Investing

How To Move Your Account (ACATS) From TD Ameritrade To Robinhood

Published:

Last Updated:

So, you’ve been looking around and you decided that it’s time to be more active in your investments. During your investigations, you might have stumbled upon Robinhood and realized that you’re leaving free money on the table by keeping your money with TD Ameritrade (NYSE:AMTD). You’re not alone.

Robinhood has been massively successful by offering low-cost investment and trading options with a clean, easy-to-use interface, and generous account benefits. If you’ve been debating how to begin the process of transferring your account from TD Ameritrade to Robinhood, the good news is that it’s far easier than you might expect, and Robinhood will reward you for your efforts, like with a free money match. This is everything you need to know about how to move your account from TD Ameritrade to Robinhood.

Whether you should transfer your account to Robinhood depends a lot on your goals as a trader and what you want to do with your assets or investments.

Following Robinhood’s success, many brokers eliminated their commission fees for their customers in 2019, including TD Ameritrade. So, the cost of trading on their platform is similar if all you want to do is trade stocks. The primary differences are the tools available to traders, the range of available stocks, and account benefits.

Robinhood has a much smaller list of stocks available for trade and fewer tools for professional and experienced traders, but it does offer a streamlined service, lower margin rates, and attractive account benefits.

For example, Robinhood offers a 1% contribution match for all IRA accounts, and a 3% match for Robinhood Gold IRA accounts (see our review of Robinhood’s IRA accounts here). In order to qualify for the higher match, you have to pay for Robinhood Gold, which costs $5 every month, but it includes other benefits and analysis tools for more experienced traders. You can see if paying for the higher 3% match is right for you in our review. Robinhood also has a generous referral program, offers free stock for opening a new account, and pays a much higher interest rate on uninvested cash through its Cash Sweep program. See how much your uninvested cash can earn through the Cash Sweep program.

If you think Robinhood is a better match for you, all you need to do is initiate an ACATS request through Robinhood.

ACATS (or ACAT) stands for Automated Customer Account Transfer Service and is a nearly entirely automated and electronic service used for transferring securities between financial institutions. It is a service offered by the Depository Trust & Clearing Corporation, which is a private company owned by all the participating banks and financial companies that make use of the ACAT service. It manages a vast majority of all the securities transactions and transfers in the United States.

The great thing about ACATS is that you don’t need to know anything about it to make use of the service. There are no physical forms you need to fill out, and most of the work is done on your behalf as long as you provide the correct information about your accounts.

You will make an ACATS request within the Robinhood app and, if you fill in your information correctly, you will see all your transferable securities appear in your Robinhood account within seven business days.

Some brokers will charge you a fee for transferring your account away from them (which is only to dissuade you from leaving or to punish you for doing so, since the ACATS process is almost entirely automated). Robinhood will reimburse any transfer fee up to $75 per transfer for transfers of more than $7,500.

If you don’t already have a Robinhood account, that should be your first step. An ACATS request will not automatically create a new account for you (and, in fact, you cannot initiate an ACATS process without one). All you need to create an account is a valid form of ID that proves you are at least 18 years old and a citizen of the United States. You will also need to link your bank account. You can complete this process in the Robinhood app or on the website.

There are a few things you should do before you initiate an ACATS request, of course. First, you should verify your TD Ameritrade account information. This includes your account number and the name associated with your account. If the name on the account is different from the name on your Robinhood account, the transfer request will be denied. Second, you should verify which assets you want to transfer and make sure that Robinhood will accept them.

