Some of the biggest insider purchases of the past week were in biotech and energy companies, including some that have just gone public. Also, renowned hedge fund manager Bill Ackman continues building a stake in a real estate firm. Here is a look at these and other notable insider buying of the past week.

A well-known adage reminds us that corporate insiders and 10% owners really only buy shares of a company because they believe the stock price will rise and they want to profit from it. Thus, insider buying can be an encouraging signal for potential investors. This is all the more so during times of uncertainty in the markets, and even when markets are near all-time highs.

Remember that when the earnings-reporting season is in full swing, many insiders are prohibited from buying or selling shares. Below are some of the more notable insider purchases that were reported recently.

Buying Into the Cargo Therapeutics IPO

- Buyer(s): 10% owners Third Rock Ventures V and Samsara BioCapital GP

- Total shares: nearly 2 million

- Price per share: $15

- Total cost: nearly $30 million

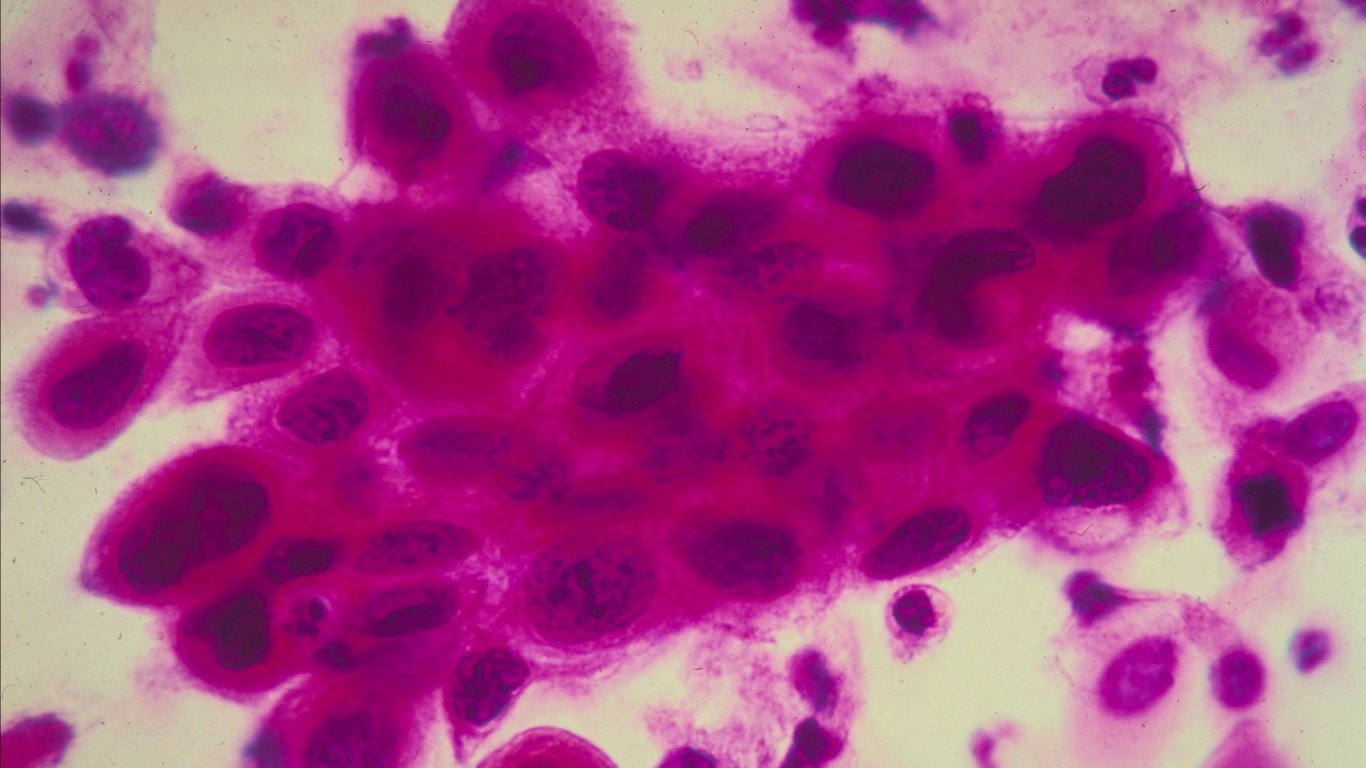

These two owners acquired these Cargo Therapeutics Inc. (NASDAQ: CRGX) shares (via derivative conversion) at the initial public offering price. The shares of this cancer-focused clinical-stage biotechnology company were trading near that price on last look, so no quick gain for these buyers. Cargo reportedly intends to use proceeds from the IPO ($281 million) to continue its phase 2 trial and to fund internal R&D and potential licensing assets.

