Fintel reports that on May 16, 2023, Goldman Sachs maintained coverage of Erasca (NASDAQ:ERAS) with a Buy recommendation.

Analyst Price Forecast Suggests 426.74% Upside

As of May 11, 2023, the average one-year price target for Erasca is 15.59. The forecasts range from a low of 9.09 to a high of $23.10. The average price target represents an increase of 426.74% from its latest reported closing price of 2.96.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Erasca is 0MM. The projected annual non-GAAP EPS is -1.43.

What is the Fund Sentiment?

There are 292 funds or institutions reporting positions in Erasca. This is an increase of 19 owner(s) or 6.96% in the last quarter. Average portfolio weight of all funds dedicated to ERAS is 0.11%, a decrease of 40.79%. Total shares owned by institutions decreased in the last three months by 10.87% to 78,607K shares. The put/call ratio of ERAS is 0.07, indicating a bullish outlook.

What are Other Shareholders Doing?

Arch Venture holds 11,056K shares representing 7.33% ownership of the company. No change in the last quarter.

Cormorant Asset Management holds 10,813K shares representing 7.17% ownership of the company. No change in the last quarter.

Armistice Capital holds 7,350K shares representing 4.88% ownership of the company. In it’s prior filing, the firm reported owning 2,700K shares, representing an increase of 63.27%. The firm increased its portfolio allocation in ERAS by 56.92% over the last quarter.

PFM Health Sciences holds 4,797K shares representing 3.18% ownership of the company. No change in the last quarter.

Artal Group holds 4,721K shares representing 3.13% ownership of the company. In it’s prior filing, the firm reported owning 4,711K shares, representing an increase of 0.22%. The firm decreased its portfolio allocation in ERAS by 25.48% over the last quarter.

Erasca Background Information

(This description is provided by the company.)

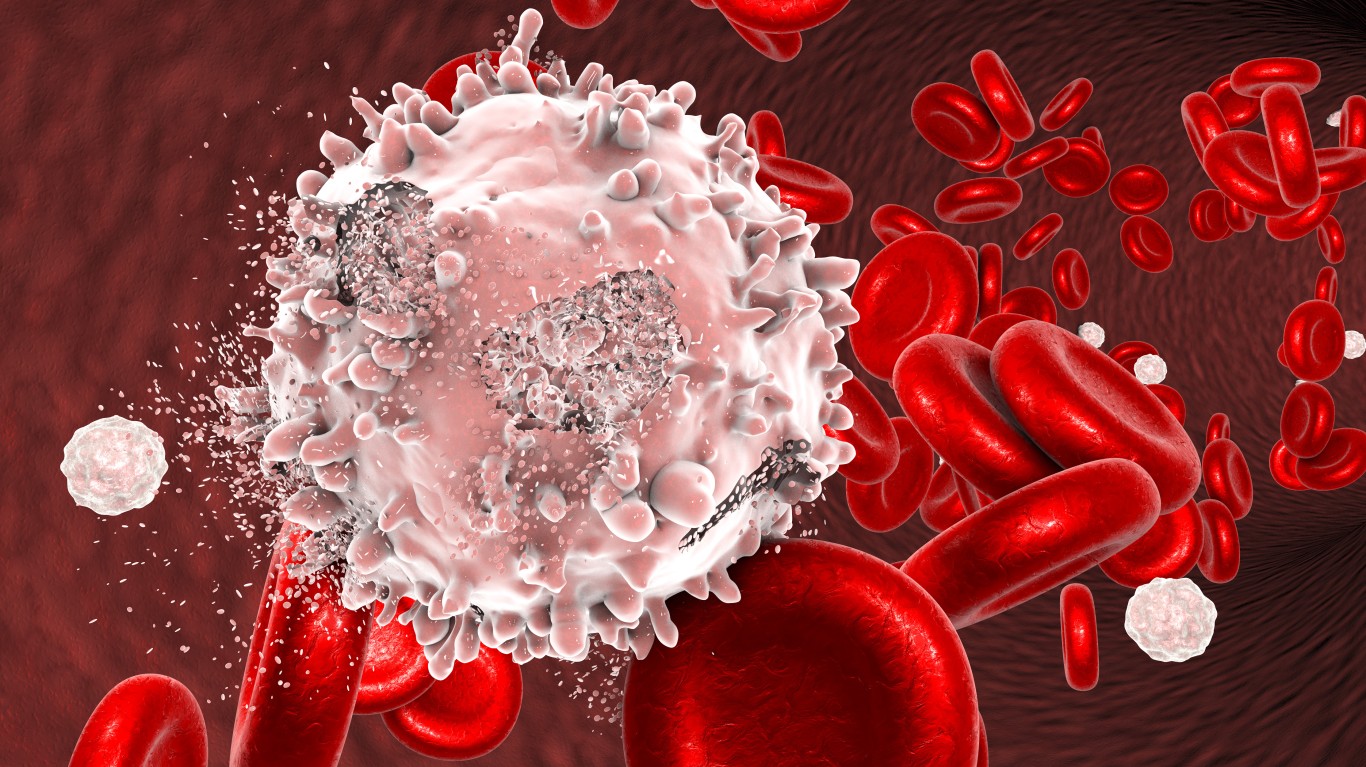

At Erasca, its name is its mission: To erase cancer. Erasca is a clinical-stage precision oncology company singularly focused on discovering, developing, and commercializing therapies for patients with RAS/MAPK pathway-driven cancers. The company was co-founded by leading pioneers in precision oncology and RAS targeting to create novel therapies and combination regimens designed to comprehensively shut down the RAS/MAPK pathway for the treatment of cancer. Erasca has assembled what the company believes to be the deepest RAS/MAPK pathway-focused pipeline in the industry. Erasca believes its team’s capabilities and experience, further guided by its scientific advisory board which includes the world’s leading experts in the RAS/MAPK pathway, uniquely position the company to achieve its bold mission of erasing cancer.

Key filings for this company:

This article originally appeared on Fintel

Want to Retire Early? Start Here (Sponsor)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.