Stock trading used to be the domain of the wealthy and connected. Retirement savings used to be something you set up once and forget about. With the advent of Robinhood in 2015, all that changed. Now, anyone can trade stock for free and compare different companies for their retirement needs. The ability to transfer accounts from one broker to another has made it even better for consumers to find the right company for them without feeling like they’re stuck with one forever.

Whether or not you’re an experienced trader, you’ve probably seen Robinhood’s ads online and wondered whether they’re a better trading platform than the one you use. If you’re worried that you might be missing out on free money by not using Robinhood, you’re not alone. In this article, we will list out the reasons you might want to transfer to Robinhood, and how to do so if you currently have an account with Charles Schwab (NYSE:SCHW).

What is Robinhood?

Robinhood is an online trading and investment platform that launched with a smartphone app in 2015. It offered commission-free trades, no minimum account balances, and no account fees for basic trading. It eventually added the ability to trade cryptocurrency and invest in IRAs. This includes a generous 3% IRA match.

It exploded in popularity, adding millions of users in just a couple of years. It was so successful, in fact, that many other brokers had to eliminate their own trading fees in 2019 (some were charging up to $10 for every trade) and cited Robinhood as the reason for the change.

The majority of Robinhood’s users are millennials and first-time traders. The sleek, simple, and easy-to-use design of the app made it an attractive choice for those who wanted to try their hand at trading stock.

Why Transfer Your Account to Robinhood?

Whether or not Robinhood is a better alternative for you than Charles Schwab depends very much on your goals as a trader and an investor.

Charles Schwab calls itself a “modern approach to investing and retirement”, but is that actually true when they maintain a complicated fee schedule and burdensome interface? Charles Schwab didn’t eliminate their trade commissions until years after Robinhood entered the market.

Today, however, the main differences come down to the range of tradable assets available on each platform.

Charles Schwab has a much larger range of stocks you can buy and sell on its platform and charges a $0.65 fee per options contract, while Robinhood has no fee. Robinhood allows you to sell and buy cryptocurrency, while Charles Schwab does not. Charles Schwab offers mutual funds, CDs, bonds, and futures while Robinhood does not. Both accounts are free, but Robinhood offers a $5 Gold account you can choose to pay for.

New accounts with Robinhood are given their first stock for free, and all accounts can earn extra money with a very generous referral program. Uninvested cash in your Robinhood account can earn up to 5% interest (with a Robinhood Gold account, the APY is 1.5% for free accounts) through its Cash Sweep program. Learn more about the Cash Sweep program and Robinhood’s FDIC insurance.

Robinhood will match your IRA contributions (1% for free accounts and 3% for Gold accounts), (see how you can qualify for this match). If you are transferring an IRA account (or want to rollover a 401(k) account), Robinhood will match 1% of your transfer amount (or 3% until April 2024 for Gold accounts). That’s free money just for transferring your IRA.

If you want to trade professionally, Charles Schwab might be a better option with their in-depth tools and a wider menu of tradeable stock. However, if you’re interested in making some extra money with your IRA, just want to trade in your spare time, or are starting out, we think Robinhood is a better choice. If you want to upgrade to a Gold account, see our review and see if it’s right for you.

If you have decided that Robinhood is the better broker for your money, you will have to initiate something known as an ACATS request.

How to Move Your Account to Robinhood

ACATS stands for Automated Customer Account Transfer Service. It is an almost entirely electronic and automated system, so there are no complicated forms to fill in and mail. The entire process can be completed within the Robinhood app.

To begin, you will need a Robinhood account, of course. You can set up an account on your smartphone by downloading the app, or on the website. You will need to link your bank account to complete the process.

Next, verify your Charles Schwab account information. This includes your account number, the name on your account, and the assets you have in your account. It will be easier to keep the window of your account open until you complete the ACATS process to save you time and frustration. If your account number is wrong, the name on the accounts doesn’t match, or you select the transfer assets that can’t be transferred, the entire ACATS request will be rejected and you’ll have to start over.