Block Director Scoops Up Shares

- Buyer(s): a director

- Total shares: over 540,600

- Price per share: $50.63 to $51.00

- Total cost: more than $27.5 million

This appears to be a fresh stake, and the shares were acquired indirectly. The San Francisco-based mobile payments company Block Inc. (NYSE: SQ) recently posted a smaller-than-expected quarterly loss and beat revenue projections, and it offered rosy guidance. The stock is up more than 34% since then to $57 or so. That is a gain of more than 10% for that director. The $71.71 consensus price target suggests there is 27% or so more upside in the coming year.

Insider Buying at Madrigal Pharmaceuticals

- Buyer(s): a director

- Total shares: almost 156,900

- Price per share: $155.51 to $162.00

- Total cost: over $23.6 million

These indirect purchases of Madrigal Pharmaceuticals Inc. (NASDAQ: MDGL) shares lifted the director’s stake of more than 1.54 million. They also came after the recent appointment of a new chief commerce officer and the release of stage 3 trial results. Shares are up more than 23% in the past week and were trading at more than $172 apiece, above the director’s purchase price range. The stock is down about 42% in the past six months, but the $319.83 consensus price target suggests analysts see plenty of room for shares to run.

Who Is Acquiring Talos Energy Shares?

- Buyer(s): 10% owner Control Empresarial de Capitales

- Total shares: almost 1.7 million

- Price per share: $13.34 to $14.25

- Total cost: almost $23.7 million

Talos Energy Inc. (NYSE: TALO) is a Houston-based exploration and production company focused on the Gulf of Mexico. Its third-quarter earnings fell short of expectations in the recent report. The share price has retreated more than 9% since then to above $14. That is near the top of the owner’s purchase price range. The stock is more than 17% higher than six months ago, while the Dow Jones industrials are up less than 5% in that time. The consensus price target is up at $20.67.

Hedge Fund Manager Loves Howard Hughes

- Buyer(s): 10% owner Pershing Square Capital Management

- Total shares: almost 159,700

- Price per share: $7.13 to $74.77

- Total cost: over $11.4 million

Bill Ackman continues to build a stake in real estate developer Howard Hughes Holdings Inc. (NYSE: HHH), in compliance with Rules 10b-18 and 10b5-1 of the Securities Exchange Act of 1934. Pershing Square has purchased more than 10 million shares of the stock so far this year. The share price popped almost 6% in the past week but is still down more than 3% year to date. The consensus price target is up at $92.25, and all five analysts covering the stock recommend buying shares.

Three TXO Partners Insiders at the Buy Window

- Buyer(s): three directors

- Total shares: nearly 471,900

- Price per share: $17.60

- Total cost: over $8.30 million

Two of those directors were also founders of Texas-based energy master limited partnership TXO Partners L.P. (NYSE: TXO). The company recently declared its highest quarterly dividend since its initial public offering earlier this year. The yield is 8.3%. The share price is down about 16% since the IPO and was last seen trading above $18, about a buck higher than the purchase price above. The consensus price target of three analysts who follow the stock is $30.67.

A Beneficial Owner Believes in ProFrac

- Buyer(s): 10% owner THRC Holdings

- Total shares: almost 630,500

- Price per share: $9.63 average

- Total cost: around $6.07 million

ProFrac Holding Corp. (NASDAQ: ACDC) is a Texas-based energy services and products provider that posted declining revenues and a widening net loss in its third quarter. The stock fell to a 52-week low of $7.75 after that report, but they were last seen trading above $8 a share. Note that THRC has been scooping up shares since last spring, and the share price was in double-digits until recently.

And Other Insider Buying

Some insider buying was seen at Caesars Entertainment, CenterPoint Energy, Darling Ingredients, Emerson Electric, Keurig Dr Pepper, W. K. Kellogg, Topgolf Callaway Brands, Perrigo, and SolarEdge Technologies in the past week as well.

Travel Cards Are Getting Too Good To Ignore (sponsored)

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.