Fintel reports that on August 21, 2023, Stephens & Co. upgraded their outlook for Neogenomics (NASDAQ:NEO) from Equal-Weight to Overweight.

Analyst Price Forecast Suggests 56.52% Upside

As of August 2, 2023, the average one-year price target for Neogenomics is 22.07. The forecasts range from a low of 17.17 to a high of $27.30. The average price target represents an increase of 56.52% from its latest reported closing price of 14.10.

See our leaderboard of companies with the largest price target upside.

The projected annual revenue for Neogenomics is 540MM, a decrease of 2.02%. The projected annual non-GAAP EPS is -0.53.

What is the Fund Sentiment?

There are 561 funds or institutions reporting positions in Neogenomics. This is an increase of 16 owner(s) or 2.94% in the last quarter. Average portfolio weight of all funds dedicated to NEO is 0.18%, an increase of 5.14%. Total shares owned by institutions increased in the last three months by 2.23% to 140,604K shares. The put/call ratio of NEO is 0.40, indicating a bullish outlook.

What are Other Shareholders Doing?

IJR – iShares Core S&P Small-Cap ETF holds 9,213K shares representing 7.22% ownership of the company. In it’s prior filing, the firm reported owning 9,414K shares, representing a decrease of 2.18%. The firm increased its portfolio allocation in NEO by 79.17% over the last quarter.

Janus Henderson Group holds 7,589K shares representing 5.95% ownership of the company. In it’s prior filing, the firm reported owning 7,424K shares, representing an increase of 2.18%. The firm decreased its portfolio allocation in NEO by 70.90% over the last quarter.

Brown Advisory holds 6,594K shares representing 5.17% ownership of the company. In it’s prior filing, the firm reported owning 6,591K shares, representing an increase of 0.05%. The firm decreased its portfolio allocation in NEO by 54.60% over the last quarter.

T. Rowe Price Investment Management holds 5,060K shares representing 3.97% ownership of the company. In it’s prior filing, the firm reported owning 4,901K shares, representing an increase of 3.13%. The firm decreased its portfolio allocation in NEO by 9.47% over the last quarter.

VTSMX – Vanguard Total Stock Market Index Fund Investor Shares holds 3,692K shares representing 2.89% ownership of the company. In it’s prior filing, the firm reported owning 3,640K shares, representing an increase of 1.38%. The firm increased its portfolio allocation in NEO by 76.42% over the last quarter.

Neogenomics Background Information

(This description is provided by the company.)

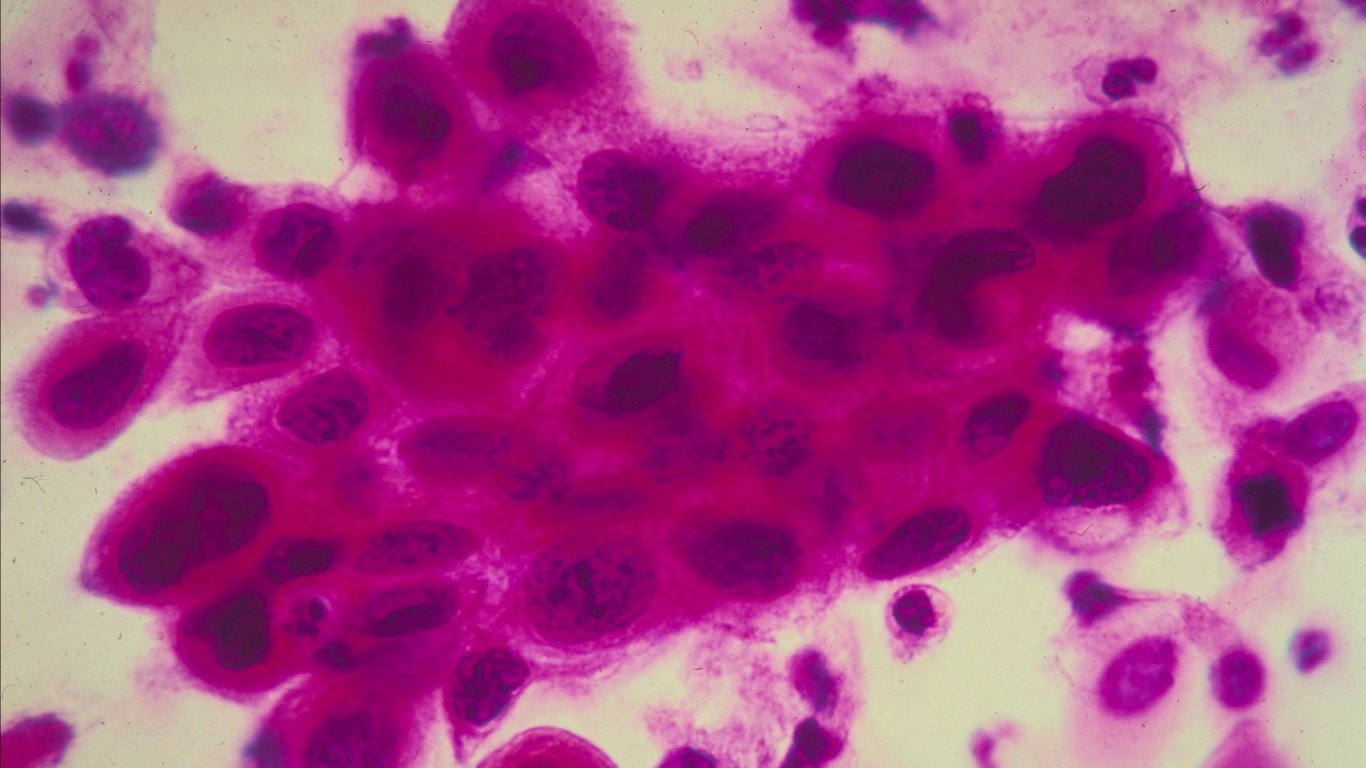

NeoGenomics, Inc. specializes in cancer genetics testing and information services. The Company provides one of the most comprehensive oncology-focused testing menus in the world for physicians to help them diagnose and treat cancer. The Company’s Pharma Services division serves pharmaceutical clients in clinical trials and drug development. Headquartered in Fort Myers, FL, NeoGenomics operates CAP accredited and CLIA certified laboratories in Ft. Myers and Tampa, Florida; Aliso Viejo, Carlsbad and Fresno California; Houston, Texas; Atlanta, Georgia; Nashville, Tennessee; Rolle, Switzerland, and Singapore. NeoGenomics serves the needs of pathologists, oncologists, academic centers, hospital systems, pharmaceutical firms, integrated service delivery networks, and managed care organizations throughout the United States, and pharmaceutical firms in Europe and Asia.

This article originally appeared on Fintel

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.