Investing

3 Reasons to Take a Closer Look at PayPal Stock (PYPL)

Published:

Last Updated:

Digital payments processor PayPal Holdings Inc. (NASDAQ: PYPL) reported fiscal fourth-quarter earnings after U.S. markets closed on Wednesday. PayPal stock traded up about 4% in after-hours trading.

After a good night’s sleep, investors pushed PayPal stock up by around 7% in premarket trading Thursday morning.

| Estimate | Actual | Surprise | |

|---|---|---|---|

| Revenue ($B) | 7.39 | 7.40 | 0.1% |

| Adj EPS | 1.23 | 1.30 | 5.7% |

Compared to the third quarter of last year, revenue was up 8.1% and EPS was up 20.4%.

The headline numbers are good, but looking beyond the headlines reveals at least three good reasons to consider adding PayPal stock to a portfolio.

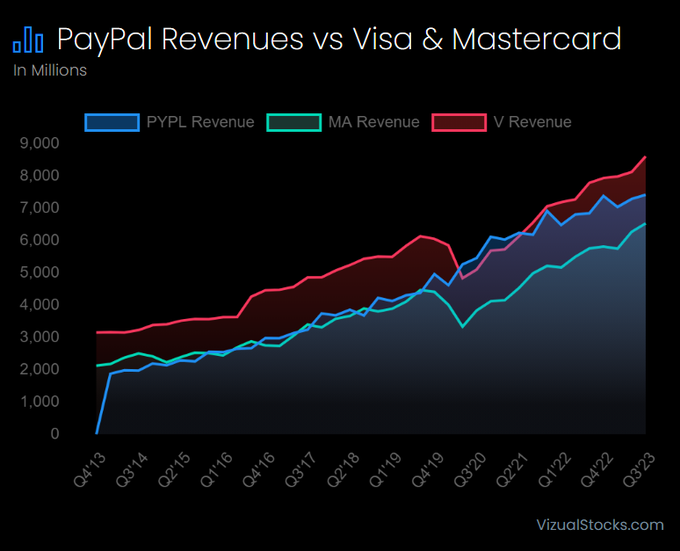

PayPal’s revenue growth has kept pace with that of the payment industry’s two giants.

But PayPal’s market cap lags, by a lot:

Over the past 12 months, PayPal revenue totals $28.56 billion to Mastercard’s $9.4 billion and Visa’s $32.65 billion.

Because PayPal does not pay a dividend, the FCF yield depends primarily on share buybacks. When Visa reported quarterly results last week, it announced a new $25 billion buyback program. In fiscal 2022, PayPal repurchased $4.9 billion in stock, Visa repurchased $11.7 billion in stock, and Mastercard bought back $8.75 billion in stock.

Put simply, PayPal gets no investor love.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.