Investing

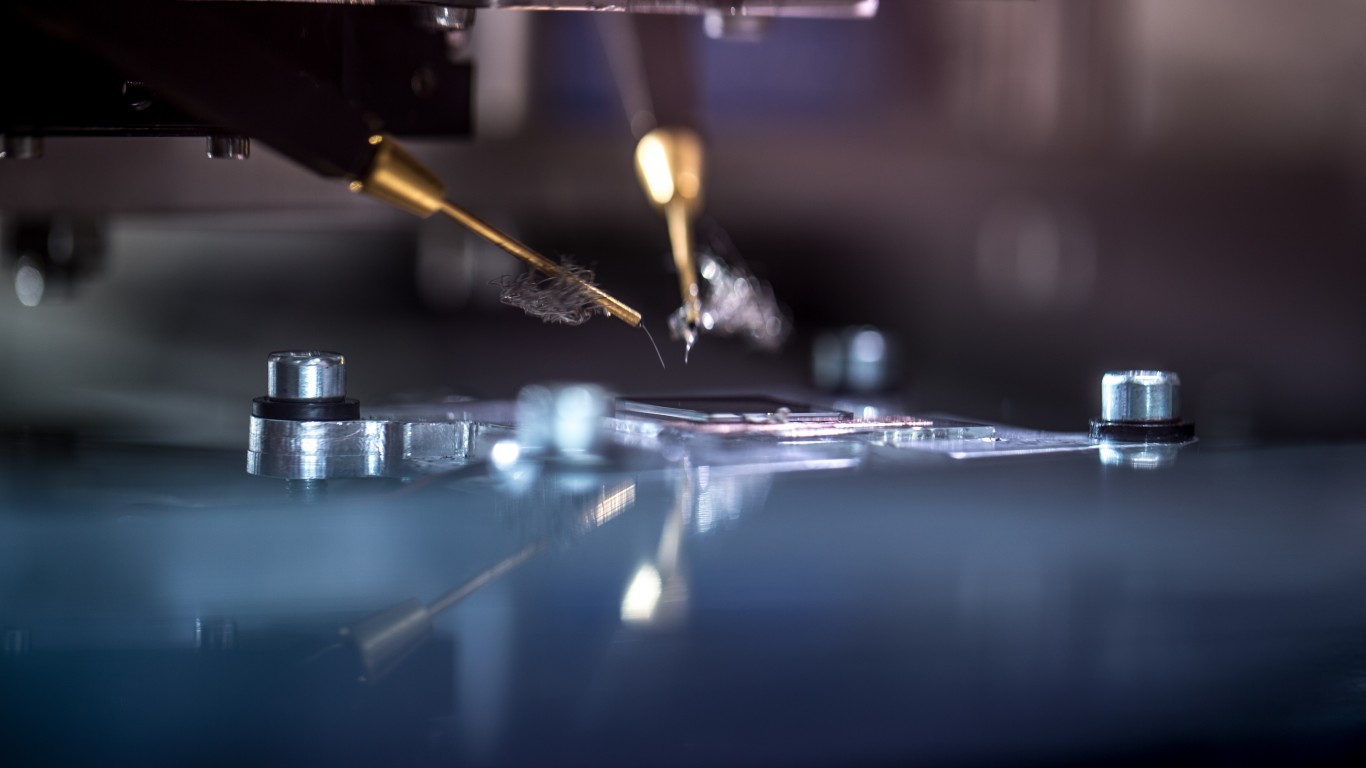

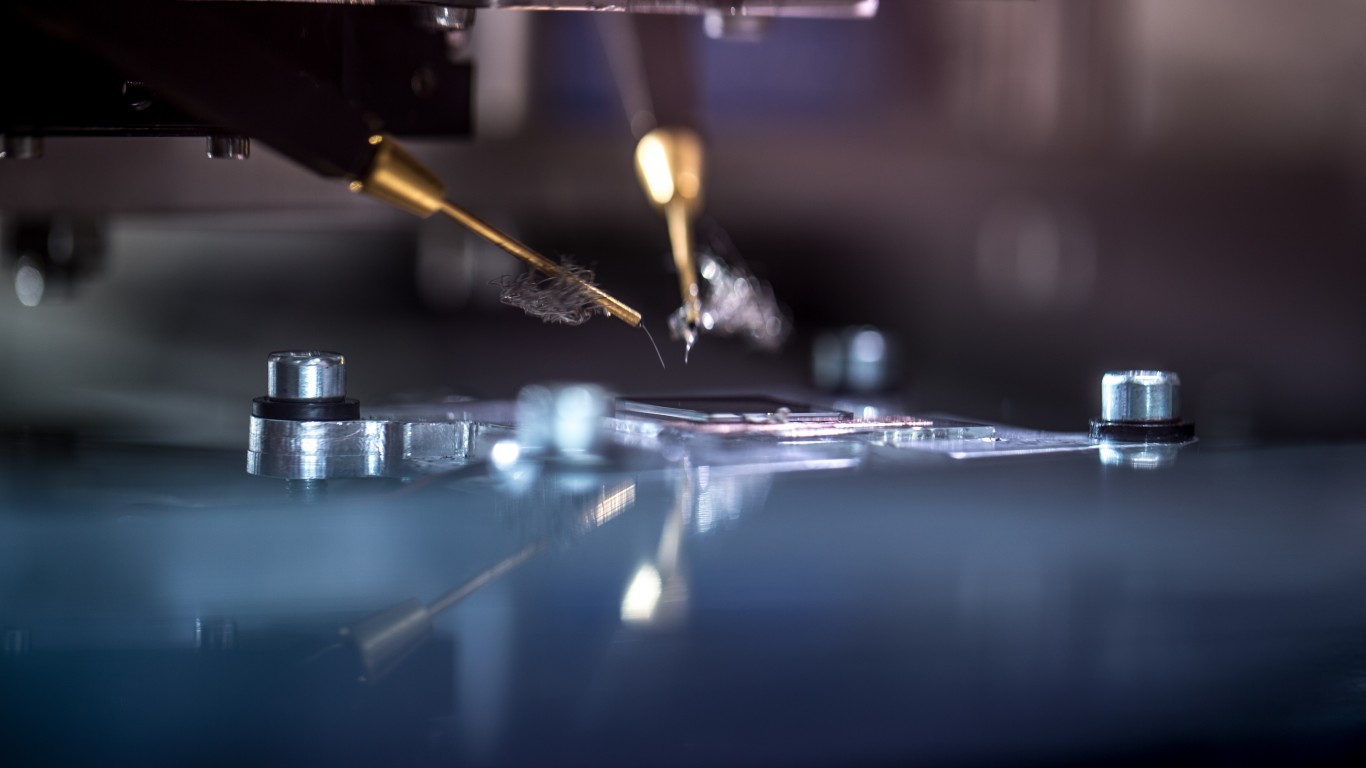

Unprecedented Attendance at SEMICON China 2023 Reflects Resilient Semiconductor Industry

Published:

Last Updated:

In the face of global supply chain challenges and pandemic-era complications, the semiconductor industry is demonstrating its resilience. This was on full display at SEMICON China 2023, the premier annual event for the global semiconductor industry, last week in Shanghai.

SEMICON China, hosted by the industry equipment consortium, broke previous attendance records with an influx of domestic and international industry professionals. The event, which attracted noticeably more participants than the pre-Covid 2019 show, is a testament to the robust health of the industry and China’s increasing role within it.

Year to date, the iShares Semiconductor ETF (US:SOXX) is up 48.5% while the Global X China Semiconductor ETF (HK:9191) is down 0.3%.

The latest U.S. chip restrictions were a key debate at the conference with the potential ban of Nvidia’s (US:NVDA) A800 that would add further pressure on local producers to lift their game in the race for the latest technology. NVDA stock is the largest holding in that iShares Semiconductor exchange-traded fund, at 8.3% weight.

Coincidentally (or, maybe not), China on Monday imposed restrictions on exporting two metals crucial to some semiconductor manufacturing. Beijing will limit gallium and germanium exports from Aug. 1.

Domestic Demand

While international presence was smaller in proportion to the overall attendees, the expo saw a significant surge in local emerging equipment, material, and manufacturing ecosystem suppliers. Industry insiders noted an encouraging trend: the rise of local players carving a niche for themselves amidst global competition.

A recurring theme throughout the conference was the continued strength of domestic equipment demand. Manufacturers are fervently supporting new fabs and localization efforts, a promising indicator of sustained growth. Commentary coming from the event, has highlighted that the supply chain is still resilient, working diligently to overcome extended lead times, especially in ramping up 2.5D/CoWoS style chip capabilities.

However, the optimism surrounding equipment demand was tempered by a more-muted outlook for fab loadings and the back-end of the logic and memory market in the second half of the year. This reflects a broader concern about the high inventory levels and the restrictions on memory.

