Since ChatGPT’s public launch in November 2022, artificial intelligence, or AI, has been the dominant storyline in the technology world and the stock market. And whether you’ve dabbled with the technology or not, there’s no denying that many of the world’s most forward-thinking minds are firmly planting themselves as huge AI believers.

Mark Cuban is on record saying the potential impact of AI tools like ChatGPT is “beyond anything I’ve ever seen in tech.”

Elon Musk has gone a step further saying, “AI will change everything.”

While many of the large tech companies – such as Amazon, Google, and Meta – have been heavily investing in AI for years, the astronomical gains seen in shares of companies like NVIDIA (NASDAQ: NVDA) and Super Micro Computer (NASDAQ: SMCI) have every investor scrambling to answer the same question, “Which companies represent the best buying opportunities for the next leg of a potential AI rally?”

Today, we’re looking at two companies – that get far less CNBC airtime and investor attention than NVIDIA and Super Micro Computer – but could still stand to massively benefit from the rapid investment and development of AI.

More Compute, More Energy

AI is allowing companies and developers to accomplish tasks that were previously impossible or very time-consuming, which is great. However, the data centers that house the equipment making it all possible are incredibly energy-intensive. According to the International Energy Agency, data centers currently account for about 1 to 1.5 percent of global electricity use, but that number is poised to rocket higher as companies demand more computing power to run AI applications.

With this surge in energy usage, AES Corp (NYSE: AES) is one company that stands to potentially benefit significantly due to its strategic focus on renewable energy solutions tailored to meet the high energy demands of technology companies, especially those operating data centers.

In 2023, AES achieved a record-breaking year by signing 5.6 gigawatts of new power purchase agreements (PPAs), underscoring its leading role in the renewable energy sector. A considerable portion of AES’s new business came from serving corporate customers, particularly large technology firms that are hungry for reliable energy sources. For example, Google (NASDAQ: GOOG) has committed to 24/7 carbon-free energy by 2030, Amazon (NASDAQ: AMZN) has committed to 100% renewable energy by 2030, and Meta (NASDAQ: META) has signed up for net zero emissions by 2030.

AES’s commitment to renewable energy and innovative approach, including the introduction of hourly match renewable energy, positions it as a preferred partner for these hyperscale data center companies looking to achieve their renewable energy and sustainability goals. With a development pipeline of over 50 gigawatts and advanced interconnection queue positions in key U.S. markets, AES is exceptionally well-positioned to capitalize on the expanding energy needs of the tech sector, which is projected to more than double by 2030.

It’s Getting Hot in Here

As you might imagine, with the equipment in these data centers running harder than ever and using more energy than ever, it can get quite toasty – which is why it’s incredibly important for data centers to have solutions that can properly cool their servers to avoid disaster.