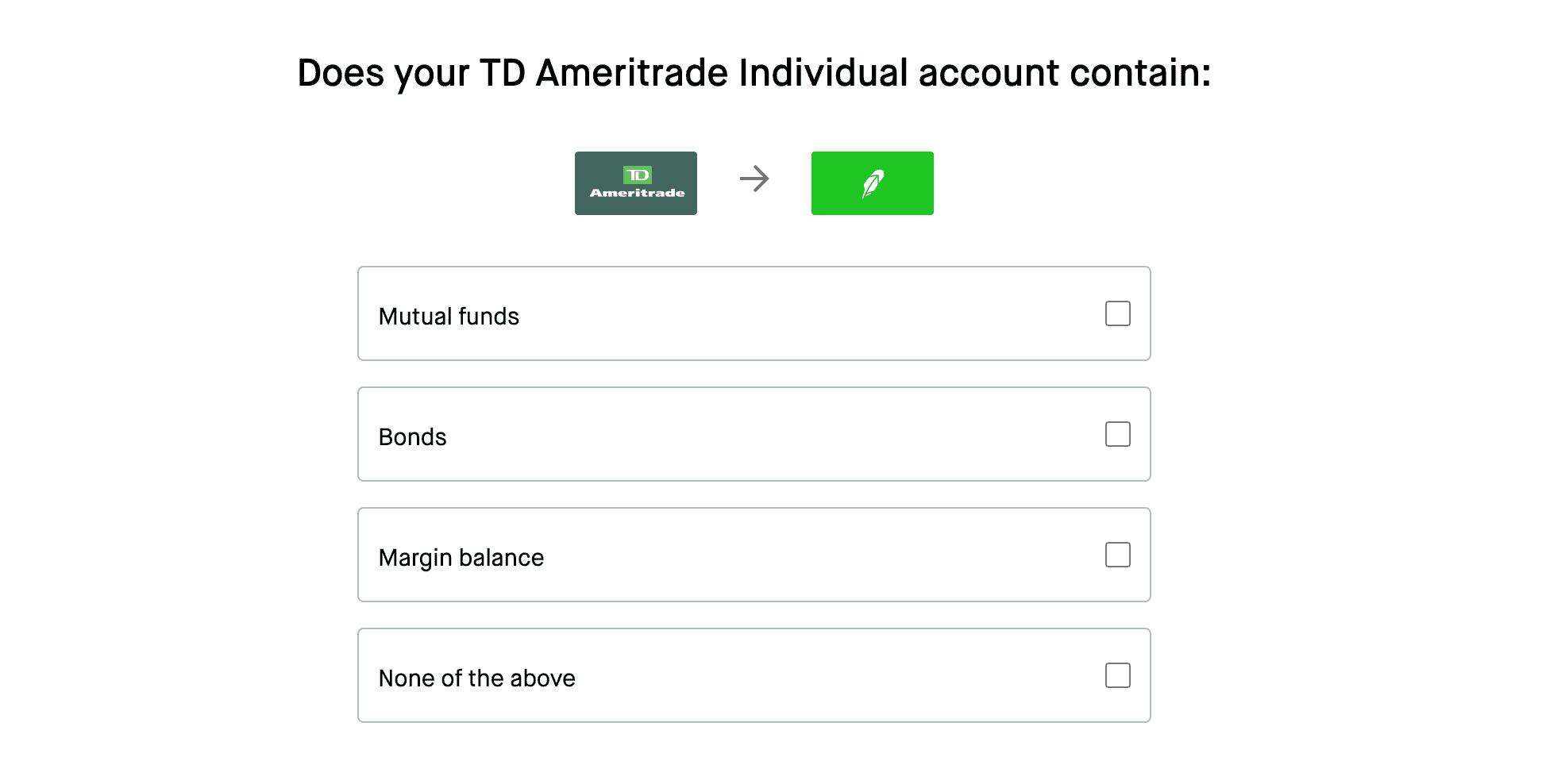

You can transfer ETFs, cash balances, options contracts that don’t expire within seven days, margin balances (if you have an account with margin trading enabled), and most stocks. If Robinhood doesn’t have a particular stock available for trade on its platform, you cannot transfer that stock into your account. If you have a large amount of securities with TD Ameritrade, it is important you do this verification to save significant time and frustration later.

