Investing

Intel (INTC) Stock Price Prediction in 2030: Bull, Base & Bear Forecasts

Published:

Since Intel Corp. (NASDAQ: INTC) announced its latest turnaround plan nearly three years ago, the company has posted year-over-year profit growth in only two of the past 10 quarters. The stock price dropped by 60% over the next 18 months but has fought its way back to a decline of about 20% since April 2021.

The success of that plan could define Intel’s future for years to come.

The company was founded in 1968 and became a publicly traded company in October 1971, selling 325,000 shares at $23.50 each to raise about $7.2 million (selling shareholders pocketed another $1 million). Accounting for 13 stock splits, the adjusted price for one share purchased at the IPO would have been $0.02.

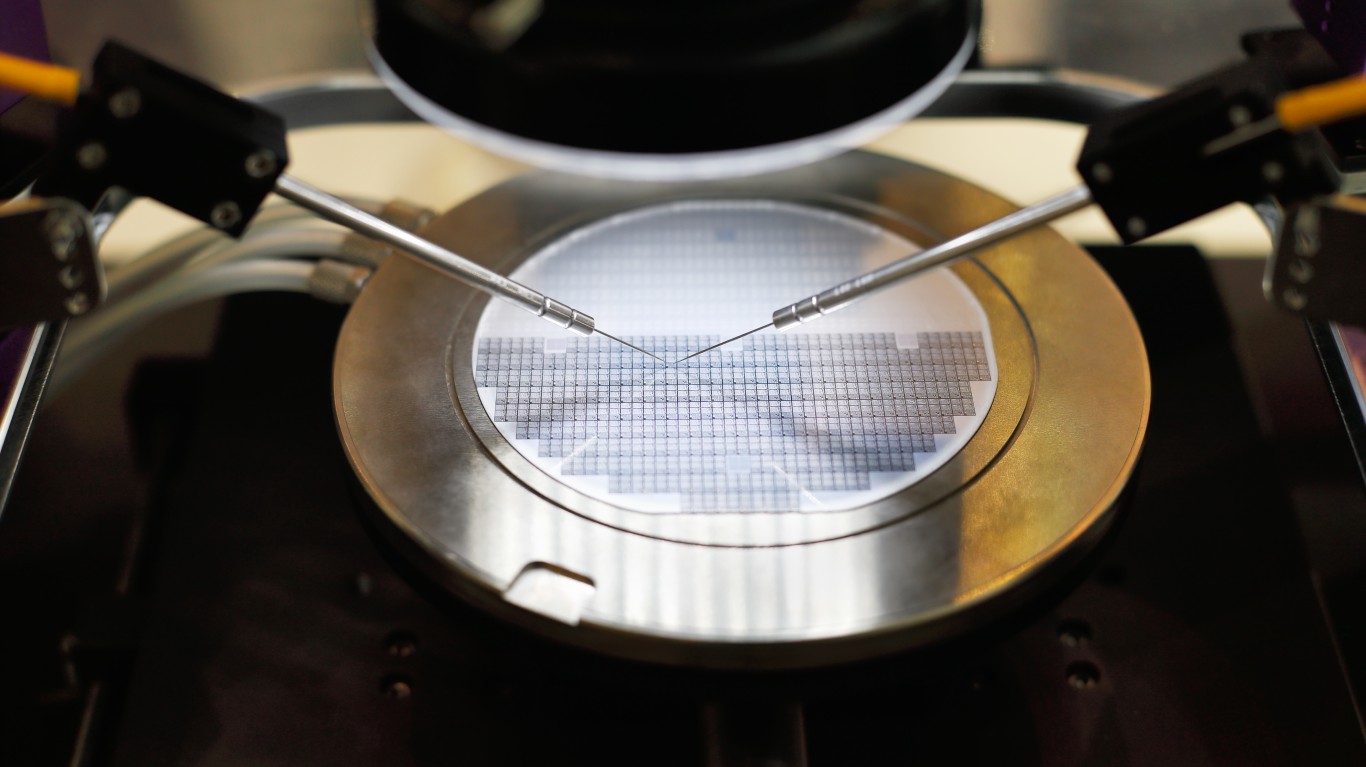

Intel’s first product was a memory chip and both static and dynamic (SRAM and VRAM) memory chips were the company’s top products until the introduction of the IBM PC in 1981. The company had developed its first microprocessor in 1971.

