When investment programs or publications refer to the capital goods or industrials sector, they are broadly describing industrial level manufacturing and distribution of heavy machinery products. The subcategories are diverse, but are generally broken down into the following:

- Aerospace and Defense

- Electrical Equipment

- Engineering

- Construction

The reason why industrial companies are categorized into the “capital goods” sector, is because heavy, engineered machines are usually described as “capital assets”. Given the functions of those machines to multiply the production capability of the workforce to benefit society on multiple levels, the level of expansion, upgrade, and replacement of capital assets is a reflection of economic demand and an indicator for a nation’s economic health.

The following stocks are the top 15 largest public companies in the Capital Goods Sector by market capitalization size (in US dollars) at the time of this writing:

International Holding Company PJSC

1. International Holding Company PJSC (ADX: IHC) – $237.89B Market Cap.

Contrary to many stereotypical accounts of Arab oil wealth, savvy members of the various royal families have diversified their holdings to be able to grow their asset base beyond oil and gas. H.H. Sheikh Tahnoon bin Zayed Al Nahyan, chairman of Abu Dhabi, UAE based International Holding Company PJSC is a prime example.

With over 400 holdings in agriculture, energy, entertainment, finance, food, healthcare, industrial manufacturing, IT and telecommunications, leisure and retail, maritime, and real estate & construction, IHC is one of the largest conglomerates on the planet, and its economic breadth could be considered a financial microcosm version to that of an independent industrialized nation.

Starting only slightly over a quarter century ago, IHC’s rocketlike success has since spun off several public subsidiaries on the Abu Dhabi Exchange (ADX): Ghita, EasyLease, Palm Sports, ESG, Alpha Dhabi and AI Seer Marine.

Ironically, despite IHC being the largest capital goods company by market capitalization on the globe, both BlackRock’s iShares and JP Morgan Betabuilders ETF categorize it for their “emerging market” funds.

General Electric Company

2. General Electric Company (NYSE: GE) – $172.65B Market Cap.

Founded by lightbulb inventor Thomas Edison in 1892, General Electric is a company that has continued to maintain its roots in electrical power in addition to its expansion into many other arenas. GE makes a wide range of hardware and software related to government and industrial power generation, from turbines for gas, wind and steam all the way to full power plant and grid components. Additionally, GE manufactures engines and other aerospace parts for both military and commercial aircraft.

While former CEO Jack Welch, who led GE during from 1981 – 2001, was best known for building GE into a huge conglomerate at the time, the company has since pared back retail and credit cards years ago, although it has retained its insurance and finance divisions.

Caterpillar

3. Caterpillar (NYSE: CAT) – $168.14B Market Cap.

When it comes to heavy-duty earthmoving, construction and land infrastructure machinery, the Caterpillar name is one of the most universally recognized. Founded in 1925, Caterpillar bulldozers, asphalt pavers, excavators, tractors, locomotives, and other machines required for the aforementioned industries are ubiquitous in most industrialized nations. Additionally, Caterpillar also makes a wide range of support equipment, such as engines, compressors. drive trains, soil compactors, etc.

Caterpillar is considered by a number of analysts to be the primary beneficiary of the bipartisan 2021 $1.2 trillion Infrastructure Bill that was passed by Congress. Therefore, its profit margins and growth may continue for the next few years purely on domestic infrastructure demand.

Siemens Aktiengesellschaft

4. Siemens Aktiengesellschaft (XTRA: SIE) – $143.19B Market Cap.

Based in Munich, Germany, Siemens has been a stalwart of the German economy for 177 years. During its founding days in the telegraph industry, Siemens pioneered some of the world’s earliest underground and underwater telegraph lines as well as the invention of the first electric street light in London. Siemens has since expanded its businesses to encompass electric power generation, hydropower, nuclear power, computers, semiconductors, automation systems, information technology, greentech, and medical imaging and scanning machines. Its products are sold worldwide.

Although the manufacturing sector is expected to contract in the near future, Siemens is poised to continue positive growth due to its diversification into digital technology. Its Smart Infrastructure and Digital Industries divisions are designed to interface with real world energy management and automation processes for industrial businesses, as well as work to incorporate and utilize new A.I. developments.

Honeywell International, Inc.

5. Honeywell International Inc. (NASDAQ: HON) – $129.56B Market Cap.

Honeywell is a textbook example of a conglomerate who has focussed on technology to become an indispensable provider of critical products for modern societies. Starting with some of the first automated heating systems designed near the end of the 19th century, Honeywell has expanded to four divisions:

- Aerospace (propulsion engines, avionics, navigation, radar, satellites, etc.)

