After U.S. markets closed on Tuesday, Nu Holdings beat revenue and profit estimates but did not report earnings per share (EPS). Revenue for the quarter rose by 60% year over year, and net profit rose by 58.6%. Shares traded up about 1% shortly after Wednesday’s opening bell.

Zim Integrated Shipping reported a net loss per share of $1.79, nearly double its expected loss, and revenue of $1.31 billion, also a miss. Zim also said it expects a fiscal year net loss of $100 million to $500 million. Because the dividend is paid as a percentage of profits, shareholders can expect no dividend payment for 2023. Shares traded down 9.4%.

Before markets opened on Wednesday, JD.com beat estimates on both the top and bottom lines. Fiscal second-quarter revenue rose 7.6% year over year, and EPS rose by nearly 33%. Doom and gloom over the Chinese economy are too much to overcome, however. Shares traded down 4.5% early Wednesday.

Target reported better than expected EPS but missed the revenue estimate. Sales fell by 4.9% year over year. Then came the really bad news. Target issued downside guidance for third-quarter EPS and a same-store sales drop in the mid-single digits. Investors do not seem to mind. The stock traded up 5.5% Wednesday morning.

TJX Companies beat estimates on both the top and bottom lines. Shares traded up 3.2%.

Cisco Systems, SQM and StoneCo are expected to report results after markets close on Wednesday. The following morning, look for Tapestry and Walmart to share their quarterly results.

Here is a look at what to expect when the following two firms report earnings after U.S. markets close on Thursday.

