Consumer Electronics

6 Reasons to Avoid Apple Stock (AAPL) Today

Published:

Last Updated:

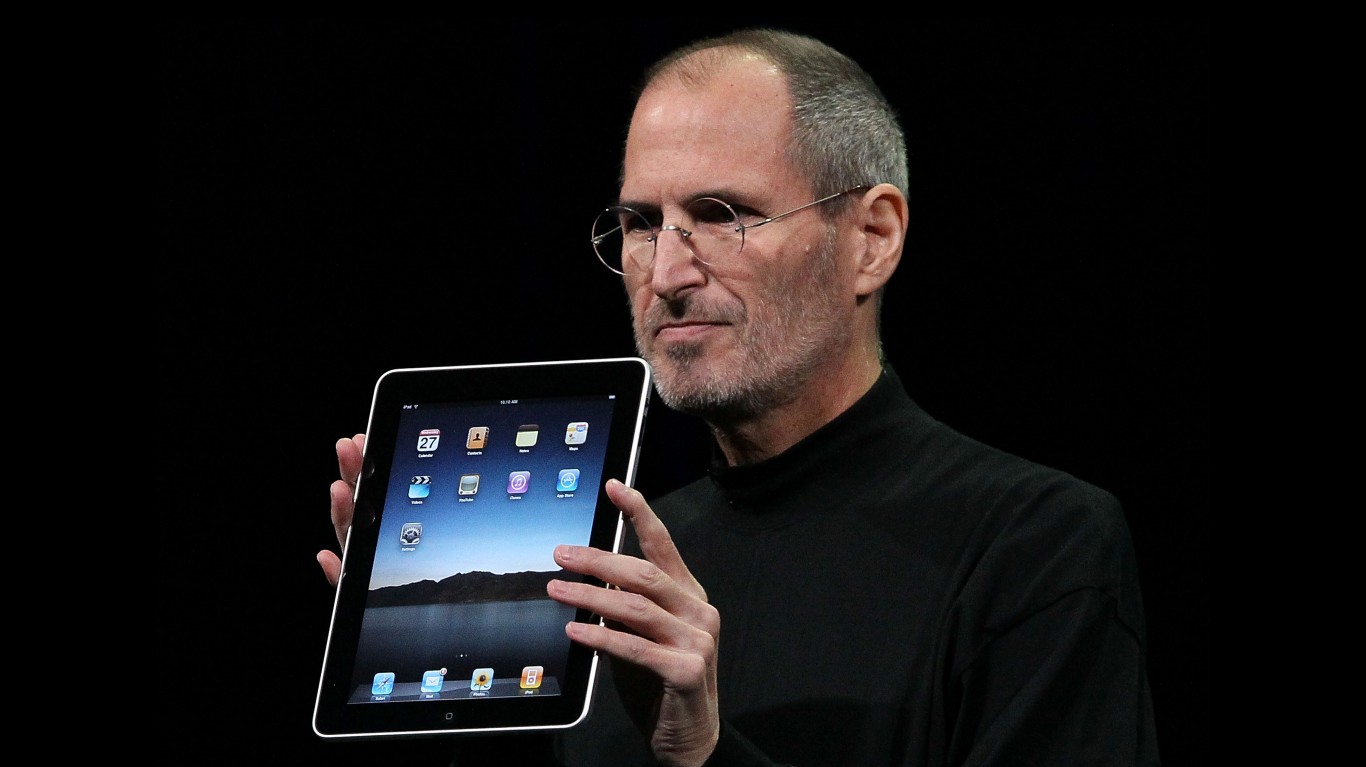

Founded in April of 1976 by Steve Jobs and Steve Wozniak, Apple Inc. (NASDAQ: AAPL) changed how consumers viewed personal computers.

Apple is one of the world’s largest companies with a stunning $3.05 trillion market capitalization and produces products that have become ubiquitous in the United States and around the globe.

The company’s groundbreaking iPhone arrived on the market in June of 2007 and was the first true smartphone the public could buy. Since then, a stunning 38 versions of the iconic product have been released, and every time, the new models have been snatched up despite every growing price tag.

Apple stock has been one the biggest success stories in the history of Wall Street, and the stock has exploded from the single digits in the late 1990s to almost $200 today, with the stock splitting five times since the IPO. The most recent being a 4-for-1 split in 2020.

While legendary in almost every way and founded by a man heralded as one of the most intelligent and innovative leaders in American business history, we found six reasons potential investors may want to be cautious about purchasing shares.

Trading at a whopping 32 times trailing earnings, the shares are priced to perfection. Over the last ten years, the average historical ratio has been 19.71. That puts the stock almost 60% above the historical average.

While there is no question about the quality of Apple’s product offerings, the reality is that compared to much of the competition, all of the company’s products are very expensive. The company’s biggest competition in the smartphone market is Samsung’s Galaxy devices and Apple devices are all priced higher.

Many consumers, especially younger consumers, tend to lean towards the Samsung Galaxy not only on a price point basis but also because Samsung phones have better cameras, longer battery life, and better display technology, per reports. The Samsung phones, however, tend to depreciate faster.

Although it is a colloquial term, the “Apple Tax” refers to the unreasonable profit margins the company derives from its product lines. While many dedicated Apple fans will still buy the newest version of the iPhone and other Apple products, the spiraling prices limit the growth of the various devices to some degree.

While gamers do indeed find a solid experience with Apple phones, Android and the Galaxy S23 Ultra offer more options for customization, mods, emulation, and cloud gaming. In addition, there is also a wider choice at more affordable price points among Android devices, which is often the ultimate decision-maker.

Given the impotence of customization for many consumers, the need for it with the iPhone is one of the many complaints about the product. Many cite the lack of customization in the App library as one of the most significant negatives for the company.

While Tim Cook has done a solid job since becoming chief executive officer in 2011, the kind of breakout ideas and technology Jobs was known for seem less prevalent today.

The reality for investors is like many of the Magnificent Seven tech stocks, Apple has skyrocketed in price over the last few years, and trading so far above the historical price to earnings makes it a stretch to buy at current levels. The shares would have to trade back to approximately $125 to be at a historical valuation far below the current $195. It makes sense to wait for a pullback.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.