- Building Automation (video surveillance, power controls, sensors, etc.)

- Performance Materials & Technology (body armor, instrument automation, nylon, etc.)

- Safety Solutions (protective gear, apparel and footwear, gas detection, switching systems, emergency alert systems, etc.)

In anticipation of the increased requirements for temperature control in data centers and other locations where digital information can be compromised due to heat, Honeywell’s $1 billion Solstice refrigerant technology may become one of its biggest assets for the future. This can especially become the case as a result of the greater proliferation of A.I.

Airbus SE

6. Airbus SE (ENXTPA: AIR) – $121.14B Market Cap.

The history of Airbus SE is rooted in the formation of the European Union. In addition to creation of the Euro and the removal of visa requirements for traveling between EU member nations, these red tape hurdles paved the way for European industrial collaborations. Airbus SE was created jointly out of aerospace companies from:

- Germany (Daimler-Benz, Dornier Flugzeugwerke, Messerschmitt-Bölkow-Blohm, and MTU München)

- France (Aérospatiale and Matra)

- Spain (CASA – Construcciones Aeronáuticas)

Airbus makes commercial passenger and freighter aircraft and military helicopters that are deployed worldwide. Additionally, Airbus Defence and Space creates and supports missile and space launch systems, telecommunications, navigation, cybersecurity, and other critical services for military and civilian defense applications.

As part of the global commercial passenger jet airline manufacturing duopoly with The Boeing Company, (see #7 below), Airbus has pulled ahead of Boeing, who had been the dominant player for decades. Many analysts believe this is due to Boeing’s recent problems with their 737 MAX aircraft quality control and inspection disasters, more than from any superiority over engineering design.

The Boeing Company

7. The Boeing Company (NYSE: BA) – $122.03B Market Cap.

As one of the largest US exporters, the name of aerospace and defense titan Boeing has become synonymous with aviation and space exploration. While best known for commercial jet airliners, Boeing is also one of the largest defense contractors in the world. The company’s technological and engineering expertise contribute not only to military aircraft, but also to drones, satellites, strategic missile and defense systems, weapons systems, and to NASA space exploration projects. Less publicized are Boeing’s Global Services division, which supplies logistics and supply chain management, data analytics, and other related services.

In addition to Boeing’s 737 MAX series woes, China’s COMAC (Commercial Aircraft Corporation of China, Inc.) is looking to break up the Boeing/Airbus duopoly in the commercial passenger jet airliner market. COMAC’s C919 is viewed by many aerospace analysts as a ”Boeing 737 knock-off”, but its lower price tag and China’s economic clout in the PacRim can potentially steal market share and billions of dollars of sales away from both companies, so newer innovations and marketing should be expected in the pipeline for the future.

RTX Corporation

8. RTX Corporation (NYSE: RTX) – $119.15B Market Cap.

While its products have a lower profile than Boeing or Airbus, those supplied by aerospace defense contractor RTX (formerly Raytheon) are no less essential for their success. Its Collins Aerospace division designs and produces plane cabin equipment, oxygen systems, food and beverage galley systems, and lavatory systems for commercial aircraft. On the military side, battlespace testing and training systems, crew escape systems, and a host of technical and engineering support and spare parts supplies. The Pratt and Whitney division builds military and commercial aircraft engines and power units. The Raytheon division supplies military threat detection and both defensive and offensive armament (missile, torpedo, etc.) responses.

Eaton Corporation plc

9. Eaton Corporation plc (NYSE:ETN) – $117.27B Market Cap.

Founded just prior to World War I, Dublin, Ireland based Eaton Corporation plc specializes in electrical power management engineering systems for municipalities, vehicles, and aircraft. Eaton Corporation’s power distribution systems include utility power, circuit protections, fire detection, emergency lighting, and hazardous duty equipment. For vehicles, Eaton electrical transmissions, hybrid power, engine valves, and EV critical components are among its high demand products. For the aviation industry, Eaton supplies essential systems for electronically controlled power, pumps, hydraulics, fueling systems, wing flap controls, and a panoply of other aircraft operations.

Of particular note is Eaton Corp.’s embrace of Industry 4.0. The Internet of Things (IoT), additive manufacturing, robotics, factory simulation, and virtual reality are all aspects of Industry 4.0. The technologies are used to optimize factory processes, increase efficiency, improve quality control, and reduce the factory’s environmental footprint. Eaton recently announced Industry 4.0 equipped smart factories for its Chinese and Mexican plants.

