Investing

Microsoft (MSFT) Stock Price Prediction in 2030: Bull, Base & Bear Forecasts

Published:

Since posting a recent low in late November of 2022, shares of Microsoft Corp. (NASDAQ: MSFT) have risen by 85%, and the company has wrestled away Apple’s title as the world’s most valuable company. All this follows from an investment of around $13 billion in a startup.

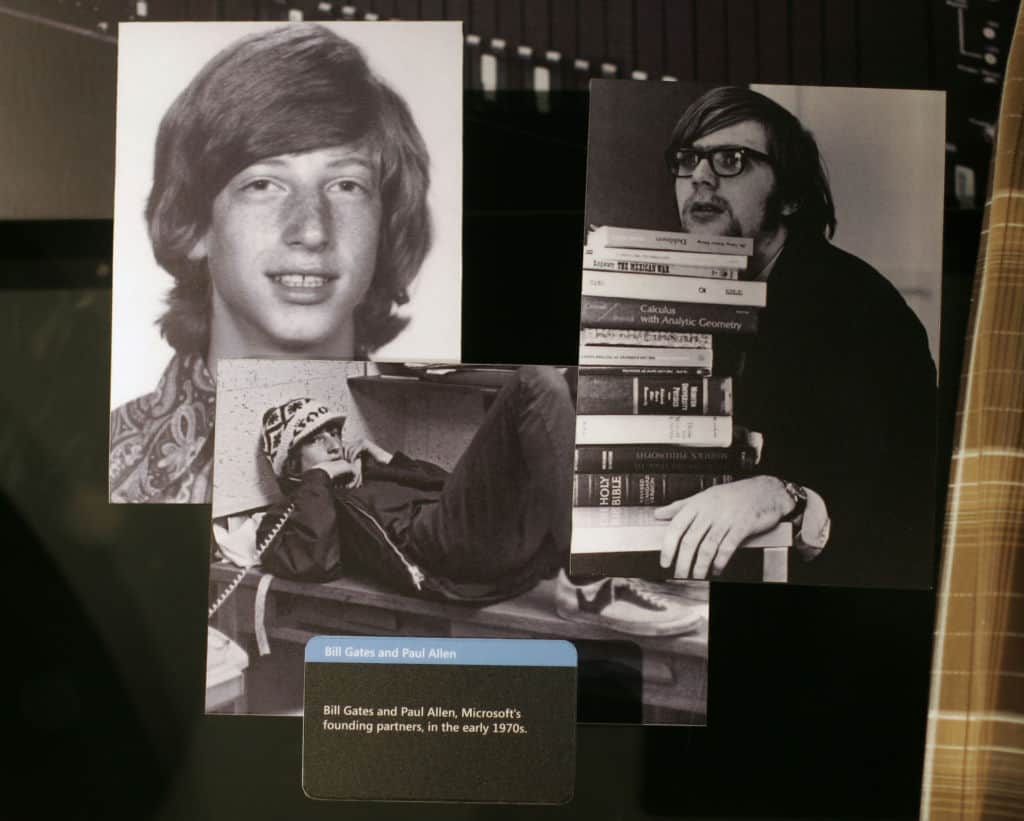

Microsoft was founded in 1975 to develop software for an early personal computer called the Altair 8800. Five years later, the company struck a deal with IBM to deliver the operating system for IBM’s first PC. In 1985, the company released its first Windows operating system and, in the following year, became a publicly traded company.

Microsoft’s innovation–and long-lived cash cow–was a computer operating system that was not tied to a single hardware vendor. Every PC, whether manufactured by IBM, Gateway, or Compaq, ran Microsoft’s system software. Some 1.4 billion PCs currently run Windows, and most still run Windows 10, first released in 2015 and set to reach its end of life in two years.

In March 1986, Microsoft sold 2.5 million shares at an IPO price of $21. The stock closed at $35.50 on the first day of trading. Since then, shares have split nine times, the last coming in 2003. One IPO share has become 288 shares. At a recent share price of around $390 (an all-time high), that one share is now worth about $83,500. An investment of $1,000 in the IPO would be worth nearly $4.2 million today.

Here’s a look at some financial data from the past six full fiscal years.

For the current 2024 fiscal year ending in June, analysts have forecast revenue of $243 billion and EBITDA of almost $121 billion. At the end of the 2023 fiscal year, Microsoft’s forward price-to-earnings (P/E) multiple was 31.9x. At the end of the September quarter, the multiple was 29.2x.

Our predicted prices for Microsoft stock in 2030 are $710 (base), $910 (bull), and $560(bear). We’ll break down each of these scenarios in more detail below.

Revenue in Microsoft’s PC business segment slipped by 9% year over year in the 2023 fiscal year that ended in June, and operating income dipped by 20%. It made a comeback in the first fiscal quarter of 2024, rising 23% year over year. The company’s other two reporting segments reported year-over-year gains for 2023, and both reported solid gains in the first quarter of 2024. Operating income rose by 13% in the first quarter, nearly double the 2023 full-year gain of 6%.

That near-doubling is down to expected growth from sales of its Copilot AI personal assistant software based on OpenAI’s ChatGPT model. Analysts see incremental growth in Microsoft’s Azure business and in both the individual and corporate Office businesses leading to gains in margin and free cash flow going forward.

The impact on margins will show up first because capex spending is expected to remain high in the 2024 fiscal year, keeping a lid on free cash flow in the short term. Cash flow from operations was actually lower (by 1.6%) year over year in 2023. Copilot customers are expected to generate positive cash flow for the year.

For the fiscal year ending in June, analysts estimate revenue will increase by about 14.7%. Over the six-year period from 2025 to 2030, revenue is expected to rise by around 7% a year. Using an industry median forward price-to-earnings (P/E) multiple of 32.1x, estimated annual profit growth of 12% in each of the six years, and 2024 EPS of $11.21, Microsoftl’s share price in 2030 reaches $710 a share. That’s our base case.

Microsoft’s fastest-growing market is certain to be AI, mainly because it is starting from zero, and the market is expected to be huge. With one major player (Apple) still on the sidelines, Microsoft has a decent chance to reconnect with PC users who may have switched to smartphones as their principal computing device.

At least one estimate has the global AI market growing by 13x over the next seven years to around $1.75 trillion. That includes chipmakers like Nvidia, AMD, and Intel. Software revenue may rise 70% by 2025. And if it is really useful–the jury’s still out on this–annual growth averaging 50% a year through 2030 is possible.

When Microsoft reports quarterly results later this month, it is sure to tout its revenue from Copilot and may even report what portion of gross profit growth is due to AI. That will be worth watching.

As it stands, though, the best we can do at this point is make some more or less reasonable guesses. Over the six-year period from 2025 to 2030, assume that Microsoft’s revenue will rise by around 10% a year, profit growth will average 15% per year, and the company’s P/E multiple rises to 35x. Starting again from 2024 EPS of $11.21, our estimate for Microsoft’s 2030 share price rises to $910.

Competition for consumers’ hearts and minds for AI is going to be fierce. Alphabet/Google is perhaps Microsoft’s strongest challenger for a foundational approach to AI. Amazon’s AWS will also compete for cloud-based AI services. The cloud is where the big payoffs are, and that’s where these three will battle it out.

We’ve assumed annual profit growth of 12% in our base case and 15% in our bull case. For the bear case, let’s assume annual profit growth of 10% and a P/E multiple of 28x. That implies a share price of $560. That’s our bear case for Microsoft stock.

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.