Investing

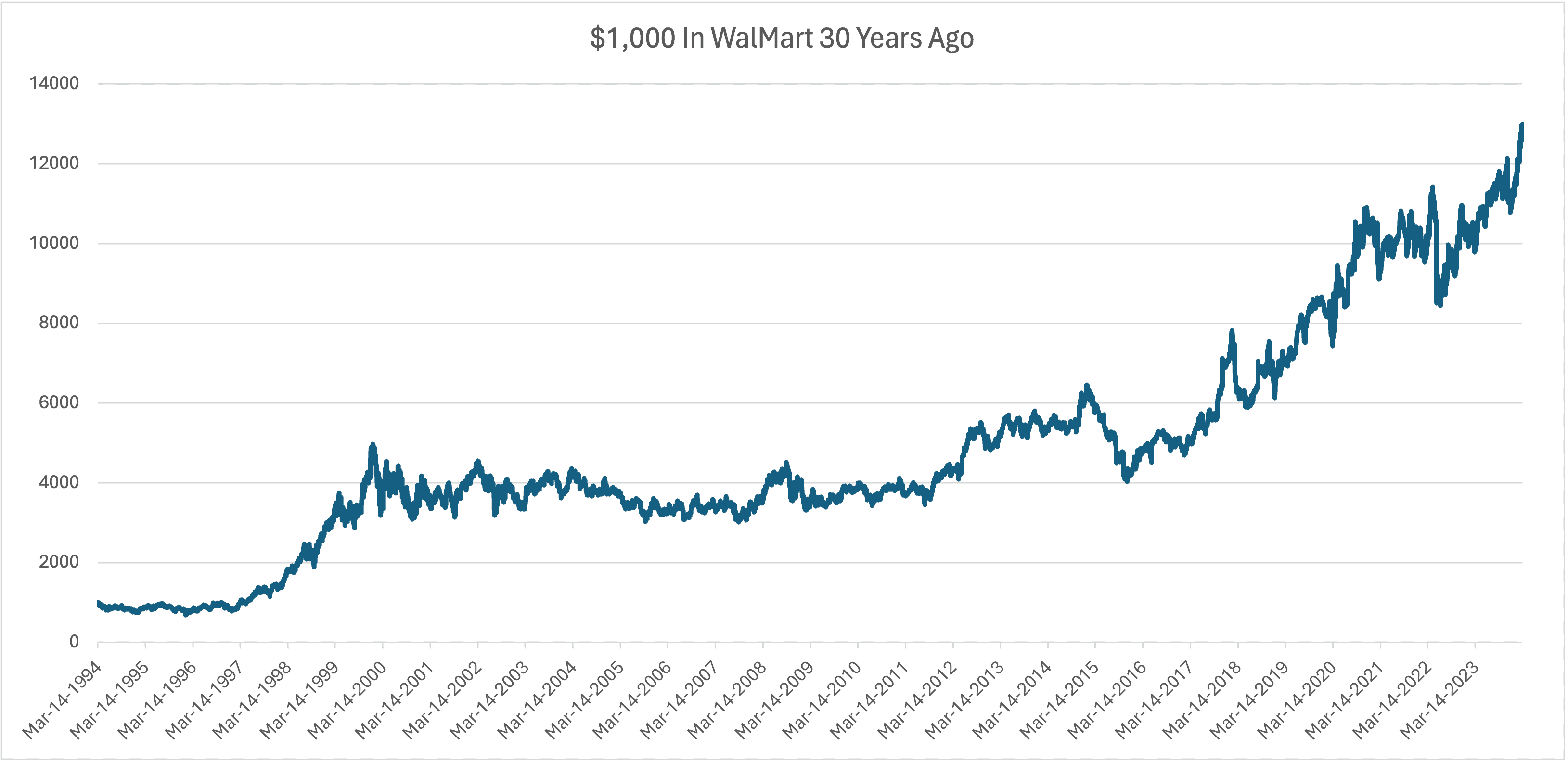

If You Invested $1,000 In Walmart 30 Years Ago, Here's How Much You'd Have Today

Published:

Walmart (NYSE: WMT) is one of the most iconic American companies of all time. Sam Walton’s Book ‘Made In America’, is a must read for many entrepreneurs and business leaders. The company is still earth’s largest retailer, as measured by retail revenue, surpassing Amazon (NASDAQ: AMZN), Costco (NASDAQ: COST), and Home Depot (NYSE: HD).

Of course an early investment in Walmart three decades ago is going to be be an impressive sum today, but just how much is it…?

If you had the foresight to invest $1,000 in Walmart three decades ago your investment would be worth almost exactly $13,000 today. Compounding every dollar 12 times over thirty years is quite a feat. Once you consider dividends over those three decades the figure becomes much larger, and even more so if you practiced reinvesting.

At Walmart’s current yield of 1.35%, that means every year the company would also pay a $175.48 dividend on these funds, a remarkable 17% yield on the original investment each year.

That’s about 20% better than the S&P500 over the same time horizon, and even more so when considering dividends and reinvestments.

While it’s easy to look at a thirty year chart and imagine holding the entire way through, the day to day reality for investors has been trying.

Walmart is one of the most impressive business stories of all time, but there have been plenty of competition and doubters along the way. To truly hold on to life changing returns and potentially retire early means having a steady hand and lots, and lots of patience.

As the saying goes, the best time to plant a tree was 20 years ago, the second-best time is now. The same is true of stocks. While we all wish we’d have bought and held Walmart for 30 years, we can’t turn back time. Instead, it’s best to focus on the new investments we can make today that could put up similar (maybe even better) returns. If you’re looking for ideas, here are three dividend monsters I’m buying in March.

Credit card companies are handing out rewards and benefits to win the best customers. A good cash back card can be worth thousands of dollars a year in free money, not to mention other perks like travel, insurance, and access to fancy lounges. See our top picks for the best credit cards today. You won’t want to miss some of these offers.

Flywheel Publishing has partnered with CardRatings for our coverage of credit card products. Flywheel Publishing and CardRatings may receive a commission from card issuers.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.