Investing

Alibaba (BABA) Stock Price Prediction in 2030: Bull, Base & Bear Forecasts

Published:

At its initial public offering in September 2014, Alibaba Group Holdings Ltd. (NYSE: BABA) was valued at $167.7 billion. The company raised $21.7 billion in the IPO, a record at the time. Only Saudi Aramco, which raised $25.6 billion at its 2019 IPO, beats Alibaba.

Adjusted for inflation, Alibaba’s IPO valuation would increase to $216.8 billion if the IPO had been held last month. Alibaba’s current market cap of $200.4 billion is about 7.6% below its inflation-adjusted IPO valuation. How could that happen?

By October 2020, Alibaba’s share price had risen by nearly 240%, earning a tidy profit for investors who got in by the end of 2016. In just half the amount of time it took Alibaba to reach its peak, the stock fell back to its IPO level. Since then, Alibaba has touched its IPO price less than a handful of times and currently trades down by a third since January.

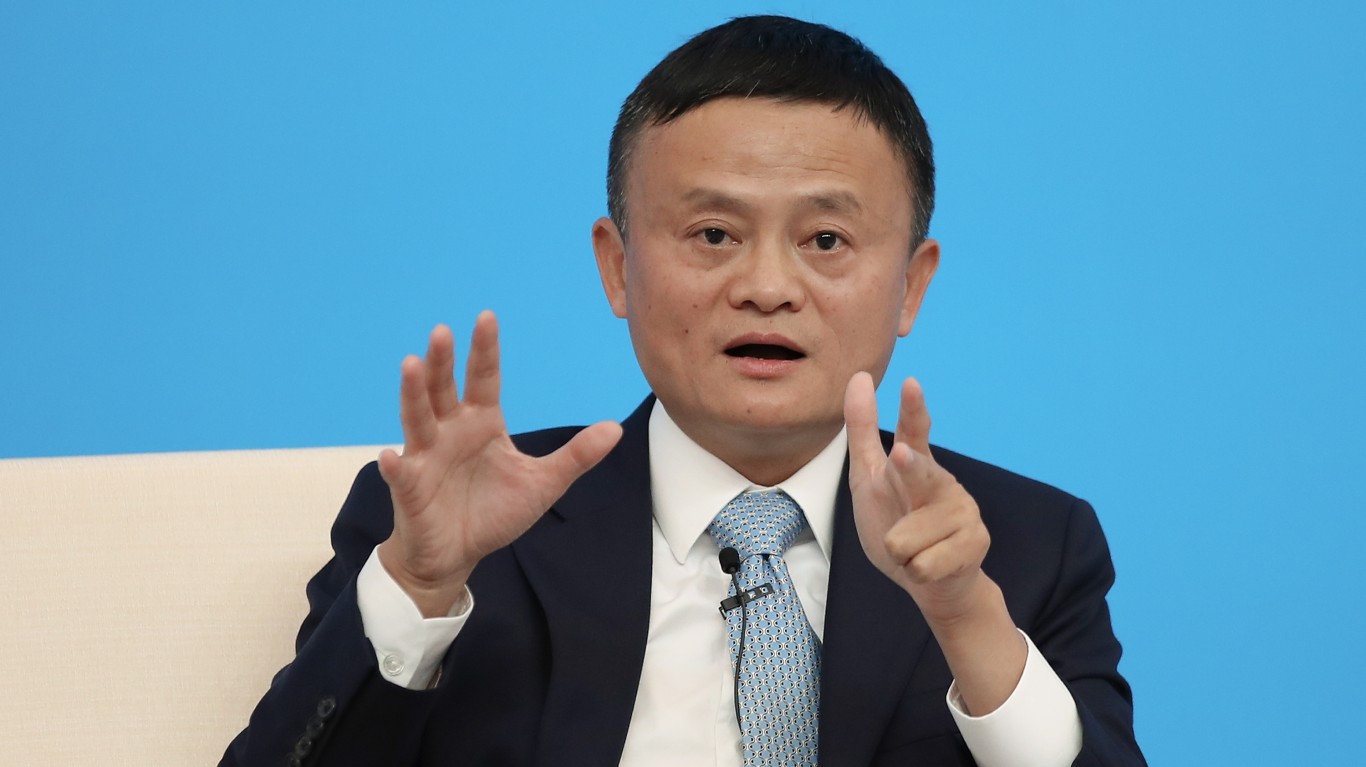

The share price decline can be traced back to November 2020, when Alibaba’s founder, Jack Ma, got sideways with the Chinese government, describing the country’s financial rules as indicative of “an old people’s club.” At the same time, Ma’s Ant Group digital payment startup was lining up an IPO that would have raised $37 billion for the new company, another record-breaking IPO for Jack Ma.

It was no coincidence that Alibaba’s troubles followed from Ma’s troubles. The government’s crackdown on Chinese tech companies included an anti-trust investigation of Alibaba and a $2.8 billion fine levied against the company in 2021 for abusing its market-leading position.

Late last November, Ma disappeared from view for several months. In June, he gave his first lecture as a visiting professor at the University of Tokyo. Ma’s family foundation is selling (or may have already sold) 10 million Alibaba shares this month. He is no longer among the company’s top five shareholders.

Adding even more uncertainty to the Chinese e-commerce giant’s future, Jack Ma is not the only Alibaba shareholder to reduce its stake. Masayoshi Son’s SoftBank Group had reduced a stake of around 33% to just 13.9% at the end of last year. It remains the only shareholder with a stake of more than 5% in the company.

