Investing

4 Analyst Favorite Blue Chip Companies Are Expected To Raise Their Dividends This Week

Published:

Last Updated:

After years of a low interest rate environment, which has been trending higher over the last year, many investors have turned to equities not only for the growth potential but also for solid and dependable dividends that help to provide an income stream. What this equates to is total return, which is one of the most powerful investment strategies going. While interest rates are on the move higher, these companies still make sense for investors looking for solid growth and income potential.

[in-text-ad]

We always like to remind our readers about the impact total return has on portfolios because it is one of the best ways to help improve the chances for overall investing success. Again, total return is the combined increase in a stock’s value plus dividends. For instance, if you buy a stock at $20 that pays a 3% dividend, and it goes up to $22 in a year, your total return is 13%. 10% for the increase in stock price and 3% for the dividends paid.

Four top companies that are Wall Street favorites are expected to raise their dividends this week, so we screened our 24/7 Wall St. research universe and found that three are rated Buy at some of the top firms on Wall Street. While it’s always possible that not all of the four do indeed raise their dividends, top analysts expect them to, and generally, the data is based on past increases in the firm’s dividend payouts. It’s important to remember that no single analyst report should be used as the sole basis for any buying or selling decision.

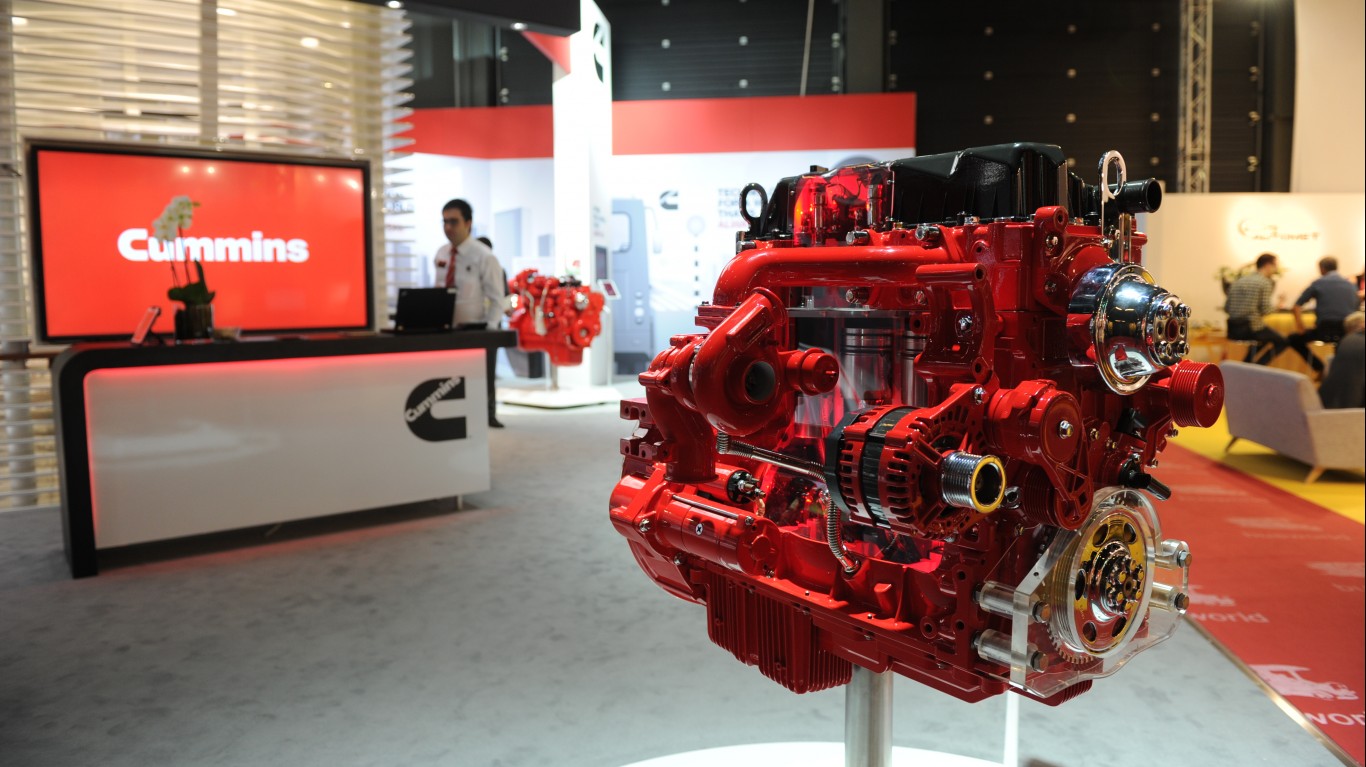

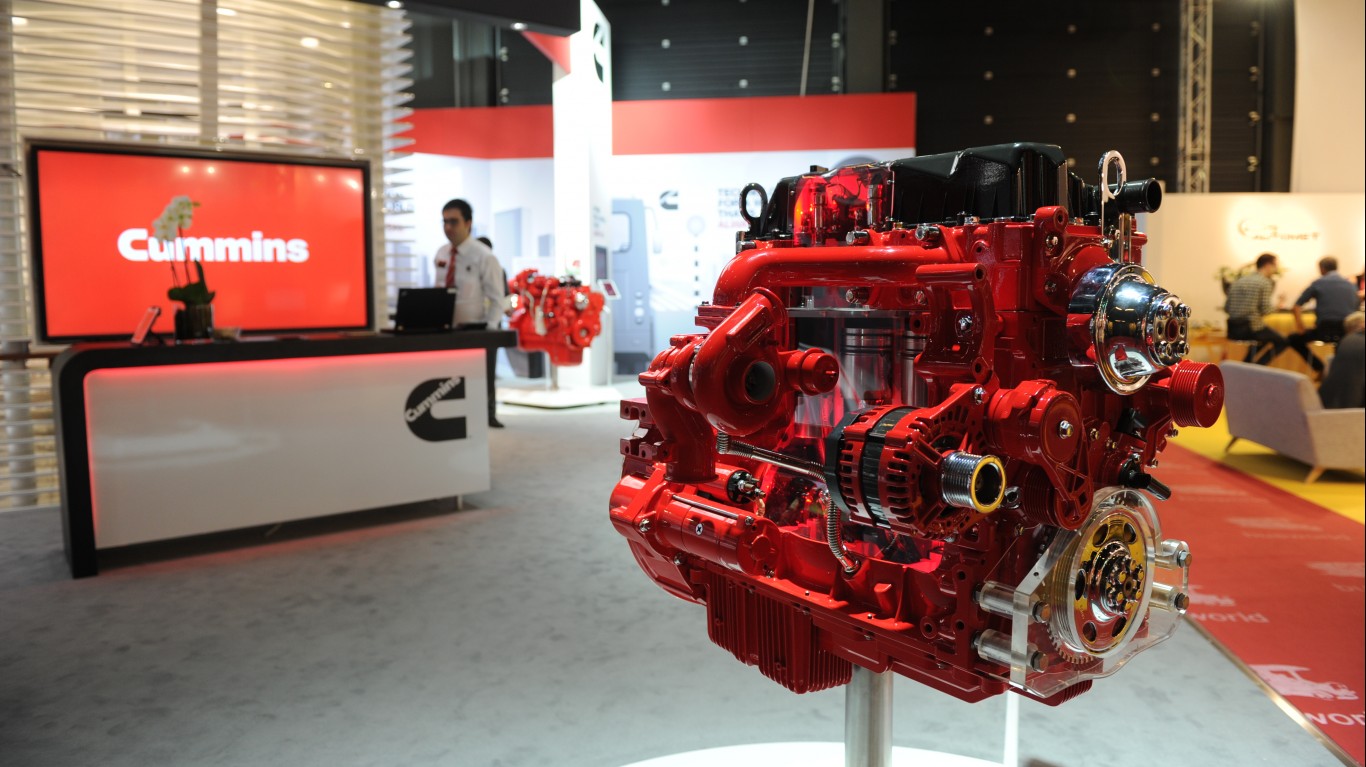

