Investing

Rivian (RIVN) Stock Price Prediction in 2030: Bull, Base & Bear Forecasts

Published:

Electric vehicle maker Rivian Automotive (NASDAQ: RIVN) began trading in the public markets on November 10, 2021. The company raised $12 billion in cash, selling 153 million shares for a valuation of $66.5 billion. Shares reached an all-time high just seven days after the IPO at nearly $180.

Amazon.com Inc. (NASDAQ: AMZN) owned about 160 million shares at the time of the IPO, and Ford Motor Co. (NYSE: F) owned about 100 million. Ford has since reduced its share count to less than 10 million shares, while Amazon has maintained its position as Rivian’s largest shareholder with about 16.5% of the outstanding shares.

Since its IPO, Rivian stock has dropped around 85% of its value; since its peak, the share price has fallen by around 90%. The basic prediction about Rivian is whether or not it will still exist in 2030.

A combination of product delays related to the COVID-19 pandemic, a weak economy, and a convertible debt offering that raised $1.5 billion in October has almost drowned the stock. Since its first quarterly earnings report in December of 2021, Rivian’s revenue has risen from $1 million to $1.34 billion. Profitability, of course, remains far in the future.

At the end of the third quarter, Rivian reported $9.1 billion in cash, equivalents, and short-term investments, along with net debt of $5.9 billion. Free cash flow in the September quarter totaled nearly a negative $1.1 billion. That means there should be enough cash to keep the company going through the end of 2025. Then Rivian’s story needs to change.

The biggest challenge has to be halting the $30,000 loss the company takes on every vehicle it sold in the third quarter. In the second quarter, Rivian lost twice that much on each vehicle sold. Rivian delivered 15,564 vehicles in the third quarter and posted a gross loss of $477 million. Another challenge is hitting its upgraded target of producing 54,000 units this year (up from an initial target of 50,000 and a target of 52,000 announced in October). At the end of the third quarter, Rivian had produced more than 39,000 units and delivered more than 36,000.

The good news is that sales have beaten estimates in each of the last two quarters and losses have been somewhat smaller than the Street’s consensus. Still, driving costs down may not be enough.

An entry-level R1T pickup has a sticker price of around $73,000, with the top-tier Performance line beginning at $89,650. Just 3 of 17 available configurations quality for the partial federal tax credit of $3,750. An entry-level R1S SUV with dual motors costs $78,000, and a quad-motor version starts at $92,000. If Rivian has to raise prices, that will not help it in a marketplace that is headed in the direction of getting EVs down to around $25,000.

Those prices reflect the high prices Rivian must pay suppliers for the low volumes and reported complexities of the necessary parts.

With just nine quarters of public data available, the numbers don’t offer a lot of guidance. Here’s a look at the past 5 quarters’ revenues, losses per share, and trailing 12-month price-to-sales ratio.

Our predicted prices for Rivian stock in 2030 are $32 (base), $128 (bull), and $0 (bear). We’ll break down each of these scenarios in more detail below.

