In 2022, Robinhood launched its new IRA account options. As an online, mobile-first trading company primarily focused on serving younger, tech-savvy, customers who are wary of big banks and everything Wall Street, Robinhood has found enormous success positioning itself as the alternative to traditional trading. This success extends to their new retirement accounts. But how do these new account options compare to the IRAs offered by traditional banks or larger financial institutions? Is a Robinhood IRA right for you? Here is everything you need to know.

Background on Robinhood

Robinhood was founded in 2013 as a mobile-first electronic trading platform. Its name is based on its mission to “provide everyone with access to the financial markets, not just the wealthy”, which proved massively successful with younger and newer traders. It was a welcome alternative to traditional brokerages which, in typical Wall Street style, would charge trading fees of up to $10 per trade and require large account minimums while Robinhood did not.

Shortly after it launched, 80% of the app’s customers were millennials with an average age of 26. It went public in 2021 and subsequently launched its cryptocurrency division and IRA account options. It reached a peak valuation in 2021 of $58 billion, but after several lawsuits, fines, layoffs, and scandals, the value plummeted to just $6 billion in 2023. It has since rebounded a little, and is currently at about $13.5b.

Even after several controversies, the cheap and easy trading provided by Robinhood continues to be an attractive option for millions of casual and professional traders (and now savers) alike.

Robinhood’s Retirement Accounts Overview

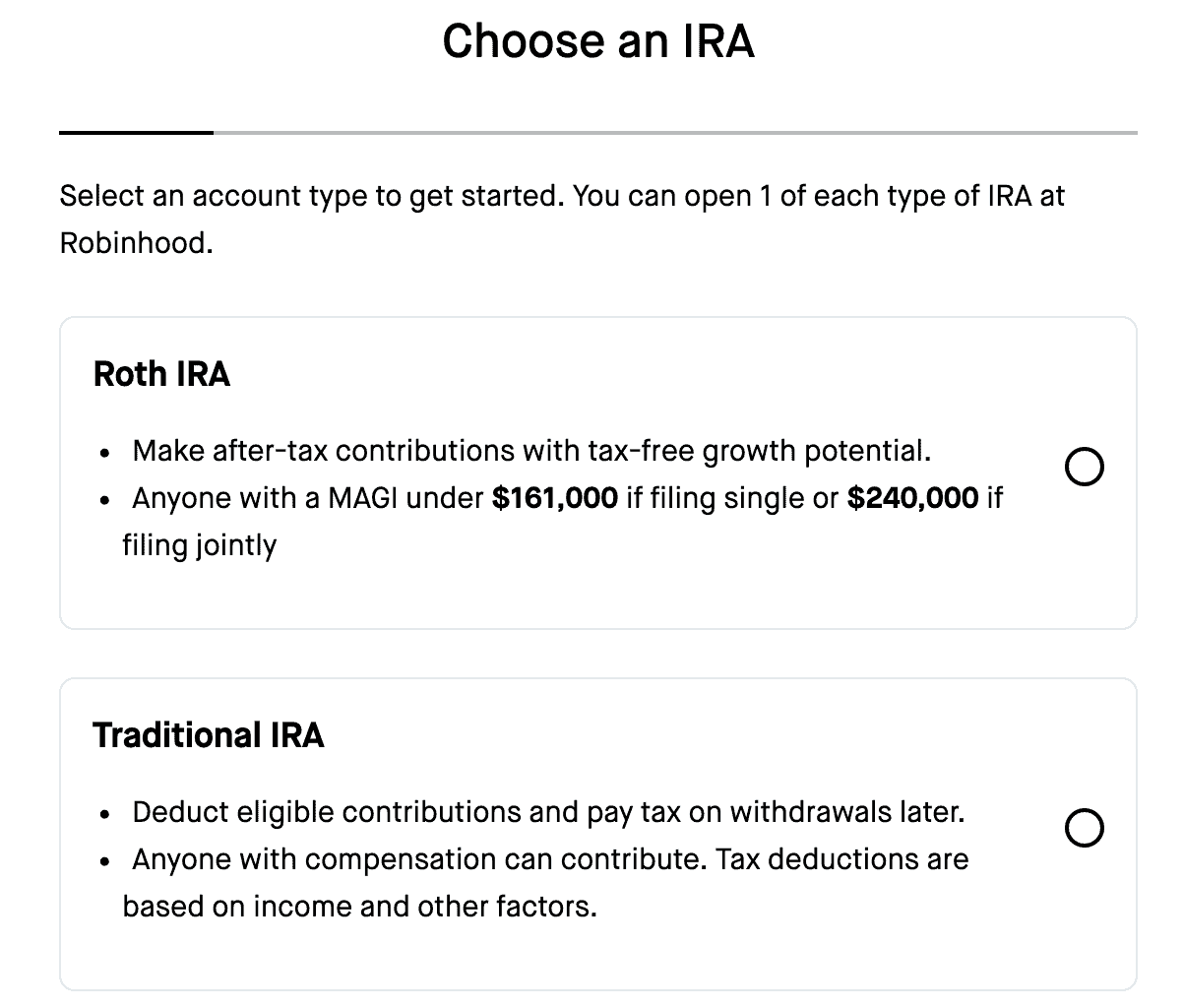

Robinhood offers both traditional IRA and Roth IRA options, and customers can open one of each, in addition to any other retirement accounts they may already have elsewhere. For each IRA, customers can choose between an IRA limited margin account or an IRA cash account. The IRA limited margin account allows customers to trade with the unsettled funds from their stock and options sales, while the cash account requires customers to wait up to two days after a sale to trade.

