Investing

Want $10,000 in Passive Income? Invest $2,000 in Each of These Dividend Stocks

Published:

The inflationary environment over the past few years has constricted consumer buying power, resulting in supplementary income requirements by many. For those who cannot augment their paychecks with additional part-time jobs but have investment funds, dividend stocks are an option worth consideration. With the potential for capital appreciation along with the generation of passive income at yield rates sometimes exceeding comparably rated bonds, dividend stocks are available from a wide range of issuers.

We screened our 24/7 Wall St. dividend equity research database, looking for stocks that pay massive dividends, and we found a collection of companies that, combined, can generate over $10,000 a year in passive annual income if you invest just $2,000 in each stock at the time of this writing:

Based in Hamburg, Germany and celebrating its 177-year anniversary (founded in 1847), Hapag-Lloyd Aktiengesellschaft is the fifth largest shipping company in the world by TEU (twenty foot shipping container units) volume. With a fleet of over 250 cargo vessels, the company provides maritime transport of dry, specialized, hazardous, reefer, and conventional containerized cargo around the globe. Hapag-Lloyd also has developed electronic cargo monitoring platforms with secure data transmissions, and has established its own land operations for inland transportation of goods by rail or truck in numerous countries.

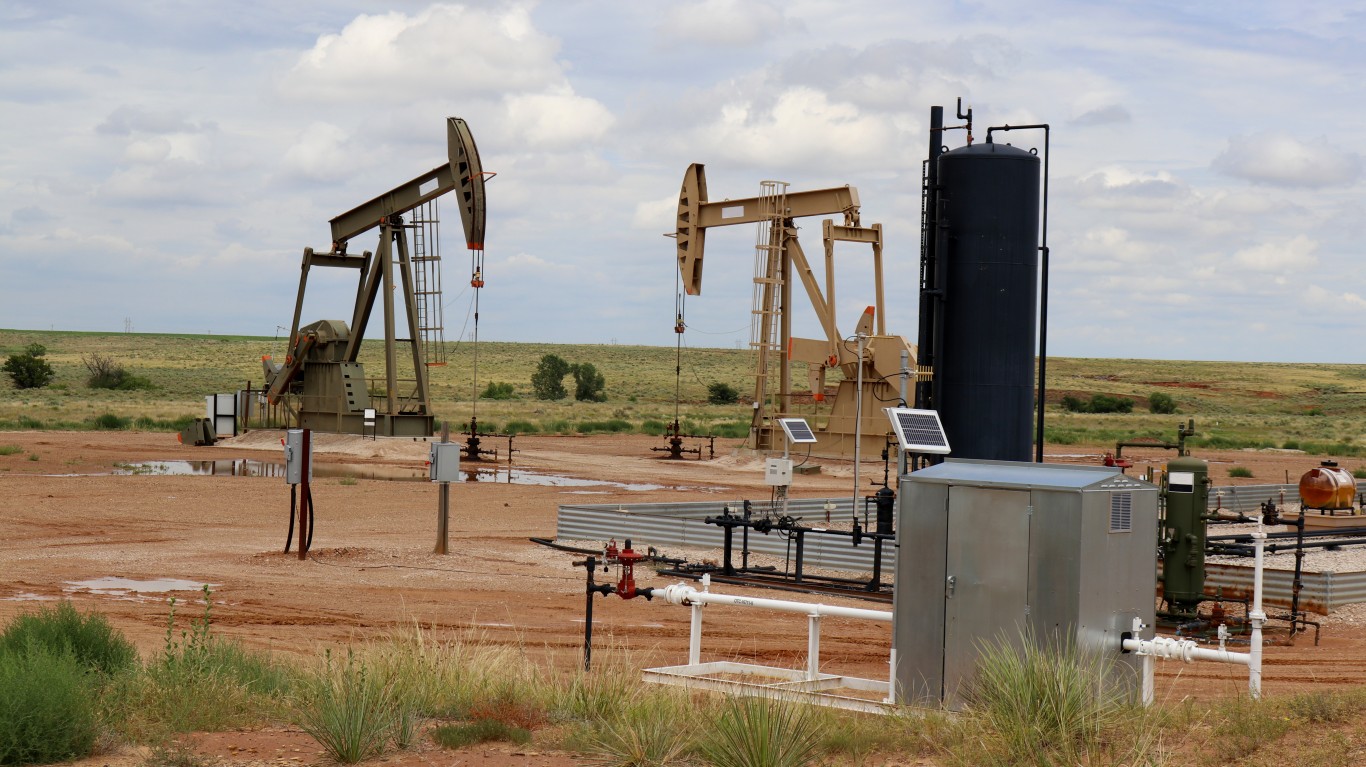

As the national oil company of Colombia, Ecopetrol is located in Bogotá and has operations in Colombia, the US, Asia, Europe, South America, Central America, and the Caribbean. In addition to oil and gas exploration, Ecopetrol transports, refines, and sells crude oil, refined fuels, petrochemical distillates, polypropylene resins and compounds, and natural gas. The company also is involved with power transmission and information technology.

Office Properties Income Trust is a Newton, MA headquartered REIT. OPI owns and manages leasing for a portfolio of 152 real estate properties equating to 20.5 million square feet across thirty states as well as Washington, D.C. (as of the end of 2023.)

Focusing on commercial office space, 64% of OPI’s revenue comes from investment grade-rated tenants from the insurance, financial, legal and other professional service sectors.

OPI recently closed a $300 million five year, 9% coupon bond offering in February, 2024, so investors appear to be comfortable with the company’s ability to continue to pay interest coupons. The common stock yield, at present, is more attractive by comparison.