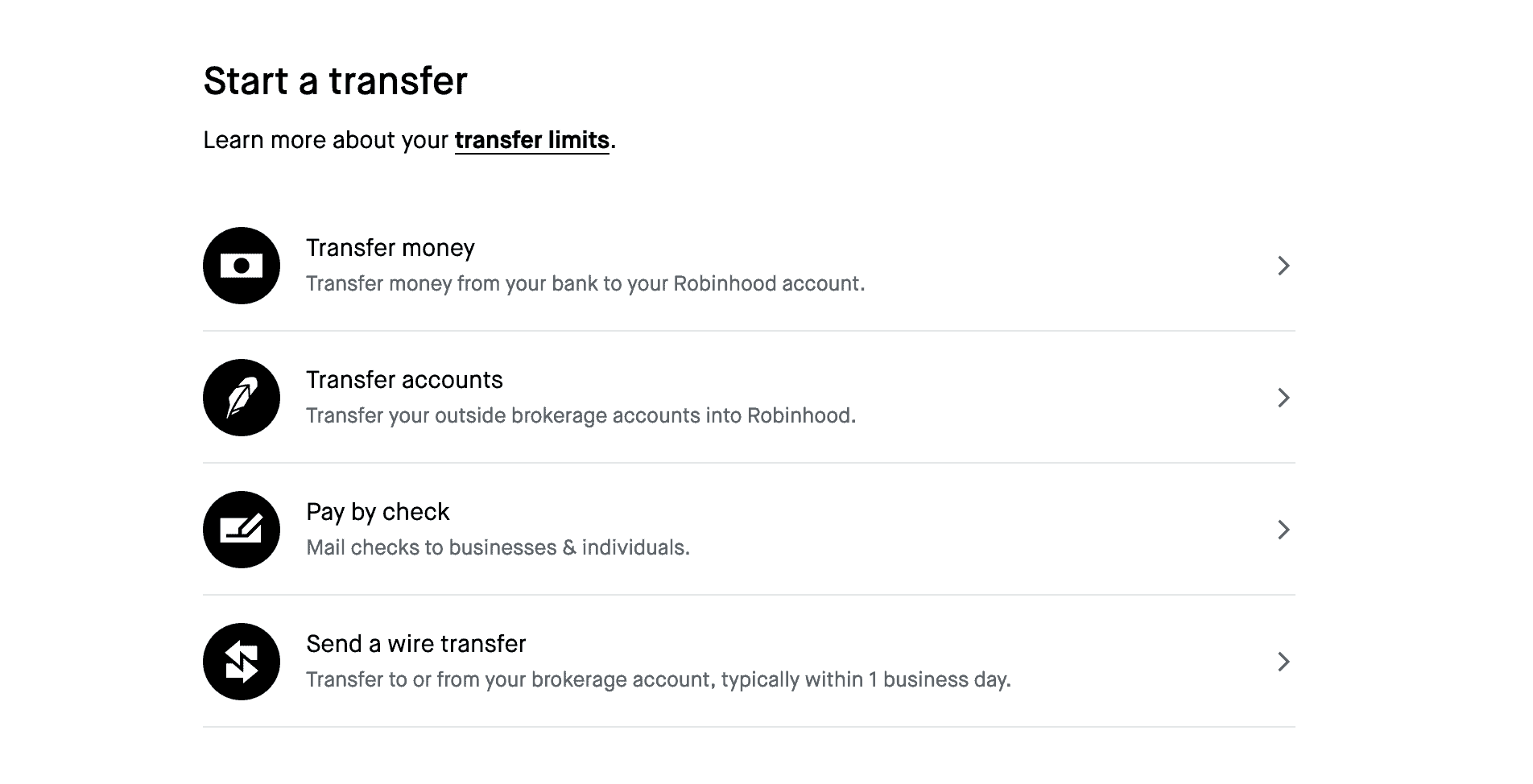

Now the fun begins. Within the app or the website, go to the account page (in the app, this is the person icon on the bottom right). You will see several options for managing your Robinhood account, you will want to select the Transfers option. There will be a few different transfers you can pick from, we want to click on Transfer accounts.

