Investing

Tuesday Premarket Newsmakers: Nvidia Eyes $1T Market Cap, and Tesla's Place in the AI Sweepstakes

Published:

Premarket action on Tuesday had the three major U.S. indexes trading higher. The Dow Jones industrials were up 0.12%, the S&P 500 up 0.55% and the Nasdaq 1.14% higher.

The Biden administration and House Republicans reached a deal Friday night that will avoid a default on U.S. federal debt at least through the 2024 election. U.S. equity markets traded higher Tuesday morning, but the oil market was down nearly 2% because oil traders are wary, of both the deal and of how the global economy will react. West Texas Intermediate crude traded at around $71 a barrel Tuesday morning.

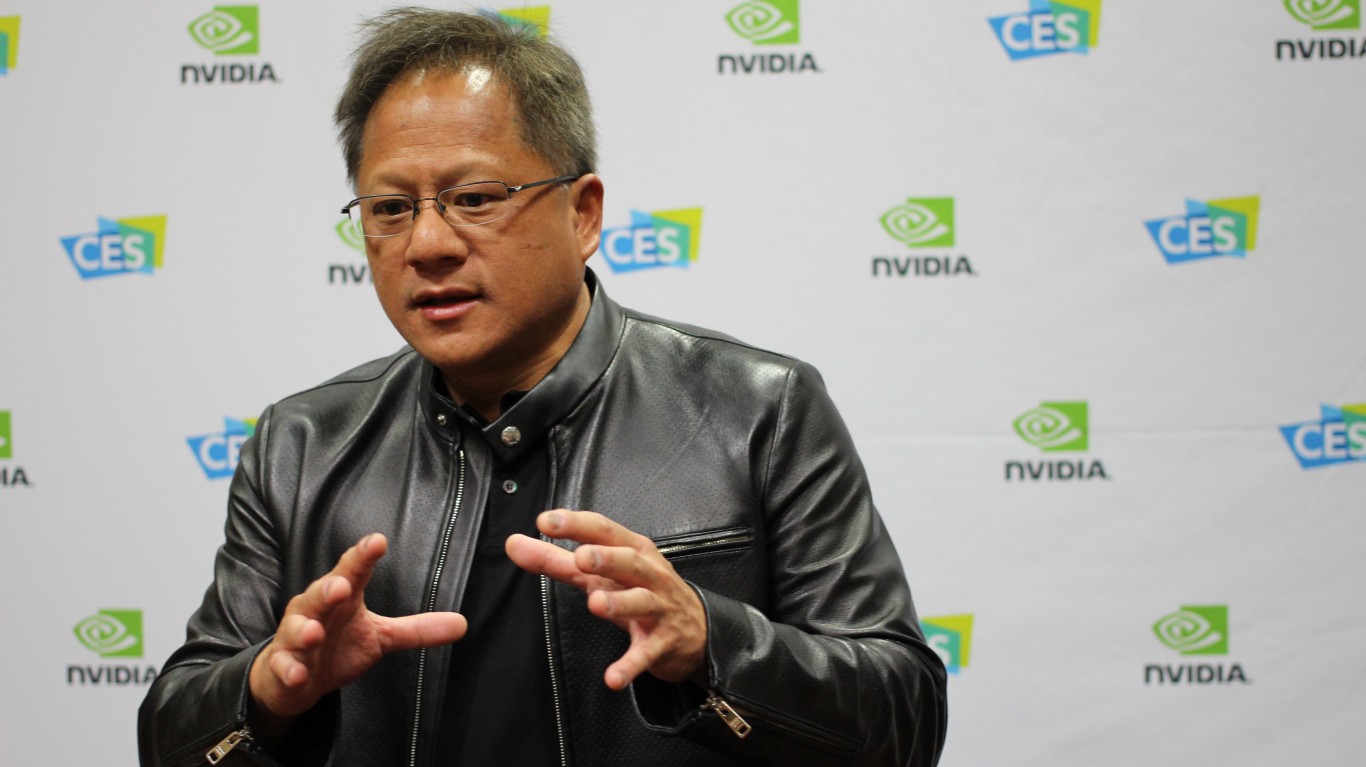

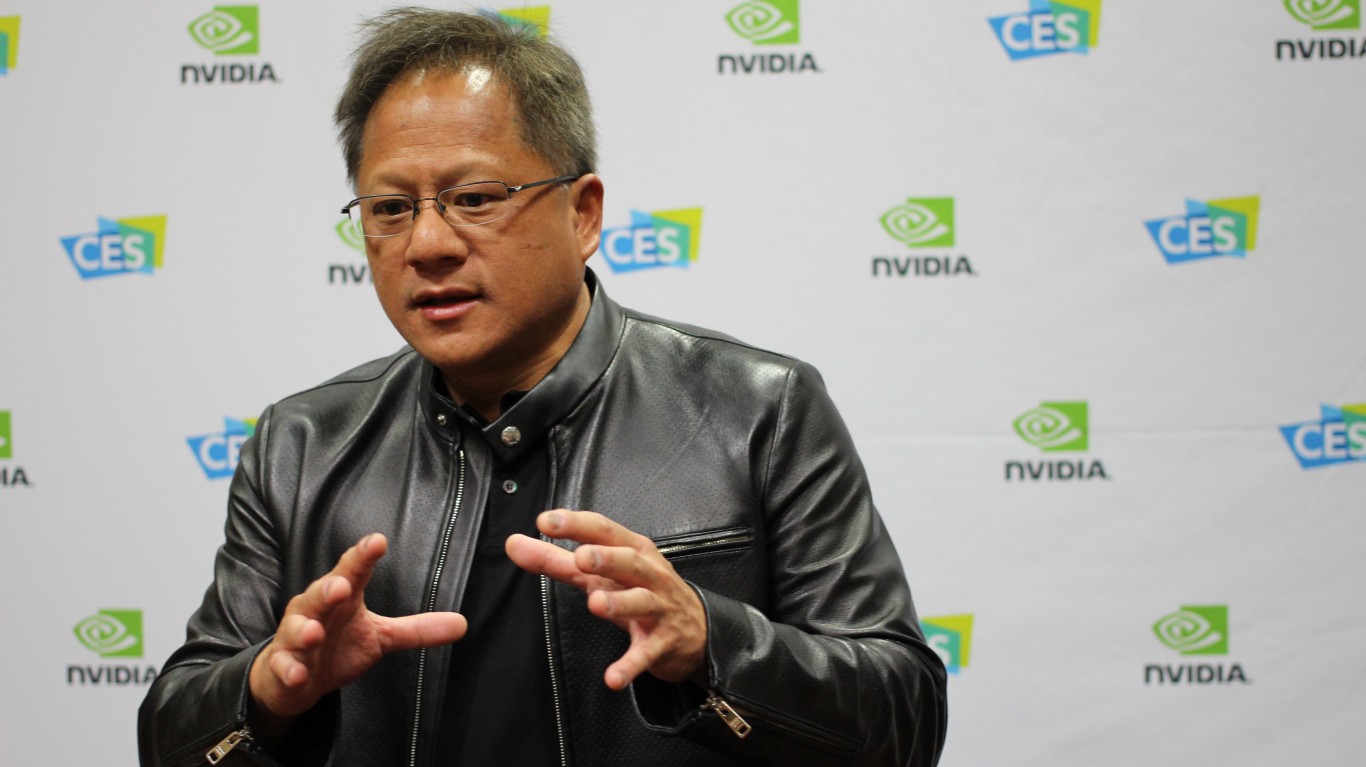

Shares of Nvidia Corp. (NASDAQ: NVDA) traded up by about 3.52% in Tuesday’s premarket session. If that price holds until markets close, Nvidia’s market cap will reach $998 billion. During a visit to Taiwan to deliver the commencement speech at the country’s national university, CEO Jensen Huang told a roundtable at the Computex trade show, “I have just turned everyone into a programmer.”

Huang also announced the company’s AI supercomputing platform, the DGX GH200, which connects 256 of the company’s Hopper superchip into a single graphics processing unit (GPU) with more than 18,000 Arm cores using 144 terabytes of memory. The new platform represents a full hardware and software stack for supercomputing and AI applications. While it is hard to make predictions about the future (h/t Yogi Berra), Nvidia’s head start in GPU computing is likely to last for at least a couple of years.

