Investing

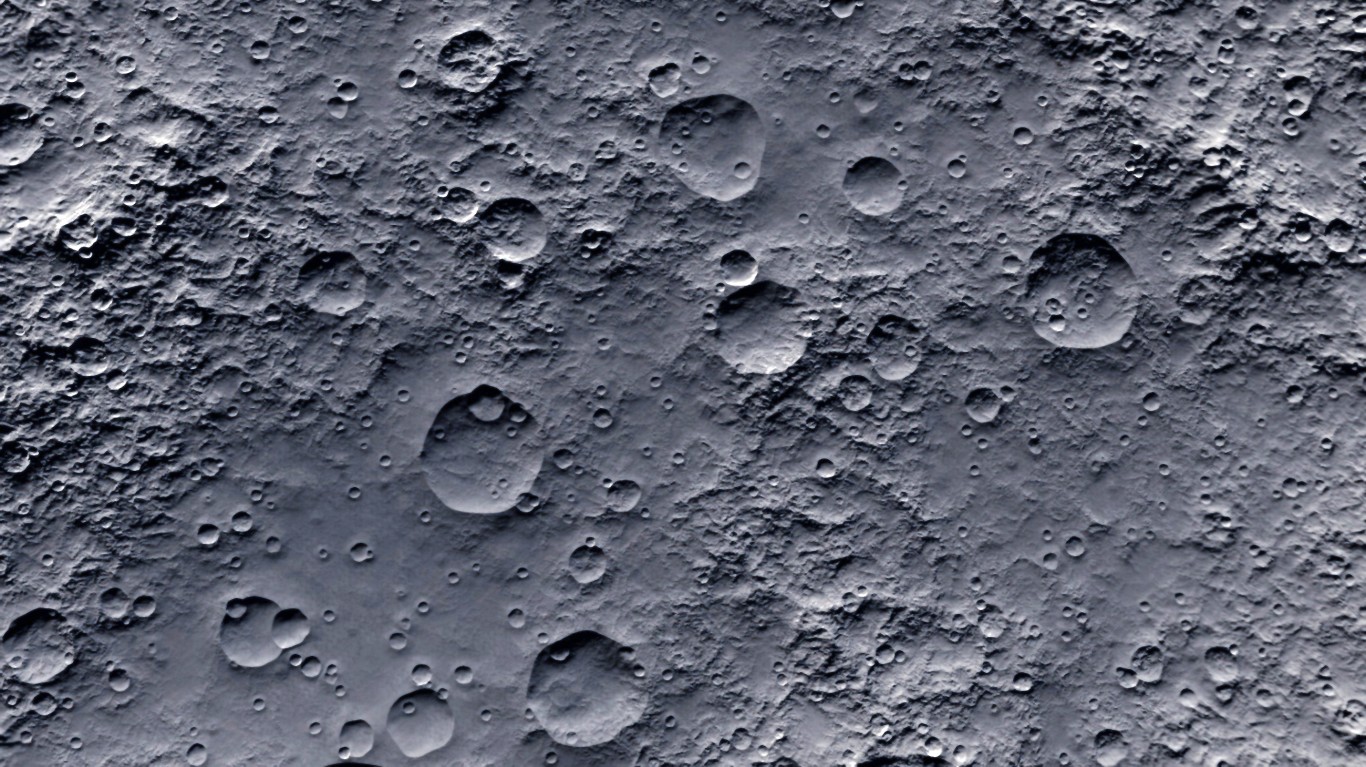

Space ETFs & Stocks in Focus on India's Historic Budget Lunar Landing

Published:

The global space community is thrilled as India’s Chandrayaan-3 has just achieved its groundbreaking lunar landing. India became the first country to land on the moon’s south pole on Wednesday. This fervor has spilled over into the financial arena, with Indian space-related stocks witnessing a considerable uptick.

Maybe the most noteworthy element of India’s lunar landing is the modest budget — considering government norms — that the country utilized to accomplish the mission. In 2020, the Indian Space Research Organization (ISRO) estimated the Chandrayaan-3 mission would cost about $75 million.

The launch was delayed two years, which likely increased the overall mission’s cost. Still, India’s space budget is much lesser than NASA. In 2023, the U.S. agency received $25.4 billion in funding, compared to the ISRO’s budget of about $1.6 billion.

Per IMF World Economic Outlook, United States allocates 0.28% of GDP toward space initiatives, followed by Russia (0.15%), France (0.12%), Japan (0.1%), Italy (0.07%), Germany (0.06%), India (0.04%), South Korea (0.03%), U.K. (0.03%) and Canada (0.01%), as quoted on CNBC.

Budget pressure amid global growth slowdown is more-or-less common to all economies. Hence, the success of the low-cost mission of Chandrayaan-3 will likely trigger a race toward low-cost space mission among global economies. Collaborations between global companies are also expected for continuous space research on budget.

“Costs are going to continue to go down, which is a very positive development for everybody who’s interested in space exploration,” Jim Bridenstine, who led NASA as administrator from 2018 to 2021, told CNBC. “And costs to get to the moon are going to go down, especially as we have more and more companies doing more and more missions,” he continued.

It means that the space research related companies will get a chance to soar with such missions. In just one week, the market capitalization of thirteen pivotal space companies of India has jumped by over $2.5 billion, highlighting the profound influence of Chandrayaan-3 on both technological and economic fronts.

With the help international investments, India looks to increase its share of the global launch market by five times in the upcoming decade. This goal will be facilitated by India’s reputation as a cost-effective provider of space launch services, per Guardian.

The global space launch market is expected to grow from $9bn (£7bn) this year to more than $20bn in 2030, per Guardian. Beyond satellite launches, major space agencies such as NASA, the European Space Agency, Russia, and China are preparing for constructing a space station in lunar orbit and developing habitats on the moon for astronauts to reside in.

Below we highlight a few ETFs and stocks that could benefit ahead thanks to continuous cost-effective space efforts.

Inside Stocks

Rocket Lab USA (RKLB)

The Zacks Rank #3 (Hold) company offers end-to-end mission services which provide access to space for civil, defense and commercial markets. It designs and manufactures the Electron launch vehicles and Photon satellite platform and is developing the Neutron launch vehicle. The stock was up 1.7% on Aug 23 and it also added 3.7% in the pre-market session on Aug 24.

Virgin Galactic (SPCE)

It is a vertically-integrated aerospace company pioneering human spaceflight for private individuals and researchers. The stock has the Zacks Rank #2 (Buy). The stock was up 0.4% on Aug 23 and it gained about 1.5% before market on Aug 24.

Inside ETFs

ARK Space Exploration & Innovation ETF (ARKX)

ARKX is an actively managed Exchange Traded Fund that seeks long-term growth of capital by investing under normal circumstances primarily (at least 80% of its assets) in domestic and foreign equity securities of companies that are engaged in the Fund’s investment theme of Space Exploration and innovation. The fund charges 75 bps in fees. The fund added 1.8% on Aug 23 and 0.1% pre market on Aug 25.

Procure Space ETF (UFO)

The Procure Space ETF seeks investment results that correspond generally to the performance, before the fees and expenses, of the S-Network Space Index. The fund charges 75 bps in fees. The fund added 0.3% on Aug 23.

Procure Space ETF (UFO): ETF Research Reports

Virgin Galactic Holdings, Inc. (SPCE): Free Stock Analysis Report

ARK Space Exploration & Innovation ETF (ARKX): ETF Research Reports

Rocket Lab USA, Inc. (RKLB): Free Stock Analysis Report

To read this article on Zacks.com click here.

This article originally appeared on Zacks

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.