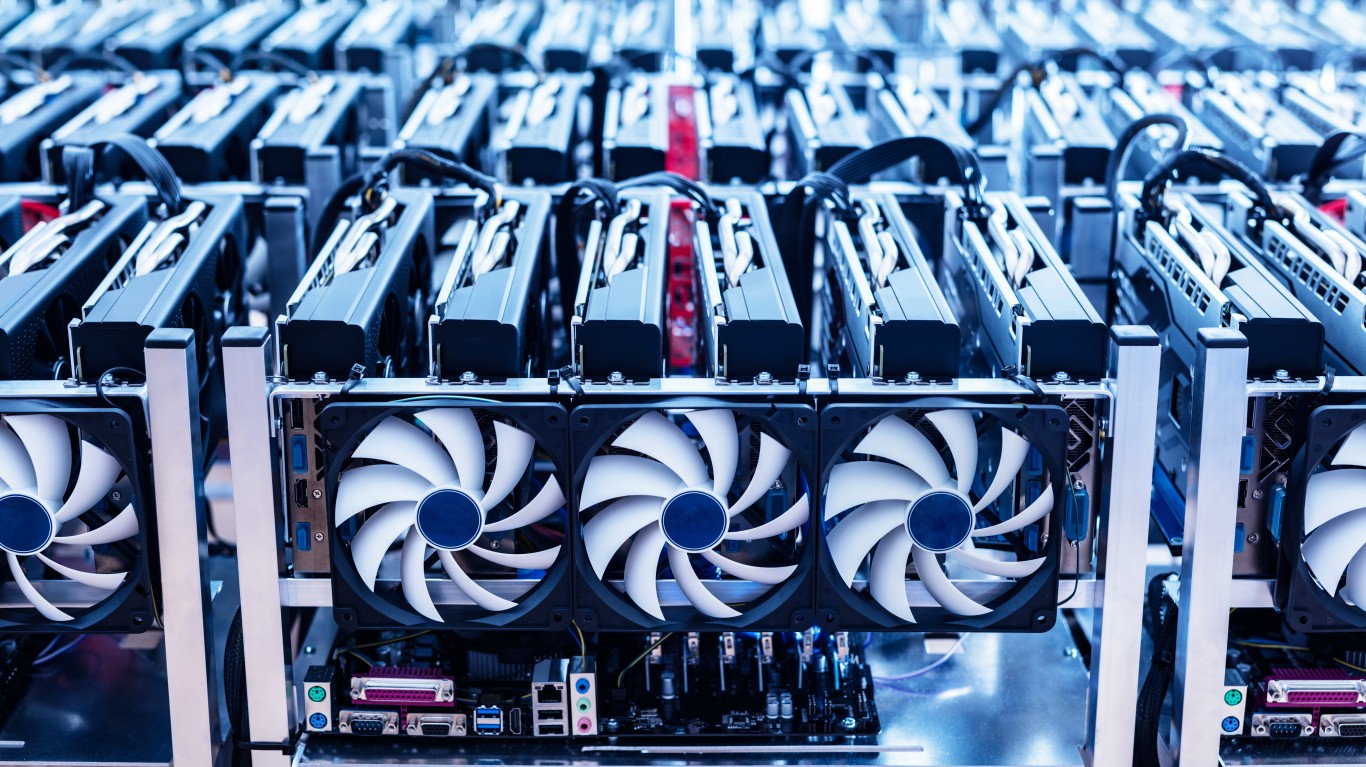

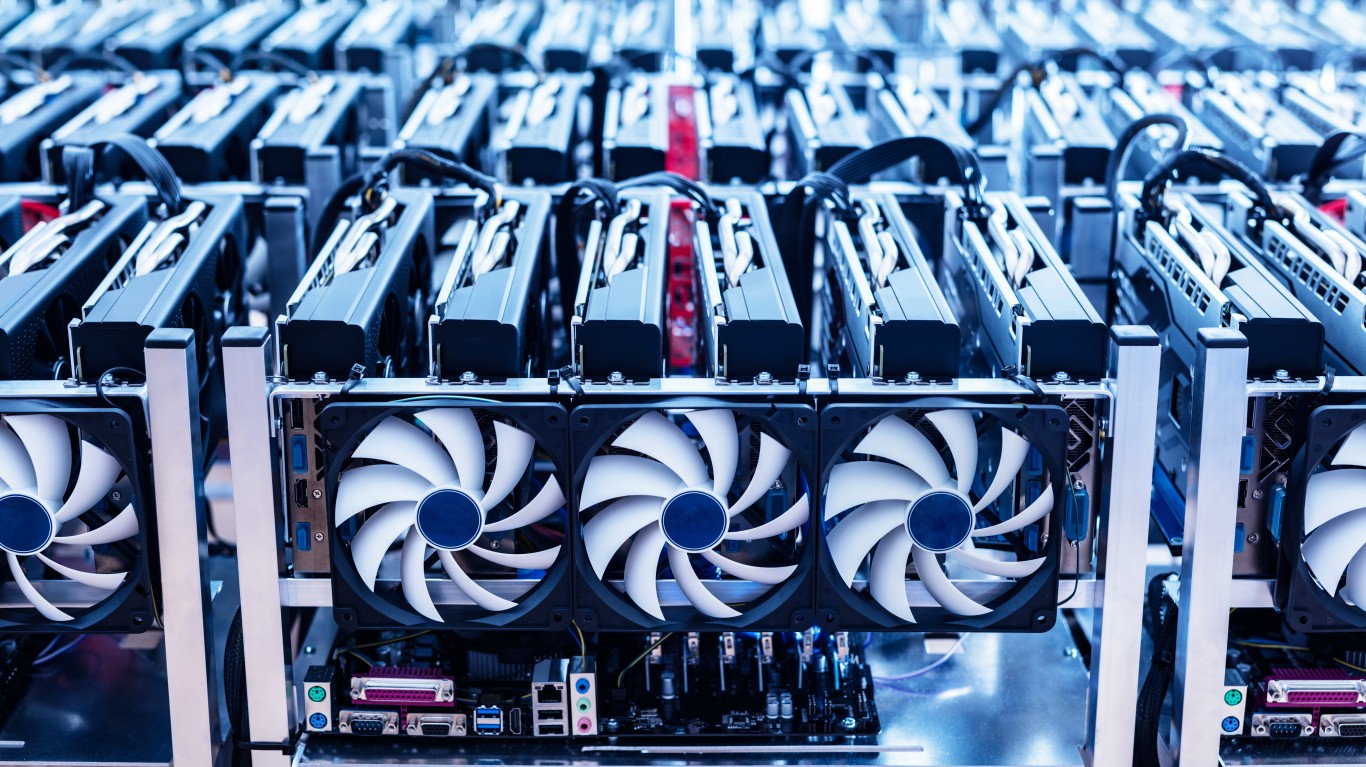

Riot Blockchain Background Information

(This description is provided by the company.)

Riot Blockchain focuses on cryptocurrency mining of bitcoin. The Company is expanding and upgrading its mining operations by securing the most energy efficient miners currently available. Riot also holds certain non-controlling investments in blockchain technology companies. Riot is headquartered in Castle Rock, Colorado, and the Company’s primary mining facility operates out of upstate New York, under a co-location hosting agreement with Coinmint.

See all Riot Blockchain regulatory filings.

This article originally appeared on Fintel

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.