Investing

2 Stocks Down 50% That Wall Street Thinks Will Double This Year

Published:

Last Updated:

The stock market has been a roller-coaster ride over the past year, and many companies have seen their shares tumble. However, some of those stocks could be presenting buying opportunities, and some on Wall Street think that those beaten-down names are going to roar back with a vengeance. We dug deep using Capital IQ to find out why two stocks that have fallen by more than 50% over the past year are expected to double within a year.

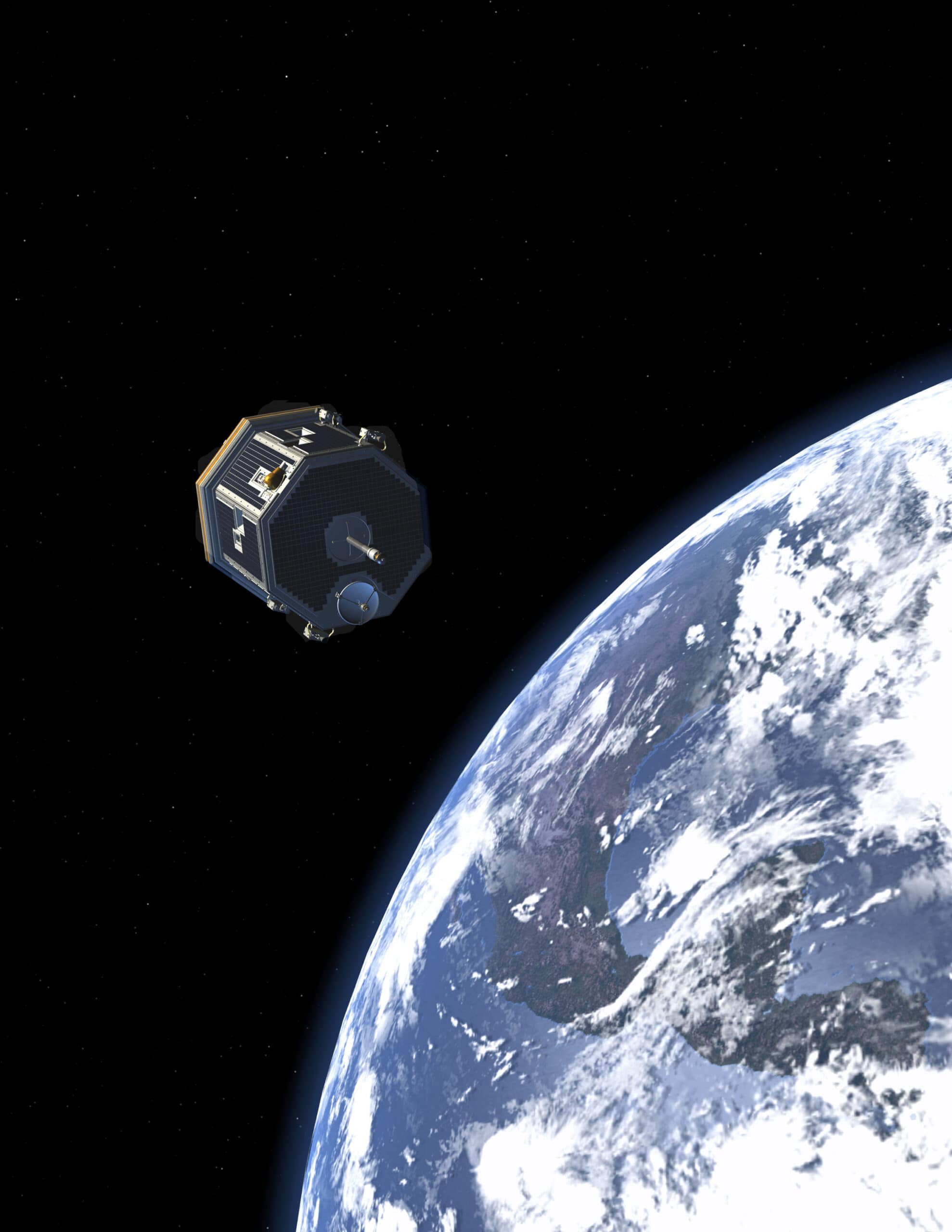

Planet Labs PBC (NYSE: PL) designs builds, and launches satellite constellations to provide high-cadence geospatial data to users worldwide through an online platform. The stock has tumbled 52.5% over the past year as the company made significant strides toward posting a profit.

Planet Labs posted a net income increase of 450% in the third quarter of fiscal 2023 versus the same quarter a year ago. The company also said its revenue growth and cash flow from operations were strengthened as well during the quarter. However, the stock has fallen from the heights expected by investors during the period, who ignored the improving earnings as they sent Planet Labs down 50% during those 12 months.

Yet analysts remain very bullish on Planet Labs even with that dismissal by investors. The stock has a median price target of $4.80 over the next 12 months, which represents a gain over 100% from the current price of $2.24. Wall Street believes that Planet Labs’ strong position in the satellite imaging niche along with the growth of its customer base will send the stock to the moon in the coming years.

SPI Energy Co Ltd (NASDAQ: SPI) is a provider of photovoltaic (PV) and electric vehicle (EV) solutions for business, residential, government, utility customers, and investors on a global basis. The company’s stock price has fallen 51.15% in the past year to close at $0.62 recently. Like Planet Labs, SPI Energy has faced several headwinds in the past year, including massive debt levels and negative profit margins. The company’s debt-to-equity ratio stands at 5.24, which is much higher than the industry average. This means that SPI Energy has an increased risk associated with its debt management. While the company’s year-over-year (YOY) gross profit margin has improved, its net profit margin of -3.57% significantly underperformed the subsector average. Despite these woes, Wall Street analysts are projecting the company’s stock to double over the next year — possibly due to revenue growth significantly above the industry average and a massive improvement in cash flow from operations. This has prompted them to establish a median price target over the next 12 months of $1.25 versus the current price of $0.62.

In summary, while Planet Labs PBC and SPI Energy Co Ltd have both seen their stock fall significantly over the past year, Wall Street believes there is potential for both of these companies to double in the next year. Both have demonstrated improvements in certain financial metrics and have opportunities for growth in their various markets. However, like any investment decision, you should properly conduct your due diligence and consider your risk tolerance before investing.

Credit card companies are pulling out all the stops, with the issuers are offering insane travel rewards and perks.

We’re talking huge sign-up bonuses, points on every purchase, and benefits like lounge access, travel credits, and free hotel nights. For travelers, these rewards can add up to thousands of dollars in flights, upgrades, and luxury experiences every year.

It’s like getting paid to travel — and it’s available to qualified borrowers who know where to look.

We’ve rounded up some of the best travel credit cards on the market. Click here to see the list. Don’t miss these offers — they won’t be this good forever.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.