Investing

Goldman Sachs Maintains 2seventy bio Buy Recommendation

Published:

Last Updated:

Fintel reports that on August 15, 2023, Goldman Sachs maintained coverage of 2seventy bio (NASDAQ:TSVT) with a Buy recommendation.

Analyst Price Forecast Suggests 322.89% Upside

As of August 2, 2023, the average one-year price target for 2seventy bio is 25.50. The forecasts range from a low of 13.13 to a high of $34.65. The average price target represents an increase of 322.89% from its latest reported closing price of 6.03.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for 2seventy bio is 97MM, a decrease of 34.16%. The projected annual non-GAAP EPS is -5.59.

What is the Fund Sentiment?

There are 331 funds or institutions reporting positions in 2seventy bio. This is an increase of 11 owner(s) or 3.44% in the last quarter. Average portfolio weight of all funds dedicated to TSVT is 0.13%, an increase of 36.54%. Total shares owned by institutions increased in the last three months by 35.74% to 53,347K shares. The put/call ratio of TSVT is 0.37, indicating a bullish outlook.

What are Other Shareholders Doing?

Kynam Capital Management holds 4,891K shares representing 9.74% ownership of the company. In it’s prior filing, the firm reported owning 3,739K shares, representing an increase of 23.55%. The firm increased its portfolio allocation in TSVT by 38.27% over the last quarter.

Wellington Management Group Llp holds 2,880K shares representing 5.74% ownership of the company. In it’s prior filing, the firm reported owning 2,769K shares, representing an increase of 3.84%. The firm decreased its portfolio allocation in TSVT by 86.10% over the last quarter.

Baker Bros. Advisors holds 2,498K shares representing 4.98% ownership of the company. In it’s prior filing, the firm reported owning 2,063K shares, representing an increase of 17.41%. The firm increased its portfolio allocation in TSVT by 19.41% over the last quarter.

Orbimed Advisors holds 2,392K shares representing 4.76% ownership of the company. In it’s prior filing, the firm reported owning 1,041K shares, representing an increase of 56.46%. The firm increased its portfolio allocation in TSVT by 155.49% over the last quarter.

Citadel Advisors holds 2,366K shares representing 4.71% ownership of the company. In it’s prior filing, the firm reported owning 262K shares, representing an increase of 88.94%. The firm increased its portfolio allocation in TSVT by 826.63% over the last quarter.

2seventy bio Background Information

(This description is provided by the company.)

