Investing

Time to Buy or Stay Clear of General Motors and Ford Stock as UAW Strike Continues?

Published:

Last Updated:

The United Auto Workers (UAW) strike could certainly affect General Motors GM and Ford F the longer it lasts but there appears to be much risk already priced into their stocks.

Furthermore, while General Motors stock is only down -1% for the year, Ford shares are still up +8%. This may have many investors wondering if they should still buy General Motors and Ford stock for longer-term opportunities or stay clear at the moment.

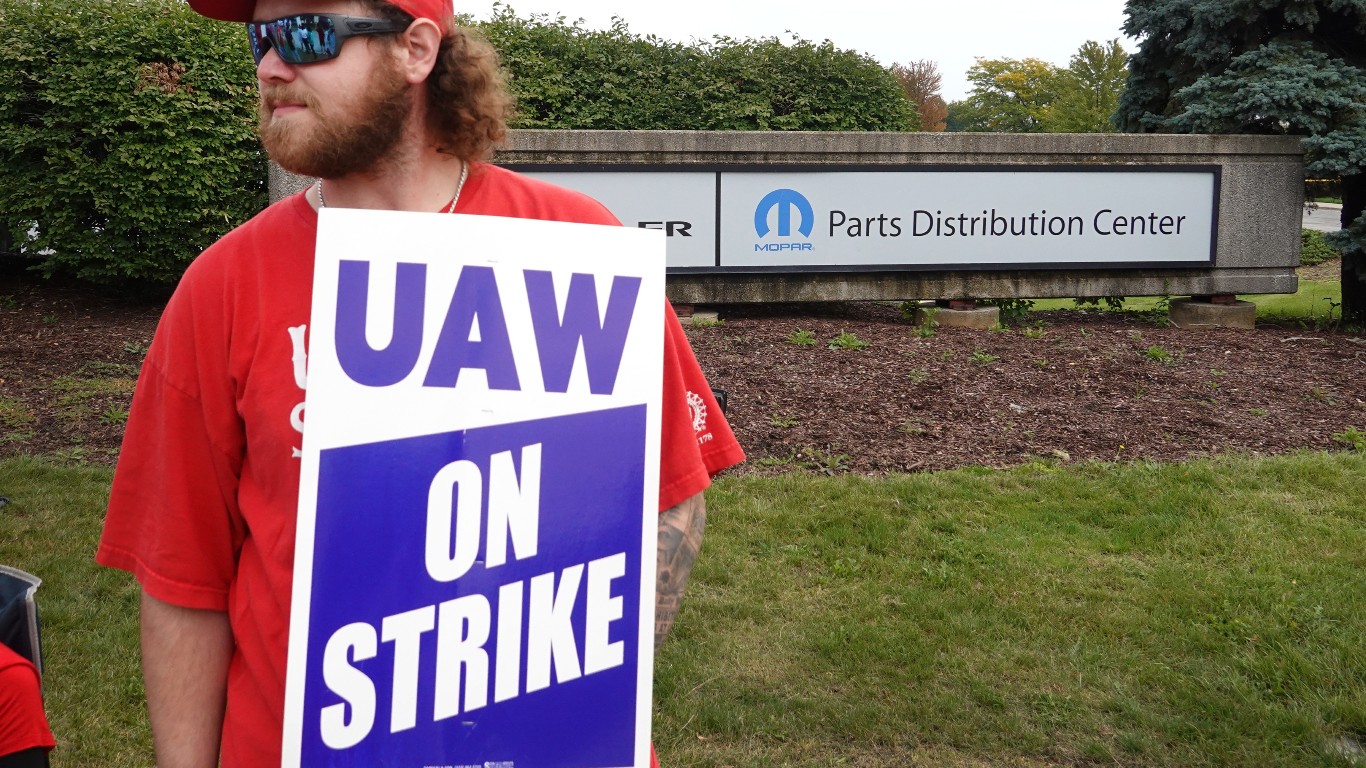

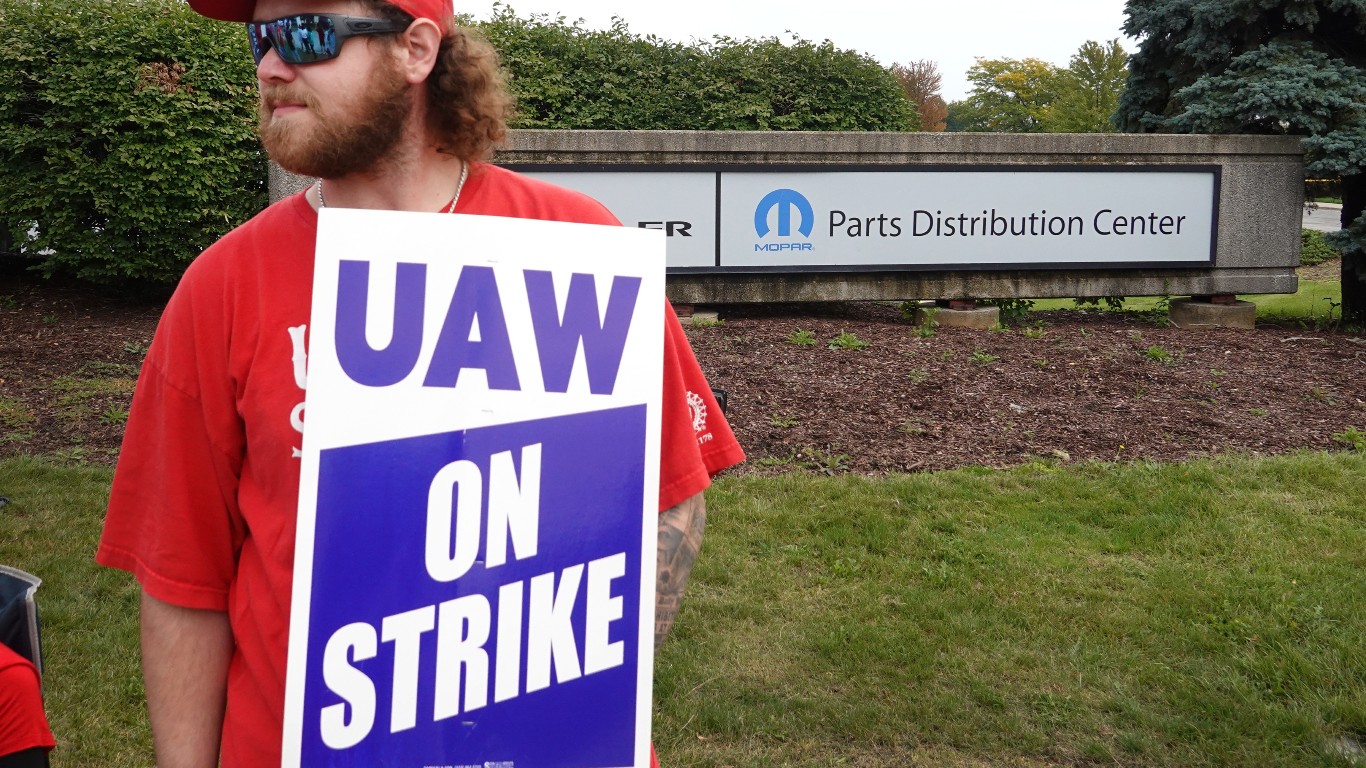

Starting on September 15, the UAW strike is aimed at General Motors, Ford, and Chrysler which is owned by Stellantis N.V. STLA. Targeting the big three Detroit automakers, the UAW strike is seeking to secure and increase wages and pensions. This is amid General Motors, Ford, and Chrysler expanding their electric vehicle production which will require fewer workers and varying skill sets causing concern.

One metric that analyzes the risk in a stock compared to the overall market is the beta. Historically, securities with betas below 1.0 have been less volatile than the market. At the moment, General Motors stock has a beta of 1.39 with Ford at 1.61 but this is actually below Tesla’s TSLA 2.09 with Stellantis at 1.61.

While this may be surprising with the ongoing UAW strike, an accurate assumption is that General Motors and Ford may continue to put pressure on Tesla in regard to the domestic EV market.

General Motors and Ford currently hold the second and third spots in the domestic EV market respectively. Still behind the market leader in Tesla, EV expansion should certainly preserve General Motors and Ford’s top and bottom lines in the future.

