Investing

Disney Is or Is Not Selling ABC, Arm IPO Left $1 Billion on the Table, UAW Walks the Talk

Published:

On Monday, the Walt Disney Co. (NYSE: DIS) settled its dispute with Charter Communications Inc. (NASDAQ: CHTR) just hours before Disney’s ESPN broadcast of the new NFL season’s first Monday Night Football game. Disney basically sold Charter the right and the means to jump into the non-linear broadband world for a paltry $2.2 billion.

The deal opens the door for similar agreements between other cable TV operators and streaming-only services like Disney+. Cable viewership has been declining for years, and operators like Charter are turning to broadband/streaming as a way to survive.

Charter’s Spectrum Select customers will have access to the basic Disney+ subscription for about half the retail rate, and Spectrum Select Plus customers will receive ESPN+ at no cost to Spectrum. Charter does not have to toss any of its loser linear programming, and it does not have to pay Disney anything other than the $2.2 billion and a wholesale price for each subscription to Disney+. That is a good deal for Charter.

For its part, Disney gets to put its ad-supported Disney+ offering in front of 14 million Charter customers with the hope that they will subscribe, earning Disney the fee plus 100% of ad revenues. For the ESPN+ part of the deal, Disney gets essentially nothing but more eyeballs. That may pay off when ESPN launches its streaming service in — wait for it — 2025.

Oh, and Charter will also dump eight Disney networks right now: Freeform, Disney Junior, Disney XD. Nat Geo Mundo, Nat Geo Wild, FXM, FXX and Baby TV.

Following Thursday night reports that Allen Media has offered to buy Disney’s ABC network for something in the neighborhood of $10 billion, Disney on Friday morning issued this statement:

While we are open to considering a variety of strategic options for our linear businesses, at this time The Walt Disney Company has made no decision with respect to the divestiture of ABC or any other property and any report to that effect is unfounded.

Right.

Arm Holdings PLC (NASDAQ: ARM) reaped $4.87 billion from its Thursday initial public offering but left more than $1 billion behind. The stock closed more than $12 a share above the IPO price of $51 on nearly 100 million shares. For every dollar above the IPO price, Softbank donates $100 million to its stable of handpicked (by the underwriters) initial investors.

Softbank Group boss Masayoshi Son preferred to take no risk that initial buyers would pull out of the deal and start an exodus that would have lowered Arm’s valuation further from Son’s original IPO hopes for a valuation of between $60 billion and $70 billion. At Thursday’s closing price, Arm is valued at $65.25 billion. Arm shares were trading at around $68 in Friday’s premarket. That is another $300 million that fell through a hole in Softbank’s pocket.