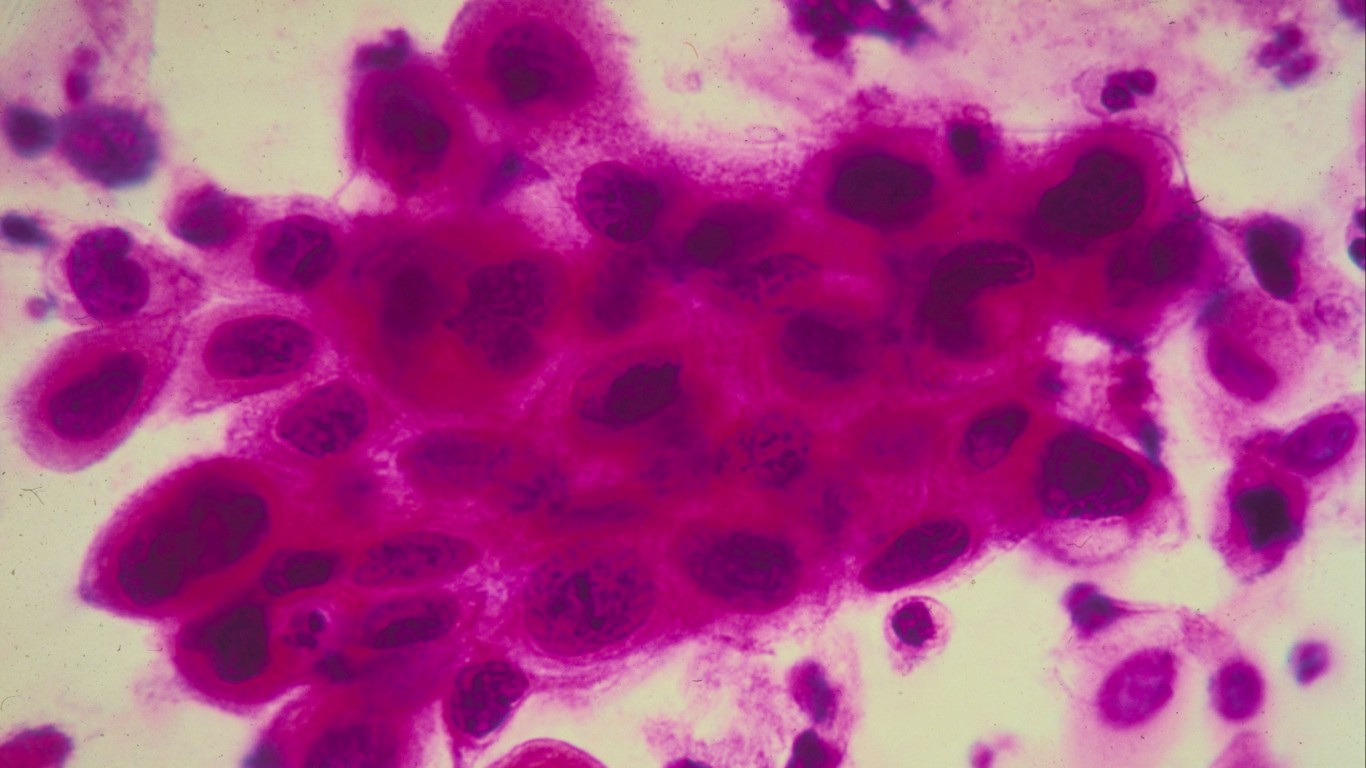

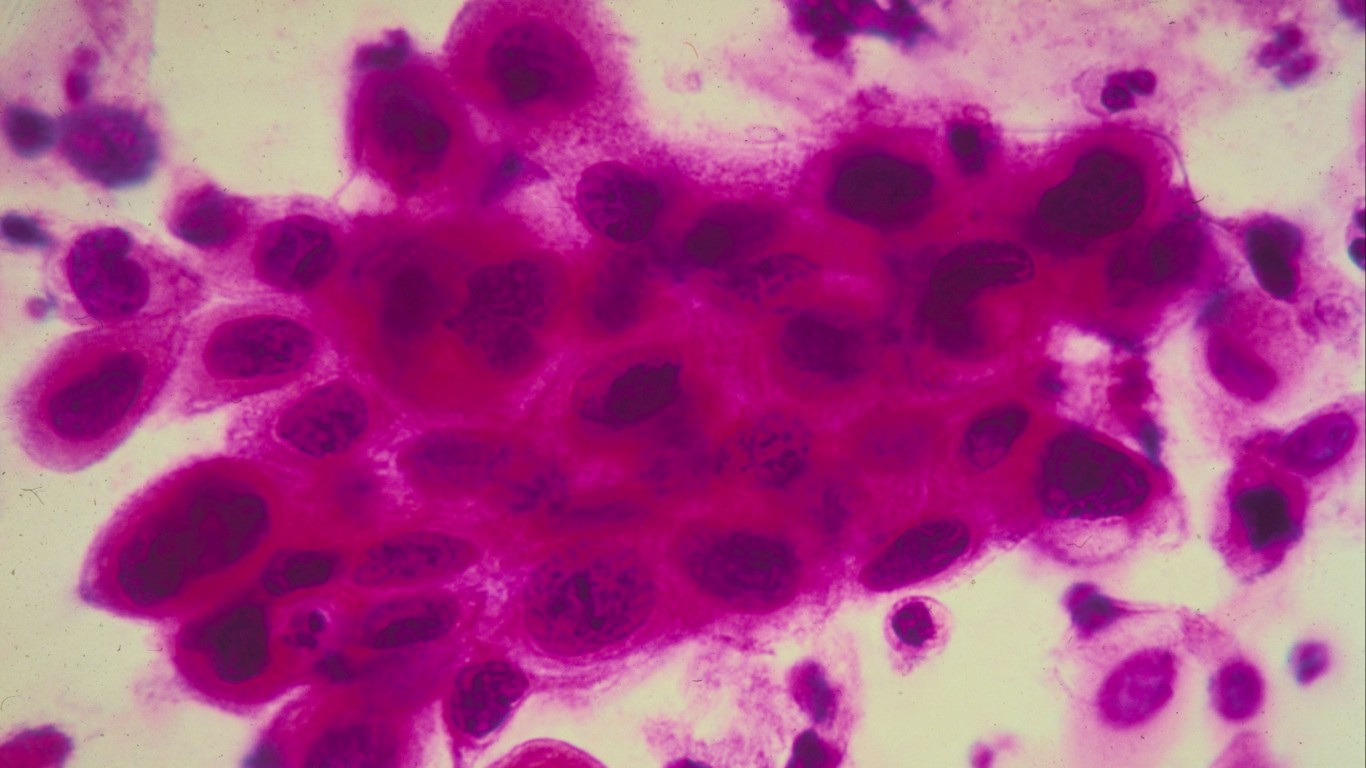

Its name, 2seventy bio, reflects why 2seventy bio does what 2seventy bio does – TIME. Cancer rips time away and its goal is to work at the maximum speed of translating human thought into action – 270 miles per hour — to give the people 2seventy bio serve more time. 2seventy bio is building the leading immuno-oncology cell therapy company, focused on discovering and developing new therapies that truly disrupt the cancer treatment landscape. With a deep understanding of the human body’s immune response to tumor cells and how to translate cell therapies into practice, 2seventy bio’s applying this knowledge to deliver next generation cellular therapies that focus on a broad range of hematologic malignancies, including the first FDA-approved CAR T cell therapy for multiple myeloma, as well as solid tumors. Its research and development is focused on delivering therapies that are designed with the goal to “think” smarter and faster than the disease. Importantly, 2seventy bio remains focused on accomplishing these goals by staying genuine and authentic to its “why” and keeping its people and culture top of mind every day.

This article originally appeared on Fintel

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.