Investing

Will Coinbase Stock Soar 50% More In 2024? Here's Wall Streets Answer

Published:

Coinbase Global (Nasdaq: COIN) stock has been on a tear the past 6 months, soaring over 200% buoyed by the surge in activity in the cryptocurrency market. Some of the biggest cryptos are experiences exception gains, including Bitcoin, up 123% this past year and Solana, up 630% over the same time period.

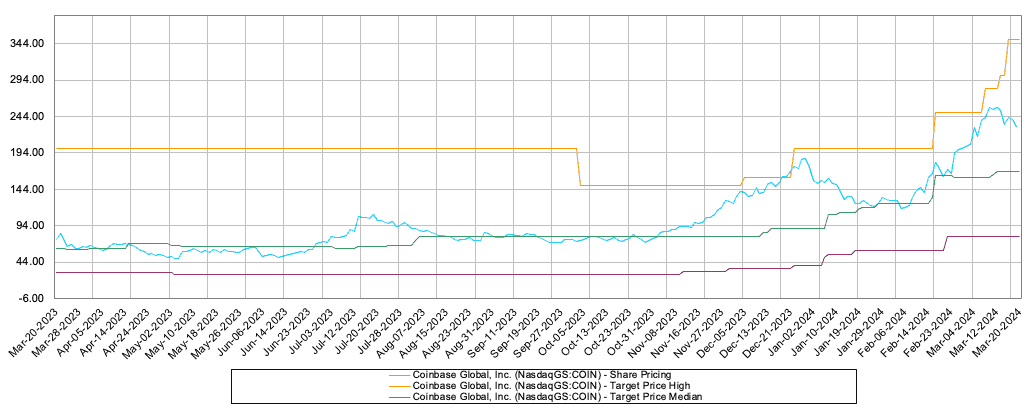

As investor interest around digital assets increases, Coinbase stands to gain a large exchange between buyers and sellers of cryptocurrencies as well as supporting its clientele with a suite of products to protect the market participants. In fact most recently, JMP Securities analyst Devin Ryan boosted his target price on Coinbase stock from $220 to $300, but one analyst sees even more growth setting a price target of $350. With a current price of $230, that would be a 30% to 50% upside respectively.

Wtth the Securities and Exchange Commission (SEC) recent approval for Bitcoin exchange-traded funds (ETFs), investors have easier options to invest in digital assets and expectations are this market will continue to grow, with some estimates suggesting the market could be upwards of $200 billion.

With more investors entering the market and enthusiasm for digital assets returning after the sharp declines in the market throughout 2022, will Coinbase continue to soar in 2024?

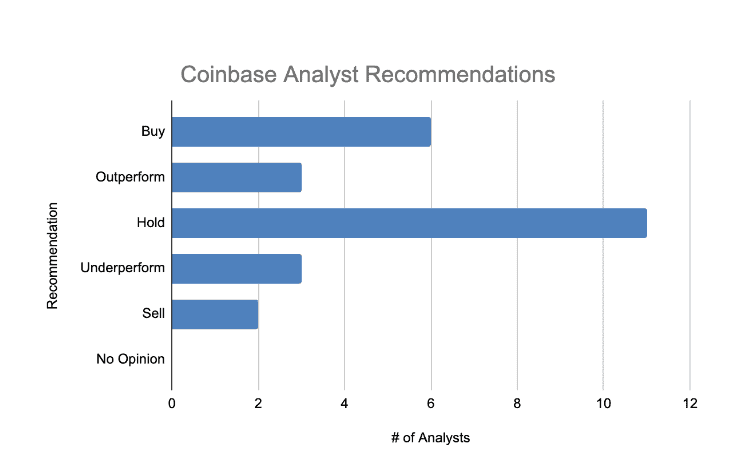

Well, according the collective thought of the 25 Wall Street analysts covering Coinbase, the answer is not likely. The median target price among these 25 analysts covering the stock is $169 which is a 25% haircut.

Moreover, the stock is a consensus hold.

Coinbase Global’s 200% gain this past year is likely outpaced the Wall Streets expectations and while a more conservative price target that match the businesses current fundamentals is likely at play, one shouldn’t lose site of the bigger picture.

Coinbase is raising $1.1 billion of .25% convertible senior notes which it plans to use to pay down its pricier debt and will also increase working capital to take advantage of of more entrants into the market. With a $200 billion market potentially opening up, I wouldn’t be surprised to see more price target upgrades in the next few years. A $350 stock price is very achievable but 2024 might not be the time that will happen.

Start by taking a quick retirement quiz from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes, or less.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.