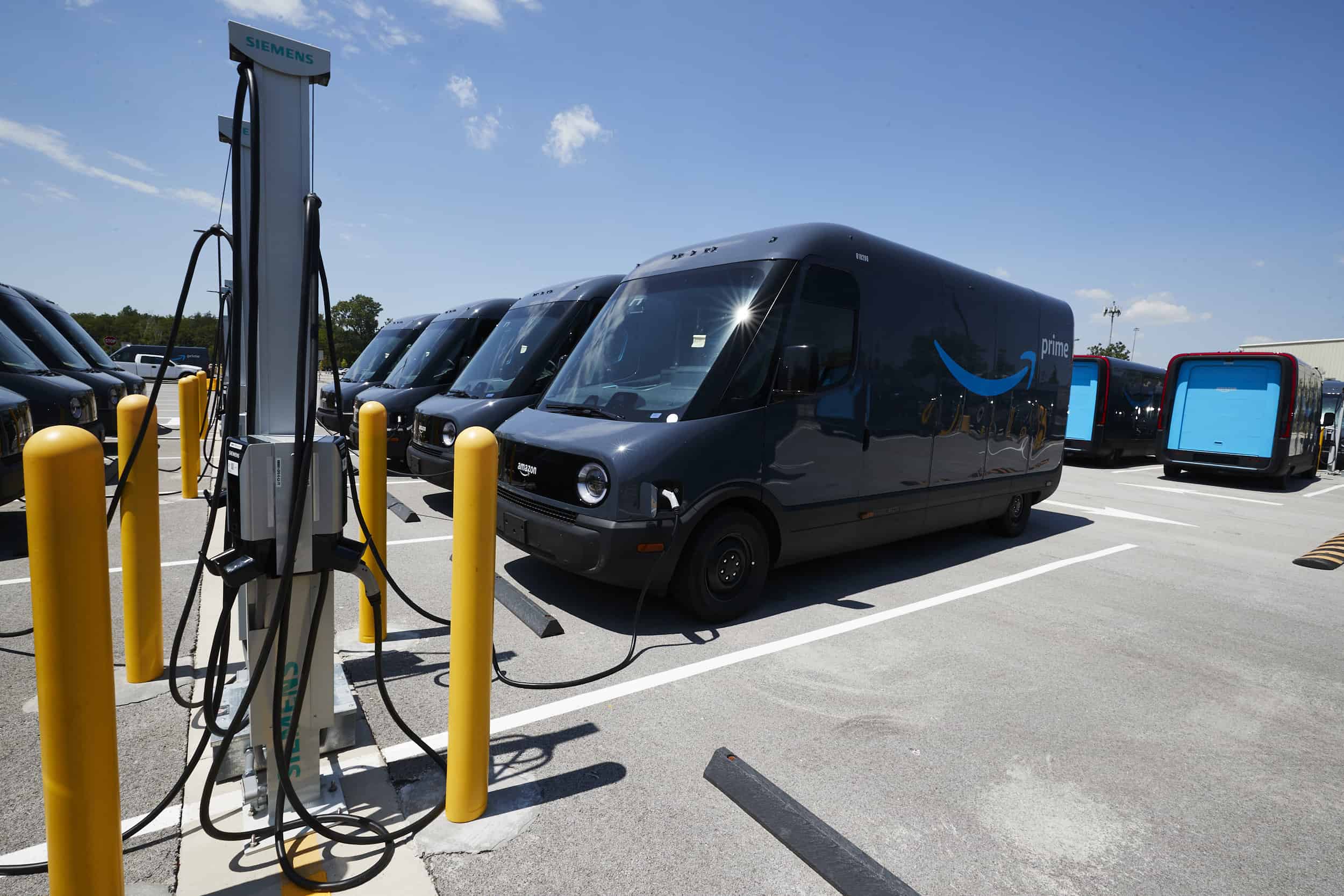

Along with its investment in Rivian, Amazon has ordered 100,000 of the EV maker’s delivery vans, all to be delivered by 2030. As of mid-October, Amazon has taken delivery of more than 10,000 of the vehicles. Amazon also agreed earlier this month to end its exclusivity agreement for Rivian’s electric vans. The list price for the basic van is $83,000; a larger version has a sticker price of $87,000.

With 90,000 vans remaining on the Amazon contract, and the possibility of additional orders from other customers, van sales could play a bigger role in Rivian’s eventual success. If more orders don’t materialize, that would hurt, but not fatal.

Ford, GM, and Stellantis combined sold more than 1.6 million pickups in the United States last year. U.S. consumers purchased more than 6 million SUVs. The market exists, and Rivian’s production has to double by the end of next year to around 9,000 units a month to begin capturing its share. That’s the first element for the base case.

The second is revenue. Profitability may not be in the cards for another five years. Street estimates call for revenue to rise to $4.39 billion this year, $6.33 billion next year, and $10.49 billion in 2025. Per share losses are forecast to drop by more than half in those three years, from $4.87 this year to $2.12 in 2025.

Because the company still won’t be profitable, the share price depends on how much investors are willing to pay for the stock, and that depends on Rivian’s performance to investors’ expectations. Solid, steady, better-than-expected progress toward the Street’s estimate could double the share price to around $32, a level it hasn’t come close to in 13 months. That’s our base case. Only a couple of analysts are forecasting a profit that first arrives in 2028.

This one’s easier. Despite a significant cash pile, Rivian’s future depends on its ability to reduce its costs and produce more vehicles that consumers want to buy. If investors don’t see actual progress toward profitability, the stock will simply fall to zero. The writing will be on the wall by the end of 2025.

The average of three analysts’ estimates for Rivian revenue in 2030 is $45.71 billion. That’s more than 4 times the consensus estimate of $10.49 billion for 2025. Revenue more than doubles by 2027 and repeats that doubling three years later. If Rivian’s share price should follow that growth pattern, by 2030, the stock price would reach $128 a share, still short of its all-time high posted a week after its IPO, but a lot closer than where the stock trades right now.

After two decades of reviewing financial products I haven’t seen anything like this. Credit card companies are at war, handing out free rewards and benefits to win the best customers.

A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges.

Our top pick today pays up to 5% cash back, a $200 bonus on top, and $0 annual fee. Click here to apply before they stop offering rewards this generous.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.