Investing

High Business Community Ratings for Brazil's Leftist Lula Carry Over to iShares' ETF

Published:

Last Updated:

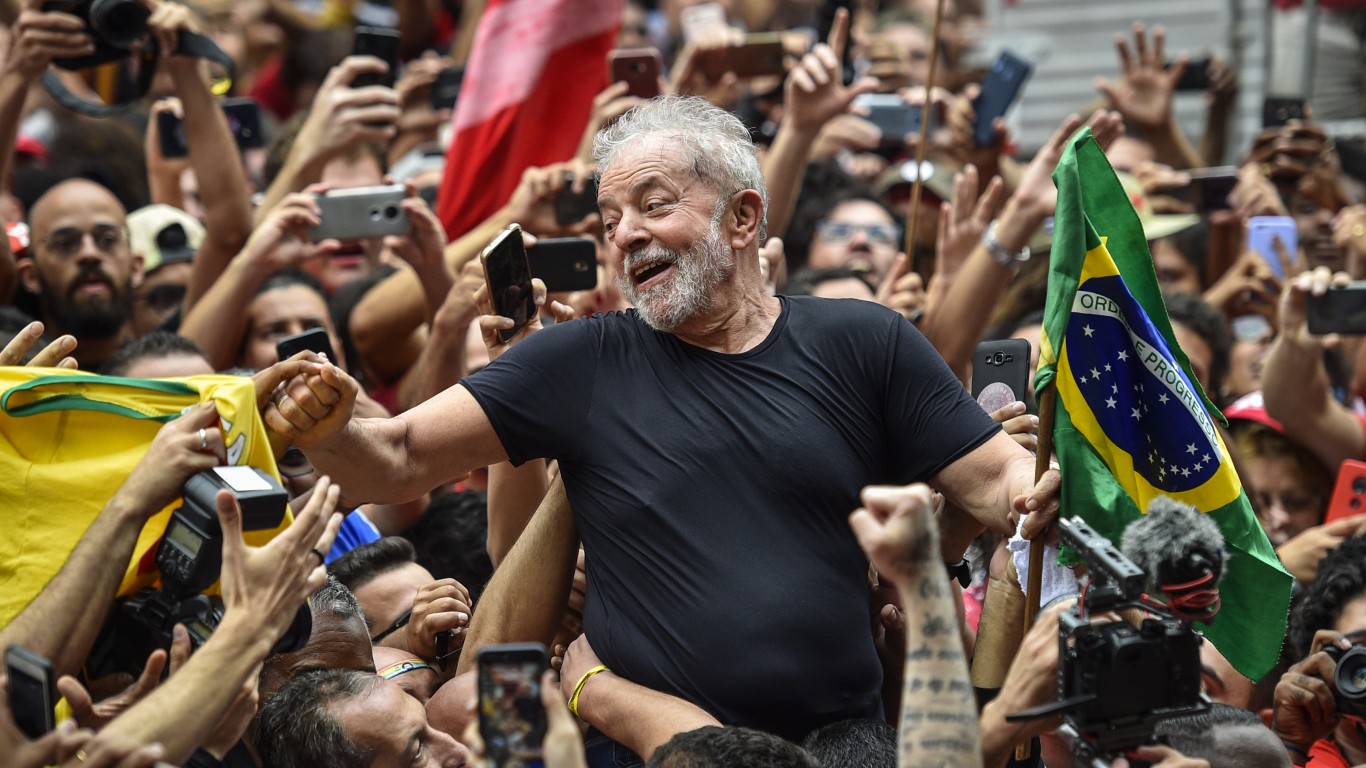

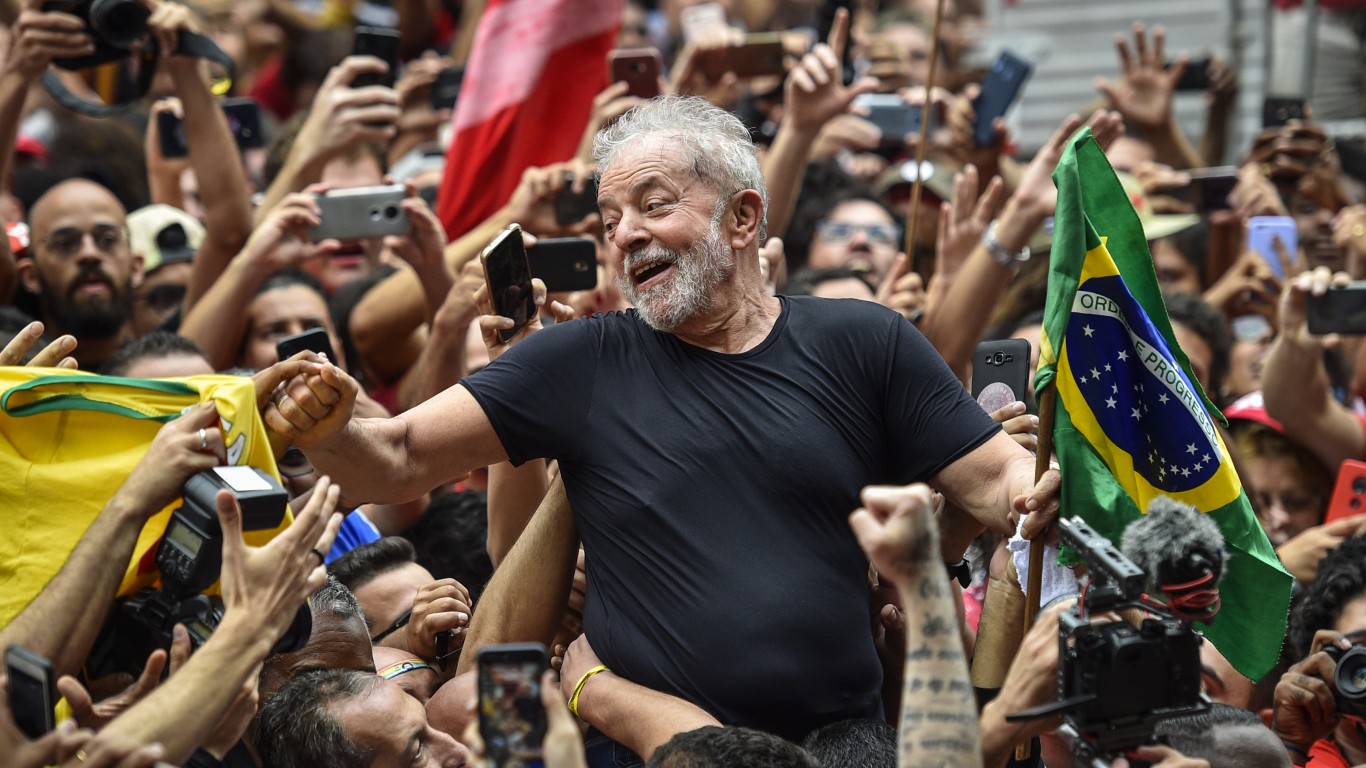

One of the biggest surprises in Latin America these days is news that Brazil’s financial community is increasingly optimistic about the continent’s biggest economy under the guidance of leftist President Luiz Inácio Lula da Silva and his finance minister.

According to a July 12 Reuters report, more than half of the country’s “market players” now feel Brazil’s economy will improve over the next 12 months.

Perhaps some of that feeling has helped stoke investor support of the leading Brazilian exchange-traded fund that’s traded in the U.S., the iShares MSCI Brazil ETF (US:EWZ). EWZ stock has surged nearly 29% since bottoming on March 23.

That has pumped the ETF’s favorable Momentum reading on Fintel’s quant dashboard and boosted its Fund Sentiment score. As well, data compiled by Fintel reveals rather bullish put/call ratios on the shares.

Assets invested in global exchange-traded funds reached a record $10.5 trillion, consultancy ETFGI noted at the end of June. In the first half of the year, net inflows came in at an all-time high of $376.19 billion, while their assets increased by 13.5%, funds europe reported last month, citing ETFGI’s data.

Also noteworthy is that several major institutions have bought sizable amounts of EWZ this year.

The MSCI Brazil ETF has a Fund Sentiment score of 73.3 out of 100, ranking it 6,935 out of 35,840 names that were assessed. The exchange-traded fund also has a six-month Momentum score of 69.47, placing it at 8,146 out of 43,803 names that were assigned the metric.

Turning to put/call data, EWZ’s overall put/call ratio is a bullish 0.73, Additionally, the put/call ratios for options that expire on July 21, Aug. 4, and Aug. 11 are 0.68, 0.40, and 0.24, respectively. These bullish ratios indicate that investors expect the ETF to continue to climb in the coming weeks.