Huang has also turned on Nvidia’s money-printing machine. On Friday, Nvidia filed a shelf registration with the U.S. Securities and Exchange Commission to sell another $10 billion in equity and debt. Between February 2022 and January 2023, Nvidia repurchased some 63 million shares of its own stock at an average price of nearly $160 per share. Issuing $10 billion in new equity and debt at a price of around $400 per share is a coup, and the company would have been negligent to pass it up. The only question remaining is not if but when Nvidia will become the first chip company to reach a $1 trillion market cap.

Ahead of its fourth-quarter earnings report due after markets close Wednesday, C3.ai Inc. (NYSE: AI) added nearly 6% to its share price in Tuesday’s premarket session. The stock closed up nearly 16% on Friday and was up about 200% so far in 2023, even more than Nvidia’s year-to-date gain of around 170%.

A third big winner in the AI sweepstakes, according to Cathie Wood, founder of ARK Investment, is Tesla Inc. (NASDAQ: TSLA). Tesla’s full self-driving (FSD) software is an AI application that depends on fast image processing from the company’s camera-based autonomous driving software. CEO Elon Musk has consistently maintained that cameras are both better and cheaper than a lidar-based autonomous driving system. Still, Wood’s forecast that Tesla could be valued at more than double Apple’s current $2.75 trillion market cap by 2027 seems something of a stretch.

Here is a look at how the markets fared on Friday, before the three-day weekend and the debt ceiling deal.

Eight of 11 market sectors closed higher on Friday. Technology (2.68%) and consumer discretionary (2.38%) had the day’s biggest gains. Energy (0.37%) and health care (−0.17%) lagged. The Dow closed up 1.00%, the S&P 500 up 1.30% and the Nasdaq up 2.19% on Friday.

Two-year Treasuries added four basis points to end Friday at 4.54%, and 10-year notes dipped by three basis points to close at 3.80%. In Tuesday’s premarket, two-year notes were trading at around 4.52% and 10-year notes at about 3.73%.

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.