This top company makes the parts and components for the trucking industry to keep the country moving. Cummins Inc. (NYSE: CMI) designs, manufactures, distributes, and services diesel and natural gas engines, electric and hybrid powertrains, and related components worldwide. It operates through five segments: Engine, Distribution, Components, Power Systems, and New Power. The company offers diesel and natural gas powered engines under the Cummins and other customer brands for the heavy and medium-duty truck, bus, recreational vehicle, light-duty automotive, construction, mining, marine, rail, oil and gas, defense, and agricultural markets; and offers new parts and services, as well as remanufactured parts and engines.

Cummins also provides power generation systems, high-horsepower engines, heavy and medium-duty engines, application engineering services, custom-designed assemblies, retail and wholesale aftermarket parts, and in-shop and field-based repair services. In addition, the company offers emission solutions; turbochargers; air and fuel filters, fuel water separators, lube and hydraulic filters, coolants, fuel additives, and other filtration systems; and electronic control modules, sensors, and supporting software, as well as new, replacement, and remanufactured fuel systems.

Further, it provides automated transmissions; standby and prime power generators, controls, paralleling systems, and transfer switches, as well as A/C generator/alternator products under the Stamford and AVK brands; and electrified power systems with components and subsystems, including battery, fuel cell, and hydrogen production technologies. Additionally, it offers filtration, aftertreatment, control systems, air handling systems, automated transmissions, electric power generation systems, and batteries.

