Investing

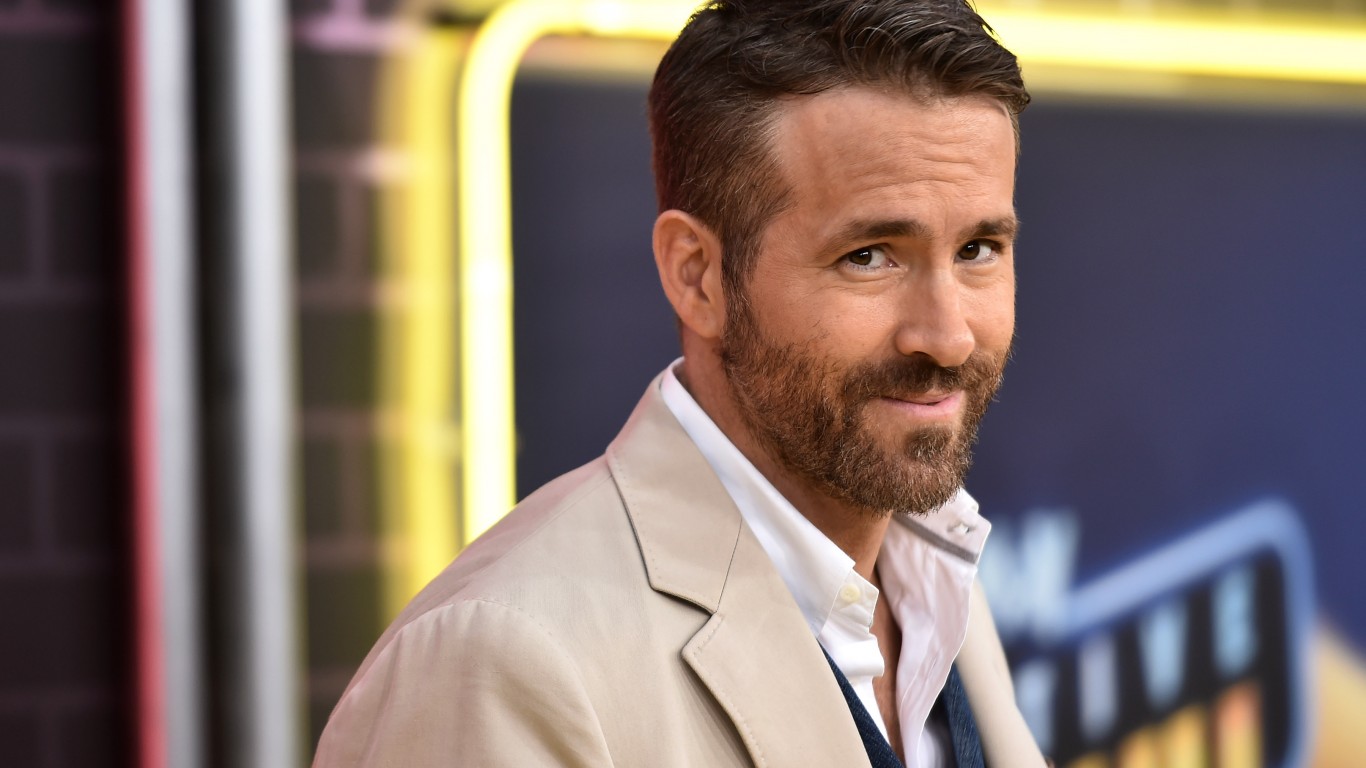

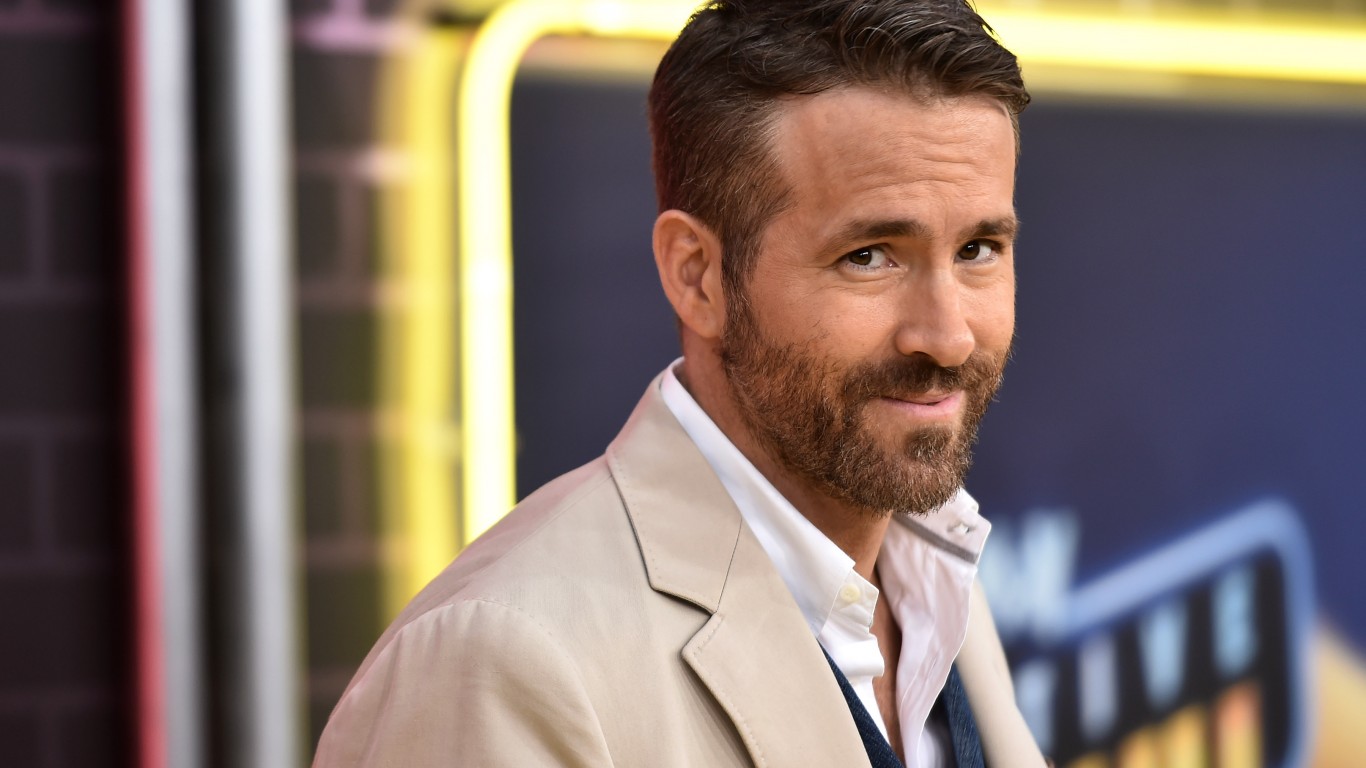

Canadian Fintech Nuvei Gets on the Ryan Reynolds Bandwagon

Published:

Last Updated:

Nuvei Corporation (US:NVEI, CA:NVEI) announced on April 17 that Canadian actor Ryan Reynolds had invested in the payments company. More importantly, Reynolds will get involved in the creative side of the business. That’s excellent news for NVEI stock holders.

“I know about as much about fintech as I did about gin or mobile a few years ago. But Nuvei is impressive. The leadership team is exceedingly intelligent and hard-working and it’s about time a Canadian company got the type of attention American tech companies do,” Reynolds stated in the Nuvei press release.

Reynolds most recently was in the business news after the telecoms holding company that owned, Mint Mobile, was sold to T-Mobile US (US:TMUS) for $1.35 billion. The actor first invested in Mint Mobile in November 2019. While it’s unknown how much Reynolds invested, he’s expected to walk away with $300 million once the sale closes.

It’s not the actor’s first big windfall from a business decision. He invested in Aviation Gin in 2018. The brand was sold to Diageo (US:DEO) for $610 million two years later. In both instances, the companies utilized the star’s ability to market products with integrity and humour.

Nuvei intends to follow the same playbook to broaden its visibility outside Canada. Wisely, they’ve decided to jump on the Ryan Reynolds bandwagon.

Other Canadian investments made by Reynolds include 1Password and Wealthsimple, both Toronto-based companies.

Accelerating Growth

The investment comes at an interesting time for Nuvei… and investors.

A day after the company announced Reynolds’ investment in the company, New York-based short-seller Spruce Point Capital Management released a damning report about Nuvei, recommending investors sell their stock or risk losses of 35-50%.

The short-seller believes that Nuvei’s business is in a far more vulnerable state than its February acquisition of Paya Holdings for $1.3 billion, a U.S. provider of integrated payment and frictionless commerce solutions, would suggest.

