Investing

Boeing (BA) Rival Looking at AI Defense Firm; Disney (DIS) Fights Back

Published:

How big a deal is artificial intelligence in the defense industry? The largest defense contractors have been boosting their investments in military AI, and we can expect to hear a lot about it when earnings reports are released next month. But we could be getting a preview from France.

There is also a new entrant in a coming proxy fight at a Dow Jones industrial average company.

European airplane maker and defense firm, Airbus S.E. (EADSY) has been discussing an acquisition of a $2 billion chunk of Atos S.E. In a statement released Wednesday, Airbus said there was no certainty that a deal would be reached with the French cybersecurity software firm. Atos needs cash to refinance its debt, and its big data and security (BDS) business is on the block.

Airbus, like U.S. rival Boeing Co. (NYSE: BA), has a defense division, but defense represents a much smaller portion of Airbus’s business. For the first nine months of 2023, the defense business hauled in €7.13 billion ($7.8 billion). That is about one-sixth of Airbus’s total revenue. Boeing’s defense segment reported $18.2 billion in nine-month revenue, about a third of the company’s revenue total.

Airbus CEO Guillaume Faury said on the company’s earnings call in November that demand is growing for new defense-related cyber and AI capabilities, and he wants Airbus to get a bigger piece of the action.

For its part, Boeing signed a development deal with AI startup Shield AI to explore Shield’s pilotless aircraft software and other AI technology. The Pentagon’s latest strategic capital program emphasizes relationships with small startups like Shield working on AI-related defense systems.