Schneider Electric SE

10. Schneider Electric SE (ENXTPA: SU) – $117.19B Market Cap.

Founded in 1836 France, Schneider Electric S.E. originally was named Schneider-Creusot, and was entrenched in the iron foundry and heavy machinery business. The aftermath of the Franco-Prussian War led to Schneider’s efforts into both shipbuilding and weapons design and manufacturing. This continued though both World Wars until the 1960s, when Schneider divested itself of heavy machinery and weaponry to focus on electronics, eventually renaming itself Schneider Electric in 1999.

Presently one of Europe’s premier electric and digital technology companies, Schneider’s specialty products are used around the world in public transportation, building electric utilities management, security, surge protection, power grid automation, environmental monitoring, software, relays, robotics, RFID, controllers, and a panoply of other products and services.

Schneider recently announced a $3 billion contract to supply electrical equipment to Texas-based Compass Datacenters, whose expanding electricity requirements from A.I. demand has increased 10-fold.

Lockheed Martin Corporation

11. Lockheed Martin Corporation (NYSE: LMT) – $103.05B Market Cap.

Fans of the blockbuster film, Top Gun:Maverick sat enthralled as Tom Cruise’s “need for speed” pushed the hypersonic “Darkstar” fighter jet beyond its engineering tolerances. The Darkstar is a conceptual design (perhaps for future production as the SR-72, according to military analysts) created by Lockheed Martin, the world’s largest defense contractor, and best known for its military aircraft. Founded in Bethesda, MD in 1912, Lockheed Martin has four divisions:

- Aeronautics – In addition to building fixed-wing combat jets like the F-35 and F-22, Lockheed’s Aeronautics division focuses on aerial battlespace. Hypersonic technology development, unmanned aircraft (UAV), and Lockheed’s famed Skunk Works designs are all part of this segment.

- Missiles and Fire Control – MFC houses Lockheed’s defense division which includes advanced combat missiles, rockets, and other weapons systems.

- Rotary and Mission Systems – In addition to both military and commercial helicopters, maritime and surface missile defense, radar, combat systems, training systems, and cybersecurity solutions.

- Space – This segment houses Lockheed’s space transportation and satellite operations, as well as strategic, advanced strike, and defensive systems for national security platforms.

Deere & Company

12. Deere & Company (NYSE: DE) – $102.99B Market Cap.

In much the same way as Caterpillar machinery is ubiquitous with heavy construction and infrastructure, Moline, Illinois headquartered Deere & Company is synonymous with heavy machinery in the agriculture and landscaping arenas.

Deere’s Production and Precision Agriculture is its highest profile division. Its harvesters, loafers, cotton pickers, large tractors, seeding equipment, and other equipment are essential for the agricultural food and fiber products that feed and clothe people worldwide.

The Small Agriculture and Turf division supplies tractors, large mowers, snow and debris management, and foraging gear for landscaping, golf course construction and maintenance, and also for the dairy and livestock industries.

The Construction and Forestry Division provides, loaders, excavation gear, logging equipment, dump trucks, road building machines and assorted equipment for private, municipal and federal lands.

Contemporary Amperex Technology Co., Ltd.