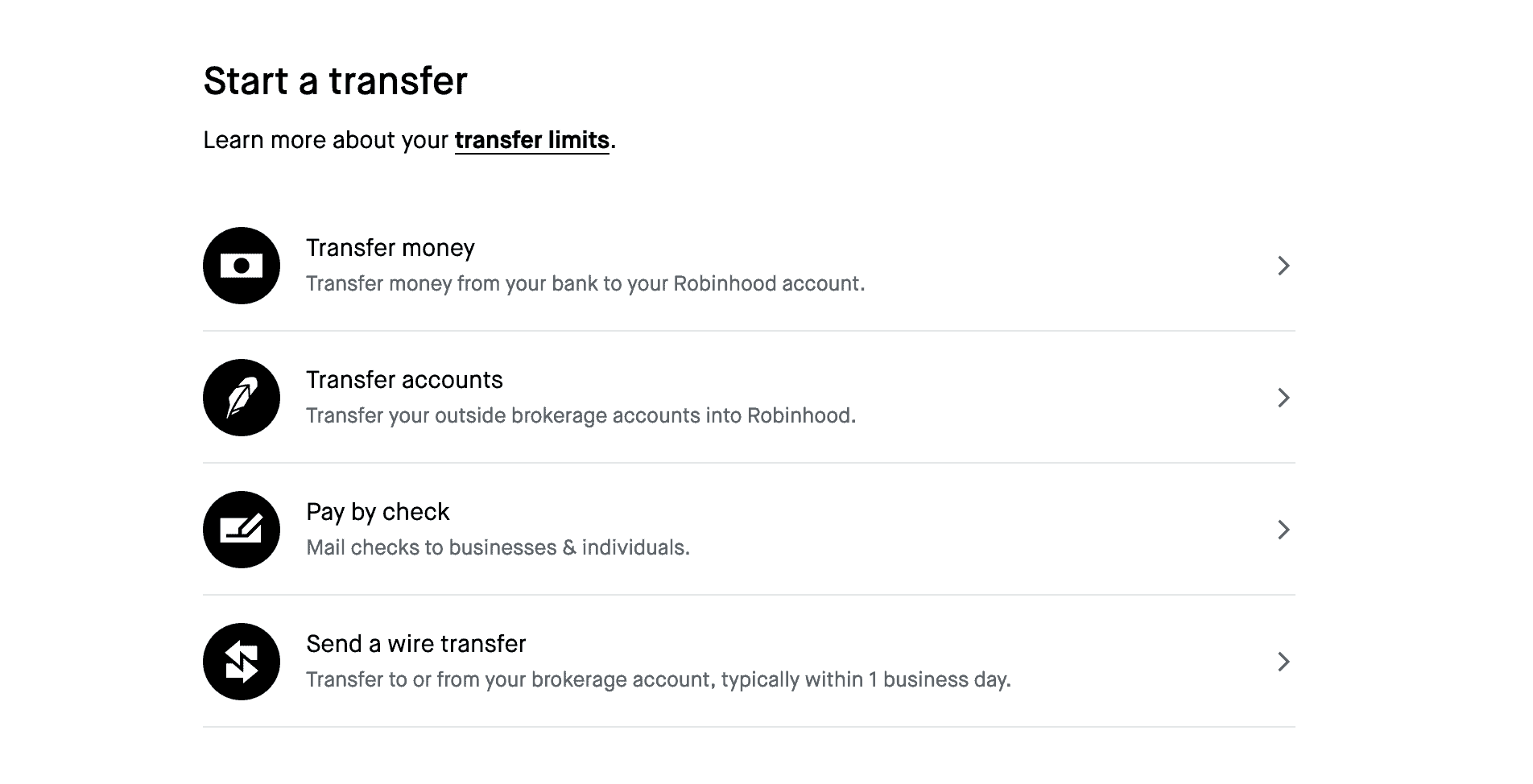

Once you have your information, go to the Accounts tab within Robinhood (the person icon on the bottom right of the app), and select the Transfers option. Within this menu you will see several different transfer options, you will want the Transfer account option. This will begin the ACATS process.

Robinhood will walk you through the process, and you will have opportunities to get clarification for questions along the way.