CVR Partners is headquartered in Sugar Land, TX. The company produces and sells nitrogen-based ammonia and urea ammonium nitrate products for agricultural and industrial distributors and retailers for use in fertilizers for farming. There is some speculation that the recent riots and protests in the European farming sector may result in global food shortages that may increase demand for greater production from US farmers. If this were to occur, there would be subsequently greater demand for CVR fertilizer products.

Based in Tulsa, OK, Unit Corporation engages in drilling and exploration of oil and natural gas in the United States, and then manages wells once the underlying reserves have been tapped. Current primary producing wells are located in Oklahoma and Texas, with additional wells in Arkansas, North Dakota, Louisiana, and Kansas. Additional contract drilling services that Unit Corporation conducts for outside clients include the aforementioned states, along with Wyoming and New Mexico.

Unit Corporation’s other division handles natural gas acquisition, processing and treatment for third parties in Oklahoma, Texas, Pennsylvania, W. Virginia, and Kansas.

Eschewing the oil side of the energy business, Hamilton, Bermuda based Avance Gas Holding, Ltd. engages solely in Liquified Petroleum Gas (LPG). The company has 12 very large maritime cargo vessels equipped for LPG transport. Avance Gas did a re-financing in Q4 2023 with the announced sale of two dual-fuel LPG newbuildings (note: “newbuilding” is a newly built, or relatively completed ship in maritime construction parlance) for over $60 million each, with the proceeds applied to the current fleet.

A REIT operating out of Birmingham, AL, Medical Properties Trust focuses on the ownership and leasing of buildings for healthcare industry tenants. Leasing its 441 different properties to be used as facilities for hospitals, clinics, and other healthcare services related operations, Medical Properties Trust is the second largest non-government hospital property owner in the world. In addition to the US, Medical Properties Trust also owns hospitals in the UK, Switzerland, Spain, Germany, and other countries.

Legendary billionaire Carl Icahn has been involved in some landmark investment plays for over a half century. Icahn Enterprises, L.P. is the public vehicle he has used for managing some of the various portfolio assets he acquires to hold. IEP is divided into industrial sectors.

