Investing

After It Fell 58%, Wall Street Expects This EV Battery Stock to Soar 230%

Published:

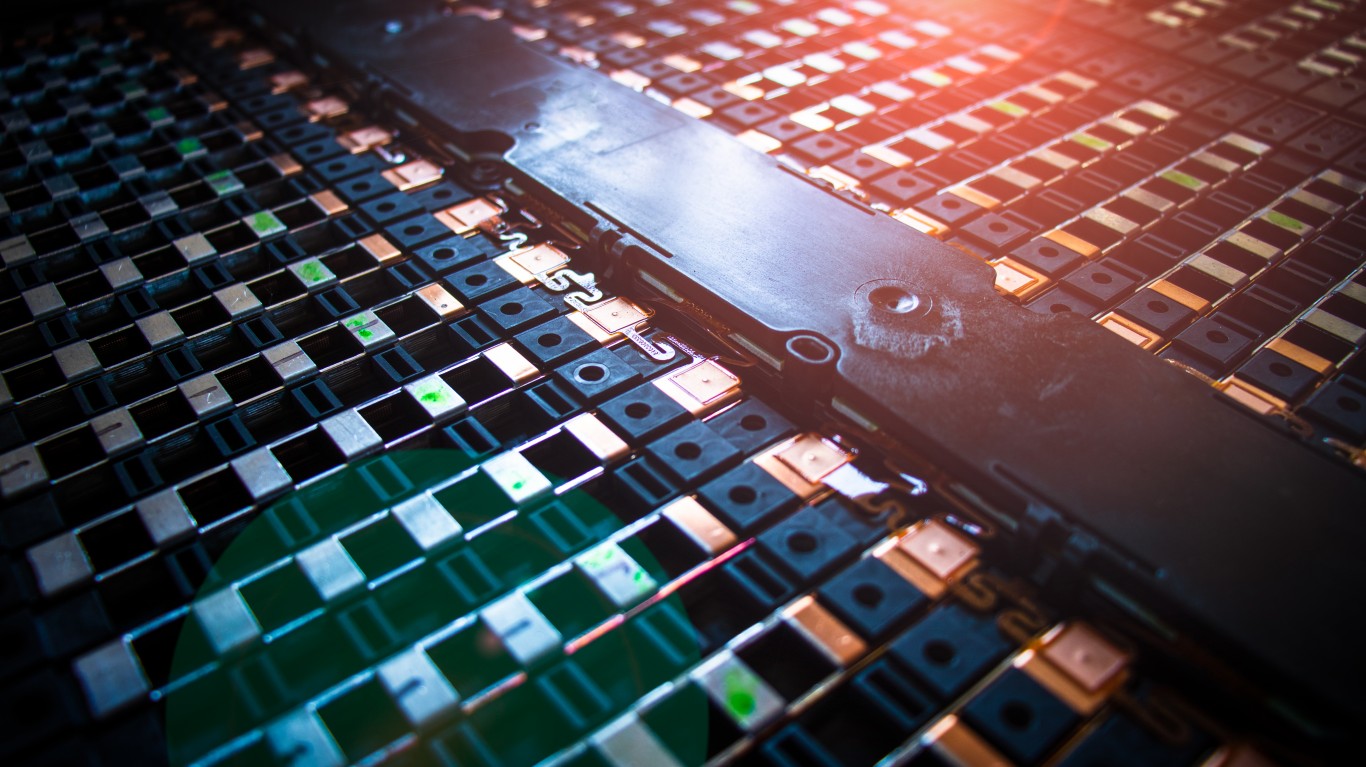

Rechargeable lithium-ion batteries have come a long way in the past few decades. And they make the increasing consumer electronics-driven society possible, powering everything from smartphones to electric vehicles (EVs). Demand for these batteries is expected to increase dramatically by the end of the decade. That means opportunities for investors to make some profits. One such opportunity could be Enovix Corp. (NASDAQ: ENVX), a lithium-ion battery maker based in the San Francisco area that went public in July of 2021. Its share price has tumbled since last summer, but it is projected to soar in the coming year. So what’s up here? Let’s have a look.

| Price Change | Target Price | Est. One-Year Gain |

| −58.2% | $29.73 | 228.9% |

Enovix engages in the design, development, and manufacture of silicon-anode lithium-ion batteries. It serves wearables and Internet of Things, smartphone, laptops and tablets, industrial and medical, and EV industries. The company’s proprietary 3D cell architecture increases energy density and maintains a high cycle life. It is also developing its 3D cell technology and production process for the electric vehicle and energy storage markets to help enable utilization of renewable energy.

The company’s market cap is about $1.5 billion. That is less than that of competitor QuantumScape Corp. (NYSE: QS) but greater than those of FREYR Battery Inc. (NYSE: FREY) and Microvast Holdings Inc. (NASDAQ: MVST).

When Enovix released its fourth-quarter results last month, the report highlighted that revenue had surged, thanks to the completion of its acquisition of Routejade, a manufacturer of lithium-ion cells. It also pointed to its progress in scaling operations made with the build-out of Fab2 in Malaysia, establishing a strong manufacturing base and team in Malaysia.

Earlier in the year, Enovix batteries were selected for an FDA-approved accurate mini blood pressure monitor. The company also established a research and design center in India, and it named a new chief financial officer.

There was a runup in the stock ahead of the recent earnings report, but shares retreated again afterward and were last seen down more than 8%. The S&P 500 and Nasdaq are up about 8% since the beginning of the year. The stock’s 52-week high is $23.90, and the all-time high is more than $35.

So, the stock has not fared well lately. Let’s see where the share price may go from here.

Eleven analysts have price targets that range from $12 to $100, all above the current share price. Reaching the high price would be a gain of more than 1,012% for the stock. Not surprisingly, the consensus recommendation is to buy shares. The three most recent analyst calls, from late February, reiterated Buy ratings.

Will the stock recover and soar this year? Almost all of the analysts who cover the stock have high expectations.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.