Between 1990 and 1999, Intel dominated the PC market, and the stock rose by more than 6,000%. The dot-com crash killed the boom, erasing about two-thirds of the stock’s value over the next 18 months. Intel began to right the ship as the world recovered from the Great Financial Crisis. Shares reached their all-time high in 2021, as the COVID-19 pandemic peaked.

The stock has dropped sharply since then, reaching a recent low in October 2022. Since then, a combination of Intel’s turnaround plan and AI euphoria has helped the stock recover much of that steep loss. Here’s a look at the rise and fall since 2018.

Following the first three quarters of fiscal 2023, analysts are looking for Intel to report revenue of about $50.7 billion for the full year, down about 20% year over year and down almost 37% since 2021. Net income is forecast to fall by around 15% year over year.

Our predicted prices for Intel stock in 2030 are $136 (base), $186 (bull), and $109 (bear). We’ll break down each of these scenarios in more detail below.

Intel CEO Pat Gelsinger had been on the job for only a month before unveiling a $20 billion turnaround integrated device manufacturing plan (IDM 2.0) in March 2021. The plan had three components: commitment to manufacture its own chips internally, continue expanding third-party relationships with other fab operators, and build its own competitive foundry business.

Intel has earmarked more than $100 billion in investments to realize the plan. That level of spending led to a reduction of two-thirds of the company’s quarterly dividend payment, cuts to executive pay, and layoffs. Since reaching a 12-month low in late February, however, Intel’s stock price doubled by the end of December. Investors appear to believe in Gelsinger’s plan and his ability to pull it off.

Intel is also divesting or spinning off businesses. Gelsinger has sold a minority stake in Mobileye and announced in October that it will spin off its programmable chip business. If, as Gelsinger hopes, Intel can attract customers to its new fabs and continue to develop its own chip designs, the company will end up much better off than it was just a year ago.

Much of the company’s future is based on massive investments that may or may not pay off. There are so many moving parts that forecasting can get complicated fast, or it can get simple. We like the second approach. Using an industry average price-to-earnings (P/E) multiple of 20x, estimated annual profit growth of 20% in each of the next seven years (2024-2030), and estimated 2024 EPS of $1.90, Intel’s share price in 2030 reaches $136 a share. That’s our base case.

In a Yahoo Finance interview in mid-December, Gelsinger said today’s $600 billion market for semiconductors could reach more than $1 trillion by 2030. He said that while he wants to compete on chip capabilities, he also wants to “manufacture all of Nvidia’s chips, all of AMD’s chips, as well as all of Intel’s chips going forward.” Intel calls this segment of its business foundry services and reports revenue and profit separately.

For fiscal 2022, Intel’s foundry services accounted for $895 million in revenue, about 1.5% of Intel’s total revenue for the year. In the first nine months of 2023, foundry revenue totaled $661 million, about 2.5x 2022’s revenue for the same period. If new foundries come online as planned and if Intel can corral a share of the global revenue going to TSMC and Samsung, Intel’s foundry revenue could explode. If Intel can nab even 20% of global foundry revenue, the company could easily live up to its current P/E multiple of nearly 30.

Once again, using estimated 2024 EPS of $1.90, we assume annual profit growth rises to 23% and the P/E multiple rises to 30x. The share price would reach about $186. That’s our bull case.

Fiscal 2023, while not a disaster, has been challenging for Intel. Its PC, data center, network, and foundry business lines are looking to finish the year with lower year-over-year results. Analysts see a nice rebound in 2024, with growth in data center (AI, storage, CPU), embedded (automotive), and networking (5G) demand.

In addition, Intel, under Gelsinger, has regained some of its technical leadership and invested heavily in its plan to expand its foundry services. Winning means beating competitors like Nvidia, TSMC, Samsung, and Qualcomm. That will be no easy task.

Starting once more with an estimated 2024 EPS of $1.90, we assume annual profit growth slips to 18% and the P/E multiple slides to 18. That implies a share price of about $109. That’s our bear case.

Retirement planning doesn’t have to feel overwhelming. The key is finding expert guidance—and SmartAsset’s simple quiz makes it easier than ever for you to connect with a vetted financial advisor.

Here’s how it works:

Why wait? Start building the retirement you’ve always dreamed of. Click here to get started today!

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.