The Energy sector handles fuel and fertilizer assets. Automotive is involved with maintenance services and replacement part distribution. The Food Packaging division manufactures casings and other types of packing materials for processed meats. The Pharma sector manages products and services. Real Estate manages a country club and various real estate properties, along with a single-family home construction and sales branch. Finally, IEP’s Home Fashion division manufactures, sources, and markets home consumer products.

For the most part, IEP contains long term assets and businesses. While some of its holding might be publicly traded securities, it does not include some of Icahn’s speculations or stock plays, such as his recently announced stake in JetBlue Airlines.

Headquartered in Antwerp, Belgium, Euronav NV is ranked as the third largest oil tanker shipping company in the world, by revenues. In addition to its fleet of 155 maritime vessels, Euronav engages in floating, storage and offloading (FSO) crude oil related services.

Separate from crude oil transport, the company’s ship management services include, fleet management, technical services, defense management, environmental protection, commercial and operational management.

A proposed merger with rival Frontline (NYSE: FRO) (see listing below at #21) would have taken Euronav private, but that deal reportedly hit some stumbling blocks in October, 2023 due to ego differences between Frontline’s John Fredriksen and Euronav’s Saverys family, owner of CMB. It resulted in Frontline purchasing 24 VLCC (Very Large Crude Carrier) ships from Euronav for $2.35 billion and to sell back the 26% of shares it had accumulated to Euronav’s parent, CMB.

Another example of specialization in the shipping industry is 135 year old UK shipping company TORM plc. Headquartered in London and founded in 1889, TORM transports refined petroleum products, such as gasoline, jet fuel and naphtha, as well as fuel oil. Their 80 vessel fleet primarily ranges between 45,000 and 114,000 DWT (Dead Weight Tons), which classifies them in the LR1 (Long Range 1: 55,000-79,999 DWT) and LR2 (Long Range 2: 80,000-159,999 DWT) categories.

TORM acquired eight fuel efficient vessels in just the past year. These included four MR (Mid Range) vessels, roughly 8-9 years old, and eight LR2 vessels about 12 years old. Analysts covering TORM were impressed by this proactive approach to fleet management upgrades with an eye towards cutting fuel costs for the future.

Since limited legalization for medical and adult use in the US, the CBD end of the cannabis industry has spawned hundreds of entrepreneur-led new companies. Rather than participating in the cultivation, harvesting and processing of CBD products, AFC Gamma, Inc. engages in the finance of these companies. Underwriting and financing senior secured loans, alternative debt securities collateralized by real estate, equipment, licenses, and other types of tangible assets comprise the bulk of AFC Gamma’s business model. In February, 2024, the company announced that it would be spinning off its real estate finance investment business (roughly 25% of AFC Gamma’s overall portfolio) into a separate independent public company. The real estate finance is expected to file for REIT status.

Based in Rio de Janeiro, Brazil, Petróleo Brasileiro S.A. – better known as Petrobras, is the national oil company of Brazil. The company has three broad divisions:

Baltimore, MD based Medifast is the parent company that produces and markets an entire catalog of weight-loss based foods and products under the brand names OPTAVIA, OPTAVIA ACTIVE, and Optimal Health. The foods range from shakes, drinks, and puddings to cereals, soups, baked goods, and even pancakes. They are sold via point-of-sale or on ecommerce in both the US and Pacific Rim.

Incorporated in 2008, Vero Beach, FL based ARMOUR Residential REIT, Inc. is a securities based REIT. Its portfolio is predominantly US Government Sponsored Entity mortgage-backed bonds. GNMA, FDMC and FNMA bonds and comparable issues comprise the bulk of the holdings, with a small percentage of non GSE residential mortgage securities.

Formerly known as American Capital Agency Corp., Bethesda, MD headquartered AGNC Investment Corp. changed its name in 2016. AGNC Investment Corp. is another REIT that primarily invests in collateral mortgage obligations, such as Fannie Mae and Freddie Mac. Although earnings growth appears to have stalled, institutional ownership remains fairly strong. Hedge fund Centiva Capital has the largest institutional fund ownership position to date, with 1.4 million shares as of the 2023 end of the fourth quarter.

