Many investors, including more aggressive traders, look at lower-priced stocks with growth prospects as a way both to make some good money and to get a higher share count. That can really help the decision-making process, especially when investors are on to a winner. Then they can always sell half and keep half.

We screened our 24/7 Wall St. equity research database, looking for inexpensive stocks that analysts project will grow 33% or more in the next 12 months. We found three that fit the bill perfectly, plus they are expected to have positive earnings growth in the next five years, and they come with dividends.

Here are three cheap growth stocks. That is, they trade for less than $5 apiece and are expected to soar at least 33% this year.

B2Gold

- Stock: B2Gold Corp. (NYSE: BTG)

- Mean price target: $4.25

- Upside potential: 61.6%

This Vancouver-based gold producer operates the Fekola mine in Mali, the Masbate mine in the Philippines, and the Otjikoto mine in Namibia. It also has a 100% interest in the Gramalote gold project in Colombia, as well as a portfolio of other evaluation and exploration assets in Mali and Finland. In the most recently reported quarter, B2Gold said the Fekola, Masbate, and Otjikoto mines had exceeded their expected production, and construction at the Goose project in Nunavut, Canada, was ahead of schedule. (These countries have most of the world’s gold.)

The stock peaked near $7 a share in the summer of 2020. The share price is around 21% lower than a year ago and down more than 16% year to date. The consensus price target is less than the 52-week high of $4.40, but analysts on average recommend buying the shares. A little over 1% of the shares are sold short, and the dividend yield is about 6%.

Nordic American Tankers

- Stock: Nordic American Tankers Ltd. (NYSE: NAT)

- Mean price target: $6.20

- Upside potential: 53.5%

This Bermuda-based tanker company acquires and charters double-hull tankers globally. It operates a fleet of about 20 Suezmax crude oil tankers. The company reports that U.S. exports and Chinese imports are both increasing, and geopolitical concerns in the Middle East have driven up demand. Also, the company has less debt than its competitors.

The stock ended 2023 more than 37% higher year over year, outperforming the S&P 500. Year to date, however, the share price is less than 4% lower. The analyst’s mean price target would be a multiyear high. The stock’s all-time high is above $54 per share. Short interest is less than 2%, and the dividend is a hefty 11.7%.

Martin Midstream Partners

- Stock: Martin Midstream Partners L.P. (NASDAQ: MMLP)

- Mean price target: $3.50

- Upside potential: 35.1%

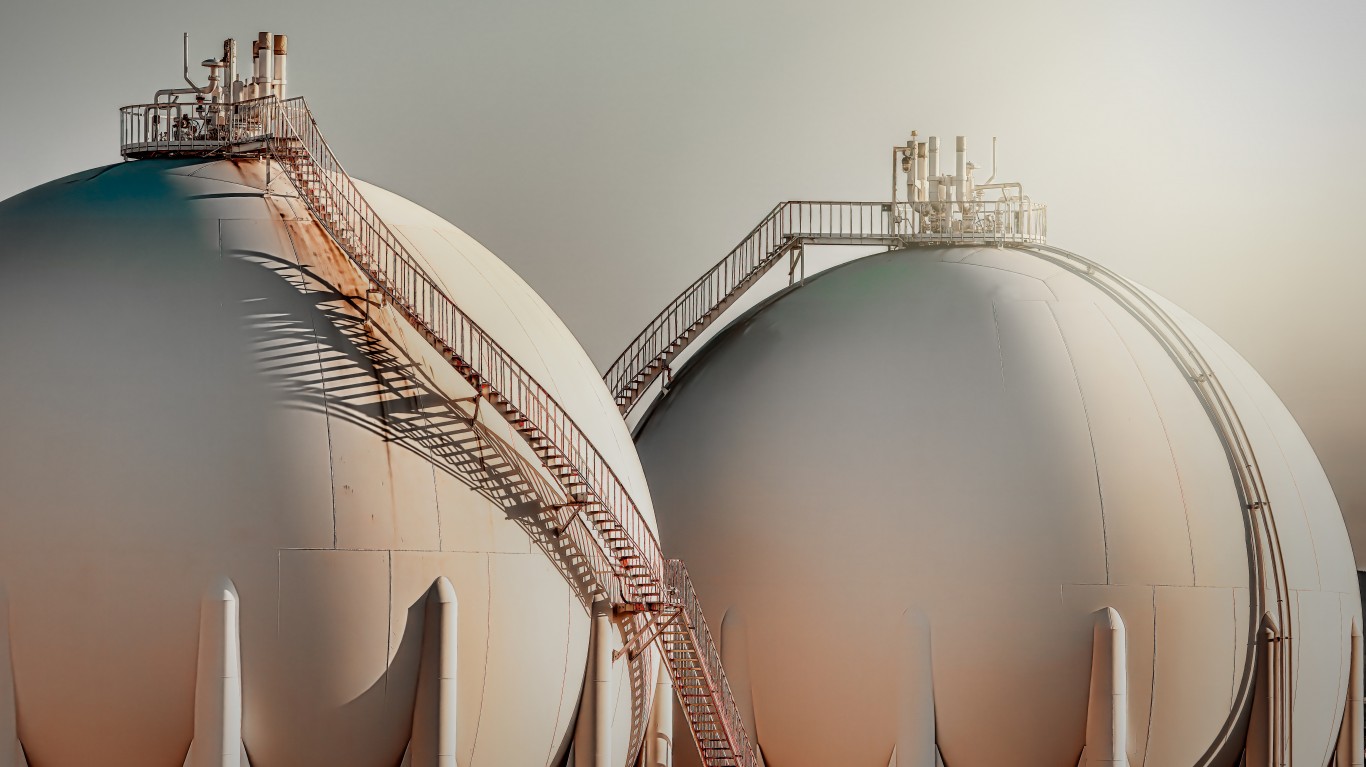

The Texas-based company provides terminalling, processing, storage, and packaging services for petroleum products and by-products primarily in the United States. Its Terminalling and Storage segment owns or operates various marine shore-based terminal facilities and specialty terminal facilities. The Transportation segment operates various trucks and tank trailers, inland marine tank barges, inland push boats, and articulated offshore tug and barge units. The Sulfur Services segment processes molten sulfur. And its Specialty Products segment stores, distributes, and transports natural gas liquids. The company recently posted strong fourth-quarter results for a year in which debt reduction was management’s focus.

Though the share price is less than 7% lower than a year ago, the stock is up about 8% since the beginning of the year, outperforming the broader markets due to its earnings report. That $3.50 price target would be a new 52-week high. The all-time high is above $46 a share. Analysts are cautious, though, with only three of nine having Buy ratings. The CEO, CFO, and other insiders have been buying small batches of shares this year. The short interest is less than 1%, and the dividend yield is about 0.8%.

Are You Still Paying With a Debit Card?

The average American spends $17,274 on debit cards a year, and it’s a HUGE mistake. First, debit cards don’t have the same fraud protections as credit cards. Once your money is gone, it’s gone. But more importantly you can actually get something back from this spending every time you swipe.

Issuers are handing out wild bonuses right now. With some you can earn up to 5% back on every purchase. That’s like getting a 5% discount on everything you buy!

Our top pick is kind of hard to imagine. Not only does it pay up to 5% back, it also includes a $200 cash back reward in the first six months, a 0% intro APR, and…. $0 annual fee. It’s quite literally free money for any one that uses a card regularly. Click here to learn more!

Flywheel Publishing has partnered with CardRatings to provide coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.