Planning for retirement can be stressful. How can you accurately predict how much money you will need after society has decided you have outlived your usefulness and isn’t willing to pay you anymore? Even the age at which retirement begins remains a question in the halls of greed and corruption we call Washington. How can you follow the advice of out-of-touch financial gurus who tell you to maximize your retirement savings now while you struggle to put food on the table?

If you get it wrong, you could see everything you’ve worked for shrivel away as you try to survive on Social Security, locked away in a nursing home because you sacrificed your family relationships to earn more money. On the other hand, you could maximize your retirement contributions all your life, scrimping and saving so you can live comfortably in a retirement you worked so hard for, only to pass on a year after retirement. No pressure.

The good thing is that there are some tools you can use to help mitigate at least some of the pressure you feel regarding saving for retirement. Among these tools is Robinhood’s 3% IRA match. But is it worth it? We’ve looked into Robinhood to find out. Here is everything you need to know about Robinhood’s IRA match, and how to get it.

All You Need to Know About Robinhood’s 3% Match

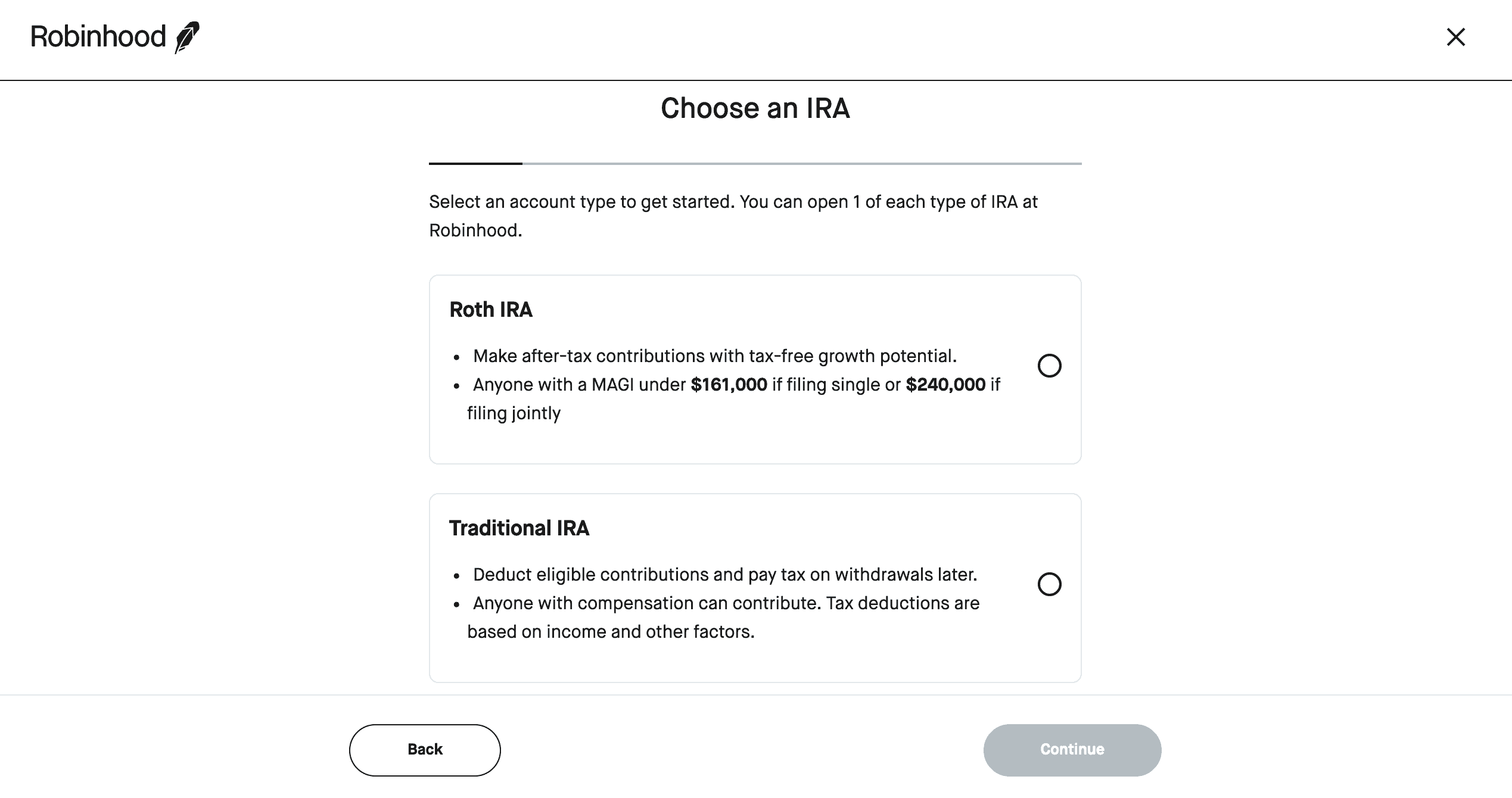

Robinhood offers two different IRA accounts: Roth IRA and Traditional IRA, and both accounts qualify for the 3% match you’ve seen advertised. However, it should be noted that the 3% is only available to those who pay for a Robinhood Gold subscription. All free accounts earn a 1% match.