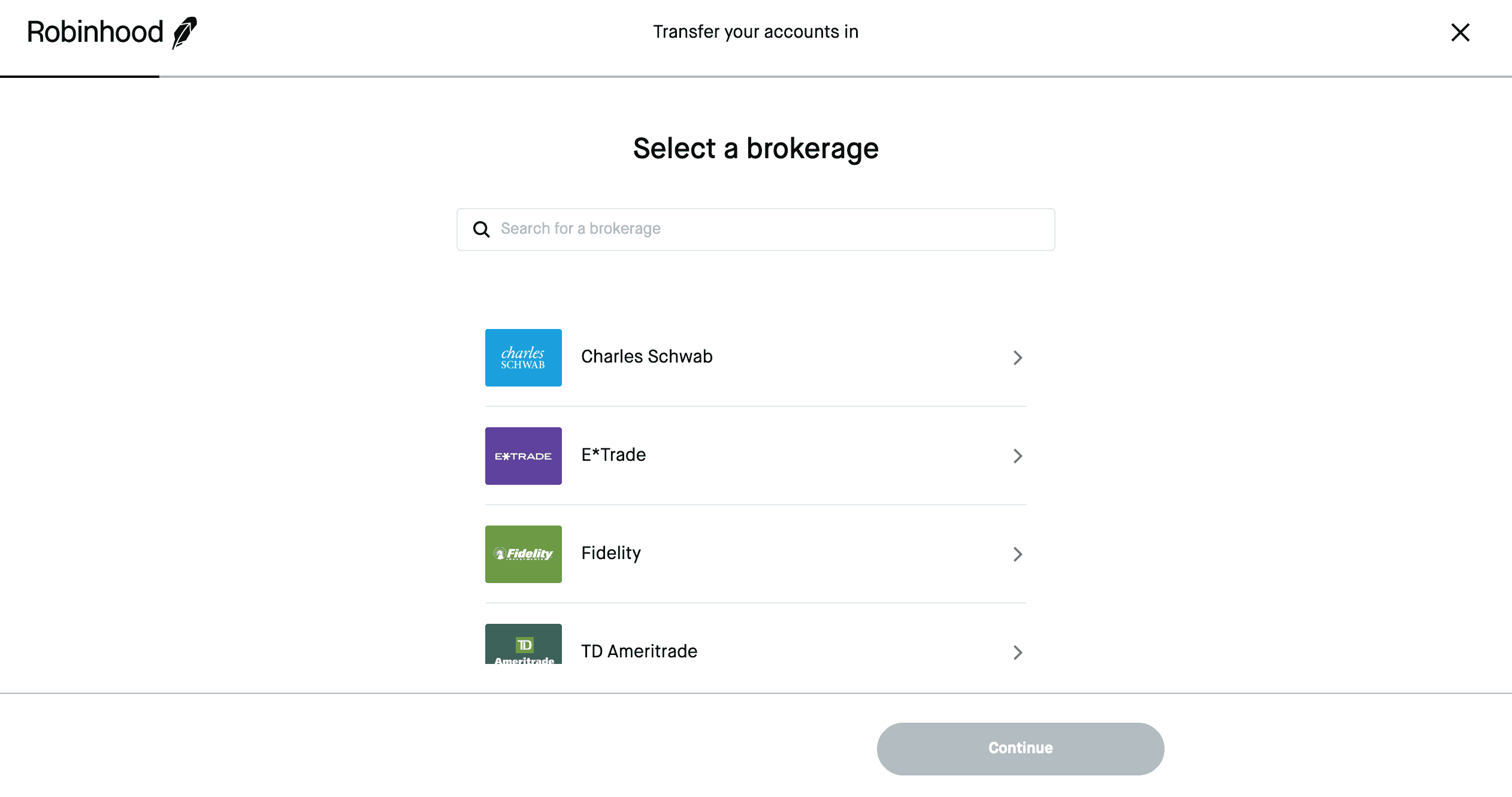

First, select Charles Schwab from the list of brokers, input your correct account number, and verify your name. Make sure the name is the same on both accounts or the transfer request will be rejected.