Joseph Tsai, an Alibaba co-founder, took over as the company’s chairman in June after a five-year stint as executive vice chairman. It falls to him and new CEO Eddie Wu to navigate the company through the rough regulatory water it finds itself in.

Like Amazon, its U.S. counterpart, Alibaba has a cloud-computing business that is thriving. Earlier this month, the company dropped plans to spin off the business citing U.S. semiconductor export controls as having created uncertainty for a successful spin-off.

The company reported a near miss on third-quarter revenue in early November while managing to beat the EPS estimate. Analysts have cut ratings and price targets since the report.

Alibaba has to do something to demonstrate that it has a plan to turn the company around that won’t get squashed by Chinese regulators. Such a turnaround will be costly and, by itself, difficult enough. Pinned under the government’s thumb at least doubles the difficulty.

Our predicted prices for Alibaba stock in 2030 are $246 (base), $318 (bull), and $79 (bear). We’ll break down each of these scenarios in more detail below.

One of Alibaba’s biggest moneymakers has been its Singles Day promotion. Gross merchandise value (GMV) for the two-week event soared from $38.4 billion in 2019 to about $75 billion in 2020 and topped out at around $84.5 billion in 2021. The 2022 GMV was flat, at best, with the 2021 result. GMV includes sales from independent vendors from which Alibaba takes a cut.

The company did not report a number last year and did not do so again this year. Alibaba only commented that sales grew this year. So, maybe a new record, but only barely so.

Here’s a look at how the company has performed in each of the past 5 years. Note that Alibaba trades American Depositary Shares in the United States. Each ADS is equal to 8 ordinary shares. The company’s fiscal year ends in March.

EPS has dropped in each of the last three years. As a result, net margin has fallen from nearly 30% to below 10%. Profitability has been massacred by government regulations enacted since 2021.

The withdrawn IPO of Alibaba’s cloud intelligence group cost investors a delayed payday for sticking with the company. The group posted revenue of $11.24 billion in the 2023 fiscal year, up 4% year over year. The cloud computing business represented 9% of all 2023 revenue, far behind the 67% the company derives from its domestic commerce division.

Other businesses Alibaba might spin-off are its logistics operations (Cainiao) and its international commerce business. The former racked up $8.11 billion in revenue last year, and the latter reported $10.08 billion in sales.

By giving current investors a payday through spin-offs, the company shrinks. The regulatory regime, even if it doesn’t get stricter, at least threatens to limit growth.

A new $1.00 annual dividend per ADS and the authorized share buyback program’s $13 billion balance don’t offset the uncertainties that confront the company.

Alibaba’s price-to-earnings multiple at the beginning of the 2022 fiscal year was 30.1x. It nearly tripled to 87x six months later and currently hovers around 17.2x. Without any clear reason to expect much better, let’s assume a multiple of 18x. For the next three fiscal years, the average EPS estimate for the same period is $9.87, an average growth rate of 8.1x

Using these numbers, EPS in 2030 rises to around $13.70. From a current share price of around $79.00 and an estimated price-to-earnings multiple of 18x based on current levels, the stock could trade at around $246. That’s our base case.

The difficulty in making a bull case for Alibaba rests almost entirely on what the Chinese government does. At the time of the 2021 crackdown, the government also initiated a five-year plan that increased regulation of many economic sectors. How U.S. export restrictions on technology to China may affect that plan remains to be seen, but as originally promulgated, the plan significantly reduced the power of giants like Alibaba.

It’s also no secret that China’s economy is slowing down. U.S. GDP is growing much faster than China’s so far this year, a nominal 4.9% compared to 1.3%. A strong dollar and a weak Chinese yuan contribute to widening the gap. The Chinese government may have no choice but to let the economy run, and that works in favor of the country’s biggest companies.

What can Alibaba do? In 2021, the company’s net income came in at nearly $23 billion. That dropped to just $9.8 billion in 2022 and $10.6 billion in 2023. Over the last 12 months, however, net income is up to $18.2 billion. If sales meet estimates for the current fiscal year, Alibaba will report about $134 billion in sales. That’s a net margin of around 13.8%.

Assume further that the company comes up with ways to cut costs in an effort to boost profitability. Alibaba currently employs more than 235,000 people. The company’s cost of revenue has dropped by about $6 billion in the past 12 months compared to fiscal 2022’s level of $85 billion. That’s a reduction of 7%, and more firings may be needed.

In our base-case scenario, we assumed a price-to-earnings multiple of 2.4x and EPS growth of 8.1%. For the bull case, we assume a price-to-earnings multiple of 20x and annual EPS growth of 12%, yielding a share price of around $318 in 2030.

In August of last year, the SEC added Alibaba to a list of Chinese companies that could be delisted from U.S. exchanges for failing to meet auditing requirements. An agreement was struck in December, averting a nasty outcome for shareholders. That doesn’t mean that the Chinese government could not by itself demand that Alibaba give up its U.S. listing.

Alibaba’s stock dropped 11% when it was threatened with a U.S. delisting. The stock currently trades about 16% below its peak following the agreement. If the Chinese government were to force a delisting, the absolute worst case is that the U.S. ADSes would drop to zero.

Because China could force a U.S. delisting at any time, this uncertainty weighs heavily. At the same time, it can’t be calculated. A reasonable bear-case assumption is that the current share price of $79 is as good as it’s going to get.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.