The match also applies to any account transfers or rollovers. All accounts qualify for a 1% match for IRA rollovers and 401(k) transfers. At the time of the writing of this article, Robinhood also offers a 3% match for all account transfers and rollovers for Gold accounts. So, if you have $100,000 in an old retirement account, you can earn $3,000 just for transferring that to Robinhood and keeping it there for just $5 a month. This additional match for Gold is scheduled to end in April of 2024, however, and Robinhood has not said if it is planning to extend the program or replace it with additional Gold account benefits. (Read about transferring from E*Trade here).

There is no cap to the match on transfers or contributions.

This match does not contribute to the annual limit for IRA contributions set by the United States government. You can maximize your contributions and still earn extra money from the match.

Additionally, this match is different from your employer match, if your company matches your IRA contribution. You can have an employer retirement plan and a Robinhood IRA, and each will match separately.

If this is your first IRA, or you are simply learning about them so you can decide where you want to invest, you should know that IRAs are going to behave identically between financial institutions. They are heavily regulated (though, perhaps, not as much as they should be), and the biggest difference will come down to whether you pick a Roth IRA or a traditional IRA. Everything else about Robinhood’s IRA accounts is similar to other institutions. You can adjust your investments whenever you want without worrying about losing the match. Robinhood has a tool that can help you choose where to invest your IRA funds when you set up your account. Read more about Robinhood’s IRA accounts.

There are a few things you should keep in mind, of course.

Once you have signed up for Robinhood Gold, you immediately qualify for the 3% IRA match. However, you must keep your funds in your Robinhood IRA for five years and maintain your Robinhood Gold account during that time. If you do not, you will lose whatever match has been paid. If you do not have enough money to cover the cost, any shares you own will be automatically sold to make up the difference.

Also, you cannot downgrade your Gold account to a free account and keep the 3% match. If you do so, any extra funds from the match will be returned to Robinhood until you have what you would have earned with the default 1% match.

As with any investment opportunity, we strongly encourage you to complete your own research before making any decision.

So, Is The 3% Match Worth It?

This question depends entirely on how much money you plan to invest in your IRA account and how long you will have your account before you plan on using it.

Since you need a Robinhood Gold account to qualify for the 3% match, you will need to contribute enough money to your Robinhood IRA so that the match covers the cost. Robinhood Gold costs $60 a year ($5/month not including a free 30-day introductory period), so you will need to contribute $2,000 to your IRA account every year to break even. If plan on doing that, then the 3% match is definitely worth it. Any less than that, and you’re better off sticking with a free Robinhood account (which is better than some other IRA options since you will still earn a 1% match).

This also applies to the account transfer match. It’s not worth it to to get a 3% match when you transfer your IRA account to Robinhood just to be charged $5 every month if you’re not planning on making regular contributions. If you plan on making enough contributions to cover the Gold cost in the near future, then you should sign up for Gold before you initiate an account transfer.

If you plan on using the money in your IRA before five years have passed, then it is definitely not worth it since you will have to return any match you’ve received in the meantime. Plan on keeping your money there long-term to secure your gains.

How to Get Robinhood’s 3% IRA Match

In order to qualify for Robinhood’s 3% IRA match, you will first need to sign up for a Robinhood Gold account. (Read more about Robinhood Gold here). You should do this before opening or creating your IRA account.

First, download the Robinhood app on your smartphone and sign up for a free account, verify your identity, and link your bank account. Once your account is set up, sign up for Robinhood Gold under the Gold menu option. Robinhood will walk you through the steps necessary to complete this step.

Next, click on the Retirement menu option to set up your IRA account. You will do this whether this is your first IRA account or you plan on an account transfer or 401(k) rollover. Follow the on-screen prompts and select your preferences for your new account. You will be able to enable extra options for your IRA like limited margin trading with your IRA funds, but none of these are necessary to complete the process. Once set up, you will have the option to transfer outside funds and set up contributions.

That’s it! Now, you can contribute any amount to your account and Robinhood will automatically match your contributions. Happy saving!

If you’re curious about any other part of the Robinhood process, check out this page: a regularly updated list of all our Robinhood guides, news coverage, and lists of benefits.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Get started right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.