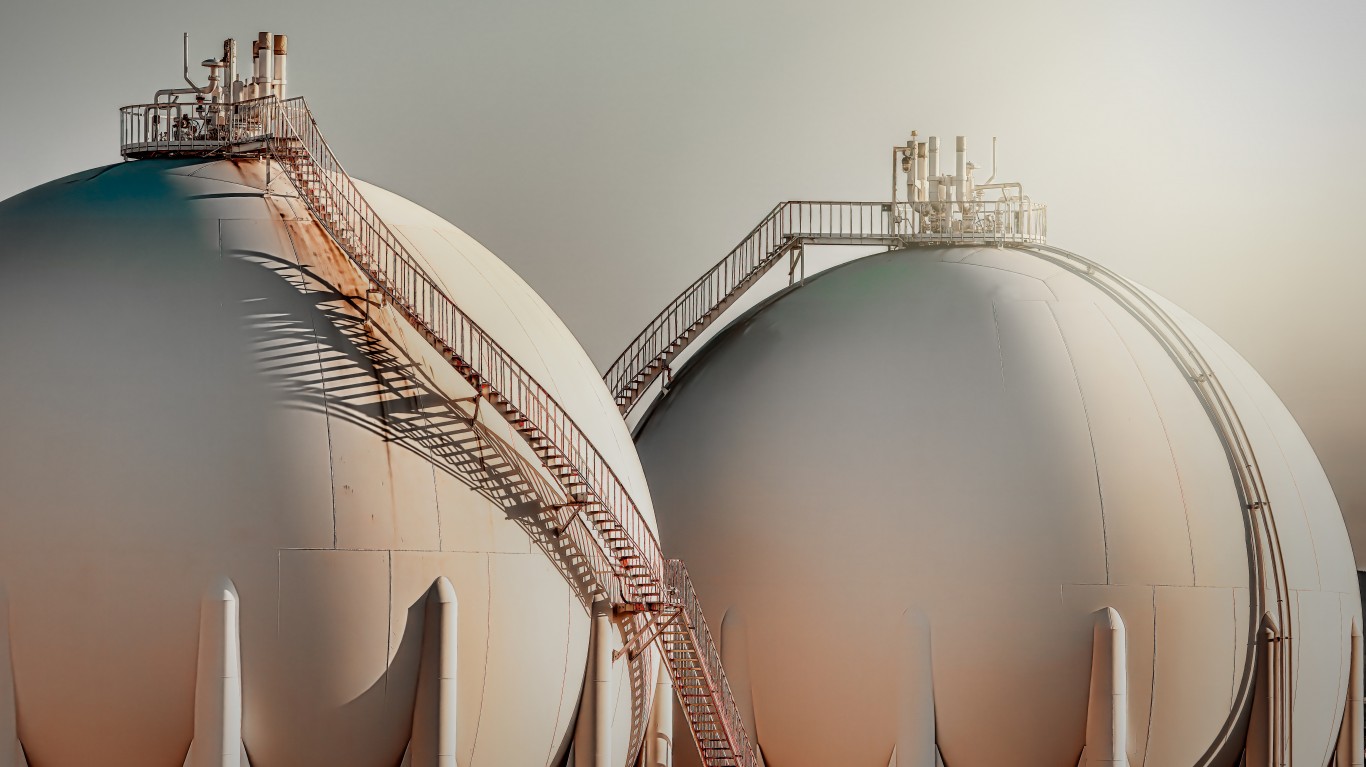

Attention energy investors – a big deal is coming down the pipeline for the US gas industry.

Kodiak Gas Services is due to go public before the end of the month.

The Texas-based gas field services firm has set its sights high – aiming for a total valuation of over $1.6 billion through its initial public offering (IPO). In an amended filing with the Securities and Exchange Commission (SEC), Kodiak revealed its plans to sell 16 million units, priced between $19 and $22 a share. It is projected to raise around $350 million from the sale if pricing goes to the high end of the range.

Kodiak plans to debut its stock offering on Thursday, June 29, according to IPOScoop. The company will list on the New York Stock Exchange (NYSE) under the ticker “KGS.” Goldman Sachs and J.P. Morgan are the deal’s lead underwriters.

Kodiak is a gas compression unit market leader in the Permian Basin – the largest producing natural gas and oil basin in the country. It services blue-chip upstream and midstream customers under stable fixed-revenue contracts. Last year its four largest customers were all S&P500 companies.

The company reported $65.98 million in adjusted net income on $729.68 mil in the 12 months ending March 31, 2023.

According to a 2021 market research report by Fortune Business Insights, the global market for hydraulic fracturing was estimated to be worth around $12 billion in 2020. It is forecast to expand at a compound annual growth rate (CAGR) of 9.5% to reach nearly 29 billion by 2028.

Kodiak’s main competitors include Weatherford, Halliburton and Schlumberger, and other Texas-based oilfield service companies.

Out of Hibernation?

Kodiak may benefit from the recent change in market mood.

Energy saw explosive growth last year. It was the only one of the S&P500’s eleven categories that bucked the downward trend, finishing 2022 up almost 60%. Despite that strong sectoral performance, the IPO market has remained weak.

Since the onset of the bearish downturn last year, IPOs have been in hibernation. The last 18 months have been the slowest for public debuts since the 2008 financial crisis. Yet recent weeks have seen signs of life that are rekindling investors’ appetite for new deals. Could Kodiak usher the IPO market out of hibernation?

This month saw investors snap up the first servings of Cava. The Mediterranean restaurant brand saw its valuation pop by nearly 100% on its opening day of trading. In May, Johnson & Johnson’s consumer health spin-off Kenvue pulled off the biggest IPO since 2021.

This momentum, along with the broad rise in stock indices this month, could create more favorable conditions for market newcomers.

Investors keen on the Kodiak deal will be hoping that bullish momentum holds through for its impending debut.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.