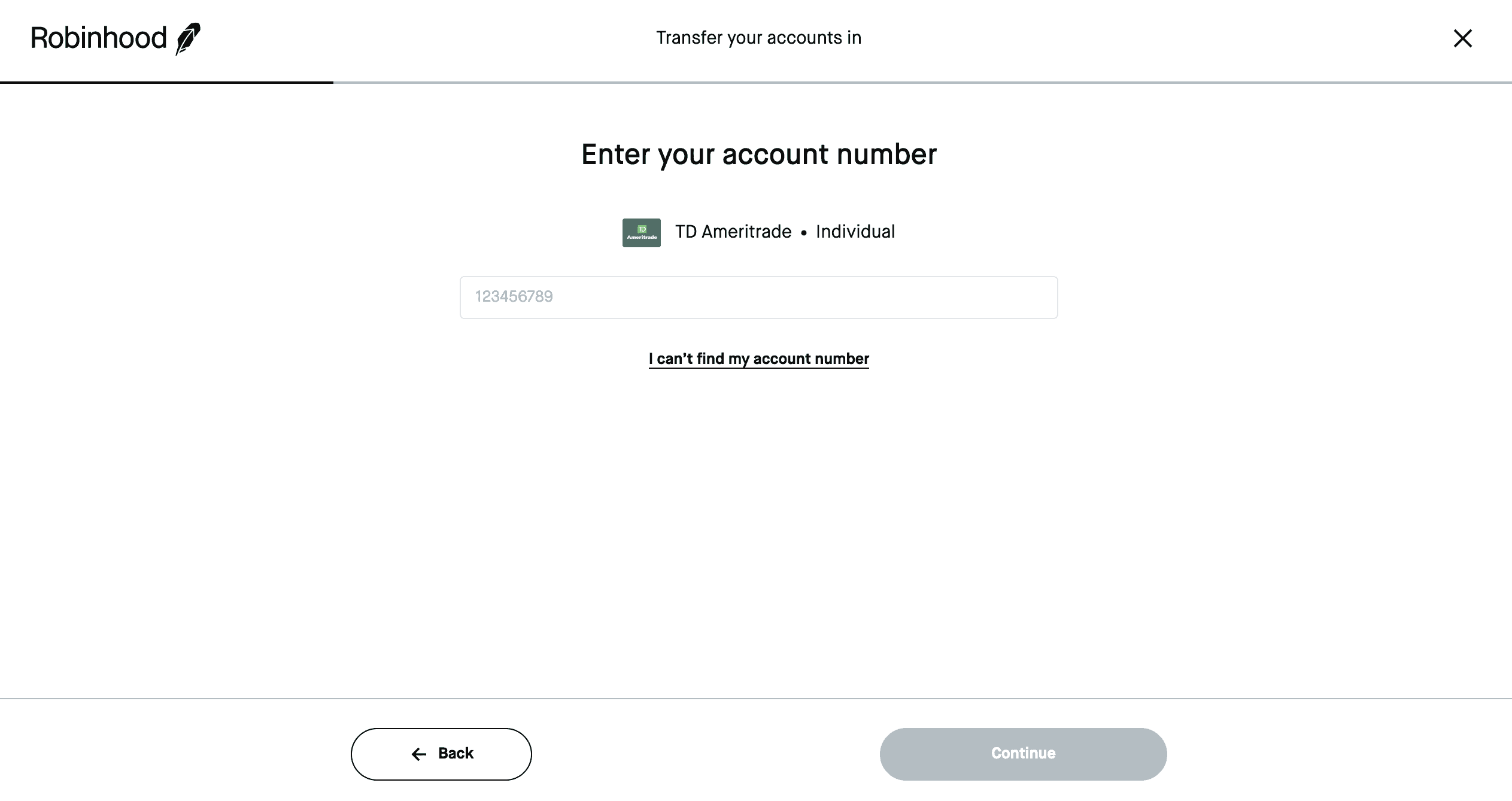

You will be presented with a list of financial institutions. Select TD Ameritrade and type in your account number. Make sure the number is correct. You will then type your name. Make sure it matches the name on both accounts. Any error here will result in your ACATS request being denied.

