Investing

Nano Dimension Buys Stratasys, Bristol Myers's Shopping Spree, Apple Gets a 'No'

Published:

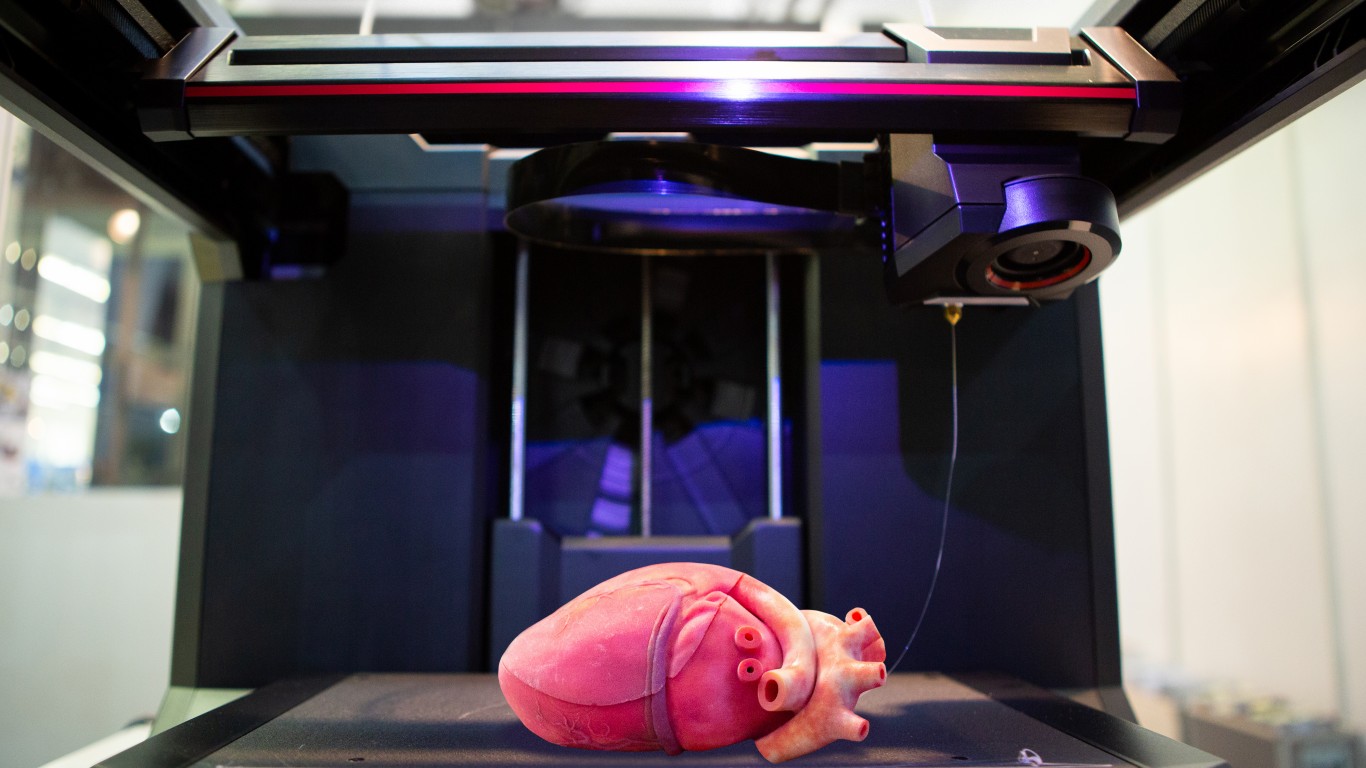

The holiday shopping season isn’t over yet. A 3-D printing company and a major pharmaceuticals maker announced post-Christmas acquisitions Tuesday morning.

Last Friday, Bristol Myers Squibb Co. (NYSE: BMY) announced that it will acquire drug developer Karuna Therapeutics Inc. (NASDAQ: KRTX) for $330 per share in cash. Tuesday morning, Bristol Myers announced that it has agreed to acquire RayzeBio Inc. (NASDAQ: RYZB), a radiopharmaceutical developer, for $62.50 per share. The all-cash deal values RayzeBio at $3.6 billion net of around $500 million in cash.

Bristol Myers’s offer represents a premium of 104.4% to RayzeBio’s Friday closing price of $30.57. Bristol Myers said the acquisition, which is expected to close in the first quarter, will reduce adjusted EPS by $0.13 per share in 2024. The Karuna acquisition will reduce 2024 earnings by around $0.30 per share according to Bristol Myers.

Both acquisitions will be financed with new debt. Bristol Myers had $7.7 billion in cash and other liquidity at the end of the third quarter. The company also had $32.2 billion in long-term debt.

RayzeBio stock traded up by about 97% at $60.25 in Tuesday’s premarket session. The stock’s 52-week range is $17.95 to $31.11. The high was posted last Friday.

Bristol Myers stock traded up about 0.2% early Tuesday at $52.39 in a 52-week range of $48.25 to $75.18. (The 7 Highest Yielding ‘Strong Buy’ Dividend Kings You Can Buy and Hold Forever)

Israel-based 3D printing firm Nano Dimension Ltd. (NASDAQ: NNDM) is tired of waiting for Stratasys Ltd. (NASDAQ: SSYS) to break its silence. Since late September, when Stratasys announced a strategic review, including a possible sale of the company, Nano Dimension has had its hand raised.

Nano already owns 14% of Stratasys and is its largest shareholder. Because Nano is getting the silent treatment, it decided to make public its preliminary offer to acquire Stratasys for $16.50 per share. The price reflects a premium of 40% to Stratasys’s share price at the time of the company’s September announcement of the strategic review.

Stratasys stock closed at $11.75 when the strategic review was announced and closed at $13.11 last Friday. The stock traded up 12.2% in Tuesday’s premarket at $14.71.

Nano Dimension stock traded flat early Tuesday at $2.40 per share in a 52-week range of $2.16 to $3.35.

Last week, Apple Inc. (NASDAQ: AAPL) began removing certain models of its Apple Watch from its stores. U.S. Trade Representative Katherine Tai declined to reverse an October ruling that Apple infringed on two Masimo Corp. (NASDAQ: MASI) patents that use light sensors to measure a person’s blood oxygen levels.

While Apple can appeal the ITC’s decision, it had 60 days to comply with the October ruling. That 60-day period ended on December 26.

Retirement can be daunting, but it doesn’t need to be.

Imagine having an expert in your corner to help you with your financial goals. Someone to help you determine if you’re ahead, behind, or right on track. With SmartAsset, that’s not just a dream—it’s reality. This free tool connects you with pre-screened financial advisors who work in your best interests. It’s quick, it’s easy, so take the leap today and start planning smarter!

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.