Valkyrie Bitcoin Miners ETF WGMI, which provides exposure to the bitcoin mining industry, has gained about 117% so far this year, becoming the top-performing ETF of the first nine months of 2023.

Although most of the stocks in WGMI’s portfolio delivered strong returns in the first nine months, a few have more than doubled. These include Cipher Mining Technologies Inc. CIFR, Bit Digital BTBT, Iris Energy IREN, Applied Digital Corporation APLD and Nvidia NVDA.

Bitcoin, the world’s largest cryptocurrency, had a strong start to 2023, surging 83% to a peak of $31,035 and shrugging off the economic uncertainty and regulatory crackdown woes on some crypto exchanges. However, a significant drop of 7.2% was observed in mid-August, with its value declining from $29,000 to $26,000 within a single day. Bitcoin dipped again in September, reaching as low as $25,000, but it didn’t breach its resistance level.

A wave of optimism from institutional investors has led to the surge in cryptocurrency. This optimism was sparked by a few key factors:

High Profile ETF Application: BlackRock, the world’s largest asset manager, recently applied to the U.S. Securities and Exchange Commission for a Bitcoin ETF, although this application awaits approval. This move likely signaled that large institutional players were showing an increased interest in Bitcoin.

Grayscale Wins Suit Over ETF Application: A court ruled that the Securities and Exchange Commission must reconsider asset manager Grayscale’s application to launch the first bitcoin ETF. The ruling could help clear the path for the first ETF offering direct exposure to bitcoin, which would allow anyone with a brokerage account to invest in the cryptocurrency.

Launch of a New Crypto Exchange: The launch of EDX Markets, a new digital asset exchange backed by major Wall Street players such as Fidelity, Charles Schwab and Citadel Securities, probably contributed to the sentiment that the infrastructure and acceptance of digital assets were improving, thus sparking more interest in Bitcoin.

Changing Sentiment Among Institutional Investors: Previously, institutional investors were quickly pulling cash out of products due to regulatory concerns. However, the sentiment appears to be shifting, which may have led to increased interest and investment in Bitcoin. As such, institutions such as JPMorgan and Goldman Sachs, which were against virtual currencies before, have now started implementing them into their systems. This is a sign of growing acceptance among institutional investors.

Let’s take a closer look at the fundamentals of WGMI.