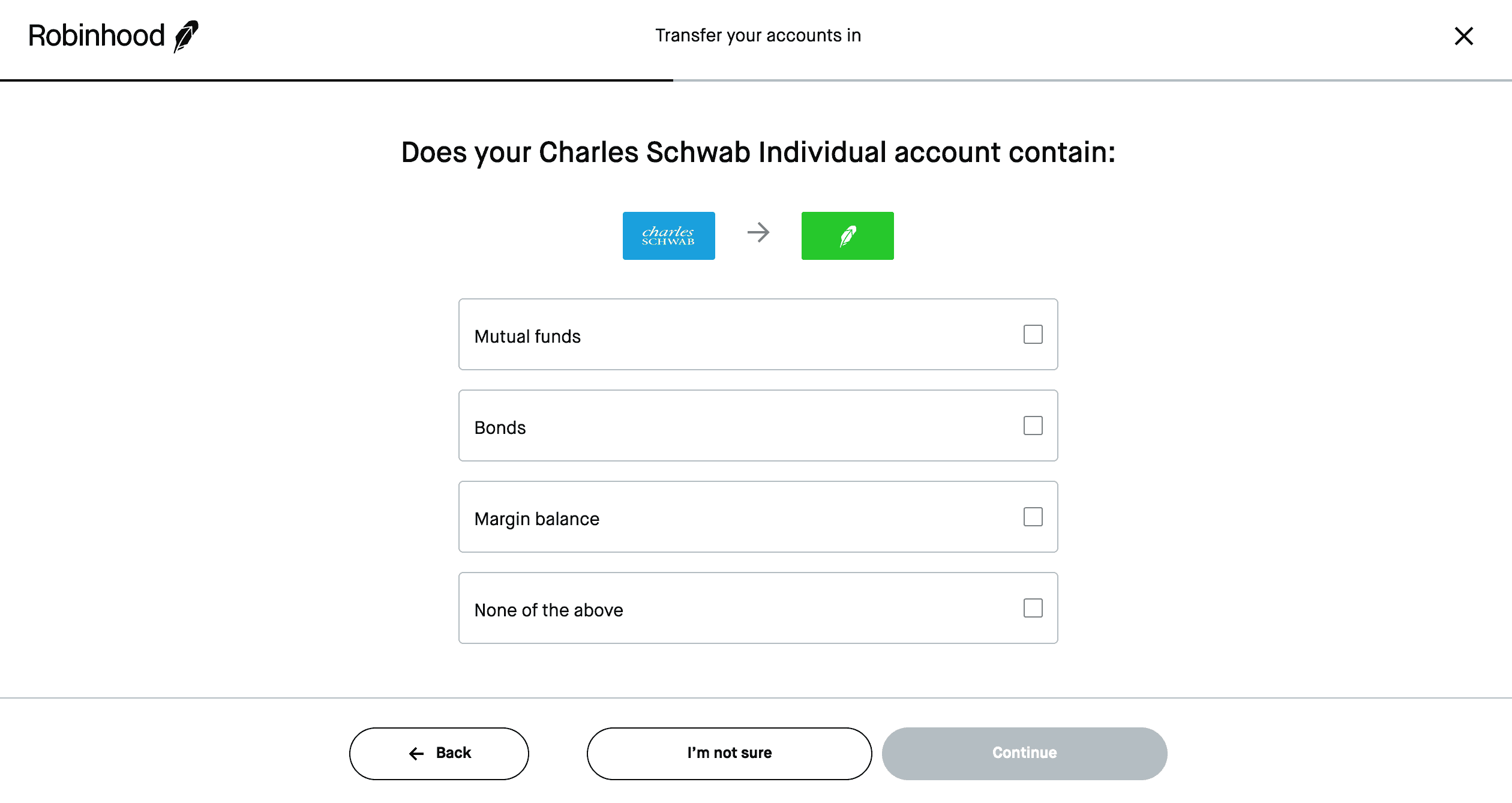

You will then be asked if you plan to transfer any mutual funds, bonds, or margin balances. Robinhood does not support these asset transfers so make sure that if your account does have any of these you are not planning on transferring them.

