Investing

How To Buy Amazon Stock In 3 Easy Steps (With Photos)

Published:

Last Updated:

Amazon (Nasdaq:AMZN) has been one of the greatest investments of all time. Since it’s 1997 IPO shares have returned over 150,000%, turning a mere $1,000 investment into a $1.5 million dollar fortune.

But the company isn’t slowing down. It is the world’s second largest retailer, the largest cloud provider, and increasingly a logistics and advertising platform.

Because the company is publicly traded, just about anyone can own shares and become an investor in Amazon today. Here is a step by step guide to buying Amazon Stock, with photos.

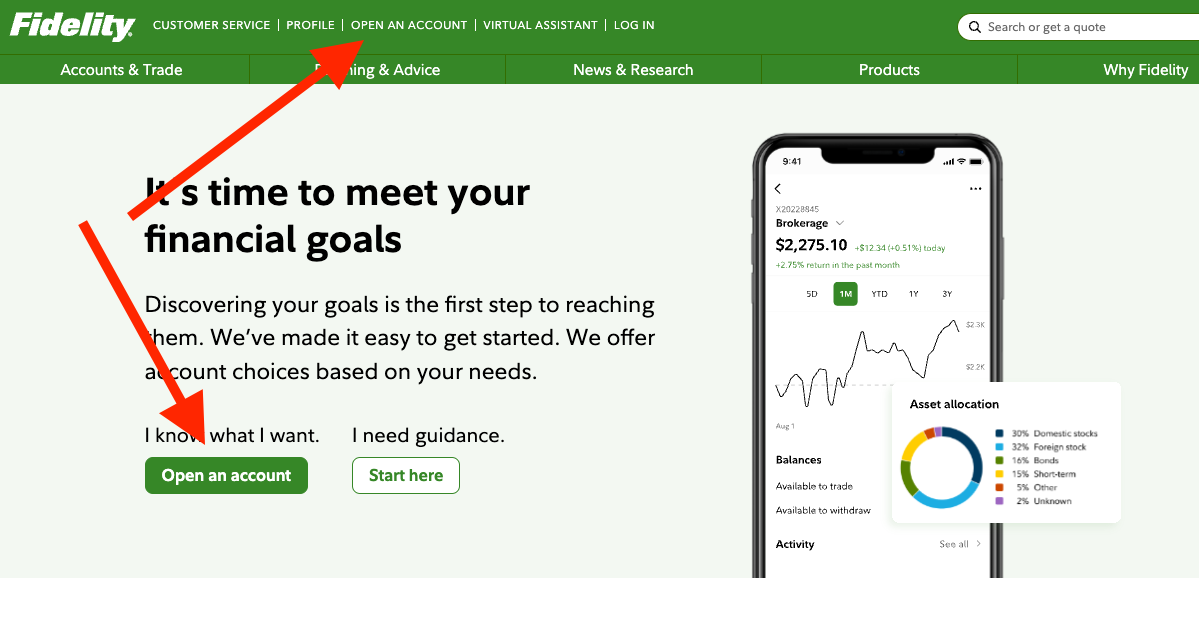

Since Amazon Stock is publicly traded, you can invest through a brokerage account that supports equities. I personally use Fidelity, but any standard broker will do. If you head to fidelity.com you’ll see multiple options to open an account directly from the home page. You can also do so in person at a Fidelity branch.

If you register through Fidelity.com you’ll have to select an account type. For the purpose of investing in Amazon stock, you should choose a standard brokerage account. Though, a retirement account like a IRA will also work.

You can get started with Fidelity here. Similar brokerages include Schwab, and Vanguard.

Of course you’ll need to fund the account before you can invest in anything. If you open your account in person at a branch you can do so by depositing cash or a check.

Fidelity.com makes it very easy to link to your bank, or other financial institution. You can even send funds through PayPal (NYSE: PYPL).

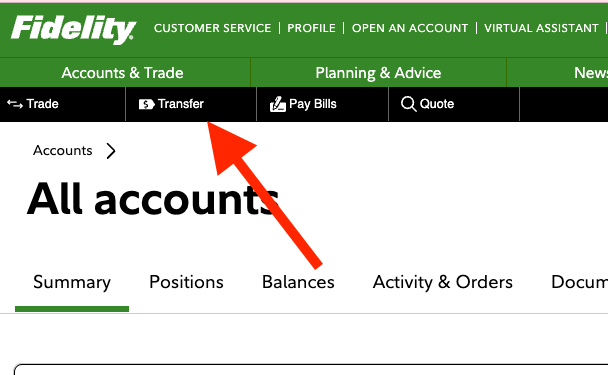

When logged in to Fidelity navigate to the ‘transfer’ option near the top and select your funding source. Then follow the prompts from there. Transfers typically take 1-2 business days to clear.

Step 3 – Invest In Amazon Stock.

Once your funds have been deposited at your brokerage find the option to ‘trade’ or ‘invest’. For Fidelity, this is located in the top left corner, right next to the ‘Transfer’ option from step 2.

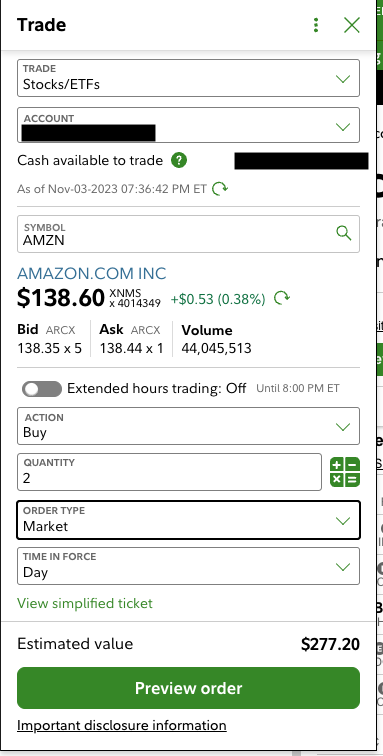

Once you select that, you will have to choose which account you’d like to invest with, and then enter the ticker symbol for that company. In this case, Amazon (Nasdaq:AMZN) trades under the symbol AMZN. Enter that in the prompt to invest, and then select the number of shares you’d like to purchase.

In the example above I’ve chosen 2 shares. Each share currently trades for $138.6, which makes this total investment $277.2.

And that’s it! Place the order, and now you are an owner in one of the most exciting and important tech companies today.

A few important notes before you invest in Amazon, or any company for that matter.

The last few years made people forget how much banks and CD’s can pay. Meanwhile, interest rates have spiked and many can afford to pay you much more, but most are keeping yields low and hoping you won’t notice.

But there is good news. To win qualified customers, some accounts are paying almost 10x the national average! That’s an incredible way to keep your money safe and earn more at the same time. Our top pick for high yield savings accounts includes other benefits as well. You can earn up to 3.80% with a Checking & Savings Account today Sign up and get up to $300 with direct deposit. No account fees. FDIC Insured.

Click here to see how much more you could be earning on your savings today. It takes just a few minutes to open an account to make your money work for you.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.