Premarket action on Wednesday had the three major U.S. indexes trading lower. The Dow Jones industrials were down 0.24%, the S&P 500 down 0.22% and the Nasdaq 0.13% lower.

Tuesday’s big story was the afternoon collapse of all three major indexes as it became clear that House Speaker Kevin McCarthy and President Joe Biden were getting nowhere in their negotiations to raise the federal debt limit. Stocks sank, bonds drifted downward and cryptocurrency took the biggest dip of all. Gold slipped by a fraction, and tech megacaps, the new safe haven, could not avoid the sell-off.

Tesla Inc. (NASDAQ: TSLA) fell by more than 1.6%, Microsoft Corp. (NASDAQ: MSFT) dropped more than 1.8% and Apple Inc. (NASDAQ: AAPL) closed down about 1.5%. Wednesday’s premarket session was on track to continue the decline. That leaves energy, and that is worth a look Wednesday morning as we wait for the weekly report on U.S. petroleum inventories.

Chevron Corp. (NYSE: CVX) added nearly 3% on Tuesday after the stock was upgraded to Buy with a price target of $189 by HSBC. The Dow component is unlikely to see big share price gains, but its announced $7.6 billion acquisition of PDC Energy adds assets in both the Denver-Julesburg and Permian Basins to Chevron’s holdings and, more important, PDC’s solid free cash flow (about $1 billion annualized) should mean more returns for shareholders. Chevron is paying no cash in the all-stock deal and is acquiring proved reserves of oil and gas at a price of around $7 per barrel of oil equivalent.

The acquisition is not so much based on increasing production now as it is being among the last companies standing as the world makes the switch to electric vehicles (EVs). Internal combustion engines will remain a significant, but ever-declining, component of world transportation for decades. The Saudis and other Middle East oil producers will be there, and the world’s oil supermajors will be there too. Protests, like the one at Shell’s annual meeting earlier this week, are sure to increase, but the position of energy in the world economy will not change, and the role of oil in that position will change slowly.

After markets closed Tuesday, the American Petroleum Institute reported that U.S. crude oil inventories declined by 6.7 million barrels last week. Analysts were expecting an addition of 525,000 barrels. Crude production remained flat at 12.2 million barrels a day, up by 300,000 year over year, but still 900,000 barrels below the all-time high set in March 2020. Gasoline inventories dropped by about 6.4 million barrels last week, and distillates (diesel fuel, heating oil) fell by 1.8 million barrels.

West Texas Intermediate (WTI) crude added about 1.1% on Tuesday and traded up another 1.6% early Wednesday. Brent crude made similar moves higher. Brent’s per-barrel price is about $4 higher than WTI’s.

