Investing

Goldman Sachs Down 1.2% as Weak Earnings Report Shows Declining Profit

Published:

Last Updated:

Goldman Sachs, one of Wall Street’s biggest banks, posted a profit decline of 58% and missed earnings estimates in the second quarter this year. The bank’s shares fell 1.34% in Wednesday’s premarket on disappointing figures.

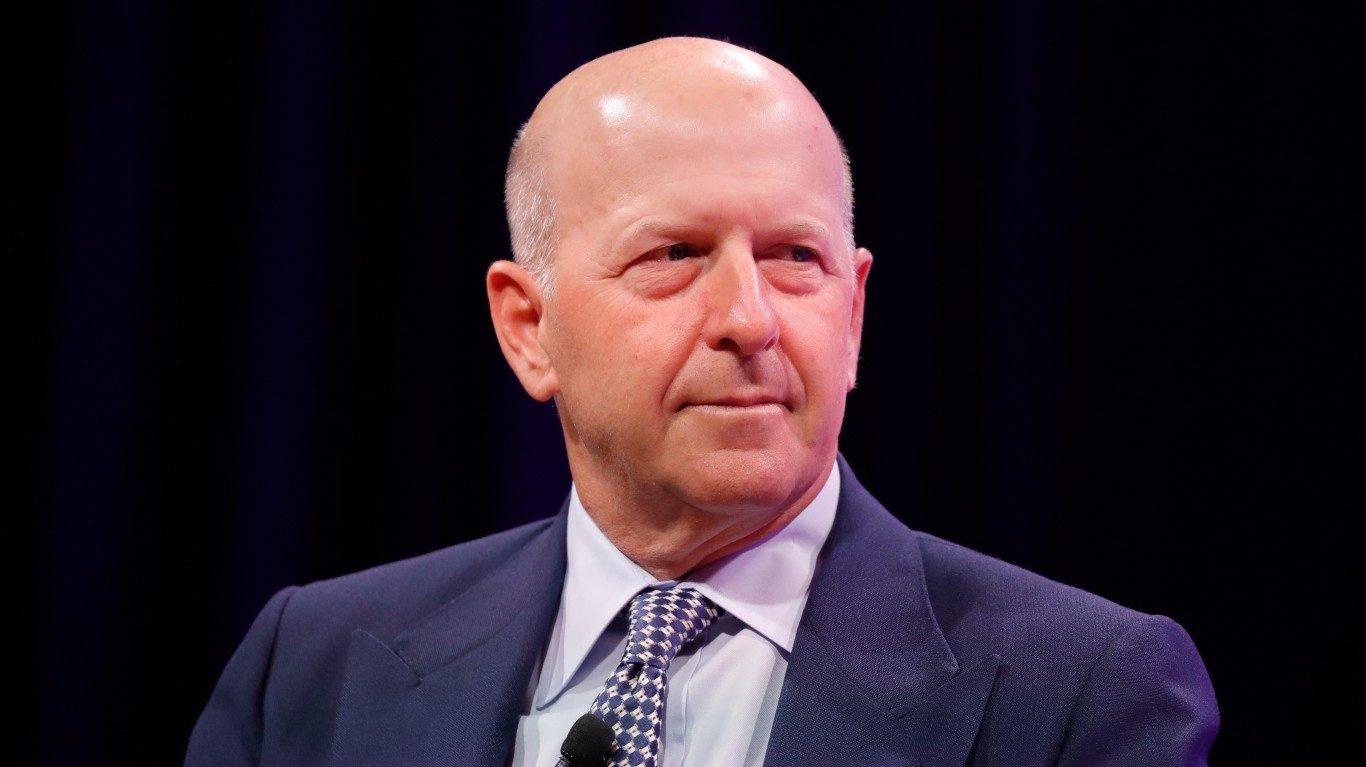

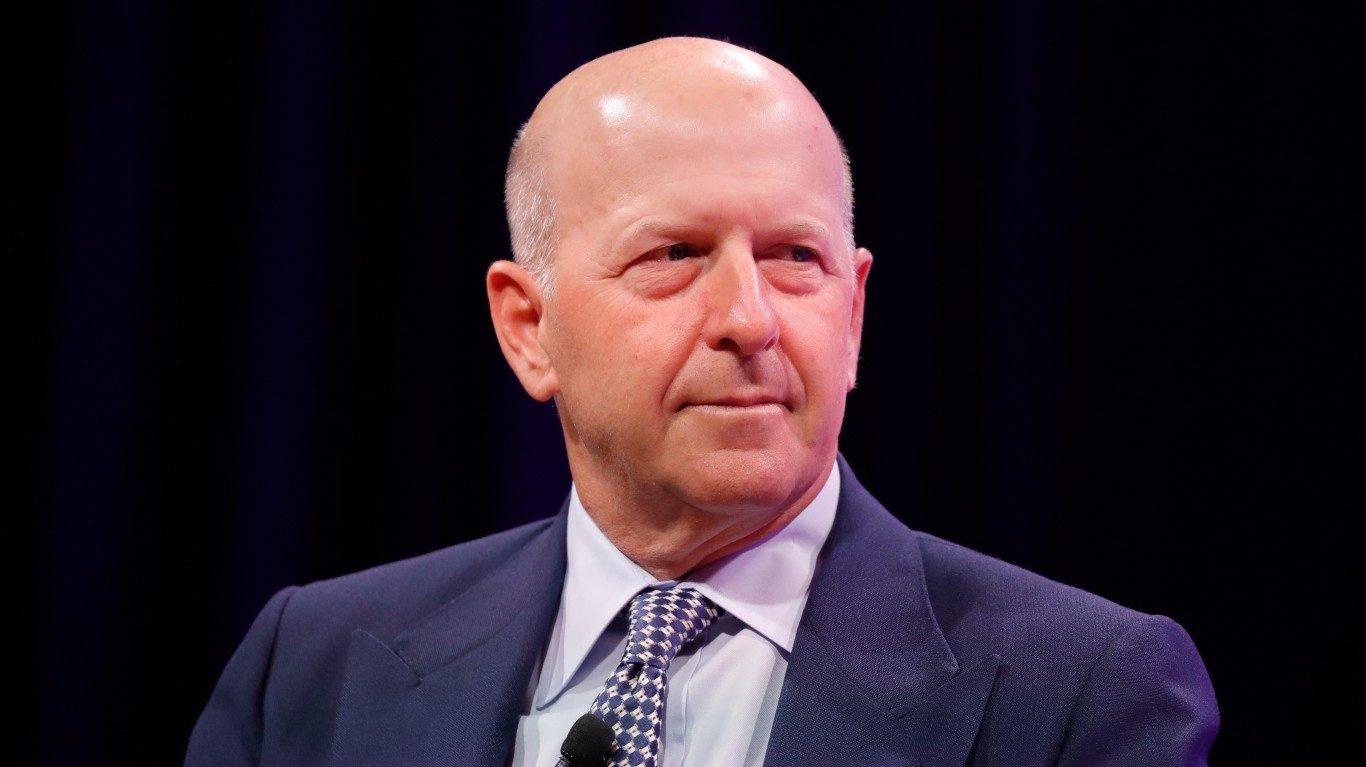

Shares of Goldman Sachs slipped 1.34% in premarket trading Wednesday after the Wall Street giant’s Q2 earnings report showed a profit drop of 58%. The drop in share price comes as investors responded to one of Goldman’s weakest quarters under CEO David Solomon. Goldman’s earnings fell short of analysts’ estimates in Q1 following a severe crisis in the banking sector.

The bank reported earnings per share of $3.08 in the quarter, missing the consensus estimates of $3.18. Revenue came in at $10.9 billion, down 8% year-over-year, though slightly ahead of Wall Street estimates of $10.84 billion.

Most notably, Goldman’s Q2 profit plummeted 58% to $1.22 billion as sharp declines in trading and investment banking and losses tied to real estate and its loan program GreenSky erased roughly $3.95 from the bank’s per-share earnings. Goldman reported a $504 million blow associated with GreenSky and $485 million in real estate writedowns.

Additionally, return on equity – considered a key gauge of profitability, fell 4% in the three months, the worst among top US banks. Equities trading marked a silver lining of the Q2 report, with Goldman beating its banking peers at $3 billion in revenue and above the expected $2.47 billion.

The premarket dip in Goldman shares comes after its major rivals witnessed noteworthy stock price jumps on Tuesday, fueled by their respective earnings data.

Shares of Morgan Stanley closed by nearly 6.5% higher on July 18 after the bank’s better-than-expected quarterly report. In particular, Morgan Stanley saw significant growth in its wealth management business, offsetting lower trading revenue.

Similarly, after its profit figures exceeded expectations, Bank of America rose 4.4% yesterday thanks to solid earnings from customers’ loan payments. In addition, the lender’s investment banking and trading reports also beat estimates. Other banks that saw notable stock price increases include Bank of New York Mellon and PNC Financial.

This article originally appeared on The Tokenist

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.