With a Schwab Roth IRA, you can save for retirement and make eligible tax-free withdrawals. Charles Schwab doesn’t charge a fee to open a Roth IRA and it doesn’t require a minimum investment.

Moreover, you can trade commission-free stocks, exchange-traded funds (ETFs) and options within your account.

Background on Charles Schwab

Charles Schwab is a well-established financial services company that was founded in California in 1971. Today, it offers a wide range of products including taxable brokerage accounts, traditional IRAs, Roth IRAs, 529 college savings plans and more.

The firm is also known for its award-winning research tools and market data, which can help guide your investment strategies.

Schwab currently manages more than $8 trillion in client assets and holds more than 35 million brokerage accounts.

Schwab Roth IRA Overview

Roth IRA rules are set by the IRS. So the benefits like tax advantages would be similar across providers. Roth IRA contributions aren’t tax-deductible because they’re made with after-tax dollars.

However, money in your account would grow tax-free from compound interest and investment earnings. Withdrawals would also be tax-free as long as you’re at least 59.5-years-old and you’ve been contributing to the account for at least five years.

And while workplace 401(k) plans generally limit you to a set investment menu of mutual funds, large brokers like Charles Schwab let you invest your Roth IRA dollars in a wide variety of securities including the following.

- Stocks

- Bonds

- ETFs

- Mutual funds

In addition, Roth IRAs don’t have required minimum distributions (RMD). This means you don’t have to start withdrawing money from your account when you reach a certain age. This leaves more room for potential growth.

And you can withdraw your contributions tax-and-penalty free at anytime because these were already taxed.

Roth IRA contribution limits and eligibility requirements

As with all Roth IRAs, the IRS sets contribution limits. For tax year 2024, the Roth IRA contribution limits are $7,000 for people under the age of 50. Those over the age of 50 can make additional catch-up contributions of $1,000 for a total of $8,000.

However, your eligibility to open any Roth IRA and contribute up to the maximum depends on your Modified Adjusted Gross Income (MAGI). Here’s how it breaks down.

- Single filers: MAGI must be under $161,000 for tax year 2024 to open a Roth IRA.

- Married and filing jointly: MAGI must be under $240,000 for tax year 2024 to open a Roth IRA.

Also, keep in mind that your MAGI determines whether you can contribute to your Roth IRA up to the maximum. After your MAGI reaches a certain threshold, maximum contributions begin to decrease until your MAGI reaches the point where you can’t open a Roth IRA.

For single filers, the maximum contribution for tax year 2024 begins to diminish when MAGI goes above $146,000. And for those married and filing jointly, the maximum contribution begins to reduce when MAGI rises past $230,000.