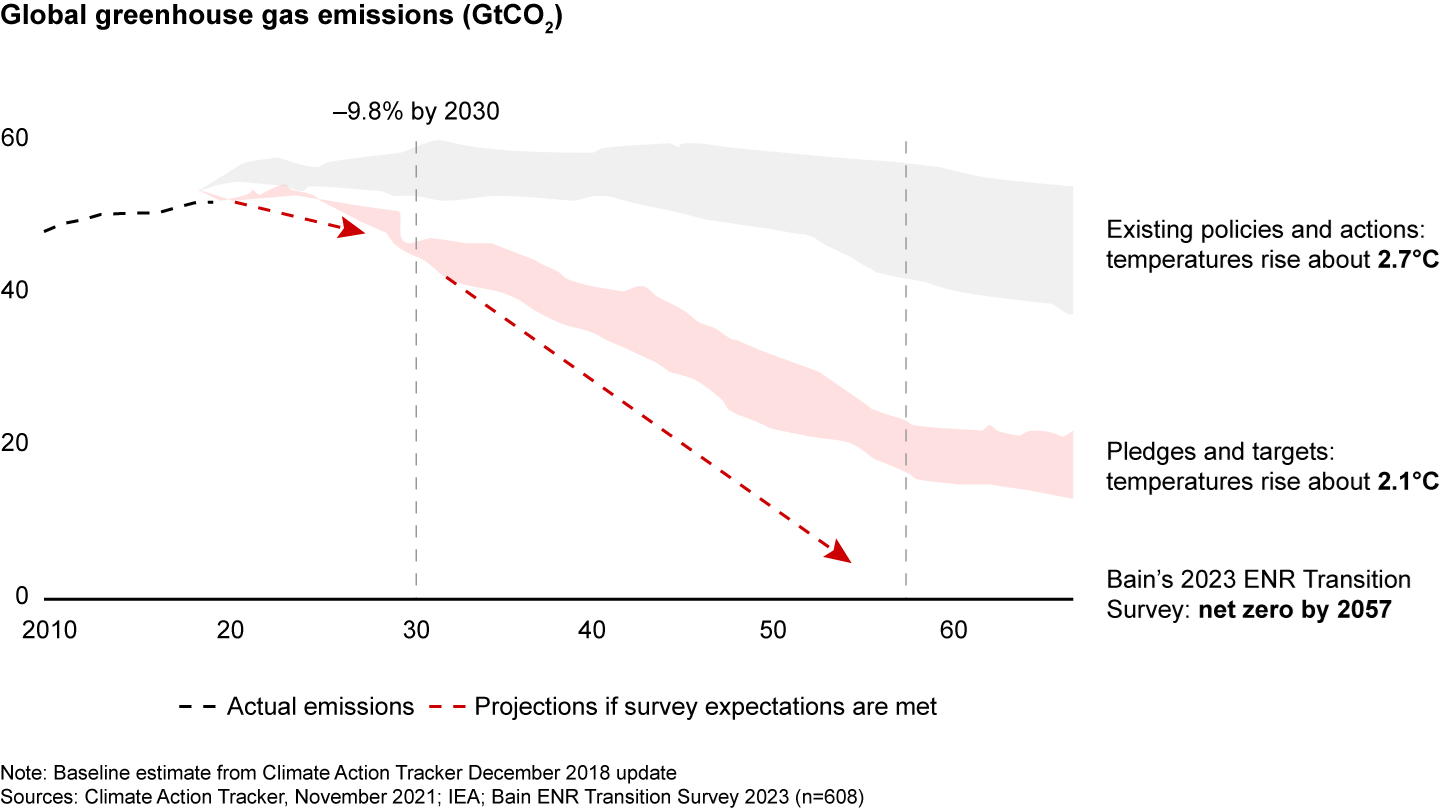

In a recent survey of oil and gas, utilities, chemicals, mining, and agribusiness executives by Bain & Co., most said that their own companies are doing better than their competitors in the march toward net-zero emissions. Their firms are expected to target 24% of 2023 capex on new growth (i.e., lower emissions) businesses. Access to capital is not a major constraint, but “return on investment certainly is.”

One executive from India told Bain, “The success of the pivot to clean energy technologies will be determined by the extent to which people see the benefits while minimizing disruptions—with focus on affordability and fairness.”

Here is a chart from the report showing the relationship between the survey’s estimated transition to net-zero emissions and the stated target of keeping the global temperature increase at around 2.1°C.

Here is a look at how the markets fared on Tuesday.

Ten of 11 market sectors closed lower on Tuesday. Materials (−1.54%) and technology (−1.5%) had the day’s biggest losses. Energy (1.04%) posted Tuesday’s only gain. The Dow closed down 0.69%, the S&P 500 down 1.12% and the Nasdaq down 1.26% on Tuesday.

Two-year Treasuries dropped three basis points to end Tuesday at 4.26%, and 10-year notes fell by two basis points to close at 3.70%. In Tuesday’s premarket, two-year notes were trading at around 4.29% and 10-year notes at about 3.68%.

In addition to the weekly report on petroleum inventories, the minutes of the May meeting of the Federal Reserve’s open market committee will be released at 2:00 p.m. ET Wednesday.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.