In the first quarter, the country’s GDP grew at a rapid annual rate of 4%. That was well above the 0.8% expansion that economists at the beginning of the year, on average, had expected.

Increased demand from China for Brazilian agricultural products, along with easing inflation and declining interest rates, are seen as key reasons for Brazil’s outperformance. Further, the nation’s unemployment rate dropped to 8.5% in April, representing one of the lowest readings in eight years.

On the other hand, the economy contracted 2% in May compared to April, according to the nation’s central bank. However, the central bank is widely expected to slash interest rates in August, a move that is likely to revitalize the economy and put it back on a growth path.

Moreover, the economy still expanded 2.15% versus the same month a year earlier, and drawing conclusions based on one month’s data, especially at a time when the nation’s economy has been rather volatile, is probably not the correct approach.

A look at the 53 holdings in the iShares MSCI Brazil ETF shows the top five, or 38.6% of the fund’s weight, are skewed toward financials and energy. Miner Vale (BR:VALE21) is the largest, at 13.02% of the portfolio. Two different classes of energy giant Petrobras occupy the second and fourth spots, with Petroleo Brasileiro SA’s B4 shares (BR:PETR4) weight at 7.31% and the B3 shares (BR:PETR3) at 6.38%.

Lenders Itau Unibanco Holding (BR:ITUB20), at 7.3% allocation and Banco Bradesco (BR:BBDC4) at 4.61%, round out the top five.

The annual expense ratio on the exchange-traded fund’s shares is 0.58%.

ESG-sensitive investors should note that some 13% of the stocks in the ETF are companies determined by MSCI to be UN Global Compact Violators. That is the percentage of the stocks that have been identified by the index-maker’s research team as failing to comply with the United Nations Global Compact Principles.

Fund sponsor BlackRock has been moving to jettison such stocks from its funds.

This article originally appeared on Fintel

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.