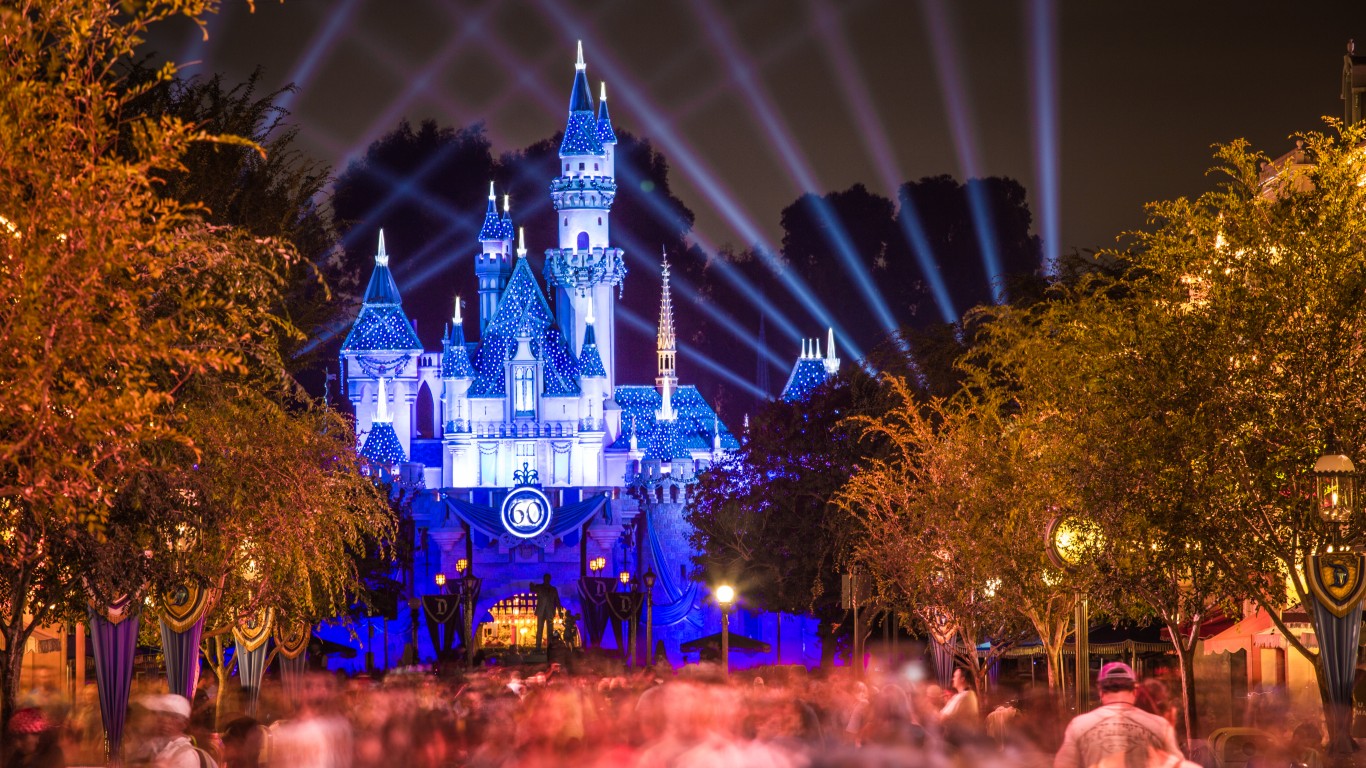

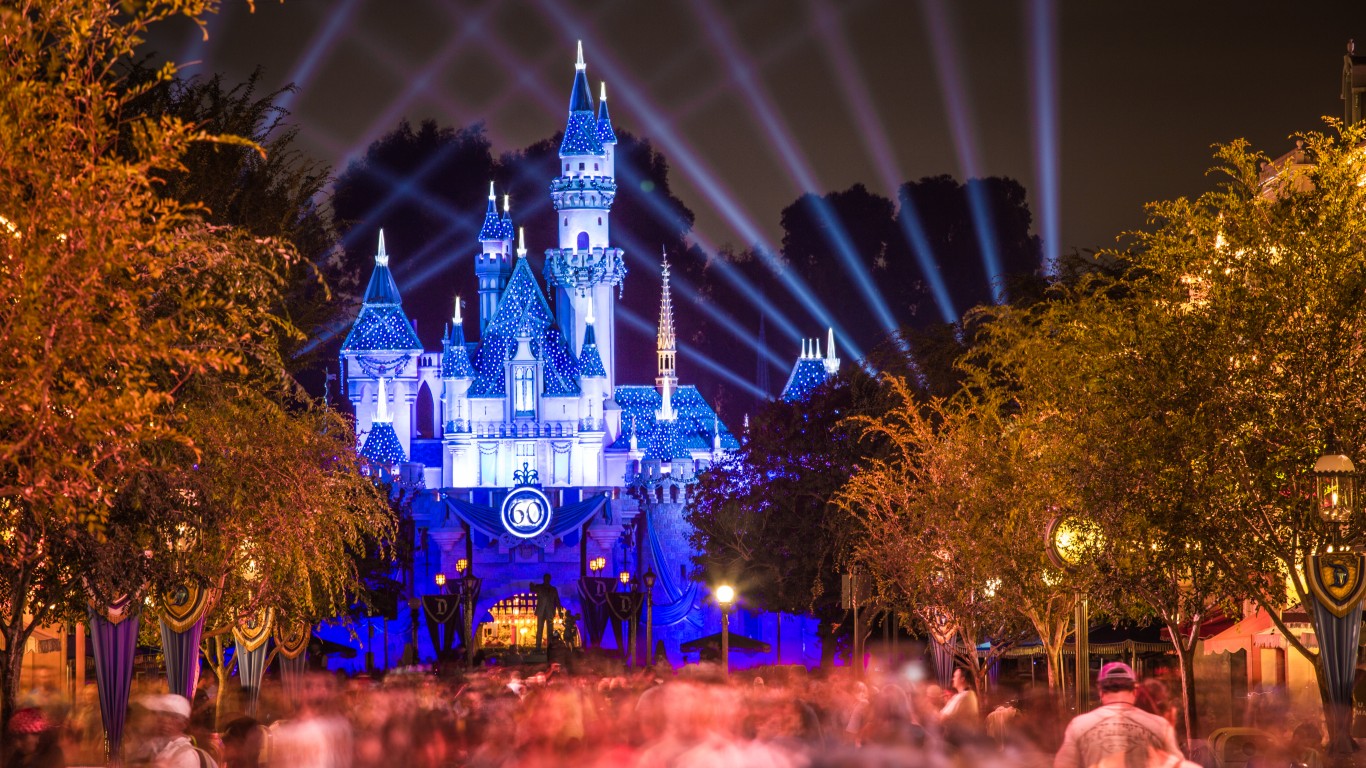

The battle line has formed between Walt Disney Co. (NYSE: DIS) and activist investor Nelson Peltz’s Trian Management. Last November, Peltz offered himself and former Disney Chief Financial Officer Jay Rasulo as candidates for Disney’s board.

Wednesday morning, Disney announced that it had retained ValueAct Capital Management. The firm will advise the Mouse House on “strategic matters, including through meetings with the Disney Board and management.” ValueAct is itself an activist investor but one that supports Disney and CEO Robert Iger’s transformation plan:

ValueAct has confirmed it will support the Disney Board of Directors’ recommended slate of nominees for election to the Board at the 2024 Annual Meeting.

The investment firm has accumulated an undisclosed position in Disney, but it is sure to be far smaller than Trian’s holdings of around 33 million shares. Disney has 1.83 billion shares outstanding, and Trian is among its top 10 institutional investors.

On Wednesday, Blackwells Capital, an investment management company that opposed Trian’s November announcement, submitted its own slate of candidates for Disney’s board for election. Disney has not yet set a date for its annual shareholders meeting.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.