How to get started

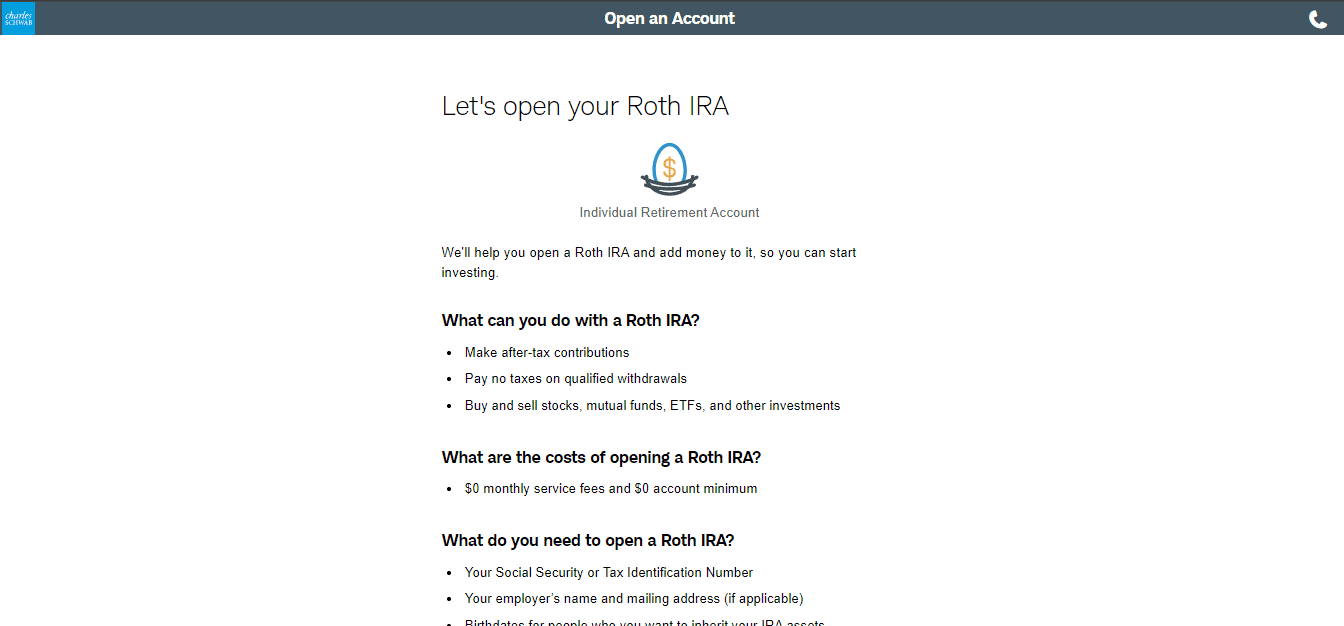

If you don’t have an existing Roth IRA, you can visit the Charles Schwab website to open an account. Make sure you have important documents and information such as the following.

- Government-issued ID to verify identity

- Banking information to fund account

- Social Security number

- Employer and financial information to prove you have earned income

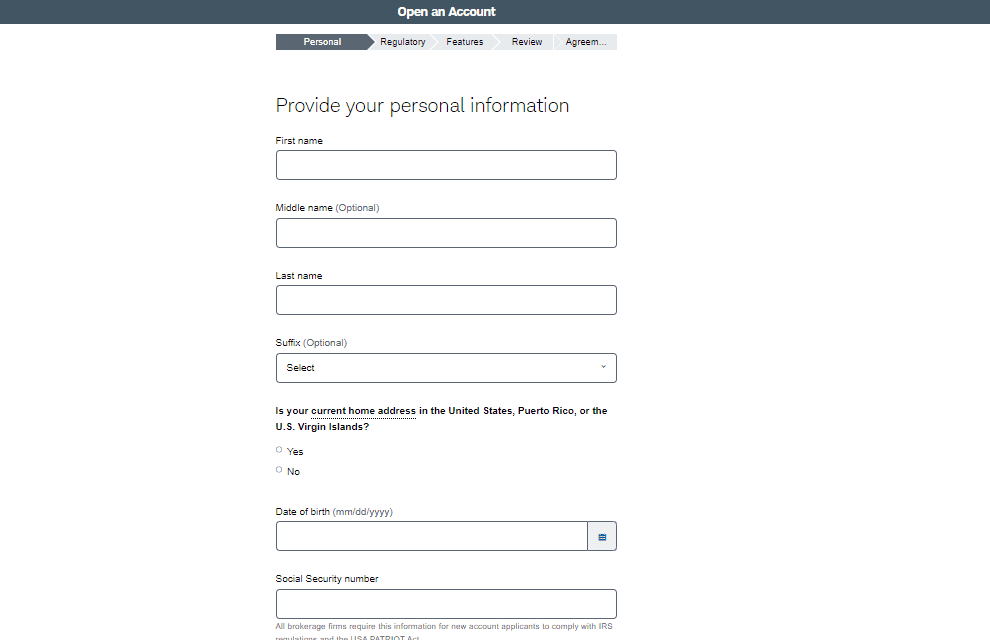

After you have your paperwork ready, you can start the application process online. Schwab says it takes about 10 minutes or less. Just follow these steps.