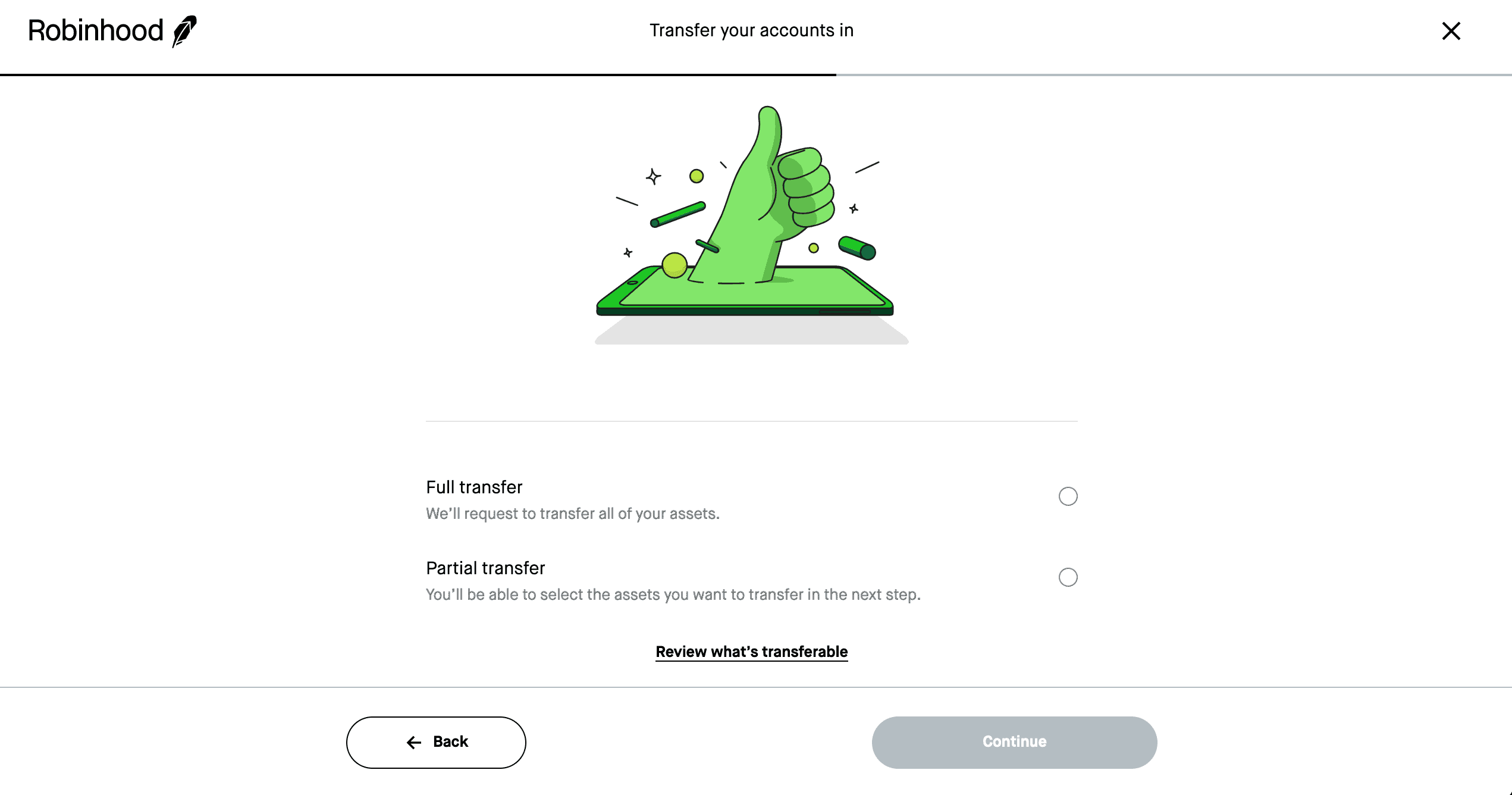

Robinhood supports both full and partial account transfers. If you have any bonds, mutual funds, or other assets that Robinhood does not support, you will have to select partial account transfer and select only the assets that you want to transfer. If you pick full account transfer and you try to transfer stocks or assets Robinhood does not support, the entire transfer will be rejected.

Continue following the prompts until you complete the process. From this point on, the ACATS transfer is out of your hands. Robinhood will send a request to Charles Schwab which should take a couple of days. Once Charles Schwab accepts the request, your assets will be unavailable until they appear in your Robinhood account. The entire process can take anywhere from five to seven business days, so account for that time in your financial planning if you need to.

Once you submit your ACATS request, you cannot cancel it after a certain period of time, so be sure of your decision before you finalize it. You can track the transfer under the Transfer History tab in your Robinhood account to see where it is. If it is rejected, you will be notified. You might continue to receive money long after the transfer is complete. These funds will be interest payments you earned at Charles Schwab that didn’t arrive in time to be included in the original transfer.

Charles Schwab will charge you a fee for the privilege of transferring your assets away from them. However, Robinhood will reimburse this fee up to $75 for any transfer of $7,500 or more. If you are just below this amount, it might be worth it to delay the transfer so you can take advantage of this reimbursement.

That’s it! Enjoy your new account. You will need to close your Charles Schwab account yourself if you don’t want it anymore, since the ACATS process doesn’t close it automatically. If you have other accounts at other companies, you can transfer your account using the same process. See how to transfer from Interactive Brokers, Fidelity Investments, or TD Ameritrade.

If you’re curious about any other part of the Robinhood process, check out this page: a regularly updated list of all our Robinhood guides, news coverage, and lists of benefits.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.