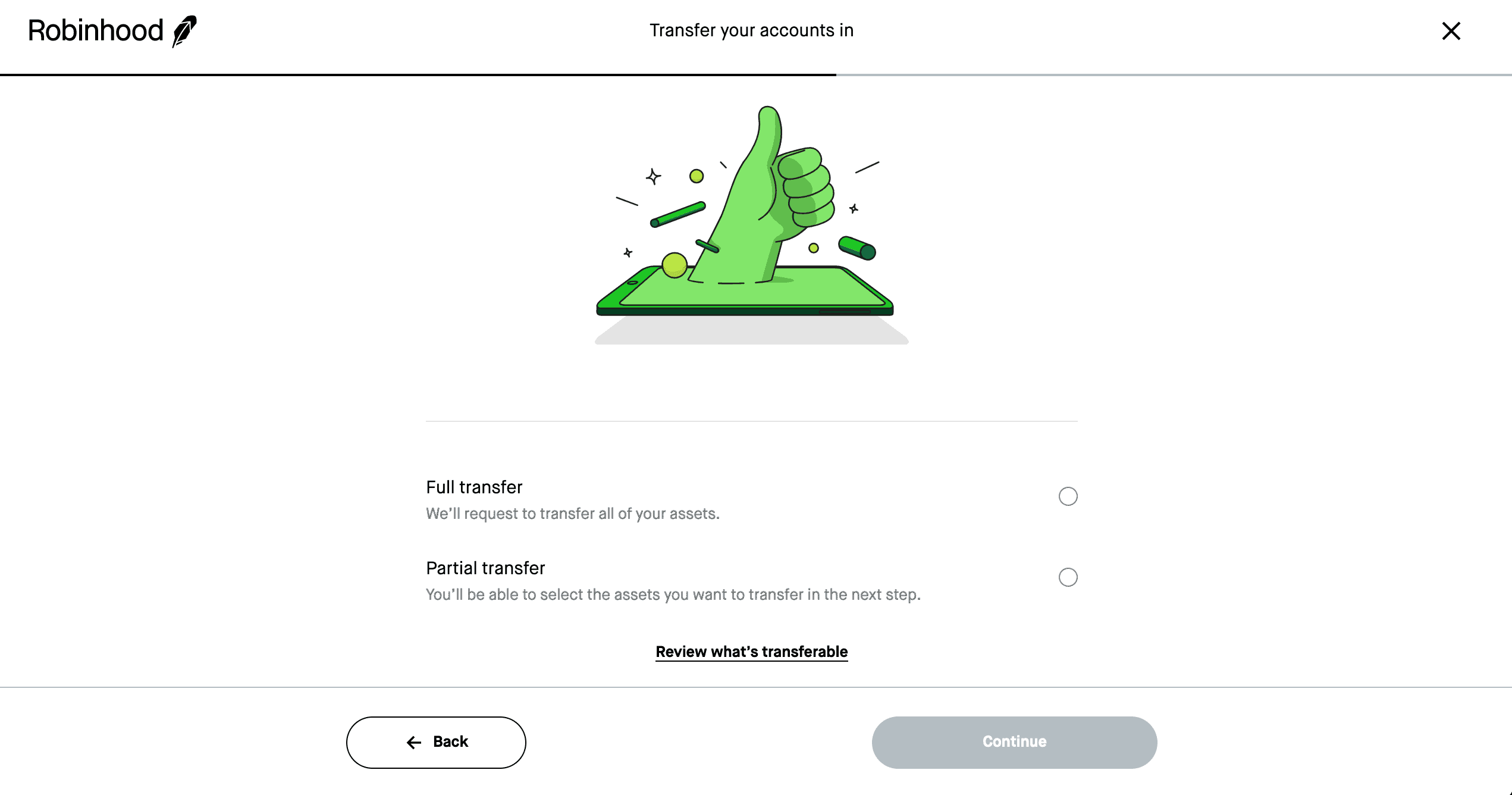

From here you will define the scope of your ACATS request. Robinhood is able to process full and partial account transfers. If you have assets with TD Ameritrade that Robinhood won’t accept, you will need to select partial account transfer. Within the options for the partial account transfer, select only the assets you want to transfer. Otherwise, you can select full account transfer.

Continue following the prompts and you can complete the process in a matter of minutes. After this point, the process is largely out of your hands. Robinhood will send the request to TD Ameritrade, which will accept or reject the request. This usually takes a couple of days, and once it is accepted, any assets being transferred will become unavailable until they appear in your Robinhood account. The entire process can take anywhere from five to seven business days (there is no real reason for this delay, other than companies wanting to squeeze just a little bit more value out of your assets before letting them go).

If you filled in all the details correctly, all you have to do is wait until the process is complete. You will have to close your TD Ameritrade account manually once you are done since the ACATS does not automatically do this for you.

Keep in mind that you can’t cancel an ACATS request once it has been sent to TD Ameritrade, so make sure this is what you want to do before finishing the process. Once it is in process you can track the status of your request within your transfer history in Robinhood.

If your request was rejected, it is usually because of one of a few common issues: you entered your account information incorrectly, or you are trying to transfer ineligible assets. If just one of the assets you are trying to transfer isn’t transferable, the entire ACATS request will be rejected. If you are trying to transfer a margin balance, you must make sure that your account has been approved for margin investing. If you are trying to transfer options from TD Ameritrade, you need to sign up for options trading before initiating a transfer request.

If you are an active trader, you might have multiple accounts at different institutions. Learn how to transfer your account from Fidelity Investments, or transfer your account from E*Trade.

If you’re curious about any other part of the Robinhood process, check out this page: a regularly updated list of all our Robinhood guides, news coverage, and lists of benefits.

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.