The report also suggested that the company may also have been an investor in the now-bankrupt FTX crypto exchange, citing a former Nuvei executive that Spruce Point spoke to about the matter. The short seller also noted that Nuvei is listed as a creditor in the FTX bankruptcy case.

Short sellers often release these reports around important news from the target company. Nuvei has yet to respond to the allegations in the report.

New Verticals

Meanwhile, Nuvei is accelerating its global expansion with the acquisition of Paya. Nuvei paid a 25% premium to acquire the payments company.

In 2022, Paya processed more than $50 billion in annual payment volume generating $283 million in revenue and $74.1 million adjusted EBITDA (earnings before interest, taxes, depreciation and amortization).

The purchase got Nuvei into “new underpenetrated and non-cyclical verticals” such as healthcare, utilities, non-profit, and others.

“It [Paya] will accelerate our integrated payment strategy, diversify our business into key high-growth non-cyclical verticals with large addressable end markets and enhance the execution of our growth plan,” stated Nuvei CEO Philip Fayer in the company’s January press release announcing the acquisition.

Founded in 2003, Nuvei went public in September 2020, selling 30.9 million shares at CAD$26 apiece. NVEI stock has fallen significantly since reaching an all-time high of $180 in September 2021. On a positive note, in the 31 months that it’s been a public company, it has yet to trade below its IPO price.

Reasonable Valuation

Brian Madden, a Toronto-based portfolio manager, and chief investment officer at First Avenue Investment Counsel, said in March that Nuvei is one of his top picks over the next 12 months.

“We bought it about three weeks ago around $47,” Madden told BNN Bloomberg in March.”It was a COVID era IPO in 2020, the biggest IPO on the TSX that year, and it went up in parabolic fashion and it went down symmetrically. But it’s regaining its momentum, which is why we bought it.”

The portfolio manager believes the Paya acquisition improves Nuvei’s margins from the high 30s to nearly 50%. In addition, it trades at less than 20x earnings, providing investors with a reasonable entry price.

With Ryan Reynolds’ Midas Touch on board, anything is possible.

This article originally appeared on Fintel

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.