Investing

After Exxon's Huge Pioneer Natural Resources Buy, Could These 5 'Strong Buy' Energy Stocks Be Next?

Published:

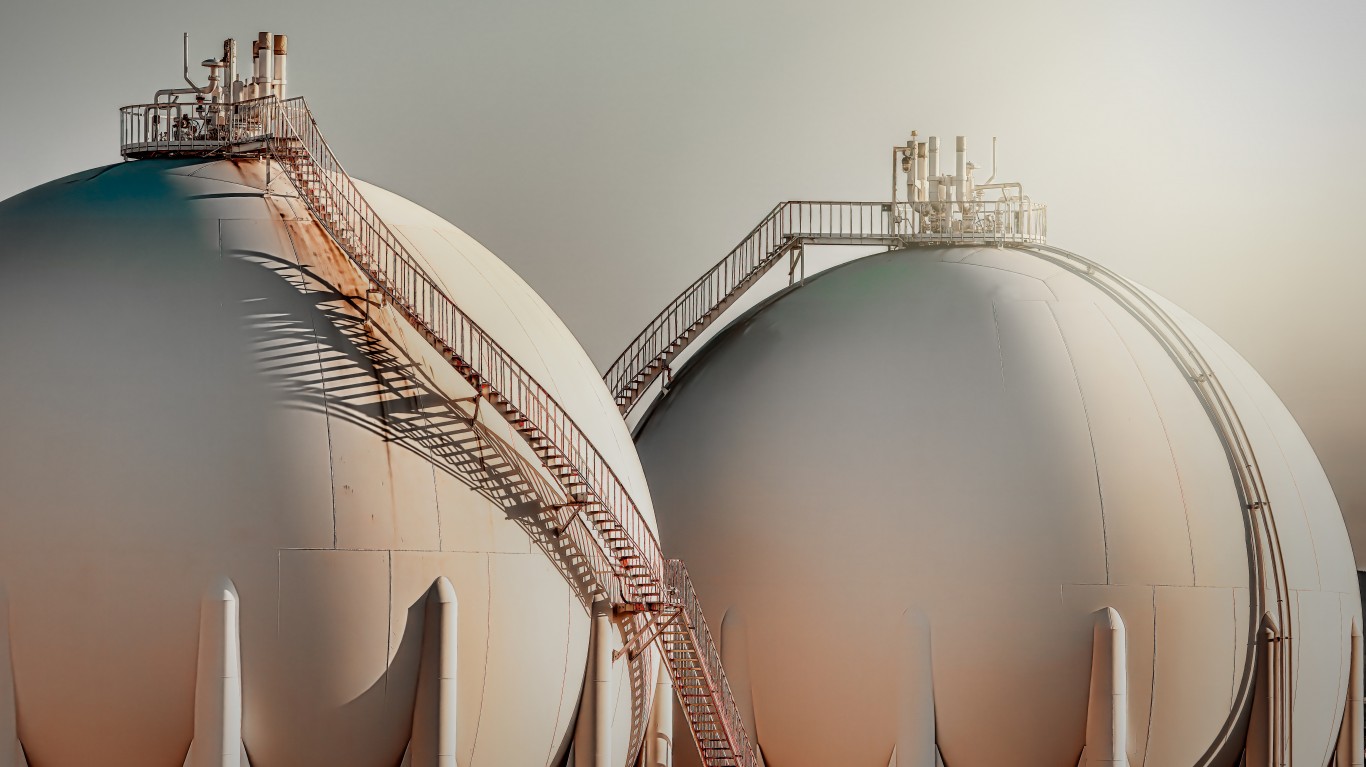

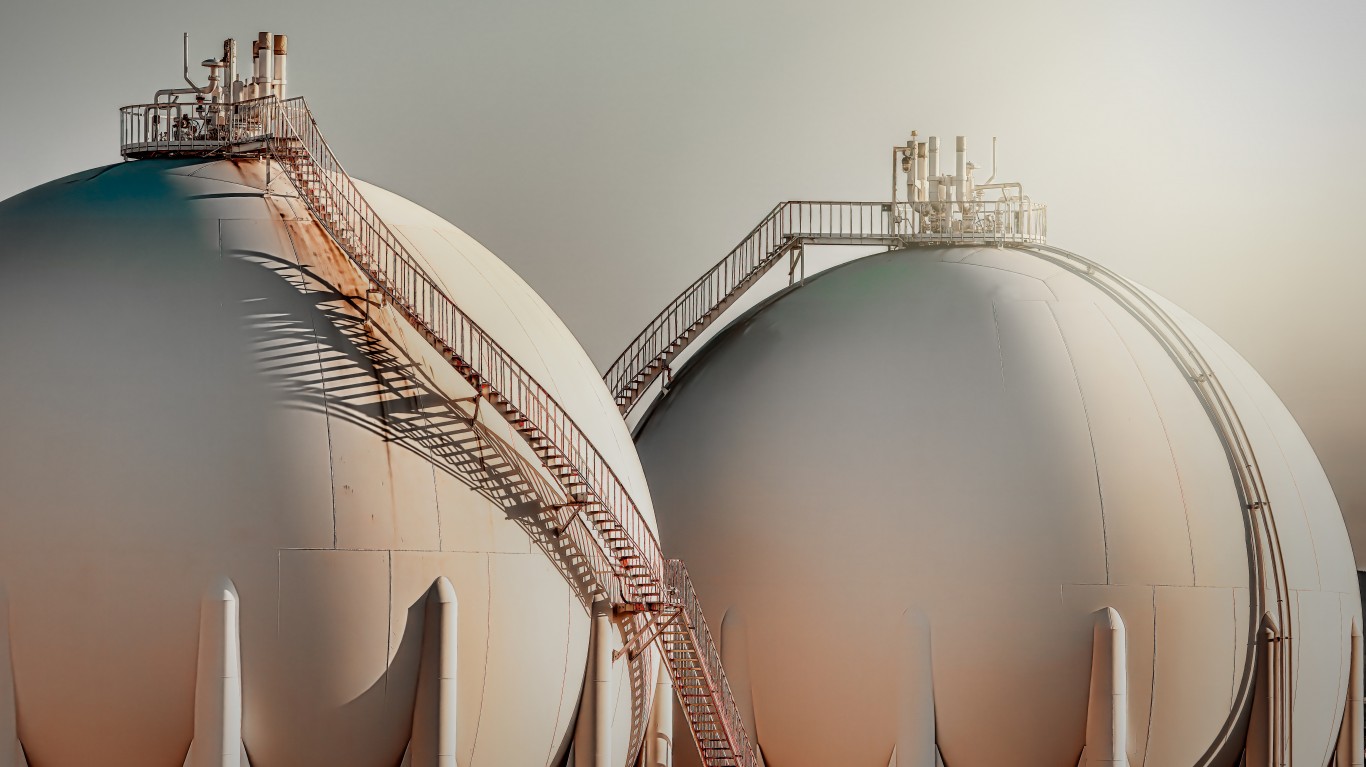

The staggering deal had been rumored since last spring. Exxon Mobil finally announced last week it would purchase oil shale giant Pioneer Natural Resources for $59.5 billion in an all-stock purchase. The deal will create the largest U.S. oilfield producer and will guarantee a decade of low-cost production.

For Exxon, the Pioneer purchase will be its largest acquisition since it purchased Mobil back in 1999 for $81 billion. The new deal will merge the largest and most powerful energy leader with one of the giants of the shale revolution. That put U.S. production back on the map over the past fifteen years.

Not only did the deal make the proverbial rich get richer. It greatly expanded the mega, integrated leader’s footprint in the Permian Basin, which has among the largest caches of resources in the world. In addition, it could possibly spark a wave of additional mergers and acquisitions as competitors try to keep up with Exxon. We screened our 24/7 Wall St. energy exploration and production universe, seeking additional companies that could be takeover targets of such Exxon competitors as Chevron and ConocoPhillips.

Five top companies hit our screens and they all pay big dividends like Pioneer does. These stocks are rated Buy, but it is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

This company was long considered an industry leader when it was known as Apache, and the stock is perhaps offering one of the best entry points in the sector. APA Corp. (NYSE: APA) explores for and produces oil and gas properties. It has operations in the United States, Egypt and the United Kingdom, as well as has exploration activities offshore Suriname. It also operates gathering, processing and transmission assets in West Texas, as well as holds ownership in four Permian-to-Gulf Coast pipelines.

APA is one of the largest U.S. exploration and production companies, with 2.3 billion barrels of oil equivalent of proven reserves (63% liquids). It is an explorer, acquirer and exploiter, and a fiscally conservative company that has grown its reserves and production consistently via acquisitions and organic projects.

The company also operates gathering, compression, processing and transmission assets in West Texas, as well as holds ownership in four Permian Basin long-haul pipelines.

