Investing

Circle Rebalances Its Treasury Holdings as Risk of US Default Looms

Published:

Leading stablecoin issuer Circle has rebalanced its treasury holdings amid growing concerns over a potential US debt default. The company, the issuer of the second-largest stablecoin in circulation, has opted for a mix of reserves that favors short-dated US Treasuries. This move comes amid a heated discussion among financial experts on the US debt ceiling.

Circle CEO Jeremy Allaire has revealed that the company no longer holds Treasuries maturing beyond early June. All current holdings, which BlackRock manages, mature no later than May 31, the CEO said in an interview with Politico.

The company hopes the move will limit its exposure to any future US default and safeguard the $30 billion reserves of its USDC stablecoin. Allaire said the company doesn’t want to carry exposure “through a potential breach of the ability of the US government to pay its debts.”

The US is facing a potential debt default, as President Joe Biden and congressional Republicans remain at odds over raising the $31.4 trillion borrowing limit. Republican leaders have demanded pledges of future spending cuts before they approve a higher ceiling.

Treasury Secretary Janet Yellen has warned that the Treasury risks running out of room to stay under the debt ceiling as early as June 1 if Congress fails to act.

Despite assurances from market analysts that America will make good on its debts, any technical default could have significant implications for the $24 trillion Treasury market. This market serves as the bedrock of the global financial system, and even a minor disruption could cause chaos and uncertainty.

Circle’s decision to rebalance its treasury holdings comes during heightened anxiety regarding the US’s debt situation. In March, the company’s USD Coin briefly lost its 1-for-1 peg to the dollar after it was revealed that $3.3 billion of the reserves used to back the stablecoin were held at the collapsed Silicon Valley Bank. The token has since stabilized, but the incident highlighted the vulnerability of Circle’s reserves to outside shocks.

Tether, the operator of the largest stablecoin, has also taken steps to limit its exposure to US Treasuries. The company recently reported increasing its holdings of US Treasury bills to $53 billion, with an average maturity of less than 90 days.

As the debate over raising the debt ceiling continues to heat up in Washington, experts are warning of the increasing risk of a US default.