As one of the largest thermal and metallurgical coal producers in the United States, Tulsa, OK centered Alliance Resource Partners, L.P. has mining production, sales, energy royalties, and technological mining services and products divisions. Services and products include data communication, tracking, collision avoidance, proximity detection, products, services and analytical software.

Presently, the 24-year old company operates underground coal mines in Illinois, Indiana, West Virginia, Maryland, and Pennsylvania. Alliance Resource Partners also owns 1.5 million oil and gas producing acres of land in the Anadarko, Permian and Williston Basins.

Online veterinary pharmacy PetMed Express, Inc. offers prescription and non-prescription medications and other health related supplies for dogs, cats and horses. Based in Delray Beach, FL, PetMed Express also competes with PetSmart, PetCo and similar retailers in offering pet food, beds, supplies, and other pet products.

Hedge Fund Renaissance Technologies recently announced in mid-February, 2024 that it had added another 328,000 shares of PETS to its portfolio, increasing its total stake to 6.36%.

Founded in 1987 in Glen Allen, VA, Dynex Capital, Inc. is a REIT that invests in a mix of GSE mortgage-backed securities, such as FDMC, as well as non agency ones.

In the past year, insider buying from Dynex executives increased significantly, with Executive V.P. Robert Colligan the largest buyer, adding $97,000 worth of stock to his holdings.

One of the few high dividend green energy companies stocks, NextEra Energy Partners, LP is based in Juno Beach, FL. The company’s holdings include solar, wind, and battery storage green technology assets, in addition to natural gas pipeline assets.

NextEra Energy, Inc. (NYSE: NEE), founded in 1925, is the parent company. It is a regulated electric power utility in Florida.

Participating in both the private corporate debt and equity markets, Stellus Capital Investment Corp. looks to make financing deals for North American companies with EBITDA between $5 million and $50 million. Financings may manifest in several configurations, such as first lien, second lien, unitranche, and mezzanine debt, often accompanied with an equity portion.

Registered in Cyprus, Frontline plc is also in the crude oil tanker shipping business. Founded in 1985 and is controlled by shipping tycoon John Fredriksen. The company has a 70 vessel fleet and is rated fifth in the industry globally by revenue.

Frontline EBIT has been strong, growing its margins from 19% to 43% over the past year. This helped to fuel its purchase of 24 VLCC ships from Euronav NV, along with selling back a sizable block of accumulated Euronav shares after merger talks collapsed in Q3 2023.

For 148 years, Houston, TX based Black Stone Minerals, L.P. has been in the natural resources business. Although its roots are in the lumber business, the company expanded to include mineral royalties, along with oil and gas drilling, in the 1960s. In 1998, they left timber, oil, and gas to focus on mineral rights and land acquisitions. It is one of the largest mineral rights companies in the US.

With ownership of five gold mine properties in Nevada, Fortitude Gold Corporation is a gold and silver mining company headquartered out of Colorado Springs, CO. Their flagship project is the Isabella Pearl, which is 9,000 acres. Proven reserves can potentially yield up to 220,000 oz. of gold and 1.3 million oz. of silver. Dividends are paid monthly.

Ensconced in the venture debt and growth capital space, Hercules Capital supplies capital to all types of private companies from the start-up stage all the way up to pre-IPO stage and, in certain situations, beyond. The financing can take a wide range of configurations, including venture or mezzanine debt, secured loans, asset backed credit lines, and other structures. Hercules Capital operates out of Palo Alto, CA.

With a preference towards the technology, biotech, healthcare, cleantech, and sustainability sectors, Farmington, CT headquartered Horizon Technology Finance Corp. provides venture and secured debt financing structures to qualifying growth-stage companies.

Civitas Resources, Inc. drills for and produces oil and gas in the Rocky Mountain region. The company’s primary business is in the Colorado Denver-Julesburg Basin’s Wattenberg Field.

