Investing

If You Invested $1,000 In WalMart 20 Years Ago, Here's How Much You'd Have Today

Published:

Everything about Walmart is gigantic. By revenue, it’s the largest retailer on earth. Bigger than Costco (Nasdaq: COST), Amazon (Nasdaq: AMZN), and Target (NYSE:TGT). The company operates more than 10,000 stores, employs over 2,300,000 people, and over the long run has been one of the greatest investments of all time.

Recently, we looked at how much $1,000 invested in Walmart 30 years ago was worth today. For those lucky investors who purchased three decades ago, they’d have turned $1,000 into nearly $13,000 today.

But the path was bumpy, filled with volatility, big gains, losses, and over a decade with 0% returns. With ten fewer years to smooth out the performance, let’s see how investors would have done had they invested $1,000 in Walmart 20 years ago.

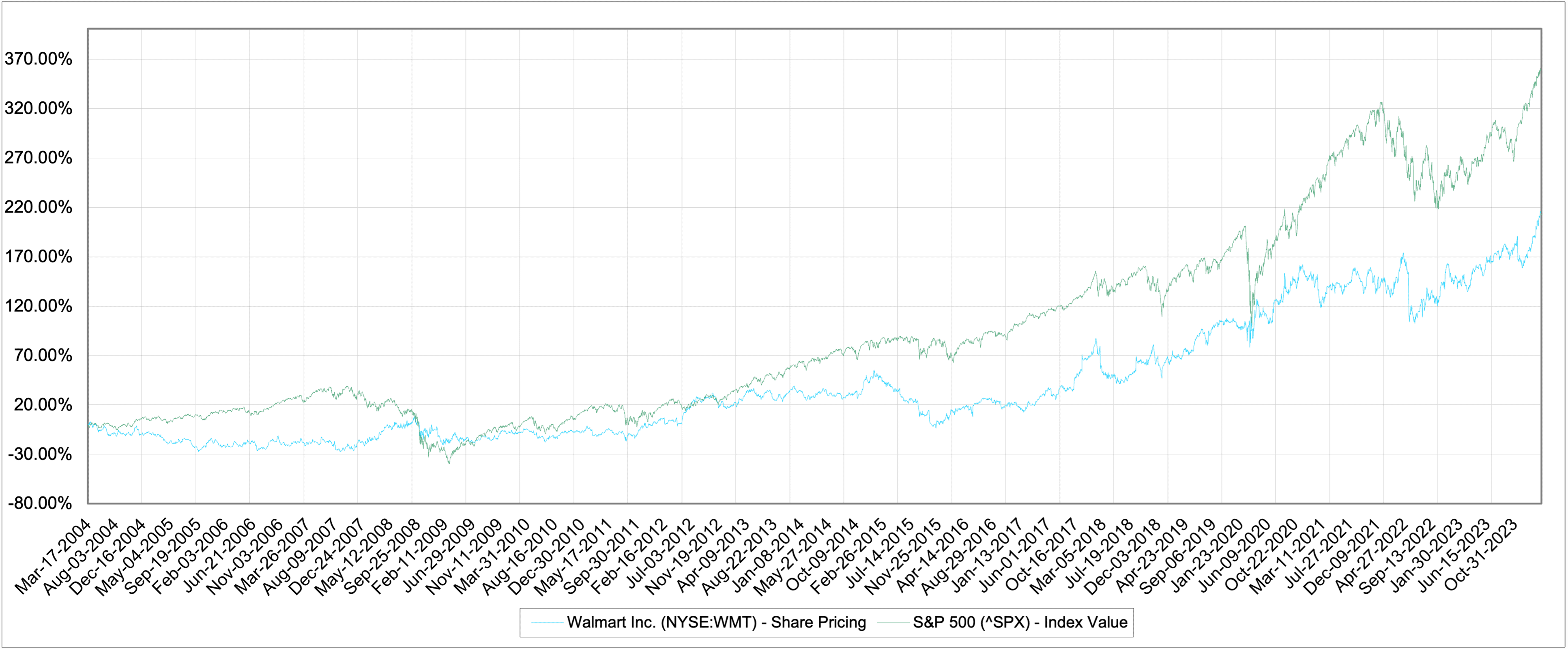

Shockingly, if you’d invested $1,000 in Walmart 20 years ago you’d have $3,112 today. This compares to $4,550 if you’d invested in the S&P 500 instead. The first thing that jumps out is the difference between Walmart’s 20 and 30 year performance. Over two decades the company has lost handily to the S&P 500, but over 30 years it’s crushed it.

While this doesn’t include dividends, or dividend reinvestments for either investment, one thing is clear: a decade can make a huge difference! Let’s take a closer look.

What explains Walmart’s 20 year performance, and why it differs so much from it’s 30 year? A few things jump out.

This last point is the most important. While Walmart the investment may have been a poor performer for roughly 7 years, Walmart the company was continuing to grow. In 2004 the company’s net income was $9 billion. By the end of 2011 it was $16.4 billion, and yet investors lost money because their appetite for the multiple they were willing to pay for those earnings changed.

Even a fantastic company can underperform if you buy when shares are expensive. Knowing exactly when shares are overpriced is tricky though. Fellow retailer Amazon looked expensive for decades, but the company was able to grow enough to justify the multiple, and investors ended up doing just fine.

So what are the lessons for investors today? First, patience. Even an investment that loses to the market for 20 years can end up trouncing it over 30. Whatever your time horizon is on your positions, try and extend it. Second, valuation matters. Be mindful of the multiple you’re willing to pay for shares in a company, even a world class one, because if things don’t go as planned (or better) it can take awhile to catch up. Third, buying an index fund like the S&P 500 can still work out just fine.

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.