One of the expo’s most notable takeaways was the local tester suppliers gaining traction in power and logic/analog integrated circuits. This development underscores the growth of indigenous innovation and reflects China’s continued push to become more self-reliant in semiconductor technology.

Amid the multitude of companies making their presence felt, Naura Technology (CN:002371), a significant player in the semiconductor industry, stood out for its wide equipment portfolio and the benefits it stands to reap from robust demand and increasing localization efforts. The stock is the second-biggest holding in the Global X China Semiconductor ETF portfolio, at 7.97%

Another highlight of the event was from Hua Hong (HK:1347), which is on track for its A-Share listing in early August. This listing is expected to stabilize the business and drive recovery in the second half of 2023, buoyed by its strengths in IGBT/discretes. This progress is impressive, especially considering the industry slowdown in the preceding quarter.

Buying Local

The event also spotlighted advanced packaging, with JCET (CN:600584) leading the domestic market’s focus on this area. This emphasis is in response to a growing demand for sophisticated chip packaging solutions. JCET stock is the ninth-biggest holding on the Global X China Semiconductor ETF roster, at 4.2% weight.

The partially state-owned tech company ZTE (CN:000064) announced new products including its latest Wifi 7 product that is using local suppliers for chips.

A Semiconductor Manufacturing International Corp (HK:981) exec at the event said that “China must find new ways to embed itself in the cross-border supply chain,” noting that industrial cooperation is facing challenges as well as opportunities.

Both the AI and automotive sectors were the capital market’s focal points, drawing attention to the increasingly intertwined relationship between semiconductors and these two industries.

Overall, SEMICON China 2023 confirmed China’s growing clout in the global semiconductor industry, driven by flourishing domestic demand, the rise of local manufacturers, and the country’s ongoing localization efforts.

As global tech standards and market competition continue to be preserved, it’s clear that the “re-globalization” effort of the semiconductor industry is well underway — with China trying to lead the charge.

This article originally appeared on Fintel

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.