WGMI in Focus

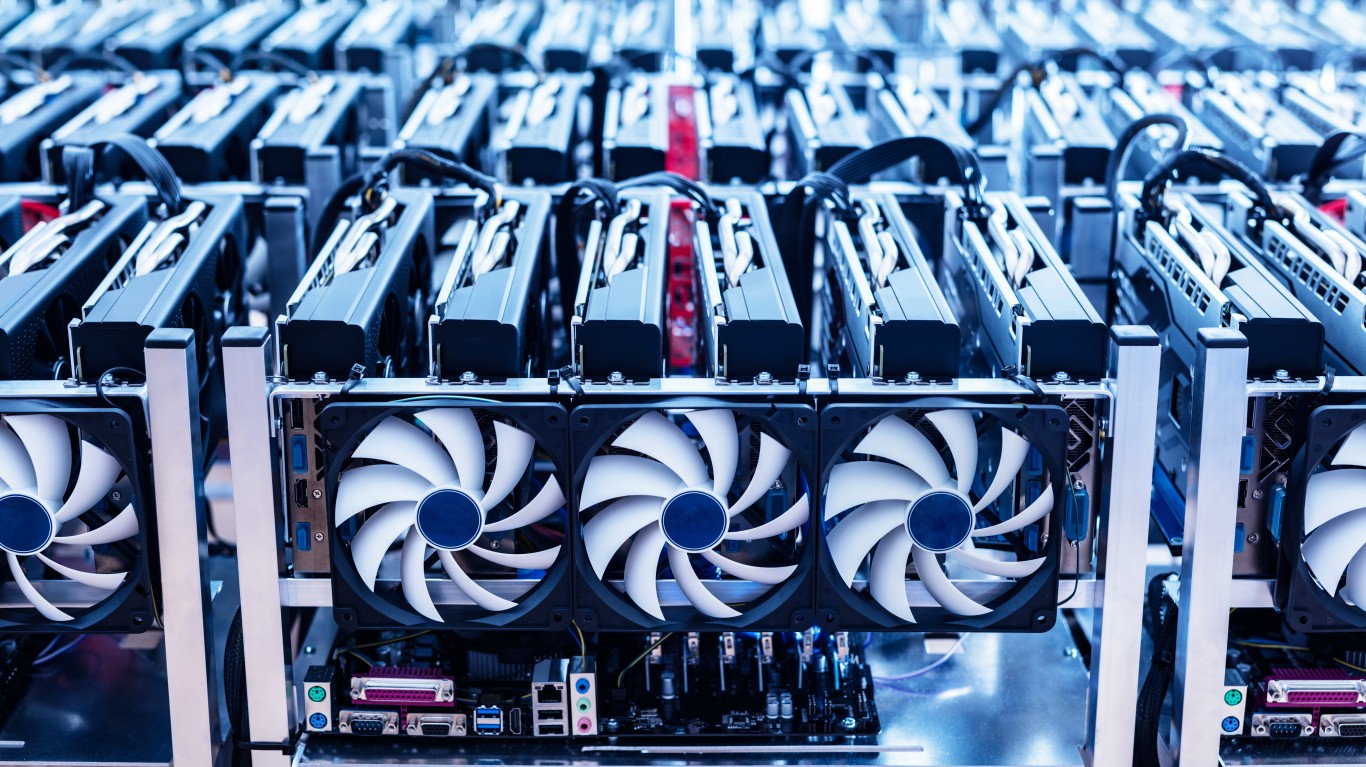

Valkyrie Bitcoin Miners ETF is an actively managed ETF that invests at least 80% of its net assets (plus borrowings for investment purposes) in securities of companies that derive at least 50% of their revenues or profits from bitcoin mining operations and/or from providing specialized chips, hardware and software or other services to companies engaged in bitcoin mining. Valkyrie Bitcoin Miners ETF holds 22 stocks in its basket with a double-digit concentration on the top five firms.

Valkyrie Bitcoin Miners ETF has amassed $15.3 million in its asset base while trading in an average daily volume of 119,000 shares. It charges 75 bps in annual fees.

Best-Performing Stocks of WGMI

Cipher Mining is an industrial-scale bitcoin mining company. The stock has soared 375% so far this year and accounts for a 9.9% share in the ETF.

Cipher Mining earnings are expected to decline 12.5% this year. It has a Zacks Rank #3 (Hold).

Bit Digital is an emerging bitcoin mining company. It has an estimated earnings growth rate of 85.1% for this year.

Bit Digital skyrocketed 244.2% this year and makes up for a 4.5% share in the WGMI basket. The stock has a Zacks Rank #3.

Iris Energy is a Bitcoin mining company that builds, owns and operates data center infrastructure with a focus on entry into regions where it can access abundant and/or under-utilized renewable energy to power its operations. The stock has surged 209% so far this year and accounts for a 10.3% share in the ETF.

Iris Energy has an estimated earnings growth rate of 100.6% for the fiscal year ending June 2024 and a Zacks Rank #2 (Buy).

Applied Digital is a designer, builder and operator of next-generation datacenters that provide power to blockchain infrastructure and support High-Performance Computing applications. It has rallied 183% so far this year and makes up for 4.7% of the WGMI portfolio.

Applied Digital has an estimated earnings growth rate of 155.1% for the fiscal year ending May 2024 and a Zacks Rank #3.

Nvidia is the worldwide leader in visual computing technologies and the inventor of graphic processing unit or GPU. The stock has jumped 181% so far this year. It has an estimated growth of 219.5% for the fiscal year ending January 2024.

Nvidia makes up for 4.6% of the assets in WGMI and has a Zacks Rank #1.

NVIDIA Corporation (NVDA): Free Stock Analysis Report

Applied Digital Corporation (APLD): Free Stock Analysis Report

Bit Digital, Inc. (BTBT): Free Stock Analysis Report

Cipher Mining Inc. (CIFR): Free Stock Analysis Report

Iris Energy Limited (IREN): Free Stock Analysis Report

Valkyrie Bitcoin Miners ETF (WGMI): ETF Research Reports

To read this article on Zacks.com click here.

This article originally appeared on Zacks

Is Your Money Earning the Best Possible Rate? (Sponsor)

Let’s face it: If your money is just sitting in a checking account, you’re losing value every single day. With most checking accounts offering little to no interest, the cash you worked so hard to save is gradually being eroded by inflation.

However, by moving that money into a high-yield savings account, you can put your cash to work, growing steadily with little to no effort on your part. In just a few clicks, you can set up a high-yield savings account and start earning interest immediately.

There are plenty of reputable banks and online platforms that offer competitive rates, and many of them come with zero fees and no minimum balance requirements. Click here to see if you’re earning the best possible rate on your money!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.