Investing

How To Invest In The Las Vegas Sphere That's Blowing Everyone's Mind in 3 Steps

Published:

The Las Vegas Sphere is a completely audacious, expensive, and extremely fitting venue for a city known for spectacle. It has also, by all accounts, blown past expectations.

Entertainment Mogul James Dolan spearheaded the project. Dolan is no stranger to world class venues. He is CEO of the publicly traded Madison Square Garden Sports Corp (NYSE:MSGS) and Madison Square Garden Entertainment (NYSE:MSGE).

Dolan announced the project way back in 2018. It was originally a partnership between Madison Square Garden and Las Vegas Sands Corporation (NYSE:LVS). Fast forward a few years, some ownership shuffles, a spike in input costs, and a pandemic thrown in the mix and the Sphere has come in well over budget and timeline.

What was originally forecasted to cost $1.2 billion actually came in at $2.3 billion, and the target opening of 2021 was pushed back to April, 2023.

But the wait appears to be well worth it. Advertising on the exterior of The Sphere reportedly costs upwards of $450,000… per day. That’s before you consider revenue from the actual entertainment inside.

Investors are eager at the potential of the concept, and it seems inevitable that more spheres are opened globally. So, how do investors invest in The Sphere today? It’s easy.

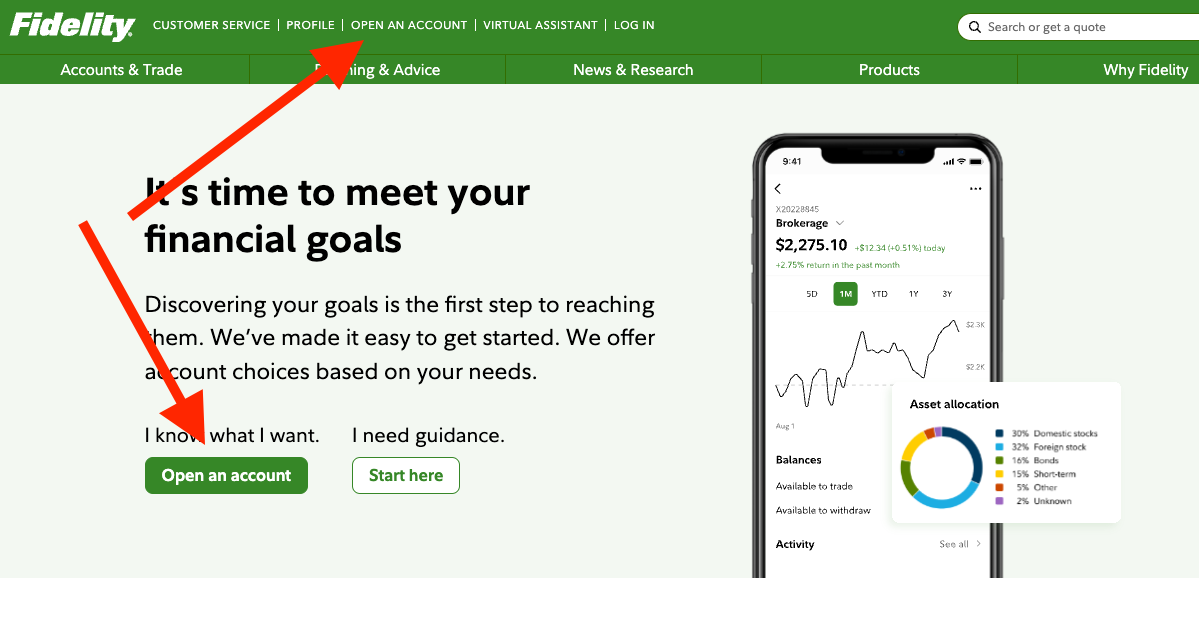

Since The Sphere is publicly traded, you can invest through a brokerage account that supports equities. I personally use Fidelity, but any standard broker will do. If you head to fidelity.com you’ll see multiple options to open an account directly from the home page. You can also do so in person at a Fidelity branch.

If you register through Fidelity.com you’ll have to select an account type. For the purpose of investing in The Last Vegas Sphere, you should choose a standard brokerage account.

Of course you’ll need to fund the account before you can invest in anything. If you open your account in person at a branch you can do so by depositing cash or a check.

Fidelity.com makes it very easy to link to your bank, or other financial institution. You can even send funds through PayPal (NYSE: PYPL).

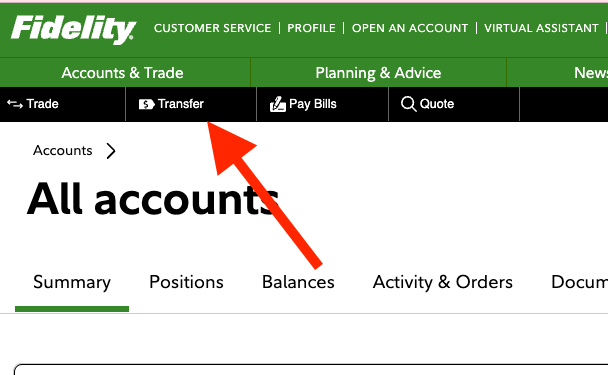

When logged in to Fidelity navigate to the ‘transfer’ option near the top and select your funding source. Then follow the prompts from there. Transfers typically take 1-2 business days to clear.

Step 3 – Invest In Sphere Entertainment Co.

Step 3 – Invest In Sphere Entertainment Co.

Once your funds have been deposited at your brokerage find the option to ‘trade’ or ‘invest’. For Fidelity, this is located in the top left corner, right next to the ‘Transfer’ option from step 2.

Once you select that, you will have to choose which account you’d like to invest with, and then enter the ticker symbol for The Sphere. In this case, Sphere Entertainment Co. (NYSE: SPHR) trades under the symbol SPHR. Enter that in the prompt to invest, and then select the number of shares you’d like to purchase.

In the example above I’ve chosen 10 shares. Each share currently trades for $33.88, which makes this total investment $338.8.

And that’s it! Place the order, and now you are an owner in Las Vegas’s most exciting venue.

A few important notes before you invest in The Last Vegas Sphere, or any company for that matter.

One other point. Technically, there is a second way to invest in Sphere Entertainment Co. via your brokerage account. That is through VICI Properties (NYSE: VICI) which is an entertainment and gaming REIT that currently owns the land under The Sphere. However, VICI has many other locations and revenue streams, so a better way to gain direct exposure to The Sphere itself is through Sphere Entertainment Co.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.