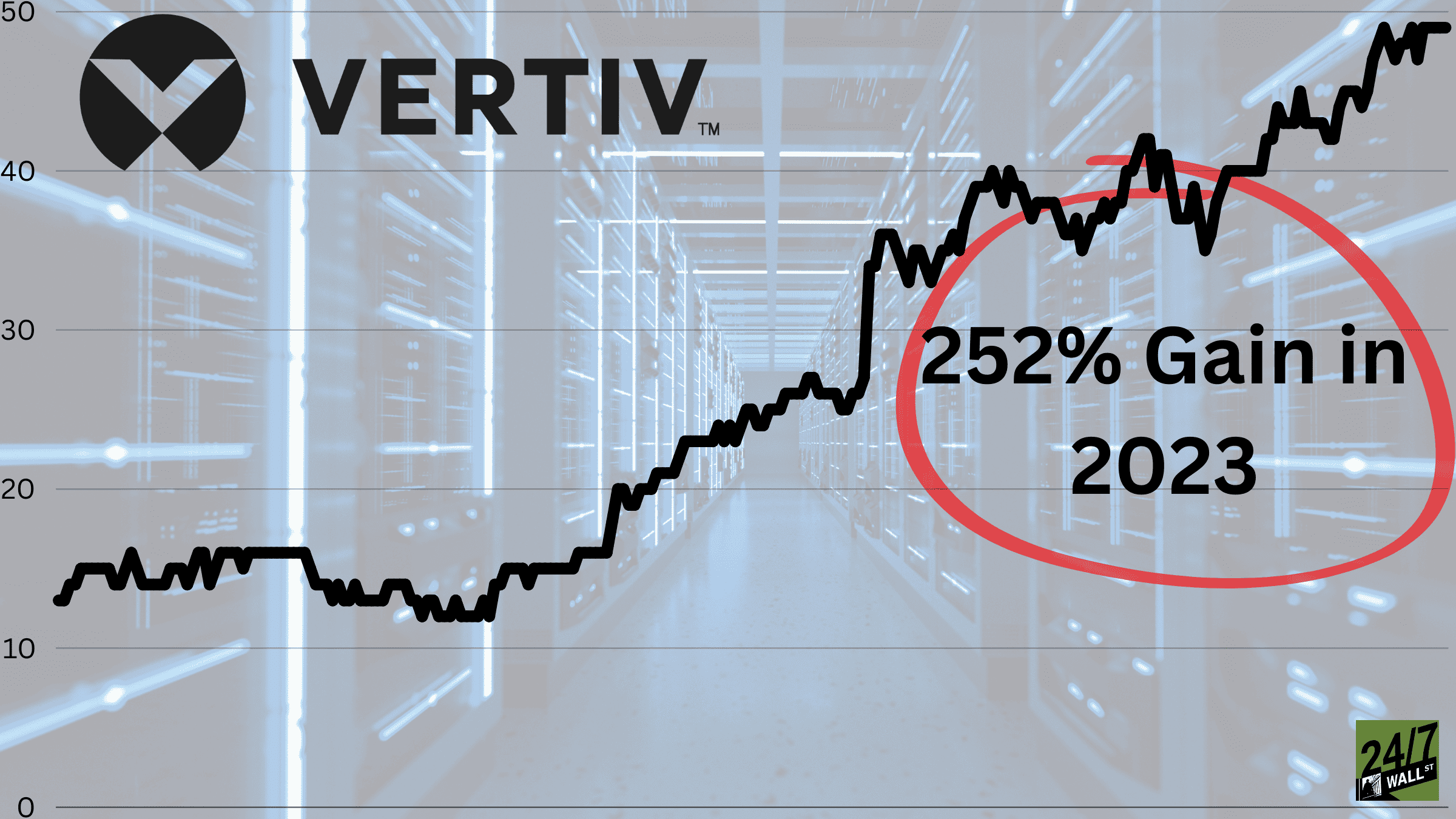

Enter Vertiv (NYSE: VRT).

Vertiv is a leader in thermal management solutions for data centers. In 2023, the company’s stock price jumped 252%, signaling strong investor confidence and exceptional value creation.

But that doesn’t necessarily mean the stock isn’t potentially still a good buy today.

Vertiv’s operational execution continues to improve markedly, as demonstrated by a 12% organic sales growth in its most recent quarter The company’s focus areas for 2024, including customer relationships, technology, and operational resilience, are well-aligned with the demands of the AI-driven market expansion.

The recent acquisition of CoolTera further strengthens Vertiv’s technology leadership in high-density and liquid cooling, a critical area for AI data centers due to their intensive computing demands and heat generation. This move positions Vertiv to capitalize on the increasing need for advanced cooling solutions as AI deployments scale. With significant capacity expansions underway across its portfolio, Vertiv is proactively preparing to meet the anticipated surge in demand.

Vertiv’s robust order strength and record backlog entering 2024, coupled with the strong demand environment projected for the year and beyond, highlight its advantageous market position. The company’s comprehensive thermal management solutions, including its now fully owned high-density liquid cooling technology, equip it to lead the industry transition toward GPU-accelerated computing.

It Won’t Be All Smooth Sailing

With the demand for additional computing power and AI infrastructure soaring, the past 18 months have been a rip-roaring good time for many technology-focused investors – with each earnings report seemingly confirming endless demand. However, as with many new technologies, it will likely take several years for the market to fully understand and properly measure the supply and demand dynamics at play when it comes to AI.

Therefore, it’s important to understand that many of the companies navigating this industry are likely to experience extreme volatility – both in share prices and business result. So, if you are building out your exposure to companies potentially benefitting from the AI boom, it’s important to diversify your holdings and be prepared for a bumpy ride.

Are You Ahead, or Behind on Retirement? (sponsor)

If you’re one of the over 4 Million Americans set to retire this year, you may want to pay attention.

Finding a financial advisor who puts your interest first can be the difference between a rich retirement and barely getting by, and today it’s easier than ever. SmartAsset’s free tool matches you with up to three fiduciary financial advisors that serve your area in minutes. Each advisor has been carefully vetted, and must act in your best interests. Start your search now.

Don’t waste another minute; get started right here and help your retirement dreams become a retirement reality.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.