This year General Motors earnings are expected to be virtually flat but drop -5% in fiscal 2024 at $7.18 per share. However, FY24 EPS projections would still represent 46% growth over the last five years with 2020 earnings at $4.90 a share.

Plus, General Motors stock does make a strong case for being undervalued at just 4.2X forward earnings and sales are forecasted to rise 9% in FY23 and edge up another 2% in FY24 to $175.19 billion.

Pivoting to Ford, annual earnings are now projected to jump 12% in FY23 at $2.11 per share compared to EPS of $1.88 last year. Fiscal 2024 earnings are forecasted to dip -7% at $1.96 a share but would represent a very stellar 378% growth over the last five years with Ford’s earnings at $0.41 a share in 2020.

Furthermore, showcasing a sharp post-pandemic recovery, Ford shares also make the case for being undervalued at 5.9X forward earnings. On the top line, sales are anticipated to rise 7% this year to $160.21 billion but dip -1% in FY24.

It appears that we are not at a turning point that calls for staying clear of General Motors and Ford stock as the valuation of both auto giants is attractive. With that being said, there could be better buying opportunities ahead as the UAW strike continues. For now, General Motors and Ford stock both land a Zacks Rank #3 (Hold).

Ford Motor Company (F): Free Stock Analysis Report

General Motors Company (GM): Free Stock Analysis Report

Tesla, Inc. (TSLA): Free Stock Analysis Report

Stellantis N.V. (STLA): Free Stock Analysis Report

To read this article on Zacks.com click here.

This article originally appeared on Zacks

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.