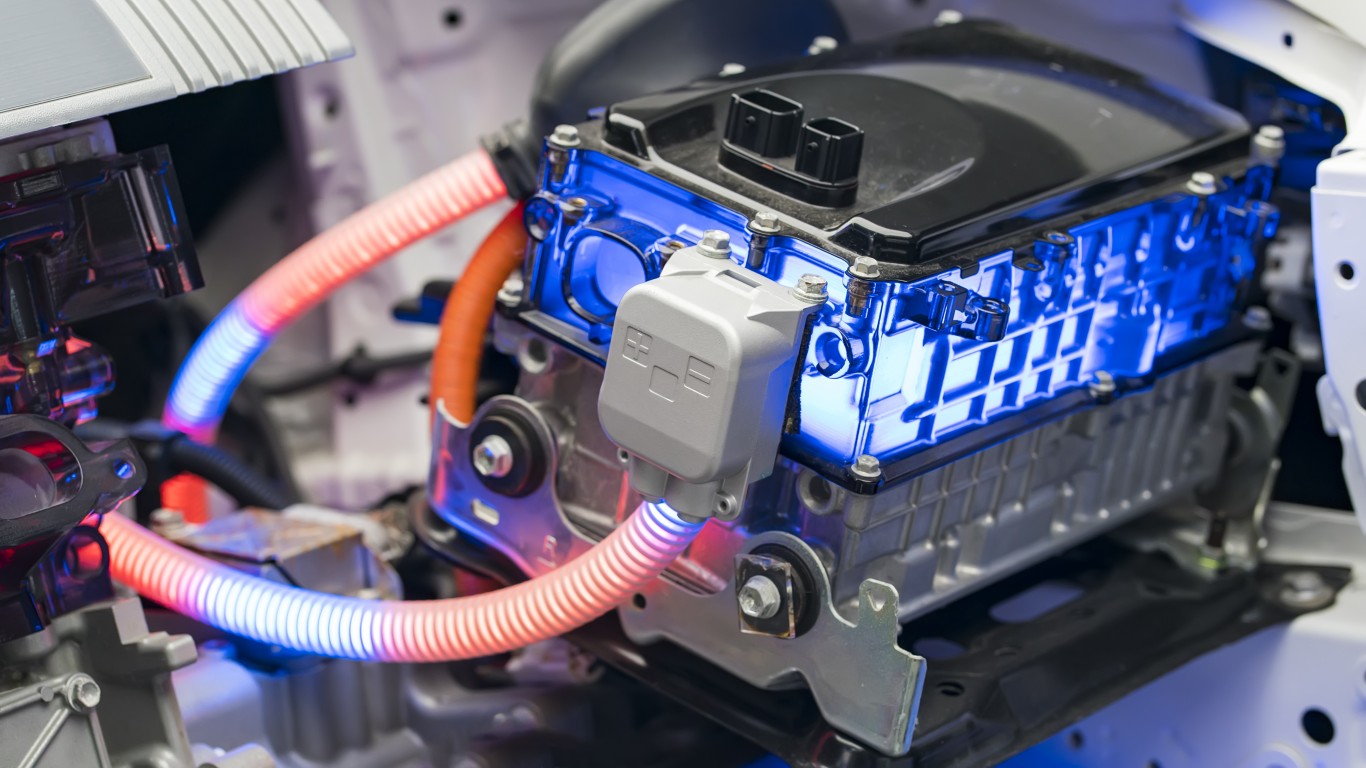

13. Contemporary Amperex Technology Co., Ltd. (SZSE:300750) – $100.59B Market Cap.

Better known as CATL, Contemporary Amperex Technology, Ltd. is based in Ningde, China. The company designs, manufactures and services a wide range of batteries for all types of motorized vehicles and equipment. The long list of CATL battery users stretches from electric bicycles and motorcycles, passenger and commercial vehicles, trucks of all sizes, and large public transportation vehicles. Industrial machinery includes, but are not limited to: road cleaning trucks, forklifts, excavators, and other construction or other electric powered heavy machinery.

Though founded only in 2011, CATL’s production capabilities and its focus on batteries and all of their applications and potential improvements have garnered international respect in the field. Elon Musk’s Tesla Inc. (NASDAQ: TSLA) apparently holds CATL in high enough regard to select their battery technology for the forthcoming Tesla EV battery plant to be constructed in Nevada.

Mitsubishi Corporation

14. Mitsubishi Corporation (TSE:8058) – $89.67B Market Cap.

Mitsubishi Corporation is the conglomerate branch of Japan’s Mitsubishi Group (est. 1870) and Japan’s largest trading company.. The other three branches are: MUFG Bank (Japan’s largest bank), Mitsubishi Electric, and Mitsubishi Heavy Industries. While ostensibly established for cooperation, each one is formally independently run and considered a separate entity.

Mitsubishi Corporation’s areas of operations extend to:

- Infrastructure and Industrial Materials

- Natural Gas

- Mineral Resources

- Petroleum and Chemicals

- Automotive and Mobility

- Power

- Consumer Industry

- Food Industry

- Urban Development

Safran SA

15) Safran SA (ENXTPA: SAF) – $88.62B Market Cap.

Founded in 1896 in Paris, Safran SA supplies a wide array of aerospace and defense products and services to both civilian and military customers. Safran jet propulsion and transmission systems are used in training and commercial aircraft, helicopters, drones and satellites. The company designs and builds landing gear, control panels, avionics, navigation systems, oxygen supplies, and other operation and cockpit equipment. Safran’s Aircraft Interiors division designs and supplies the entire range of aircraft cabin and cargo storage gear, including, but not limited to crew and passenger seats, storage bins, lavatory and galley equipment, dividers, in-flight entertainment systems, etc.

As capital goods represent the majority of companies involved with contributing to key aspects of modern, industrialized societies, their respective sizes makes them less likely to exhibit the same kind of volatility that other sectors, like technology, for example, might exhibit. a673b.bigscoots-temp.com has a range of other articles about large cap stocks that are followed by Warren Buffett and other successful investors.

Get Ready To Retire (Sponsored)

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.