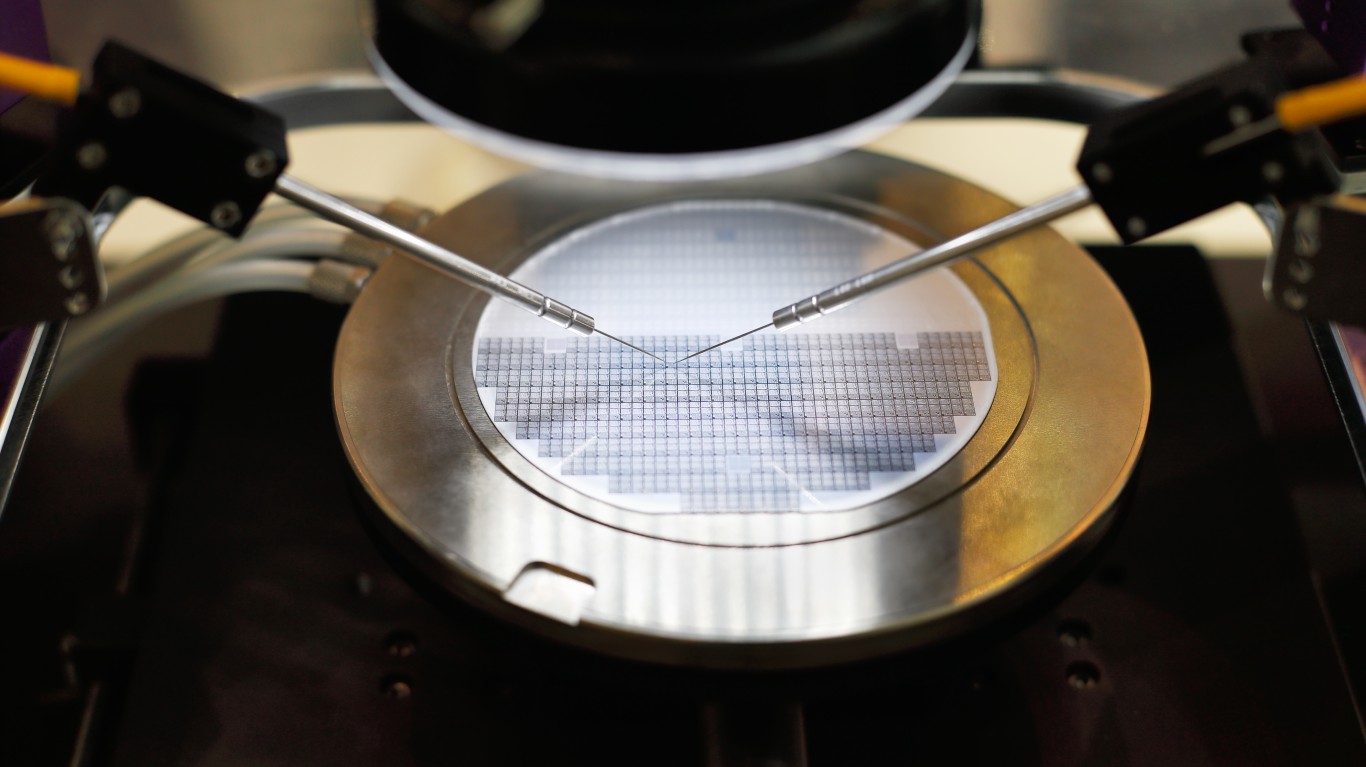

Applied Materials

Shares of semiconductor equipment maker Applied Materials Inc. (NASDAQ: AMAT) have added more than 27% over the past 12 months. So far in 2023, the stock is up nearly 44%. When the company reported fiscal second-quarter results in May and warned that sales into the consumer electronics market were weak and could continue that way, the stock price dipped 2.3% but recovered in less than a week.

Since then, the stock is up more than 10%, although it is down about 8.5% from its 52-week high set in late July. Applied’s outlook for the rest of the year may be more important to investors than third-quarter results.

Of 32 analysts covering the stock, 19 have Buy or Strong Buy ratings and 11 more have Hold ratings. At a recent price of around $140.00 a share, the implied upside based on a median price target of $145.00 is about 3.6%. At the high target of $175.00, the upside potential is 25%.

For the company’s third quarter of fiscal 2023, analysts anticipate revenue of $6.18 billion, which would be down 6.8% sequentially and by 5.2% year over year. Adjusted EPS are forecast at $1.75, down 12.4% sequentially and 9.8% lower year over year. For the full fiscal year ending in October, analysts project EPS of $7.42, down 3.7%, on sales of $25.37 billion, down 1.6%.

The stock trades at 18.9 times expected 2023 EPS, 19.7 times estimated 2024 earnings of $7.11 and 16.4 times estimated 2025 earnings of $8.54 per share. Its 52-week trading range is $71.12 to $153.28. Applied Materials pays an annual dividend of $1.28 (yield of 0.89%). Total shareholder return over the past year was 28.87%.

Farfetch

London-based Farfetch Ltd. (NYSE: FTCH) operates an e-commerce marketplace for luxury fashion goods in the United States, the United Kingdom and elsewhere. The stock price has plunged more than 50% over the past 12 months, including a boost of nearly 20% in the past three months. The stock’s 52-week high will be a year old later this month, a good thing for Farfetch since shares are trading down some 62% since that high was posted. Since a recent high on July 13, the stock is down by about 27%.

Farfetch acquired a 47.5% stake in another online luxury retailer, Yoox, in May. That acquisition will likely charge up its revenue. But will it help stem losses, or just hide them?

Despite its disappointing valuation, analysts remain somewhat bullish on Farfetch, with 11 of 22 having a Buy or Strong Buy rating. Another nine rate the stock at Hold. At a share price of around $4.90, the upside based on a median price target of $7.00 is about 42.9%. At the high price target of $20.00, the upside potential is 308.2%.

Revenue for the second quarter of fiscal 2023 is forecast at $650.71 million, up 17.0% sequentially and 12.3% higher year over year. Analysts are expecting an adjusted loss per share of $0.23, compared to the prior quarter’s loss of $0.16, and worse than the loss in the year-ago quarter of $0.21 per share. For the full fiscal year, current estimates call for an adjusted loss per share of $0.84, compared to last year’s loss of $0.92 per share, on sales of $2.82 billion, up 21.8%.

Farfetch is not expected to post a profit in 2023, 2024 or 2025. The company does not pay a dividend, and the total shareholder return for the past year was negative 50.96%.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.