Investing

Albemarle Is Better Than It Thinks It Is, According to UBS Research

Published:

How much lithium is there, and how many electric vehicles will it eventually need to provide energy for? By one estimate, from a 2019 report by the Geological Survey of Finland, there is not nearly enough; another estimate shows that there is more than enough.

For a company like lithium miner Albemarle Corp. (NYSE: ALB), the answers are complicated by issues of timing and pricing. Even if there is plenty of lithium (which is arguable), can Albemarle mine enough of it to make a profit at the market price?

Analysts at UBS think so. According to a Thursday report by Joshua Spencer and his team at the bank’s Global Research and Evidence Lab, the price reset in the lithium market that began in November is “leading to positive sentiment” on Albemarle stock. UBS raised its 12-month rating on the stock from Hold to Buy and lifted its 12-month price target from $196.00 to $255.00, a jump of 30%.

Since reaching its peak in December, the lithium price is down about 50%. Albemarle’s stock is down about 35% over the same period. UBS expects lithium prices to stabilize soon at around $40 per kilogram ($40,000 per metric ton) and then remain in a price range of around $35,000 per tonne for the next few years. UBS models a long-term price at around $23,000 per tonne.

UBS has modeled the cost curve for lithium production (excluding China) at $15 to $20 per kilogram ($15,000 to $20,000 per tonne). Near-term supply and demand “remains tight,” the analysts say, and “supply/start-p delays [create] upside risk on pricing.”

That said, UBS’s long-term price is above Albemarle’s own forecast of $20,000 per tonne, and the company’s production forecast for 2030 is 10% below the analysts’ forecast of 417,400 tonnes.