Cummins Investors are currently paid a very reasonable dividend of 2.55%. It is expected the company will raise the dividend to $1.66 per share from $1.57.

Credit Suisse has an Outperform rating and a $291 target price objective. The consensus target across Wall Street is posted at $256.93. The shares closed trading Friday at $245.80.

Typically insurance companies are not affected by increases in interest rates, and this is one of the strongest companies in the sector. Marsh & Mclennan Companies, Inc. (NYSE: MMC), a professional services company, provides advice and solutions to clients in the areas of risk, strategy, and people worldwide. It operates in two segments, Risk and Insurance Services, and Consulting.

[in-text-ad]

The Risk and Insurance Services segment offers risk management services, such as risk advice, risk transfer, and risk control and mitigation solutions, as well as insurance and reinsurance broking, catastrophe and financial modeling, related advisory services, and insurance program management services. This segment serves businesses, public entities, insurance companies, associations, professional services organizations, and private clients.

The Consulting segment provides health, wealth, and career consulting services and products, specialized management, and economic and brand consulting services.

Shareholders currently receive a 1.28% dividend. The company is expected to increase the dividend to $0.65 per share from $0.59

Wells Fargo has an Overweight rating on the shares with a $200 target price. The consensus target is posted at $192.67. The final trade for Friday was reported at $183.99.

This is a top east coast utility stock that conservative investors can embrace. New Jersey Resources Corporation (NYSE: NJR) an energy services holding company, provides regulated gas distribution, and retail and wholesale energy services. The company operates through four segments: Natural Gas Distribution, Clean Energy Ventures, Energy Services, and Storage and Transportation.

The Natural Gas Distribution segment offers regulated natural gas utility services to approximately 569,300 residential and commercial customers throughout Burlington, Middlesex, Monmouth, Morris, Ocean, and Sussex counties in New Jersey; provides capacity and storage management services; and participates in the off-system sales and capacity release markets.

The Clean Energy Ventures segment invests in, owns, and operates commercial and residential solar installations situated in New Jersey, Connecticut, Rhode Island, and New York. The Energy Services segment offers unregulated wholesale energy management services to other energy companies and natural gas producers, as well as maintains and transacts a portfolio of physical assets consisting of natural gas transportation and storage contracts in the United States and Canada.

The Storage and Transportation segment invests in natural gas transportation and storage facilities. It provides heating, ventilation, and cooling services; holds commercial real estate properties; and offers solar equipment installation, and plumbing repair and installation services, as well as engages in the water appliance sale, installation, and servicing activities.

[in-text-ad]

Investors are currently paid a solid 3.44% dividend. The company is expected to increase the dividend to $0.415 per share from $0.39.

Mizuho has a Neutral rating on the shares with a $51 target price. The consensus target is set higher at $52.17. The shares closed trading Friday at $45.41.

Investors looking for a solid play in the financials should be attracted to this top company. State Street Corporation (NYSE: STT), through its subsidiaries, provides a range of financial products and services to institutional investors worldwide.

The company offers investment servicing products and services, including custody, accounting, regulatory reporting, investor, and performance and analytics; middle office products, such as IBOR, transaction management, loans, cash, derivatives and collateral, record keeping, and client reporting and investment analytics; foreign exchange, and brokerage and other trading services; securities finance and enhanced custody products; deposit and short-term investment facilities; loans and lease financing; investment manager and alternative investment manager operations outsourcing; performance, risk, and compliance analytics; and financial data management to support institutional investors.

State Street also engages in the provision of portfolio management and risk analytics, as well as trading and post-trade settlement services with integrated compliance and managed data. In addition, the company offers investment management strategies and products, such as core and enhanced indexing, multi-asset strategies, active quantitative and fundamental active capabilities, and alternative investment strategies. Further, it provides services and solutions, including environmental, social, and governance investing; defined benefit and defined contribution; and global fiduciary solutions, as well as exchange-traded funds under the SPDR ETF brand.

The company provides its products and services to mutual funds, collective investment funds and other investment pools, corporate and public retirement plans, insurance companies, foundations, endowments, and investment managers.

State Street Shareholders are currently receiving a respectable 3.41% dividend. The company is ex[ect to increase the dividend to $0.69 from $0.63. Wells Fargo has an Overweight rating on the shares with a $90 target price. The consensus is posted lower at $85.64. The final trade on Friday was reported at $73.88.

Four top companies that all are analysts’ favorites across Wall Street and are expected to lift the dividends they pay to shareholders. Not only is increasing dividends and returning capital to investors important, but they also show that the company is doing well and has the earnings and cash flow strength to increase the payouts.

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.