Shareholders receive a 2.37% dividend. BofA Securities has a $57 price target for APA stock. The consensus target is lower at $50.44, and the closing share price on Tuesday was $42.43.

This company resulted from the $17 billion merger of Cabot Oil & Gas and Cimarex Energy in 2021. Coterra Energy Inc. (NASDAQ: CTRA) is an independent oil and gas company. It engages in the development, exploration and production of oil, natural gas and natural gas liquids (NGLs) in the United States. Its primary focus is on the Marcellus Shale. It has approximately 177,000 net acres in the dry gas window of the play located in Susquehanna County, Pennsylvania.

The company also holds Permian Basin properties with approximately 306,000 net acres. Its Anadarko Basin properties in Oklahoma include approximately 182,000 net acres. In addition, it operates natural gas and saltwater disposal gathering systems in Texas. The company sells its natural gas to industrial customers, local distribution companies, oil and gas marketers, major energy companies, pipeline companies and power-generation facilities.

Investors receive a 2.74% (but variable) dividend. Mizuho has set a $42 target price, and Coterra Energy stock has a consensus target of $31.91. Shares closed on Tuesday at $29.40.

This may be one of the best value propositions in the sector. Devon Energy Corp. (NYSE: DVN) was one of the first to utilize a variable dividend strategy. This independent energy company that primarily engages in the exploration, development and production of oil, natural gas and NGLs in the United States and Canada.

Devon Energy operates approximately 19,000 wells. It also offers midstream energy services, including gathering, transmission, processing, fractionation and marketing to producers of natural gas, NGLs, crude oil and condensate through its natural gas pipelines, plants and treatment facilities.

Production is weighted toward crude oil. Growth opportunities are liquids focused, anchored by the Delaware Basin, SCOOP/STACK, Eagle Ford Shale, Canadian Oil Sands, and the Barnett. Devon also owns equity in the publicly traded midstream MLP EnLink.

Devon Energy stock comes with a 6.98% dividend. The $65 Piper Sandler target price is higher than the consensus target of $57.36 and Tuesday’s close at $49.93.

This red-hot energy play looks poised to press higher again. Diamondback Energy Inc. (NASDAQ: FANG) is an independent oil and natural gas company. Its focus is on the acquisition, development, exploration and exploitation of unconventional and onshore oil and natural gas reserves in the Permian Basin in West Texas and New Mexico.

Diamondback Energy primarily focuses on the development of the Spraberry and Wolfcamp formations of the Midland basin, as well as the Wolfcamp and Bone Spring formations of the Delaware basin, which are part of the Permian Basin.

The company owns, operates, develops and acquires midstream infrastructure assets. These include 770 miles of crude oil gathering pipelines, natural gas gathering pipelines and an integrated water system in the Midland and Delaware Basins.

The dividend yield is 4.11% but is also of the variable variety. That means it could change depending on production and profits. Truist Financial’s $210 target price compares with a consensus target of $178.11. Diamondback stock closed at $168.47 on Tuesday.

This is a solid way for investors who are more conservative to play the energy sector. Marathon Oil Corp. (NYSE: MRO) operates as an independent exploration and production company in the United States and internationally.

The company engages in the exploration, production and marketing of crude oil and condensate, natural gas and NGLs. It is also involved in the production and marketing of products manufactured from natural gas, such as liquefied natural gas (LNG) and methanol. It also owns and operates 32 central gathering and treating facilities. And it owns the Sugarloaf gathering system, a 42-mile natural gas pipeline through Karnes and Atascosa Counties in Texas.

Shareholders receive a 1.41% dividend. Marathon Oil stock has a $45 target price at Raymond James. The $33.52 consensus target is closer to Tuesday’s closing print of $28.63.

Over the past 75 years, there have been numerous big oil deals. Prices are rising and demand from China, India and other emerging markets is expected to grow over the coming years. So, you can bet that more deals could be on tap in the energy world. These top companies could be ripe for the taking.

Choosing the right (or wrong) time to claim Social Security can dramatically change your retirement. So, before making one of the biggest decisions of your financial life, it’s a smart idea to get an extra set of eyes on your complete financial situation.

A financial advisor can help you decide the right Social Security option for you and your family. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you.

Click here to match with up to 3 financial pros who would be excited to help you optimize your Social Security outcomes.

Have questions about retirement or personal finance? Email us at [email protected]!

By emailing your questions to 24/7 Wall St., you agree to have them published anonymously on a673b.bigscoots-temp.com.

By submitting your story, you understand and agree that we may use your story, or versions of it, in all media and platforms, including via third parties.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.