The function and tax benefits of traditional and Roth IRA accounts are determined by United States law, so they will be similar between companies and across accounts. Traditional IRAs allow you to invest in your retirement with pre-tax earnings. This lowers your tax burden now and defers the tax on your earnings until you withdraw the money during retirement. A Roth IRA account allows you to save for retirement with after-tax money. This means you can fund your account with money from any source if it has already been taxed and enjoy tax-free withdrawal during retirement.

In order to compete with larger successful retirement accounts, and convince customers to make the effort to transfer their existing retirement savings, Robinhood offers some of the most attractive investing benefits in the industry.

First, Robinhood offers a 3% contribution match for every dollar you contribute to your account if you have a Robinhood Gold account. If you have a free account, they will still match 1% of every dollar. Robinhood Gold costs $5.00 every month, with a free 30-day introductory period. If you contribute $500 to your Robinhood IRA every month, your Gold account will more than pay for itself, not including all the other benefits provided by Gold.

Starting in 2024, the IRS limits how much you can contribute to your retirement account to $7,000 if you are under 50. If you are 50 and over, the limit is $8,000. So, if you invest the maximum amount into your Robinhood account every year, a 1% match would earn you an extra $70-$80, while a 3% match would get you $210. It might not sound like a lot, but it’s 3% better than what you would have otherwise (and much more than other institutions that charge you for the privilege of investing with them).

Robinhood knows that most of its customers are new to investing, trading, and saving. That’s why, when you set up your new IRA account, it will ask you a few short questions about yourself and your investment goals to recommend a portfolio that meets your needs and goals.

Second, qualified account holders can also add options trading to their retirement accounts. These trades, similar to non-brokerage accounts, will have no commission or contract fees and can be completed in the same app.

The catch with Robinhood’s contribution match is that you need to keep your money in your account for five years before you can withdraw or use your matched funds. If you’re planning on using your money before five years pass, you won’t get those extra funds.

Aside from the Gold account cost, there is no account fee or low balance fee for Robinhood. The only requirements for opening a Robinhood IRA account are earned income, an existing Robinhood account, and being at least 18 years old.

How to get started

In order to get started with a Robinhood IRA, you will first need to download the Robinhood app and create an account. If you don’t have an existing IRA with another company, or you don’t want to transfer your account to Robinhood, all you need to do is follow three simple steps:

- In your account, select the Investing option.

- Choose whether you want a Traditional IRA or a Roth IRA.

- Select your account type from a limited margin account or cash account.

If you have an existing IRA on an employer-sponsored 401(k) that you want to transfer to Robinhood, you will need to complete a transfer (from an existing IRA) or a rollover (for a 401(k) plan).

To transfer your existing IRA:

- In the Robinhood app, select the Menu on the Retirement page.

- Go to IRA Setting, and then Transfer to an external IRA under the Actions option.

- Follow the instructions to initiate and complete the transfer.

The great thing about transferring to Robinhood is that they will reimburse any closing or transfer fees that your existing brokerage might charge you.

To initiate a rollover from your 401(k) to your new Robinhood IRA, you will need to contact your current account holder to begin the process. Every company will have different steps and requirements to complete a rollover, so make sure you understand the steps you need to complete to avoid unnecessary taxes and fees.

Robinhood IRA Accounts Verdict

Trying to find an ethical and moral financial institution to manage your money is an exercise in futility — you might as well pick one that pays you instead of the other way around.

Large companies bank on their customers setting up their retirement accounts and forgetting about them until they need them, while they earn a passive income on your hard work in the meantime. There are IRA options that don’t charge you, but none offer the same match that Robinhood does, as their 3% match is the largest in the industry even after considering the $5/month Gold fee.

In the author’s experience, Robinhood incentivizes its customers to trade often, this extends to options trading in your IRA account. This can put your savings at risk if you get too eager with risky trades. However, there is no obligation to do so. Customers are able to trade as little or as much as they want.

But what’s the downside? The main drawback for experienced investors is that you are limited in your investment options to just equities and options. If that doesn’t make a difference to you, then Robinhood is probably one of the best options for your retirement investments.

Other criticisms of Robinhood IRA accounts are about the company and not the accounts themselves. Older investors and industry veterans are heavily incentivized to promote and use IRAs offered by large companies and older institutions. The natural distrust of newer companies, especially those that operate primarily in an app, is strong in those opposed to anything besides the “set it and forget it” way of retirement saving.

Even in the face of a turbulent company history and dropping company value, we can’t help but recommend Robinhood’s IRA accounts to new investors. The ease of setup, seamless transition from saving to investing to trading, low cost, contribution match, and simple design make it an easy positive recommendation. In the end, all retirement savings are insured by the Securities Investor Protection Corporation (SIPC) which guarantees the value of all accounts up to $500,000.

If you’re curious about any other part of the Robinhood process, check out this page: a regularly updated list of all our Robinhood guides, news coverage, and lists of benefits.

Find a Qualified Financial Advisor (Sponsor)

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.