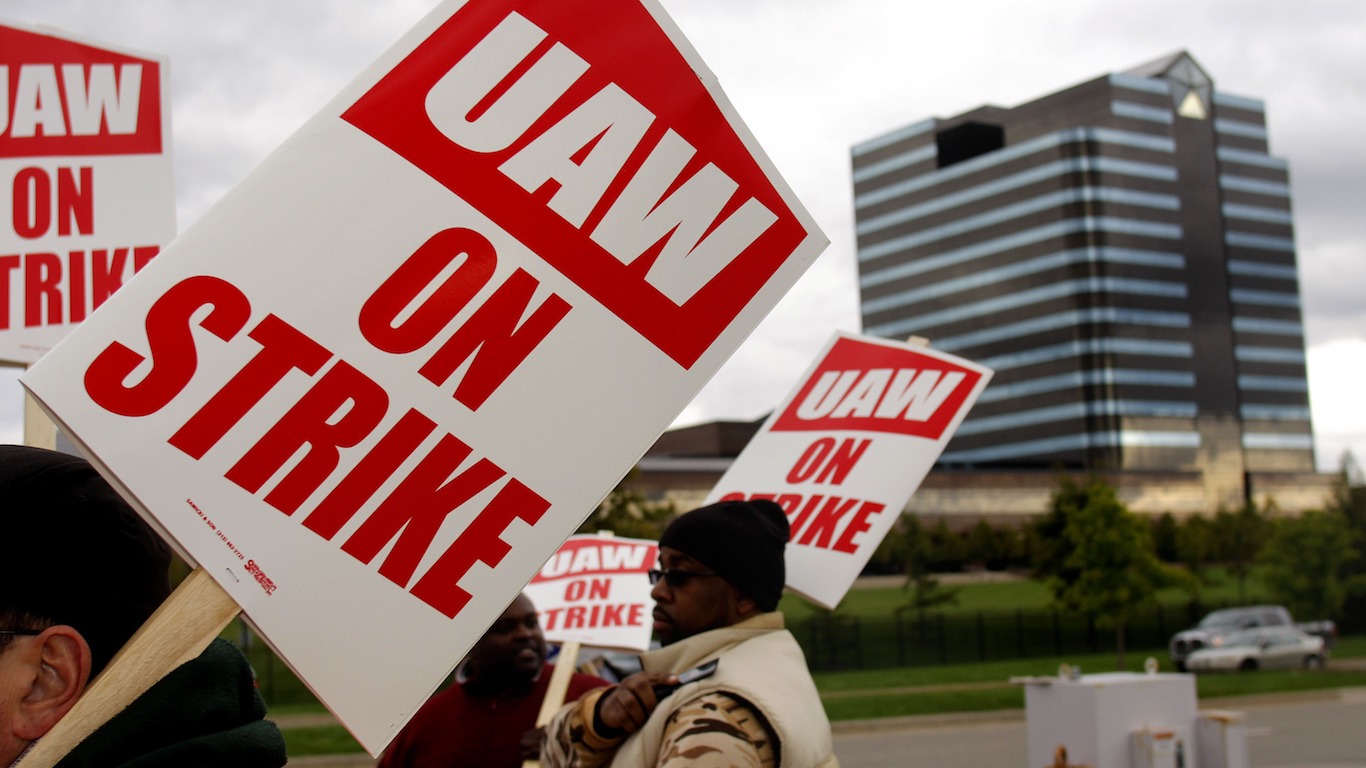

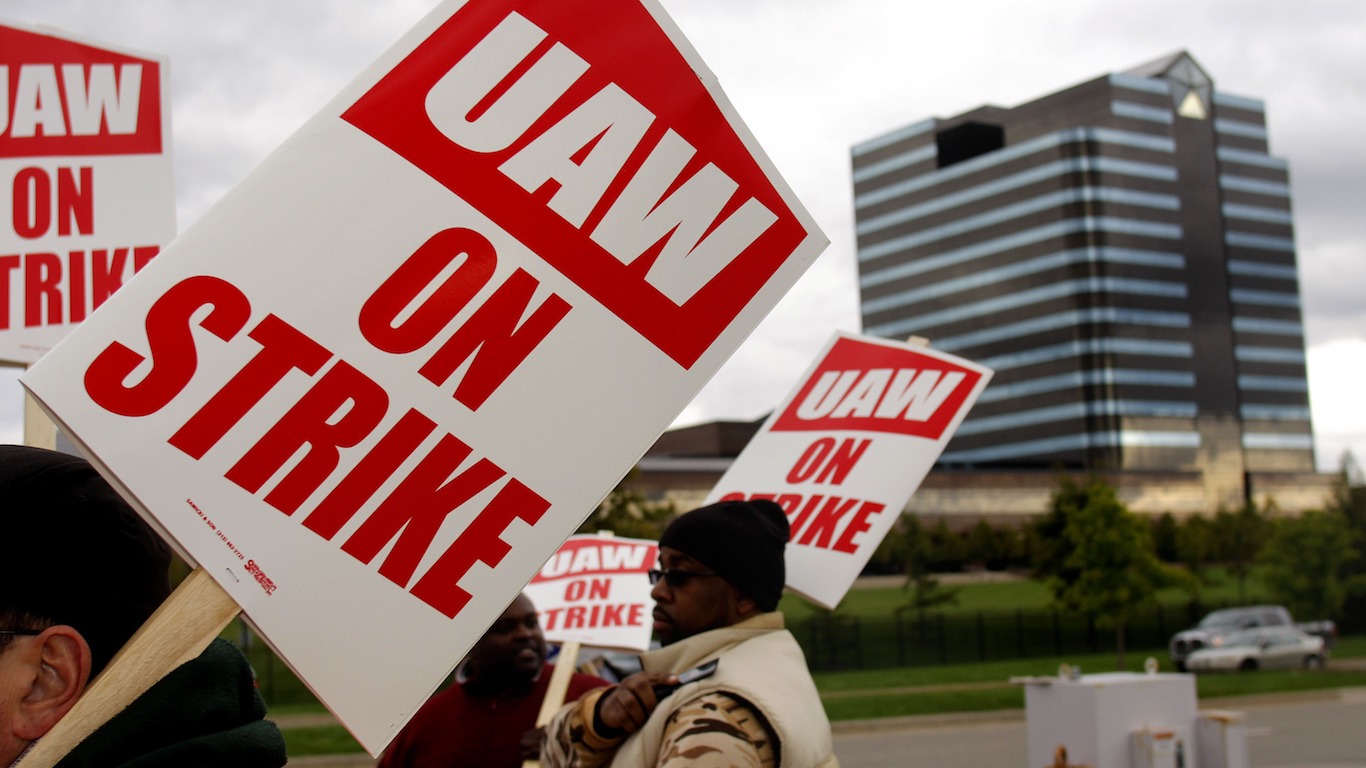

The United Auto Workers union went out on strike at 11:59 pm Thursday night, closing one plant from each of Ford Motor Co. (NYSE: F), General Motors Co. (NYSE: GM), and Stellantis NV (NYSE: STLA). This is the first time the union has ever taken a strike action against all of Detroit’s Big Three automakers.

About 12,700 workers out of 150,000 union members will be affected by what union president Shawn Fain is calling a stand-up strike. The strike could affect more plants if negotiations between the union and the automakers if a new four-year contract is not concluded.

Union members have walked out at a Wayne, Michigan, Ford plant that makes the company’s popular Bronco SUV and Ranger pickup trucks; the Wentzville, Missouri, GM plant that makes the GMC Canyon and Chevy Colorado pickups; and the Toledo, Ohio, Stellantis plant the makes the Jeep Gladiator and Wrangler.

A settlement does not appear to be close. The union is seeking a 40% wage increase over the four-year term of the contract, along with changes to wage tiers, cost-of-living adjustments and pensions. The automakers have offered wage increases of around 20%, but have balked at the union’s other demands.

Are you ahead, or behind on retirement? For families with more than $500,000 saved for retirement, finding a financial advisor who puts your interest first can be the difference, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors who serve your area in minutes. Each advisor has been carefully vetted and must act in your best interests. Start your search now.

If you’ve saved and built a substantial nest egg for you and your family, don’t delay; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.