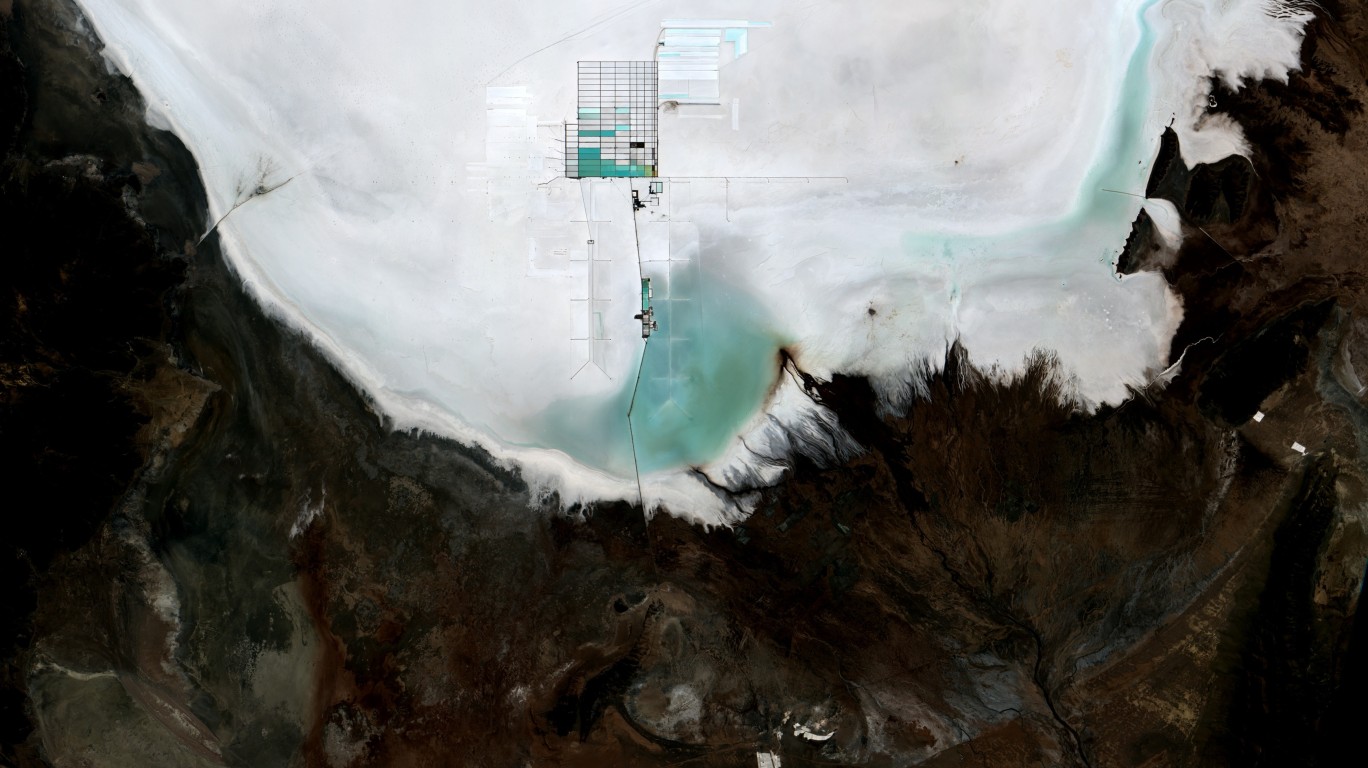

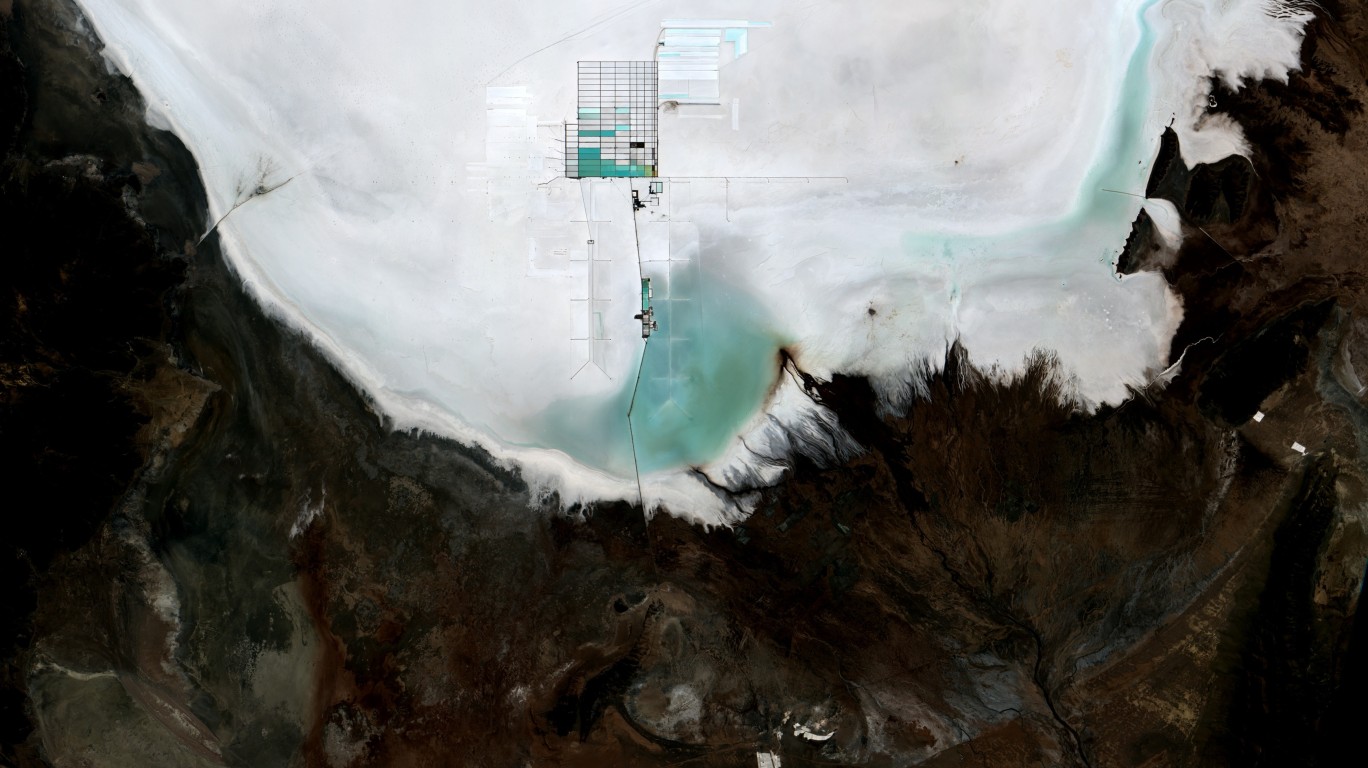

According to the U.S. Geological Survey, the global supply of lithium reserves as of January is around 26 million tons and global resources total 98 million tons. Reserves, which are defined as resources that are extractable at a profit with existing technology, have nearly doubled since 2018. Resources, defined as not currently economically extractable, have more than doubled in the same period. Chile, Australia, Argentina, China and the United States are the top five resource countries. Australia, Chile and China were the top three producers in 2022.

Albemarle is one of only two companies licensed to produce lithium in Chile. The other is Sociedad Química y Minera de Chile S.A. (NYSE: SQM), and both have been tagged recently by the Chilean government’s proposed nationalization of the lithium industry. SQM’s license expires in 2030, and Albemarle’s in 2043. In any event, it is expected to take years for the government to hammer out the details of its National Lithium Strategy.

Albemarle’s stock traded up more than 1% in mid-morning trading Thursday at $210.20 in a 52-week range of $171.82 to $334.55. Trading volume is more than three times the 30-day daily average.

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.