In January, Civitas announced the acquisition of additional oil and gas assets in Texas from Vencer Energy, LLC.

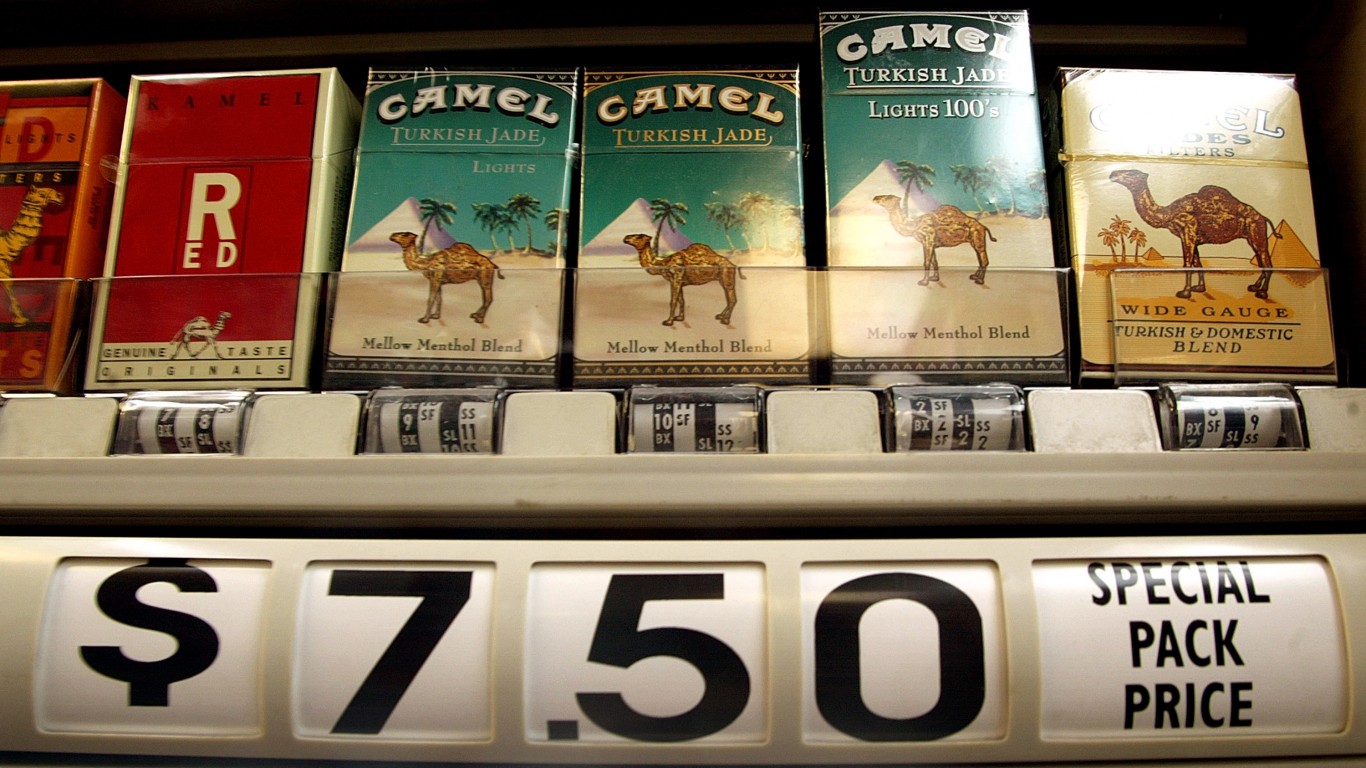

Altria’s Marlboro cigarettes are an internationally recognized American brand, and the 200 year old tobacco company has a long history, weathering the negative publicity inherent with tobacco’s medical study links to lung cancer, nicotine addiction, and disfavor from the ESG policies of institutional funds.

From a dividend growth perspective, the Richmond, VA based company has consistently increased dividends 54 times in 58 years to the present, with a 4.3% hike made just last year.