1. Click the “Get Started” button on the Schwab Roth IRA page

2. Choose Roth IRA as your chosen account type

3. Fill out personal and financial information

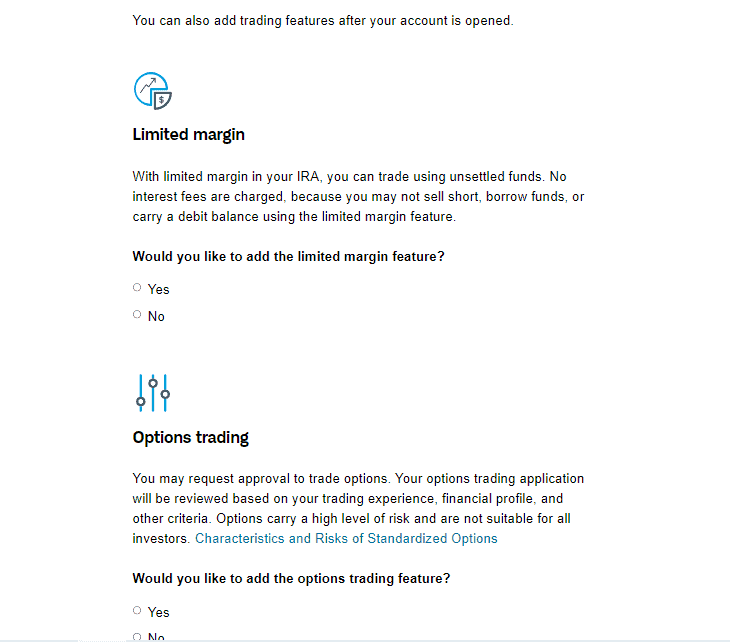

4. Select account features

5. Create log-in credentials

6. Verify your identity

7. Link bank account or other funding option

8. Choose your investments

If you have an existing Roth IRA with another provider, you can transfer eligible assets to a Schwab Roth IRA account. First, follow the above instructions to open a Roth IRA account, but choose “Investment account transfer” as your funding option.

Schwab can approve your account within five business days. Afterward, follow these steps.

1. Log-in to your account and begin the transfer process

2. Enter the name of your current Roth IRA provider and account number

3. Choose whether you want to transfer your entire existing account or make a partial transfer (Some assets may not be transferable to a Schwab account.)

4. Provide personal information to authorize the transfer (Your current provider may charge a fee to transfer assets.)

The verdict: Schwab Roth IRA

Overall, experienced traders may take comfort in managing their Roth IRA with Schwab because of the firm’s research tools like stock screeners, watch-lists and reports from third-party firms like Morningstar and Schwab financial experts. As a bonus, Schwab’s recent merger with TD Ameritrade also means account holders have access to TD’s products including thinkorswim. This investing platform is equipped with various research tools that can help you make investment decisions and customize your portfolio.

But a Roth IRA isn’t your only self-directed retirement plan. If you’re self-employed and don’t have any employees, with the exception of your spouse, you may want to look into the Schwab 401(k) plan for individuals.

But hands off-investors can also open a Roth IRA through Schwab’s Intelligent Portfolios. This is a robo-advisor platform that creates and manages a portfolio for you based on your financial goals, risk tolerance and other personal factors.

But despite Schwab’s vast investment options, the firm won’t let you invest directly in cryptocurrency as part of your Roth IRA portfolio. You can do this with other providers, but be aware of crypto’s risks and volatility. And while Schwab doesn’t charge a management fee, it’s important to understand indirect Roth IRA fees you may encounter.

If you want to learn more about Schwab, check out our regularly-updated list of Charles Schwab guides, news and coverage.

100 Million Americans Are Missing This Crucial Retirement Tool

The thought of burdening your family with a financial disaster is most Americans’ nightmare. However, recent studies show that over 100 million Americans still don’t have proper life insurance in the event they pass away.

Life insurance can bring peace of mind – ensuring your loved ones are safeguarded against unforeseen expenses and debts. With premiums often lower than expected and a variety of plans tailored to different life stages and health conditions, securing a policy is more accessible than ever.

A quick, no-obligation quote can provide valuable insight into what’s available and what might best suit your family’s needs. Life insurance is a simple step you can take today to help secure peace of mind for your loved ones tomorrow.

Click here to learn how to get a quote in just a few minutes.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.