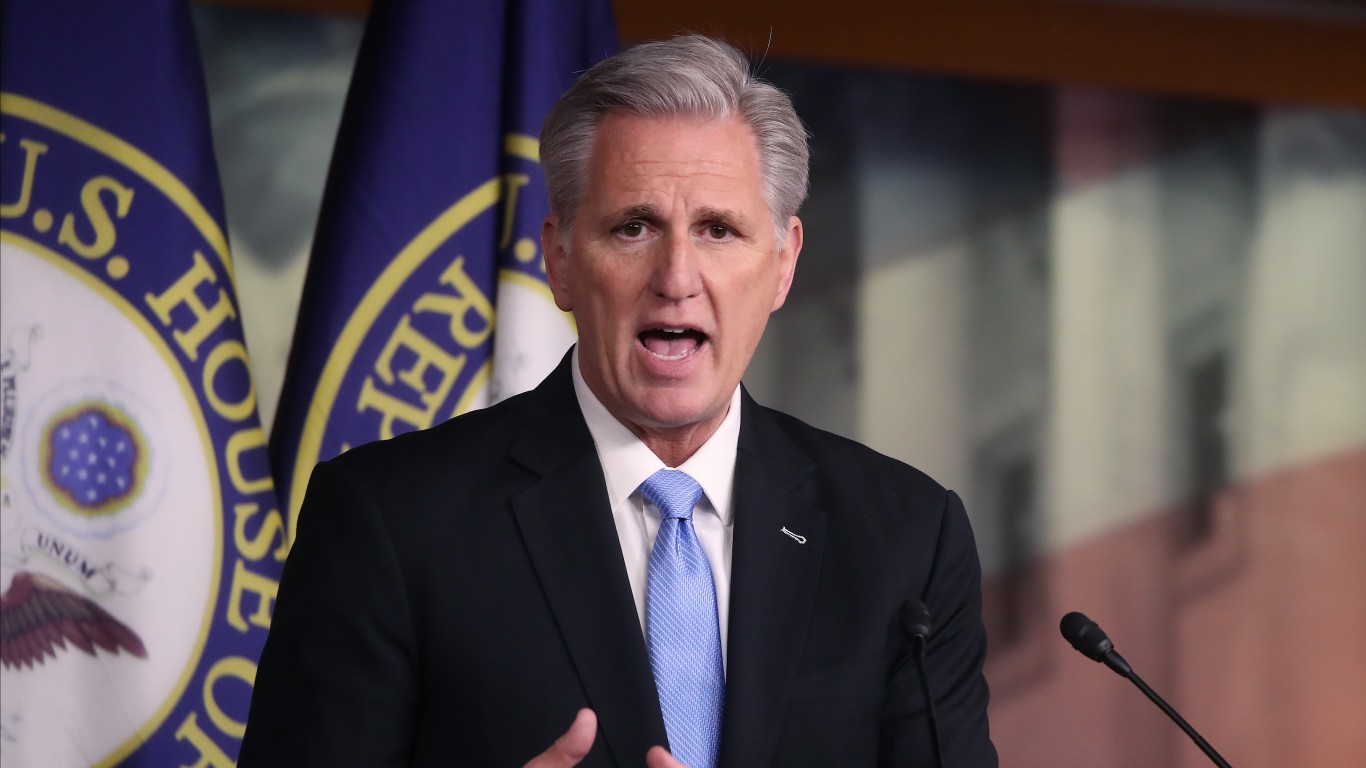

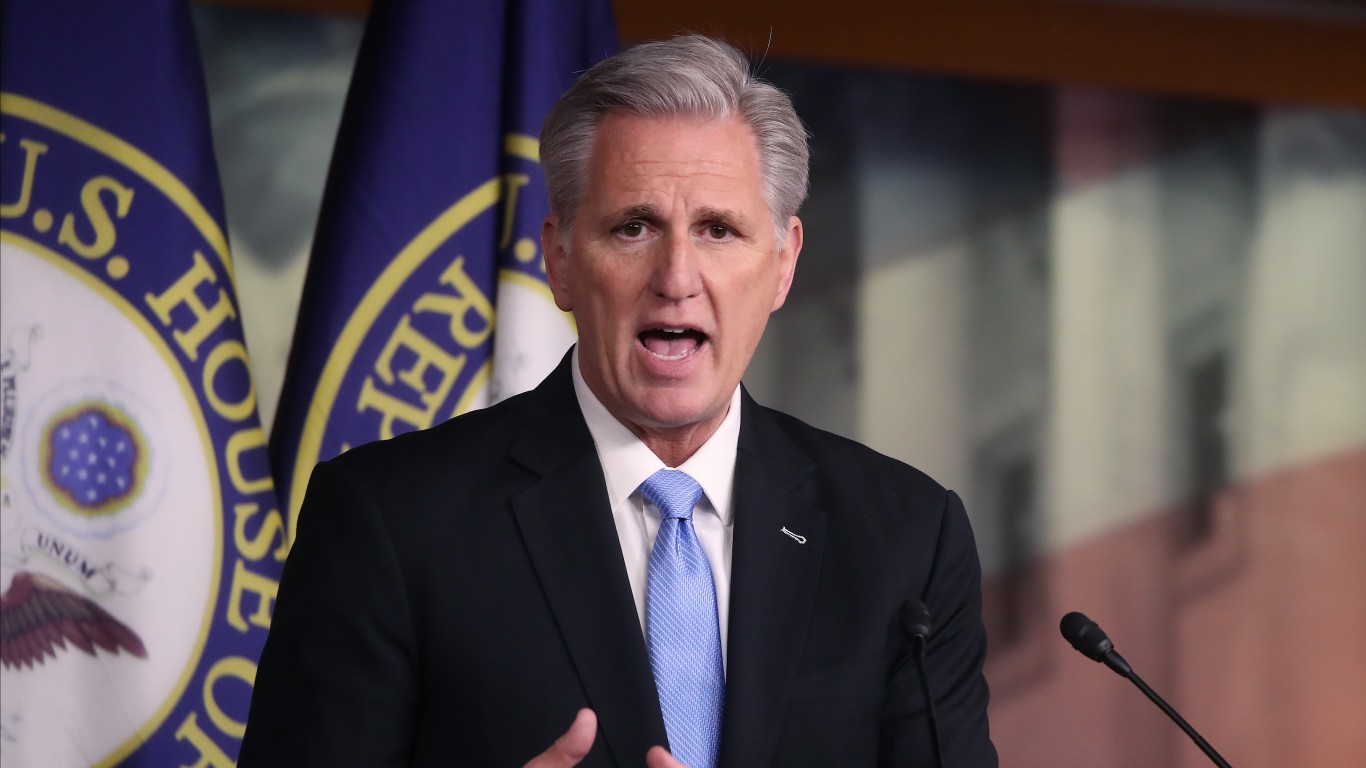

On Tuesday, President Joe Biden met with congressional leaders to discuss the issue, but the talks appeared unproductive. House Speaker Kevin McCarthy recently proposed a bill that would raise the borrowing limit by $1.5 trillion while cutting spending by $4.5 trillion, but the proposal has faced opposition from Democrats.

Yellen has repeatedly warned lawmakers of the potential catastrophe if the debt ceiling is not raised in time. She has even gone so far as to suggest that the US could begin defaulting on its debts as early as June 1.

Even tech billionaire Elon Musk has weighed in on the issue. In response to a Twitter user who wrote that “defaulting on the national debt is a bad idea,” Musk replied with two worrying words: “Increasingly possible.”

Meanwhile, Warren Buffett, CEO of Berkshire Hathaway, has taken a different view, dismissing the idea that the US would allow American depositors to lose money or refuse to allow more government borrowing.

“That is not how the US is going to behave, any more than they’re going to let the debt ceiling cause the world to go into turmoil,” he reportedly said during his company’s annual shareholder meeting on Saturday.

This article originally appeared on The Tokenist

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.