One of the main competitors to #27 Altria Group above, British American Tobacco plc is based in London, England. Its international tobacco brands are well known throughout the US, UK, China and Europe under brand names like: Camel, Lucky Strike, Dunhill, Kent, Newport, Shuang Xi, and others.

Ares Capital Corporation is an asset management company that engages in a wide range of activities, including, but not limited to, acquisitions, leveraged buyouts, debt financings, restructurings, rescue financings, and resales. With a stated preference towards manufacturing companies, Ares is otherwise industry agnostic.

Ares’ investment range per deal is between $20 million to $200 million or half that if debt, for companies with EBITDA between $10 million and $250 million.

A subsidiary of Marathon Petroleum, Findlay, OH based MPLX LP is an oil and gas midstream company engaged in gathering, processing, storage, transport, pipeline logistics, and other related services for oil, refined oil products, and natural gas in its different forms.

| Company | Yield | Annual Dividend Payment | ||

| Hapag-Lloyd Aktiengesellschaft (OTC:HLAGF) | 47.88% | $957.60 | ||

| Ecopetrol, S.A. (NYSE: EC) | 27.78% | $555.80 | ||

| Office Properties Income Trust (NASDAQ: OPI) | 26.67% | $533.40 | ||

| CVR Partners, L.P. (NYSE: UAN) | 25.60% | $512.00 | ||

| Unit Corporation (OTC: UNTC) | 25.03% | $500.60 | ||

| Avance Gas Holding, Ltd.(OTC: AVACF) | 23.11% | $462.20 | ||

| Medical Properties Trust, Inc. (NASDAQ: MPW) | 22.92% | $458.40 | ||

| Icahn Enterprises, L.P. (NASDAQ: IEP) | 20.89% | $417.80 | ||

| Euronav NV (NYSE: EURN) | 17.86% | $357.20 | ||

| TORM plc (NASDAQ: TRMD) | 17.20% | $344.00 | ||

| AFC Gamma, Inc. (NASDAQ: AFCG) | 17.08% | $341.60 | ||

| Petróleo Brasileiro S.A. – Petrobras (NYSE: PBR) | 16.63% | $332.60 | ||

| Medifast, Inc. (NYSE: MED) | 16.27% | $325.40 | ||

| ARMOUR Residential REIT, Inc. (NYSE: ARR) | 15.29% | $305.80 | ||

| AGNC Investment Corp. (NASDAQ: AGNC) | 15.09% | $301.80 | ||

| Alliance Resource Partners, L.P. (NASDAQ: ARLP) | 14.81% | $296.20 | ||

| PetMed Express, Inc. (NASDAQ: PETS) | 13.07% | $261.40 | ||

| Dynex Capital, Inc. (NYSE: DX) | 12.83% | $256.60 | ||

| NextEra Energy Partners, LP (NYSE: NEP) | 13.04% | $260.80 | ||

| Stellus Capital Investment Corp. (NYSE: SCM) | 12.58% | $246.80 | ||

| Frontline plc (NYSE: FRO) | 12.39% | $247.80 | ||

| Black Stone Minerals, L.P. (NYSE: BSM) | 12.34% | $246.80 | ||

| Fortitude Gold Corporation (OTC: FTCO) | 10.74% | $214.80 | ||

| Hercules Capital, Inc. (NYSE: HTGC) | 10.55% | $211.00 | ||

| Horizon Technology Finance Corp. (NASDAQ: HRZN) | 10.15% | $203.00 | ||

| Civitas Resources, Inc. (NYSE:CIVI) | 10.10% | $202.00 | ||

| Altria Group, Inc. (NYSE: MO) | 9.63% | $192.60 | ||

| British American Tobacco PLC (NYSE: BTI) | 9.87% | $197.40 | ||

| Ares Capital Corporation (NASDAQ: ARCC) | 9.57% | $191.40 | ||

| MPLX LP (NYSE:MPLX) | 8.57% | $171.40 | ||

| Total: | $10,105.00 |

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.